UPDATE: Hot Off The Presses: The 2017 Notice of Benefit & Payment Parameters!

Last November, the Centers for Medicare & Medicaid (CMS) posted a whole mess of proposed ACA policy improvements for the 2017 Open Enrollment Period. They included a Public Comment period, then spent awhile reviewing all of the suggestions and making tweaks/changes to the proposals accordingly.

Just moments ago, they released the final parameters/rules for 2017...all 540 pages of it. Good grief.

Anyway, while there's a mountain of legalese to wade through here, the first one which leaps out at me is the one relating to the public Rate Review policy.

As you may recall, last summer/fall, I embarked on a fairly massive effort to calculate the weighted average premium rate increases for the individual market for 2016. While the new RateReview database added to HealthCare.Gov was very helpful for policies with rate increases above 10%, it was completely useless when trying to figure out what the upcoming rate changes might be for carriers raising rates less than 10%...worse than useless, in some ways. As I posted last June:

At the same time, there are several major gaps in this tool. Some of them, such as not breaking out the rate requests by metal levels, are merely unfortunate. One, however, is extremely important, and from a media perspective could make this tool worse than not having it at all: It only includes companies which are asking for increases of more than 10%.

Again, from the perspective of following the regulations, this makes perfect sense; if they don't have to justify increases of less than 10%, there's no need to list them for public comment.

HOWEVER, there's a slew of reporters, pundits and activists who are going to be poring over these rate filings...and by only listing those higher than 10%, the HHS Dept. is setting themselves up for a whole bunch of OMG!!! SKY IS FALLING!!! CRAZY HIGH RATE SPIKES FOR 2016!! headlines over the next week or so.

The problem is that a given state might have 10 companies offering individual policies. Five of those carriers might have been asking for huge rate hikes of 15%, 20%, whatever...but if the other 5 were only asking for nominal rate hikes (say, 3-4%), or even planned on cutting their premium rates...none of those would appear on the Rate Review website. That means that even if the true average was only, say, 7-8%, it would look like 15-20% since half the carriers weren't even listed.

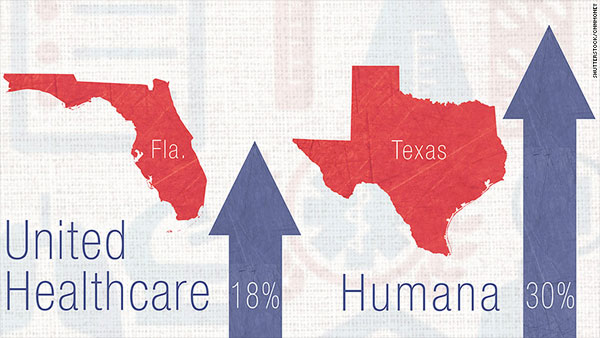

Now, HC.gov did update the database with all of the approved/final rate changes once they were locked in and Open Enrollment started, regardless of how high/low they ended up being...but that didn't change the fact that for five straight months, all most people ever saw were the double-digit hikes, which, sure enough, led to headlines like this:

...and graphics like this:

...even though Florida and Texas's actual requested average rate hikes ended up being only about 9.5% and 15.8% respectively. Don't get me wrong, I'm not saying that a 9-16% rate hike is great news, but it's a hell of a lot better than 18-30%.

Well, if you look at today's massive 2017 Parameters report, check out pages 123-124:

Comment: A majority of commenters supported the proposal and several recommended that all proposed rate changes should be made public, rather than just proposed rate increases. Some commenters, however, expressed concern regarding the proposal, citing the statutory obligation to review only unreasonable premium increases, rather than all increases. A few commenters stated that publicizing rate filings before they are finalized eliminates competitive advantages for plans.

