2026 Final Gross Rate Changes - Maine: +23.9%, slight drop from preliminary but still ugly...

Originally posted 6/11/25

via the Maine Bureau of Insurance:

Each year insurers that sell Individual and Small Group plans in Maine's pooled risk market must submit their proposed forms and rates to the Bureau of Insurance, using the System for Electronic Rate and Form Filing (SERFF). Details of the filings submitted to the state since June 10, 2010 can be viewed in the system.

Anthem Health Plans of Maine:

The proposed rates have been developed from 2024 Individual and Small Group ACA combined experience, and the proposed average annual rate change at the Merged Market level is 18.0%.

The proposed annual rate changes by product for Individual range from 17.9% to 20.6%, with rate changes by plan from 10.1% to 30.0%. These ranges are based on the renewing plans, and are consistent with what is reported in the Unified Rate Review Template. Exhibit A shows the rate change for each plan.

Factors that affect the rate changes for all plans include:

- Emerging experience different than projected.

- Trend: This includes the impact of inflation, provider contracting changes, and changes in

- utilization of services.

- Morbidity: There are anticipated changes in the market-wide morbidity of the covered population

- in the projection period.

- Benefit modifications, including changes made to comply with updated AV requirements.

- Changes in taxes, fees, and some non-benefit expenses.

...The projected population consists of expected retention of existing policies and new sales. The new sales include the previously uninsured population and previously insured populations from other carriers or markets. The morbidity adjustment reflects projected Anthem and market changes in morbidity, including changes from the expiration of the enhanced ACA premium tax credits on December 31, 2025. Selective lapsation is expected to increase morbidity of the risk pool as a disproportionate number of healthy enrollees is expected to leave the market due to increases in their net premiums after subsidies and economic considerations. The cumulative morbidity factor can be found in Exhibit E, which is a factor of 1.0580 applied to claims.

HPHC Insurance Co:

Harvard Pilgrim is filing updated plans for 2026 to comply with the 2026 Clear Choice Designs published by the Bureau of Insurance in accordance with Rule 851. The existing 2025 enrollees have been mapped to the most similar 2026 plan in considering the rate increases for 2026. With these changes the increases by plan will vary, with some plans receiving higher increases and some receiving lower increases than the average. The average increase for renewing members is 17.7%.

The primary drivers of the rate increase include:

- Medical and pharmacy cost trend reflecting anticipated increases in unit cost, utilization, and service mix

- Difference in actual to projected experience

- Impact of the enhanced advanced premium tax credits (APTCs) set to expire after 2025

- Changes in benefit design and product mix

- Anticipated changes in risk adjustment

- Changes in administrative expenses

...A 1.02 factor was entered in this section of URRT Worksheet 1, reflecting the anticipated change in average morbidity of the Maine Merged Market population due to the enhanced advanced premium tax credits (APTCs) set to expire after 2025.

Harvard Pilgrim Health Care, Inc:

Harvard Pilgrim is filing updated plans for 2026 to comply with the 2026 Clear Choice Designs published by the Bureau of Insurance in accordance with Rule 851. The existing 2025 enrollees have been mapped to the most similar 2026 plan in considering the rate increases for 2026. With these changes the increases by plan will vary, with some plans receiving higher increases and some receiving lower increases than the average. The average increase for renewing members is 20.0%.

The primary drivers of the rate increase include:

- Medical and pharmacy cost trend reflecting anticipated increases in unit cost, utilization, and service mix

- Difference in actual to projected experience

- Impact of the enhanced advanced premium tax credits (APTCs) set to expire after 2025

- Changes in benefit design and product mix

- Anticipated changes in risk adjustment

- Changes in administrative expenses

...A 1.020 factor was entered in this section of URRT Worksheet 1, reflecting the anticipated change in average morbidity of the Maine Merged Market population due to the enhanced advanced premium tax credits (APTCs) set to expire after 2025.

Maine Community Health Options:

This document is provided to request a rate increase for Maine Community Health Options (CHO) (dba Community Health Options) individual products in Maine with effective dates of January 1, 2026 through December 31, 2026.

This document specifically addresses the rate increases requested, which impacts roughly 22,482 members that CHO had enrolled in the individual market as of April 1, 2025. The rate increase being requested is 34% in aggregate across all individual plans renewing in 2026. The requested rate increase varies by plan with a minimum increase of 22% and a maximum increase of 40%.

