Colorado: Preliminary 2019 #ACA rate hike request: 6.0% INCREASE instead of a ~5.1% DECREASE w/out sabotage

Via the Colorado Division of Insurance:

DENVER (July 13, 2018) – The Colorado Division of Insurance, part of the Department of Regulatory Agencies (DORA), today released preliminary information for proposed health plans and premiums for 2019 for individuals and small groups. Colorado consumers can file formal comments on these plans through August 3.

2018 Companies Return for 2019

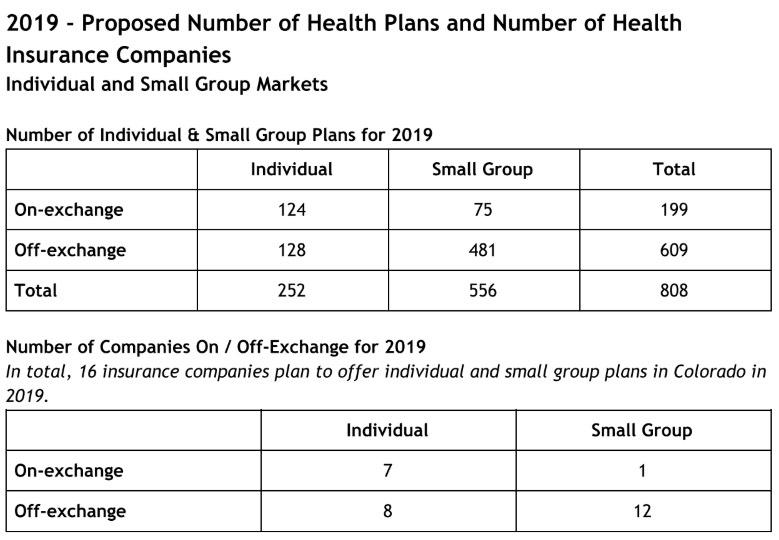

The same seven companies that offered on-exchange, individual plans are returning for 2019 - Anthem (as HMO Colorado), Bright Health, Cigna Health and Life, Denver Health Medical Plans, Friday Health Plans, Kaiser Foundation Health Plan of Colorado and Rocky Mountain HMO. And like in past years, this means that all counties in Colorado will have at least one on-exchange company selling individual health plans.“I’m very pleased to see that we kept the same seven companies selling on-exchange plans,” said Interim Insurance Commissioner Michael Conway. “Last year we worked hard to keep them in Colorado and I think that work is reflected in their decisions for 2019.”

Smallest Increase in Years

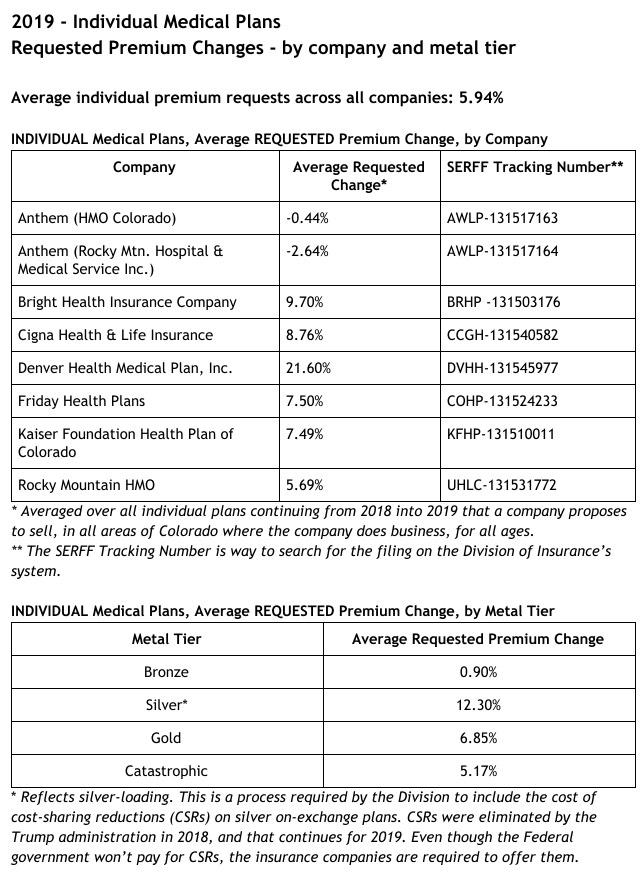

For 2019 individual plans, the average premium increase request is 5.94 percent across all companies and metal levels. In the small group market, the average premium increase request is 7.15 percent. Remember, these are averages across all plans from all companies, across all areas of the state where a company offers plans, for all ages. These averages are not representative of how one individual’s premium could change.Looking closer, the requested average premium increase for individual gold plans is 6.85 percent, and is 12.3 percent for silver plans. For bronze plans, the requested average premium increase is 0.9 percent.