Response: We are finalizing the proposal to collect rate filings for all single risk pool products in order to carry out the Secretary’s statutory responsibility to monitor premium increases of health insurance coverage. HHS will post information for all proposed rate filings for the individual and small group markets within a state at a uniform time to promote fair market competition between issuers through and outside of the Exchange and further enhance transparency of the rate-setting process. We note that States with an Effective Rate Review Program are required to post proposed rate increases subject to review and have a mechanism for receiving public comments on those proposed rate increases. CMS’s decision to post information for all proposed rate filings for single risk pool coverage does not affect or change the State’s obligation to post proposed rate increases under §154.301(b).

If I'm reading this correctly, it means that they're doing exactly what I was hoping: Posting all of the rate change requests as well as the final, approved changes, regardless of whether they're over 10%, under 10% or even negative (ie, rate reductions). This is excellent news.

Of course, in order to get a weighted average, you also have to know the relative market share (ie, number of enrollees) held by each carrier, which is a tougher nut to crack, since that information is legally protected as a trade secret in some states...but not having to dig around or guess at the requested rate changes for any of the carriers should still make the job far easier this summer, as well as giving a less skewed depiction of the situation to healthcare reporters, politicians and so forth.

UPDATE: D'oh!!! OK, it turns out that they also posted a blog entry on the CMS site which summarizes some of the biggest bullet points from the full 540-page report. Some of these either go over my head or are areas I just haven't written about much, but here's a few of the ones which caught my eye:

FFM User Fee for 2017: We will charge a Federally-facilitated Marketplaces (FFM) user fee rate of 3.5% of premium for 2017, a rate calculated to cover user fee-eligible costs. This user fee rate is the same as the rate for each year from 2014 through 2016. We will charge issuers operating in a State-based Marketplace on the Federal platform (SBM-FP) a reduced user fee rate of 1.5% of premium for the 2017 benefit year, to ease the transition for SBM-FP States, and will allow additional flexibility in the assessment of these charges for those States.

All of the ACA exchanges, whether federal (HC.gov) or state-based have to collect fees to cover the cost of operations. For HealthCare.Gov, that fee has been 3.5% of the premiums for every policy sold on the exchange. The fee for the state-based exchanges varies widely; some charge a flat fee (Covered California charges $13.95 per enrollee per month, for instance), while others charge a percentage, but spread that across off-exchange or other types of policies as well. Of course, the "single risk pool" requirement effectively means that the actual premium charged to the enrollee is the same for the same policy on or off-exchange anyway, so that doesn't make much difference.

Anyway, the exception to this until now has bee the states which officially operate their own exchange (Oregon, Nevada, Hawaii and New Mexico...and, starting this year, Kentucky), but which still use HC.gov as their tech platform. The reasons vary (technical problems in the case of OR, NV & HI; a change of heart on the part of NM, and a really douche-baggy new Governor in the case of KY), but the point is that all 4 (5) of these states still have their own board of directors, call centers and so forth, but are using HC.gov for the actual technical side of things.

Until now, these states have gotten a pass from CMS; they've essentially been getting a free ride on HC.gov without having to pay a fee to do so. CMS is saying that starting next year, they're gonna have to pay a smaller fee of 1.5%, though that may change after the first year.

Annual Limitation on Cost Sharing: The maximum annual limitation on cost sharing is the product of the dollar limit for calendar year 2014 ($6,350 for self-only coverage) and the premium adjustment percentage for 2017, rounded down to the next lower $50. The 2017 maximum annual limitation on cost sharing is $7,150 for individual coverage and $14,300 for family coverage.

Student Health Insurance Plans: Under this rule, issuers of student health insurance plans may establish one or more separate risk pools for each college or university, but the risk pools must be based on a bona fide school-related classification and not on health status. The premium rates for each risk pool must reflect the claims experience of individuals who comprise the risk pool, and any adjustments to rates within a risk pool must be actuarially justified. Also, we eliminate the requirement for student health insurance plans to offer coverage within specific metal levels, and instead require student health insurance plans to offer an actuarial value of at least 60%.

Rate Review: We are requiring all issuers to submit the unified rate review template (URRT) for all single risk pool products in the individual and small group markets (excluding student health plans) regardless of whether they propose rate increases, rate decreases, or no change in rates for these products.