The rate changes are being driven by the following key changes in rating from 2025 to 2026:

- Development of underlying experience relative to expected

- Expected market morbidity changes caused by a shifting risk pool for certain populations purchasing exchange coverage after expiration of the enhanced federal subsidies

- Changes to the Maine Guaranteed Access Reinsurance Association (MGARA) 1332 waiver insurance program parameters in 2026

- Increased medical cost trend

...Assuming the enhanced premium subsidies first introduced through the American Rescue Plan Act (ARPA) and later extended by the Inflation Reduction Act (IRA) are allowed to expire at the end of 2025, we anticipate a reduction in the overall market size in 2026. This will lead to increasing average statewide morbidity in 2026 relative to the 2024 experience period as consumers either lose access to subsidies (for those at or above 400% of the Federal Poverty Level) or face higher net premiums due to less generous subsidies.

We anticipate the remaining risk pool in 2026 to have higher healthcare needs, on average, as healthier consumers are more likely to lapse coverage. Given these considerations, we apply a morbidity adjustment of 1.03 to reflect anticipated changes in statewide average morbidity in 2026 relative to 2024.

Taro Health Plans of Maine (Mending):

Mending is renewing seven plans and terminating one plan offered in 2025 in Maine. The overall rate increase proposed for the plans in this filing is 19.0% for the merged market membership weights and 19.1% for the individual market membership weights. Note that the plan level rates do not vary between individual and small group as it is a merged market. Table B.1 contains basic rate change information on the proposed plans and table B.2 provides a brief benefit description of each plan.

...The rates for these products are being adjusted for the reasons outlined in this section.

EXPIRATION OF ENHANCED SUBSIDIES: With the expiration of enhanced premium tax credits anticipated at the end of plan year 2025, we expect both the market and Mending’s morbidity will increase as members no longer eligible for a subsidy (or eligible for a lower subsidy) who may have fewer healthcare needs leave the market.

MEDICAL TREND: The claim cost assumptions have been adjusted to reflect expected increases in unit cost and utilization. The manual rate and experience rate development sections contain additional information.

BENEFIT DESIGN CHANGES: Changes were made to a number of cost-sharing parameters, including updating maximum out-of-pockets and deductibles according to Clear Choice limits. See the accompanying AV calculator screenshots for more detail on plan benefits.

EXPERIENCE DATA: We have incorporated Mending’s 2023 and 2024 Maine merged market experience data to develop the 2026 rates assuming 84.6% credibility of this experience. The experience period premium and claims section contains additional information.

MANUAL RATE CHANGES: We have updated our approach to develop the manual rate using the latest available information on risk adjustment and publicly available data submitted in connection with Maine individual and small group rate filings for the 2024 and prior plan years, adjusted to Mending’s projected 2026 population and service area. This also includes an update to the underlying direct primary care contracted fees and assumed member effectuation, based on experience and known changes to-date. The manual rate development section contains additional information.

...For the 2026 plan year, the Maine Bureau of Insurance has requested that carriers submit three versions of rates. One version would assume the existence of Maine’s 1332 waiver reinsurance program and the expiration of enhanced subsidies at the end of 2025. A second version of rates would assume the existence of the reinsurance program and extension of enhanced subsidies into 2026. Alternative versions of the Part I Unified Rate Review Template and Rates Tables are uploaded to SERFF to support this scenario. A third version of rates would assume the reinsurance program is not in effect for plan year 2026 (and enhanced subsidies expire at the end of 2025). For purposes of this submission, the waiver effect does not include the impact of the merged Maine individual and small group markets. Rather, it only captures the impact of the continued operation and funding of the Maine Guaranteed Access Reinsurance Association (MGARA). Both versions include the MGARA assessment fee of $4.00 PMPM.

...Morbidity: We adjusted the market average claim costs by 2.5% for the impact of the expiration of enhanced subsidies.

UnitedHealthcare of New England:

The year-over-year proposed change in rates for this filing is 7.1% compared to the prior filing.

The proposed pricing trend is 10.8% annually. Proposed trends are shown on Appendix 6.A. Automatic trend increases are limited to one year from the effective date.

The primary drivers of the proposed rate changes are the following:

Changes in medical service costs

- Increasing Cost of Medical Services – Annual increases in reimbursement rates to health care providers – such as hospitals, doctors and pharmaceutical companies.

- Increased Utilization – The number of office visits and other services continues to grow. In addition, total health care spending will vary by the intensity of care and/or use of different types of health services. Patients who are sicker generally have a higher intensity of health care utilization. The price of care can be affected by the use of expensive procedures such as surgery vs. simply monitoring or providing medications.

- Higher Costs from Deductible Leveraging – Health care costs continue to rise every year. If deductibles and copayments remain the same, a greater percentage of health care costs need to be covered by health insurance premiums each year.

- Cost shifting from the public to the private sector – Reimbursements from the Center for Medicare and Medicaid Services (CMS) to hospitals do not generally cover all of the cost of care. The cost difference is being shifted to private health plans. Hospitals typically make up this difference by charging private health plans more.

