The Paid/Unpaid Brouhaha (Updated)

(Reposted with updated numbers and additional info given that NewsBusters has decided to launch a hit piece on me using the "But how many have PAID???" attack point)

I've written about the "But How Many Have PAID???" issue many times before, but going into the final stretch, I wanted to explain my reasoning as clearly as possible.

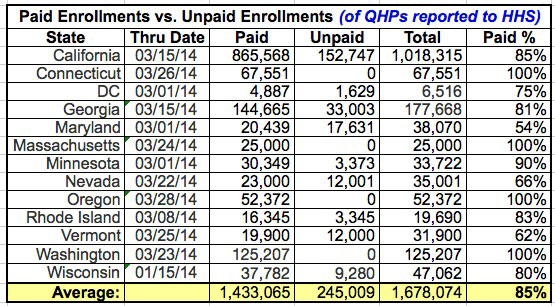

The following chart only includes states which have broken out Paid vs. Unpaid Enrollments. If you only use these 10 states as a guideline, it looks like the paid rate is around 85%:

NOTE: This represents the Paid vs. Unpaid enrollments out of all enrollments reported to the HHS as of the Thru Date listed.

Massachusetts doesn't report unpaid enrollments at all, and Washington lists unpaid enrollments separately in their press releases but does not included them in HHS report data. As a result, both states are actually at 100% paid (in terms of the numbers in the HHS reports, which is what we're talking about here).

UPDATE 3/27/14: Connecticut announced yesterday that they've purged their 5,000 unpaid enrollments to date...out of 72,551 total...or less than 7% unpaid. Assuming the cleaned-up number is the one reported to HHS for March, they join MA & WA as having 100% paid enrollments:

UPDATE 3/28/14: Oregon appears to be doing the same thing as Connecticut, "purging" their unpaid enrollments as well.

The following is from an article about California's exchange from March 9th:

The numbers of nonpayers varied only slightly among the largest insurers on the exchange: Kaiser Permanente reported that 13 percent of its enrollees didn't pay. Anthem Blue Cross of California, Blue Shield and Health Net said it was closer to 15 percent.

Federal officials say they've noticed the same trend nationwide.

While the article above only refers to enrollments through January 31st, a follow-up press release from CoveredCA itself on March 13 states that 85% of all enrollees (through March 9th) have paid up:

The surge continues this month, with total enrollment in Covered California health insurance plans reaching 923,832 through March 9.

...Lee said insurance companies are reporting that 85 percent of all enrollees have paid their first month’s premium.

UPDATE: Moving ahead to the March 19th update after California reached the 1 million enrollment mark, Peter Lee reiterated that the 85% paid figured continues to hold:

The number of people who have picked a Covered California health insurance plan now tops 1 million. This is an amazing accomplishment, and it means that with two weeks to go we have exceeded the highest “enhanced forecast” for the entire open-enrollment period. The health insurance companies report that more than 85 percent of those who have enrolled are paying their premium and getting coverage. That means 850,000 Californians are on their way to coverage through Covered California, which surpasses the top projection of 830,000....

Considering that California represents nearly 21% of all QHP enrollments to date nationally, until I receive solid data otherwise, I'm going to stick with 85% paid.

There's two more factors to consider as well, however:

- This is a rolling average. People who enrolled between 2/16 and 3/15 don't even start coverage until April 1st, while anyone who enrolls between 3/16 - 3/31 won't start coverage until May 1st. In many cases, their first month's premium won't even be due until up to 6 weeks or more after they enroll. Considering how many people wait until the last minute to pay their bills, it's silly to write these people off as deadbeats. The vast majority of these will eventually be paid up, it's just that we won't have confirmation of many of them until well into MAY.

Consider the following:

- Around 3.7 million people had enrolled in QHPs (paid + unpaid) on the exchanges as of February 15th. Total enrollment as of March 15th was roughly 4.9 million (it hit 5 million a day or two later).

- So, out of 4.9 million enrollments, about 1.2 million of them came in between 2/16 - 3/15, and won't start coverage until 4/01.

First, let's suppose the final 3/31 total ends up being 5.5 million.

- That would mean that 1.2 million (22%) won't have their policies start until April, and another 600K (who enrolled between 3/16 - 3/31, around 11%) won't start until May.

- That's a full 1/3 of the total policies which won't even have started coverage until after March 31st.

