HEAD'S UP: CMS has FINALLY released the official OE5 report; let's dig in... (Part 1)

NOTE: THIS IS A LIVE BLOG, SO CHECK BACK FREQUENTLY FOR UPDATES.

Yes, at long last (3 weeks later than last year, which itself was 4 days later than in 2016), the Centers for Medicare and Medicaid has finally released the official, final 2018 Open Enrollment Report. Let's dig in!

This report summarizes enrollment activity in the individual Exchanges during the Open Enrollment Period for the 2018 plan year (2018 OEP) for all 50 states and the District of Columbia. Approximately 11.8 million consumers selected or were automatically re-enrolled in Exchange plans during the 2018 OEP. An accompanying public use file (PUF) includes detailed state-level data on plan selections and demographic characteristics of consumers. The methodology for this report and detailed metric definitions are included with the public use file.

The 2018 OEP Final Report includes data for the 39 states that use the HealthCare.gov eligibility and enrollment platform, as well as for the 12 State-Based Exchanges (SBEs) that use their own eligibility and enrollment platforms. Demographic and plan information for consumers with a plan selection provided by all 50 states plus DC include: age, metal level, and whether the consumer had advance payments of the premium tax credit (APTC) or cost sharing reductions (CSR).

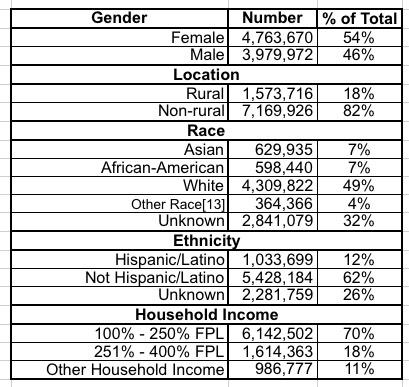

For the 39 states that use the HealthCare.gov platform, additional data are available, including gender, rural location, self-reported race and ethnicity, household income as a percent of the federal poverty level (FPL), and the average premiums among consumers with and without APTC. Data files with information on plan selections at the county and zip code levels are also available for HealthCare.gov states.

Key findings from this report include:

- Approximately 11.8 million consumers selected or were automatically re-enrolled in an Exchange plan in the 50 states, plus DC.

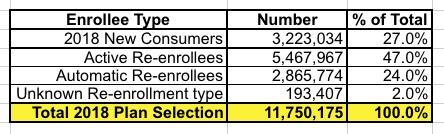

- Twenty-seven percent of consumers with a plan selection were classified as new consumers.

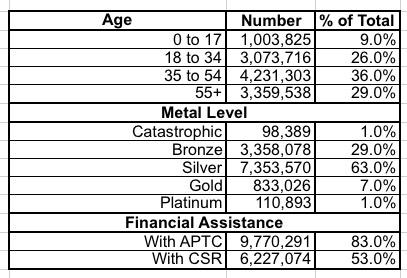

- Sixty-three percent of consumers selected silver plans; 29 percent of consumers selected bronze plans and 7 percent of consumers selected gold.

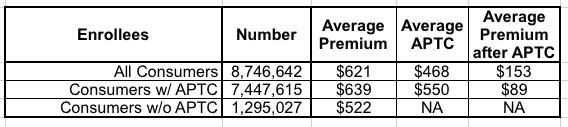

- Among consumers using HealthCare.gov, the average premium before application of the tax credit was $621 during the 2018 OEP and $476 during the 2017 OEP.

OK, that's the housekeeping and basics. The 11.8 million figure is well known, of course, although the official tally is about 10,000 fewer than my earlier data suggested (there's always a bit of last-minute number tweaks when the final report comes out due to clerical glitches and so forth, so this isn't suspicious). The final official number is 11,750,175 QHP selections nationally.

Consumers Selecting Plans through the Exchanges: 50 States, plus DC

Approximately 11.8 million consumers selected or were automatically re-enrolled in an Exchange plan during the 2018 OEP. This includes approximately 8.7 million consumers in the 39 states using the HealthCare.gov platform and approximately 3.0 million consumers in SBEs (see Figure 1).[6]

Table 2 summarizes selected demographic and plan characteristics for consumers during the 2018 OEP; additional information is contained in the accompanying public use file. Nine percent of all Exchange consumers were younger than 18 years old. Nationally, 83 percent of consumers had their premiums reduced by APTC.

Table 2: Demographic and Plan Characteristics of Consumers with 2018 OEP Plan Selections

The most important data to look at here will likely be the metal level shift on a state-by-state basis, due to the impact of Trump cutting off CSR reimbursement payments and the carriers responding by going with Silver Loading and Silver Switching strategies to cancel out/mitigate the CSR cut-off damage. More on this later.

Consumers Selecting Plans through the HealthCare.gov Platform

Additional information is available for the 8.7 million consumers in states that use HealthCare.gov. Table 3 shows selected demographic and plan characteristics among consumers who selected plans during the 2018 OEP. Fifty-four percent of HealthCare.gov consumers were female and 18 percent of consumers resided in a rural location. Seventy percent of consumers reported household incomes between 100% and 250% FPL.