- Impact of New Technology – Improvements to medical technology and clinical practice often result in the use of more expensive services - leading to increased health care spending and utilization.

Administrative costs and anticipated profit

- UnitedHealthcare works to directly control administrative expenses by adopting better processes and technology and through the development of programs and innovations that make health care more affordable. We have led the marketplace by introducing key innovations that make health care services more accessible and affordable for customers, improve the quality and coordination of health care services, and help individuals and their physicians make more informed health care decisions.

- Additionally, UnitedHealthcare indirectly controls medical cost payments by using appropriate payment structures with providers and facilities. UnitedHealthcare’s goal is to control costs, maximize efficiency, and work closely with physicians and providers to obtain the best value and coverage.

- State and/or Federal government imposed taxation and fees are additional significant factors that impact health care spending. These fees include ACA taxes and fees which will have increased health insurance costs and need to be reflected in premium.

UnitedHealthcare Insurance Co:

The year-over-year proposed change in rates for this filing is 7.4% compared to the prior filing.

The proposed pricing trend is 10.8% annually. Proposed trends are shown on Appendix 6.A. Automatic trend increases are limited to one year from the effective date.

The primary drivers of the proposed rate changes are the following:

Changes in medical service costs

- Increasing Cost of Medical Services – Annual increases in reimbursement rates to health care providers – such as hospitals, doctors and pharmaceutical companies.

- Increased Utilization – The number of office visits and other services continues to grow. In addition, total health care spending will vary by the intensity of care and/or use of different types of health services. Patients who are sicker generally have a higher intensity of health care utilization. The price of care can be affected by the use of expensive procedures such as surgery vs. simply monitoring or providing medications.

- Higher Costs from Deductible Leveraging – Health care costs continue to rise every year. If deductibles and copayments remain the same, a greater percentage of health care costs need to be covered by health insurance premiums each year.

- Cost shifting from the public to the private sector – Reimbursements from the Center for Medicare and Medicaid Services (CMS) to hospitals do not generally cover all of the cost of care. The cost difference is being shifted to private health plans. Hospitals typically make up this difference by charging private health plans more.

- Impact of New Technology – Improvements to medical technology and clinical practice often result in the use of more expensive services - leading to increased health care spending and utilization.

Administrative costs and anticipated profit

- • UnitedHealthcare works to directly control administrative expenses by adopting better processes and technology and through the development of programs and innovations that make health care more affordable. We have led the marketplace by introducing key innovations that make health care services more accessible and affordable for customers, improve the quality and coordination of health care services, and help individuals and their physicians make more informed health care decisions.

- • Additionally, UnitedHealthcare indirectly controls medical cost payments by using appropriate payment structures with providers and facilities. UnitedHealthcare’s goal is to control costs, maximize efficiency, and work closely with physicians and providers to obtain the best value and coverage.

- State and/or Federal government imposed taxation and fees are additional significant factors that impact health care spending. These fees include ACA taxes and fees which will have increased health insurance costs and need to be reflected in premium.

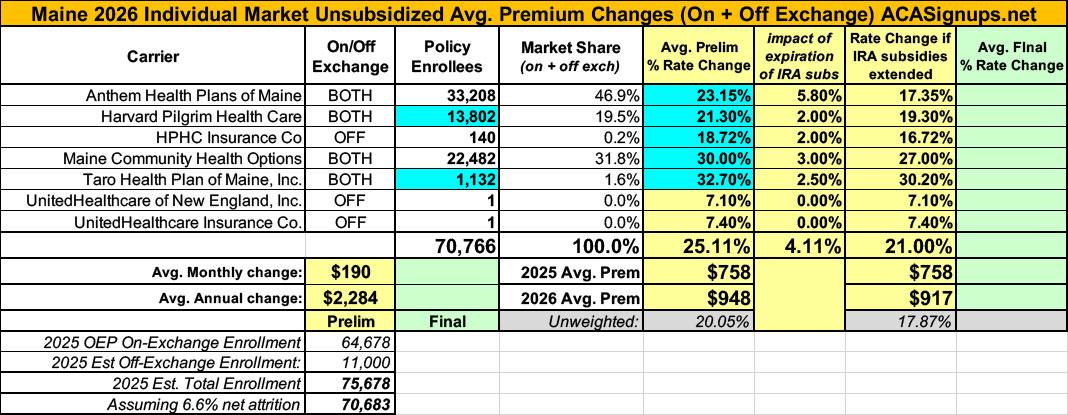

End result of all of this: An average 24% preliminary rate hike (ouch), 4.1 points of which is due specifically to the IRA subsidies expiring.