But wait, what if the total hits my current projection of around 6.2 million?

- Well, in that case, about 19% (the same 1.2 million) won't start until April, and another 21% (1.3 million enrolled between 3/16 - 3/31) won't start until May.

- That's a full 40% of the total which won't start until after March 31st.

So again, when the deadline hits, I'm not gonna worry about 15% of enrollments not being paid when 33% or more of the policies haven't even started yet.

Next, let's look at Vermont.

I realize that VT probably isn't representative of the other 49 states (+DC), but for now, it's the only state to break out not only the paid/unpaid numbers, but which month each one was/is set to start.

As of March 20th, they're only showing about 64%, which admittedly doe sound bad.

However, guess what?

- Out of 12,677 January-start policies, 11,915 of the enrollees have paid their premiums. That's 94% of them.

- Out of 1,989 February-start policies, 1,842 have paid. That's 93%.

So why is it 64% overall? Simple.

- Out of 3,268 March-start policies, 2,689 have paid. That's 82%.

- Out of 9,865 April-start policies (you know, the month that hasn't started yet), 1,878 have paid...or just 19%.

- And finally, out of 1,151 May-start policies (still almost 6 weeks away), 183 have paid...or just 16%.

In other words, I've said it before and I'll say it again: Since more than 1/3 of the total QHP enrollments won't even start coverage until April or May, why is anyone freaking out about the "unpaid" number already? The April and May policies are completely dragging down the overall total, when they don't even start yet!

As of mid-March, the only ones which can honestly be judged for their paid/unpaid status so far are January, February start policies (and possibly March, depending on your perspective), since those months are either over with or already started...and in Vermont, at least, those 3 months combined add up to 16,446 paid out of 17,934...or 92% PAID.

Compare this to the 90% "final payment" ratio that I've been assuming...which is now looking pretty conservative (pun intended) by comparison, no?

So again, when the deadline hits, I'm not gonna worry about 15% of enrollments not being paid when 33% or more of the policies haven't even started yet.

Now, let's assume that in the end, 8% of the enrollees really and truly DON'T pay up, even a month into their coverage period, because they're deadbeats, or losers, or whatever.

In fact, for the moment, let's even assume that none of those 8% are due to the insurance company billing system screwing up up (more on this below).

At this point, then I have to ask the following: What was the industry norm for cancelations/deadbeat policyholders before the exchanges launched?

I'm sure it's lower than 8%, but what is it? 0.5%? 1%? I have no idea. Let's assume it's only 1%.

Well, that leaves 7% that can be legitimately attacked as not "counting" towards the total.

However, again, we won't know that until mid- to late May.

So, I'll say this here and now:

Whatever percentage of total exchange-based QHP enrollments still haven't been paid by the policyholder as of May 31st should indeed be subtracted from the official HHS total number, assuming that those non-payments are due to either a) the policyholder bailing/refusing to pay or b) the government-run exchange (not the insurance company's billing system) screwing up.

If the total number ends up being 6.2 million but the non-payments fitting these criteria are 7% as of May 31st, I'll gladly subtract 434,000 from the total. If the total number is 6.5M and the non-payments are 10% as of 5/15, I'll subtract 650,000, and so on.

Until then, it's all a bunch of blather.

In addition, as noted above, there have also been numerous stories of the payment being made but the insurance company screwing up, due to their billing system being messed up, their notification system failing to confirm receipt and so on.

My own family is an example of this--we made our payment to BCBSM back in December via auto-pay right after we enrolled for January coverage...but BCBSM's system messed up, sent us three sets of cards (they had to cancel 2 of them), and didn't actually confirm our December payment for January coverage until early February. I've heard numerous similar tales, where the payment problem was not the fault of the customer or the exchange itself, but the insurance company. Here's a similar story from one of the articles linked to above:

For some Californians, however, the biggest problem wasn't paying for a plan, it was getting confirmation that their payment had been processed.

It took Woodside resident Jennifer Jones and her husband a nerve-racking seven weeks and two payments -- the first paid by check, the second online -- before their insurance company finally acknowledged that they were insured.

"It was extremely chaotic, just a nightmare," said Jones, a marketing consultant, who stopped payment on the initial check she wrote after waiting seven weeks for the insurer to cash it.

I have no idea how many people fall into this second category, but it's certainly more than a handful.