Table 3: Demographic and Plan Characteristics of Consumers with 2018 OEP Plan Selections on HealthCare.gov

Table 4 contains information on premiums for consumers in states that used HealthCare.gov in 2018. The average premium before application of the tax credit was $621 during the 2018 OEP and $476 during the 2017 OEP. Eighty-five percent of consumers who selected or were automatically re-enrolled in a 2018 plan through HealthCare.gov had APTC. Among consumers with APTC in 2018, the average tax credit covered about 86 percent of the total premium, resulting in an average premium after APTC of $89 per month.

Table 4: Average Premium and Average Net Premium after APTC for Consumers with a 2018 OEP Plan Selection on HealthCare.gov

Voila. There's the power of the ACA's tax credits, and the main reason why most exchange enrollees plan on sticking around next year, as the Kaiser Family Foundation determined this morning: 83% of exchange enrollees are protected from premium rate increases (and this year, thanks to Silver Loading/Switching, many of them saw a net premium decrease).

In the 2018 OEP, nine percent of consumers were younger than 18 years old compared to 10 percent in 2017 (see Figure 2). Twenty-six percent of consumers were between 18 and 34 years old in 2018 compared to 27 percent in 2017. Twenty-nine percent of 2018 OEP consumers were 55 years or older, while 27 percent of 2017 OEP consumers were 55 years or older.

The report includes a whole mess of footnotes:

- This report includes Qualified Health Plan (QHP) selections made on the individual Exchange; the state-level and county-level public use files also includes data on dental plan selections.

- In addition to the total plan selections in this report there were 829,197 individuals in New York and Minnesota who signed up for coverage through a BHP. States have the option of establishing BHPs to provide health coverage for low-income residents who might otherwise be eligible for Exchange coverage.

- As in prior years, consumers with coverage at the end of 2017 who did not make an active selection were generally automatically re-enrolled for 2018. When consumers had 2018 Exchange plans available to them from their 2017 issuer, they were automatically re-enrolled into the same plan as 2017 or a different plan from the same issuer; depending on the Exchange, they could also be automatically re-enrolled into a suggested alternate plan from a different issuer.

- The state-level PUF can be found here. For the 39 states that use the HealthCare.gov eligibility and enrollment platform, public use files with information on plan selections at the county and zip code levels are also available.

- Data for SBEs that use their own eligibility and enrollment platforms are retrieved from the respective states’ information systems and have not been validated by CMS, thus metric calculations for these states may vary. The 12 SBEs that use their own eligibility and enrollment platforms are California, Colorado, Connecticut, the District of Columbia, Idaho, Maryland, Massachusetts, Minnesota, New York, Rhode Island, Vermont, and Washington.

- Figures for HealthCare.gov states and SBEs do not sum to 11.8 million due to rounding, see the state-level PUF for more information.

- The data for the 2014 OEP was from 10/1/2013 to 4/19/2014; the 2015 OEP was from 11/15/2014 to 2/22/2015; the 2016 OEP was from 11/1/2015 to 2/1/2016 (1/31/2016 for some states); the 2017 OEP was from 11/1/2016 to 1/31/2017; for HealthCare.gov states the 2018 OEP was from 11/1/2017 to 12/15/2017 with data reported through 12/23/2017 (data through dates vary for SBEs; see the PUF methodology for detailed information). Plan selections by Exchange platform for each OEP reflects the status of the state’s Exchange platform at the time of that OEP. Caution should be used when comparing plan selections across OEPs since some states have transitioned platforms between years, and state expansion of Medicaid may affect enrollment figures from year to year. Additionally, the rate at which issuers submitted plan cancellations may have varied from year to year and caution should be used in interpreting these data as they do not reflect plan effectuations.

- Enrollment type does not sum to the total due to administrative errors in processing a limited number of plan cancellations/terminations in Vermont. Please refer to the state-level PUF for more information.

- Some SBEs were unable to verify enrollee age and metal level characteristics, therefore those figures do not sum to 11,750,175; more information is available in the PUF definitions.

- The figures reported reflect data as a percent of the total (11,750,175), therefore totals may not sum to 100%.

- For a family of four in 2018, a household income between 100% and 250% FPL generally corresponds to an annual household income of between $24,600 and $61,500.

- Totals may not sum to 100% due to rounding.

- Other Race includes multiracial, American Indian/Alaska Native, and Native Hawaiian/Pacific Islander.

- Other household income includes plan selections for which consumers were not requesting financial assistance, incomes below 100% FPL, incomes above 400% FPL, and unknown income. Please see the public use file for more information.

- Note that these findings may not be generalizable to the entire population of consumers who selected an ACA compliant plan without APTC, as many consumers in this population purchase plans off the Exchange; premiums in this document aren’t representative of individual plans off the Exchange.

UNFORTUNATELY, I have to take care of a family committment right now, so I won't be able to get back and actually dig into the numbers until this evening.

Look for a more complete analysis tomorrow morning.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.