This is the rule I explained in detail at the beginning of this post. This is excellent news from my POV.

UPDATE: Hmmmmm...as pointed out by farmbellpsu in the comments, this might not be as good as I hoped. The exact wording on page 24 states that they're requiring carriers to submit all rate changes even if they're decreases, but they may only post the ones which include increases, not necessarily decreases:

We require the submission of a Unified Rate Review Template from all issuers offering single risk pool coverage in the individual and small group market, including coverage with rate decreases or unchanged rates, as well as rates for new plans. We also announce our intention to disclose all proposed rate increases for single risk pool coverage at a uniform time on the CMS Web site, including rates with increases of less than 10 percent.

This is still better than limiting it to >10% hikes, but why not include decreases as well? If the point is to improve/increase transparency, why go halfway like this? This is still misleading to the public (if not as much so), because it still makes it look like every carrier is raising their rates at least a little, even if some keep their rates flat or even reduce them.

(sigh) Again, it's still an improvement, but not nearly as much of one. What's the point of collecting rate decreases if you're not gonna post them?

Annual Open Enrollment Period: We are finalizing the open enrollment period for the individual market Marketplaces for benefit years 2017 and 2018 to correspond to the open enrollment period for the 2016 benefit year, meaning it will begin on November 1 of the year preceding the benefit year and run through January 31 of the benefit year. We also finalized the open enrollment period for benefit year 2019 and later benefit years, so that it will begin on November 1 and run through December 15 of the year preceding the benefit year. This policy will provide continuity in the short run and sufficient time for all entities involved in the annual open enrollment period process, including Exchanges and issuers, to make the necessary adjustments to meet this earlier deadline.

In other words, they're sticking with a 3-month Open Enrollment period (November 1 - January 31) for the next two years...but after that they're gonna cut the period in half to just 45 days (November 1 - December 15).

This is a bit surprising to me, but given that over 85% of this year's enrollees signed up by the mid-December deadline, it also makes sense. This will ensure that pretty much everyone who signs up starts their coverage on January 1st, making for much "cleaner" numbers for actuaries and carriers. It's also less confusing for enrollees, since a lot of people seemed to get confused about there being "multiple" deadlines to sign up.

In fact, I believe most corporations that provide "open enrollment" only provide a 6-week window as it is; the ACA started with 6 months since it was such a new experience for everyone on the individual market (and thank God for that, given the technical mess at launch), was then cut down to 3 months for the next 4 years (2015 - 2018), and will then apparently ease into a final 6-week window starting in 2019. With the exchange websites having worked out their problems and operating smoothly, this shouldn't be an issue by the time 2019 rolls around.

State-based Marketplaces Using the Federal Platform: Today, a few State-based Marketplaces (SBMs) rely on HealthCare.gov’s technology for eligibility and enrollment functions for individual market enrollments. In future years, additional States may wish to use the federal information technology (IT) platform for eligibility and enrollment functions for their individual and/or SHOP Marketplaces. We are codifying a Marketplace model for these States, the State-based Marketplaces on the Federal platform (SBM-FPs). The SBM-FPs will retain primary responsibility for plan management functions, consumer assistance and outreach, ongoing oversight and program integrity, and for ensuring that all Marketplace requirements are met, but will agree to rely on the Federal platform for eligibility determinations and enrollment processing activities, and associated Federal platform services. We will collect user fees to cover Federal costs in these States. Finally, we are finalizing the requirement that SBM-FPs enforce certain QHP and QHP issuer requirements that are no less strict than the requirements that HHS applies to QHPs and QHP issuers in the FFMs, along with the authority of HHS to suppress plans on HealthCare.gov in appropriate circumstances.