In addition, for the first time in years, an insurance company is requesting a rate decrease for individual market plans for 2019. In fact, both companies under the Anthem umbrella, HMO Colorado and Rocky Mountain Hospital and Medical Service, requested average decreases: -0.44 percent for HMO Colorado, and -2.64 percent for Rocky Mountain Hospital and Medical Service.

“Last year we worked to keep the companies participating in Colorado in the individual market,” continued Commissioner Conway. “Our efforts this year have concentrated on maintaining and furthering the stability we secured last year. Moving forward, we will be doubling down on our focus to address and attack the ever-increasing healthcare costs that drive premiums and push coverage out of reach for many. For too long Colorado consumers have been forced into the uncomfortable and oftentimes impossible position of paying for ever increasing healthcare costs.”

Challenges Continue

As in past years, challenges continue. Just last week, the Trump administration decided to freeze a key ACA program designed to discourage insurers from favoring healthy people over less healthy ones.“Decisions at the federal level continue to make life interesting,” said Commissioner Conway. “But as we have in the past, we will find a solution to this most recent announcement. To that end, just this morning, I informed the insurance carriers that we will require that they account for their respective risk adjustment receivables or payables as they are reflected in the July 9, 2018 federal report. I will take any subsequent steps that are necessary to protect Coloradans and to maintain market stability.”

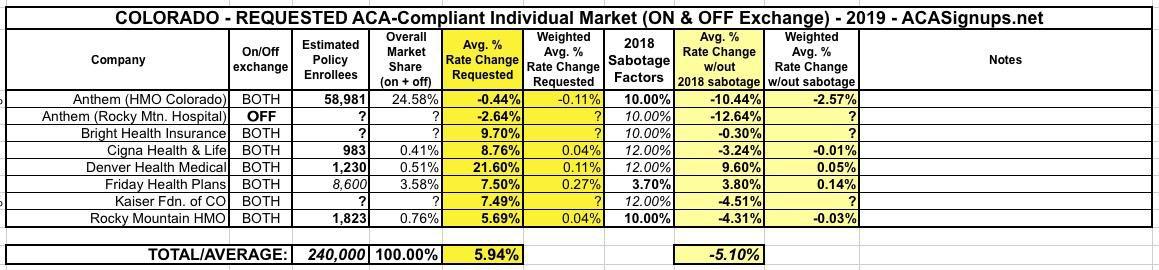

As you can see below, I don't have the hard enrollment numbers for some of the carriers, but the state insurance division has already done the weighted average calculation for me (5.94%). Several of the carriers specified how much they're raising rates due specifically to mandate repeal and/or #ShortAssPlans being expanded (10 points for HMO Colorado/Anthem and Rocky Mountain HMO, just 3.7 points for Friday Health Plans). The others didn't specify the impact, but most do mention it as a significant factor on rate hikes.

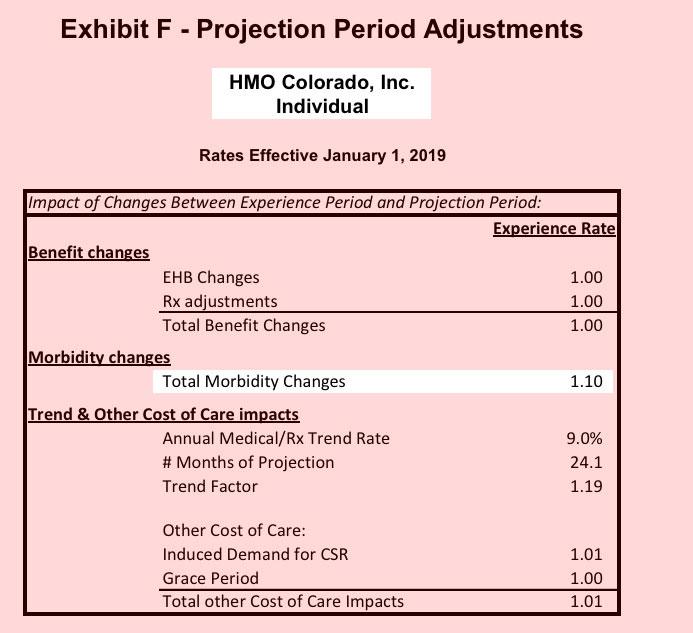

The Urban Institute projected around 18 points on average in Colorado due to sabotage factors. As usual, I'm going with 2/3 of that for carriers which aren't more specific. This gives a statewide overall impact of around 11 percentage points, meaning that without mandate repeal & ShortAssPlans being expanded, Colorado carriers would likely be dropping rates by around 5.1%.

It's also worth reiterating that Colorado, which was among the few states to "broad load" CSR costs (i.e., last year's major ACA sabotage factor), is instead jumping on board the #SilverSwitcharoo train for 2019.