As a result of all of the above, I'm assuming at least 1/3 of that 15% "unpaid" shouldn't really count as such, and in fact think I'm being pretty conservative in this estimate.

Thus, on the spreadsheet and graph I have the bare minimum QHP enrollment number as 90% "paid or unpaid for legitimate reasons" (and I suspect the actual % who do end up paying will be much higher...but again, we won't know that until sometime in May).

Now, certainly the "deadbeat" issue is still cause for some amount of concern, as are the remaining data transfer issues that some of the exchange websites are still having. The non-payment percentage probably will end up being higher for exchange QHPs than the industry norm, and if the exchanges are still screwing up with their data transfers to the insurers, that's definitely a problem. However, it's also not as simple as just "lopping off 15%" from the total for "non-payment" either.

UPDATE: OK, thanks to Markos Anderson in the comments for bringing my attention to this story out of BizTimes.com, which in turn links to this memo (PDF) from the Wisconsin Insurance Commissioners Office.

In the middle of it we find this (partial) paid/unpaid data, which indeed only applies to January and February start-dates:

4. How many consumers have enrolled in coverage through the federal exchange? How many consumers have paid their premium?

- Total federal exchange enrollment into plans with a January 1 effective date: 34,329. Insurers received premium for 28,178 of these plans (unpaid 18%).

- Total federal exchange enrollment into plans with a February 1 effective date: 12,733. Insurers received premium for 9,604 of these plans (unpaid 25%).

- Total federal exchange enrollment into plans with January 1 and February 1 effective dates: 47,062. Insurers received premium for 37,782 of these plans (unpaid 20%).

Hmmm...in the case of Wisconsin, it does sound like even when applying the "policies already started" criteria for January and February, the paid percentage kind of blows. It's annoying that they didn't include March, April or May data for comparison (although the wording of the memo makes it obvious that they're only addressing the Jan/Feb starts...for the same reason I laid out above: If their policy hasn't started yet, it's not worth making a fuss over).

So, fair enough: I've added Wisconsin's data to the chart at the top (which keeps it at 81% overall), and true to my word, I'm separating out Wisconsin's documented unpaid enrollees from the total on the spreadsheet. which reduces the total by 9,280.

If this proves to be the case with other states with regard to their January or February enrollments, then the "unpaid" argument might start holding water after all, but so far we only have the breakouts by month from 2 states (which average out to 83% for January and February).

As an aside, this Wisconsin memo also contains some info on another topic I talk about a lot: Off-Exchange QHP enrollments! This only includes Off-Exchange numbers through January 15, but it's still better than nothing:

5. How many consumers enrolled in a plan in the individual market outside of the federal exchange?

- Total enrollment, outside of the federal exchange, into plans with January 1 and February 1 effective dates: 7,885.

Amusingly, these additional 7,885 off-exchange enrollments instantly cancel out almost all of the 9,280 of the Jan/Feb unpaid enrollments that I just subtracted...just as Scott Gottlieb noted in Forbes a few days ago:

Off exchange enrollment could be as high as 20%, according to one Wall Street analyst. If that holds true nationwide, these enrollees would probably offset the number of people who sign up on the exchange, but will never pay their first premium (and thus never be truly enrolled).

And that's how the game is played. YOU CAN'T HAVE IT BOTH WAYS.

If you're going to subtract everyone who hasn't paid their premium, you have to also add anyone who's purchased an ACA-compliant QHP...regardless of whether they did so on-exchange or off, since they're all part of the SAME RISK POOL.

So, Wisconsin loses 9,300 but gains 7,900 overall, for a net loss of 1,395.

Feel free to subtract a certain percentage of the exchange-based QHP enrollments for nonpayment...but if you do so (or even if you don't really), you also have to add the off-exchange enrollments as well.

As a reminder, nationally, I've already documented over 550,000 off-exchange QHP policy enrollments to date...from 2 states (WA and WI) and a handful of companies. My guess is that there's easily 3-4 million more which simply haven't been sourced yet.

Oh, yeah, and there's also about 65,000 SHOP exchange enrollees nationally. A rounding error, I know, but every number counts.

This is why I list all of the different scenarios whenever I have the data for it, so that people can understand the full picture as clearly as possible.

UPDATE 04/03: Now that the open enrollment period has completed and updated Paid data is coming in, it looks very much like a flat 93% is a reasonable rule of thumb to use.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.