This is actually an unexpected development: While CMS reluctantly agreed to take over Oregon and Nevada's websites for 2015, and further agreed to do so for Hawaii for 2016, they never really planned on this becoming a permanent thing. Now that the King v. Burwell case is out of the way, however, and especially now that HealthCare.Gov itself is operating so smoothly, they are apparently going the other way and encouraging any states which want to do so to adopt the "hybrid" model. The important thing to remember is that this doesn't just mean states dropping their own full exchanges...it could also work the other way. That is, if Michigan or Ohio decided to "establish" their own exchange on paper but still wanted to have HC.gov handle the tech side, they could do so.

Standardized Options: To simplify the shopping experience for consumers on the individual market Federally-facilitated Marketplaces, we are finalizing the proposal to designate plans with certain standardized cost-sharing structures as “standardized options.” Plans with standardized cost-sharing structures will give consumers the opportunity to more easily compare plans offered by different issuers within a metal level, and can simplify the consumer shopping experience. We have developed 6 specific recommended designs (1 silver, which would be coupled with 3 silver cost-sharing reduction variations, 1 bronze, and 1 gold). It is optional for issuers to offer standardized options. We are carrying out consumer testing to determine how such plans will be displayed on HealthCare.gov.

(sigh) This is an excellent idea, and one which Covered California has already been doing. The idea is to avoid the confusion of having 23 "different" plans which are essentially the same plan with negligible differences cluttering up the exchange and gumming things up (or "spamming" the exchange, as Andrew Sprung and Richard Mayhew have termed it). The reason I sighed is because it seems to me that making standardized plans optional kind of defeats the whole point of the move; as I understand it, CoveredCA requires that plans be standardized. Still, I guess it's a positive move...

Network Adequacy (Continuity of Care): We finalized two provisions regarding continuity of care applicable to QHPs on FFMs. First, we require the issuer to provide written notice to all enrollees who are patients seen on a regular basis by the provider or receive primary care from the provider of discontinuation of a provider 30 days prior to the effective date of the change or otherwise as soon as practicable. Second, we require the issuer, in cases where a provider is terminated without cause, to allow enrollees in active treatment to continue treatment until the treatment is complete or for 90 days (whichever is shorter) at in-network cost-sharing rates. The provision is limited to specific cases where the enrollee is in active treatment.

This goes to address the issue of "bait & switch" on hospitals/doctors being in-network that I addressed a week or so ago.

Network Adequacy (Cost Sharing): Under this rule, beginning in 2018, issuers must count the cost sharing charged to the enrollee for certain out-of-network services provided at an in-network facility by an ancillary provider towards the enrollee’s annual limitation on cost sharing. The exception to this requirement is if the issuer provides a written notice to the enrollee by the longer of when the issuer would typically respond to a prior authorization request timely submitted, or 48 hours prior to the service that an out-of-network ancillary provider may be providing these services and that the enrollee may incur additional costs. This provision aims to limit “surprise bills” to consumers.

The problem being dealt with here is the scenario where you go into a hospital for surgery. The hospital is in-network. Your surgeon is in-network...but the anesthesiologist turns out not to be in-network. You're obviously in no condition to argue about this 5 minutes before they put you under, nor can you be expected to ensure that every single member of the surgical staff is in your network.

Network Adequacy (Transparency): With the goal of starting in 2017, HealthCare.gov plans to include a rating of each QHP’s relative network coverage. This rating will be made available to a consumer when making a plan selection, and will help an enrollee select the plan that best meets his or her needs. This summary measure will be developed by comparing the breadth of the QHP network at the plan level to the breadth of the other plan networks for plans available in the same geographic area.

SHOP: We are adding a third employee choice option under which employers will have the option of offering all plans across all actuarial value levels from one issuer (“vertical choice”). We are finalizing the addition of this vertical choice option in the Federally-facilitated SHOPs (FF-SHOPs) for plan years beginning on or after January 1, 2017, but will give States with FF-SHOPs an opportunity to recommend that the FF-SHOP in their State not offer vertical choice in their State. States with SBE-FPs utilizing the Federal platform for SHOP enrollment functions will be able to opt out of making vertical choice available in their States. SHOPs in all states would continue to be required to permit employers to offer a choice of all QHPs at a single actuarial value level of coverage.

To be perfectly frank, I was half expecting CMS to announce that they were just scrapping the SHOP program entirely. It's not like they've ever actually released any official enrollment data at the national level; to the best of my estimates, they hit around 90,000 people in 2014 and no more than perhaps 200-300K in 2015. Looks like they're still messing around with it, trying to make it a reasonable option for more small businesses, however.

Post-enrollment Assistance and Other Requirements for Assisters: We are expanding the required duties of FFM Navigators to include specific post-enrollment and other assistance activities such as helping consumers understand the basic process of filing Marketplace eligibility appeals, helping consumers understand and apply for exemptions from the individual shared responsibility payment that are granted through the Marketplace, and helping consumers understand basic concepts and rights related to health coverage and how to use it. These duties will be required in FFMs beginning with Navigator grants awarded in 2018, and State-based Marketplaces will have the option of requiring or authorizing them. In addition, we require Navigators to provide targeted assistance to vulnerable or underserved populations in the Marketplace service area, and permit each Marketplace to define and identify the underserved and vulnerable populations its Navigators will target. We are also finalizing that Navigators and non-Navigator assistance personnel are required to complete training prior to performing outreach and education activities as well as prior to providing application or enrollment assistance. Lastly, we finalize that certified application counselor designated organizations must provide the Marketplace in which they serve metrics related to the number and performance of the organization’s certified application counselors, at the Marketplace’s request.

This isn't an area that I've followed closely, but it makes total sense. Until now, ACA "navigators" appeared to focus their efforts on one particular limited time window, and then...well, I'm not sure what happened the rest of the year. I have no idea if being an ACA navigator is a year-round job or if it's more like being a Census worker, with the job essentially being seasonal. Going forward, it appears that HHS is gonna beef up the role of navigators to be more of a soup-to-nuts postion, which is a great idea.

UPDATE: I've been informed that being an ACA Navigator actually already is a full-year job; their off-season duties already include stuff like:

- Helping people enroll via Special Enrollment Periods

- Helping explain the small business exchange (SHOP)

- Teaching people about how their new insurance works and how best to utilize it

- Marketing/outreach/education at public events like festivals, farmers markets and so forth

So it sounds like this isn't as big of a change as I thought, more of an enhancement to existing duties, but that's still a good thing.

Direct Enrollment Enhancements and Agent and Broker FFM Enforcement: We are establishing a framework to support the use of an expanded direct enrollment pathway option for web-brokers and QHP issuers in 2018 and future coverage years under which an applicant may remain on the web- broker’s or issuer’s non-FFM website to complete the Marketplace application and enroll in coverage. We intend to supplement the framework we are finalizing with more specific guidance and requirements in future rulemaking. Until then, entities must continue to comply with the current direct enrollment process. We also established standards for terminating or suspending agreements between agents and brokers and the FFM in cases of fraud or abusive conduct that may cause imminent or ongoing consumer harm; for providing notice to States of those suspension and termination actions; governing the conduct of FFM-registered agents and brokers to better protect consumers and ensure the efficient operation of the FFMs; and providing for penalties other than terminations of the agent’s or broker’s FFM agreements.

This one relates to two types of companies:

- First, online insurance brokers like eHealth and GoHealth. Right now, as I understand it, if you visit one of these websites and plug in your data to enroll in a healthcare policy, someone at their end basically opens up HealthCare.Gov (or a state exchange website) and plugs the exact same info into that website (I could be wrong about this). Instead, it sounds like in the future they hope to have an API which will allow the web brokers to hook directly into HC.gov/etc, thus avoiding double-entry of data (with the accompanying potential for errors) and streamlining the process.

- Second, it sounds like this would also apply to the websites of the carriers themselves, like Blue Cross, Aetna, etc. This would be a way of letting people enroll "through" the ACA exchange without necessarily even knowing that they're doing so.