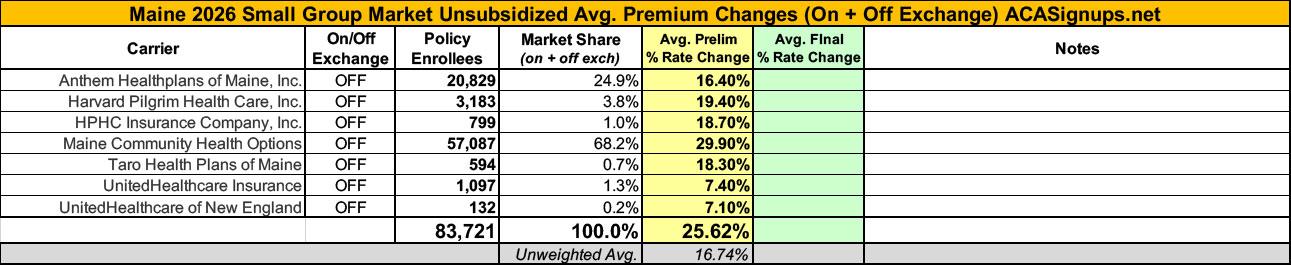

The small group market is looking at an even uglier 25.6% average rate hike.

UPDATE 8/14/25: Several of the carriers have submitted revised filings as well as revised current enrollment estimates which bump up the weighted average increase slightly to 25.1%.

- Anthem: 19% ⬆️ 23.2%

- Harvard Pilgrim: 20% ⬆️ 21.3%

- HPHC: 17.7% ⬆️ 18.7%

- Maine CHO: 34% ⬇️ 30%

- Taro: from 19.1% ⬆️ 32.7%

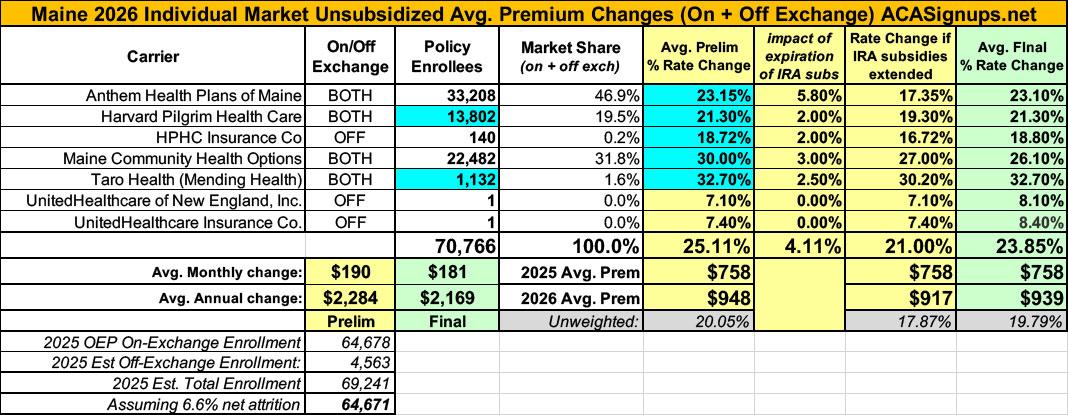

UPDATE 9/4/25: The Maine Insurance Dept. has published the final, approved 2026 rate changes for both the individual and small group markets.

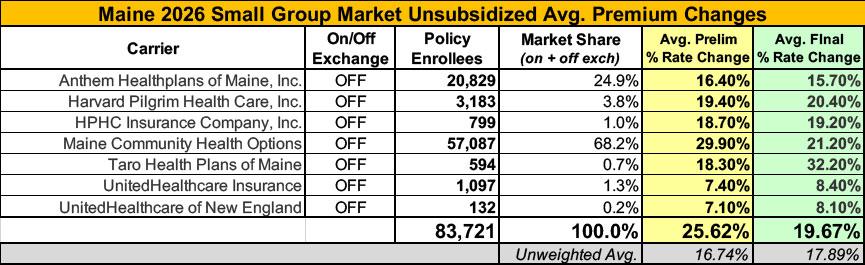

Overall, the indy market rate hikes end up slightly lower than requested, at 23.9% on average, while small group plans will go up 19.7% instead of the earlier 25.6% average...although the Maine Bureau of Insurance insists that the latter is 17.5%...

They also posted a press release about this:

Higher rates are driven by increasing cost of medical services, growing costs of prescription drugs, and instability of policies at the Federal Level

The Maine Bureau of Insurance today announced the finalized 2026 health insurance rates for Maine’s individual and small group market to take effect on January 1, 2026. Following a careful review of proposals from Maine’s insurers and after a public hearing, the Bureau has approved an average rate increase of 23.9 percent for the individual market and 17.5 percent for the small employer market (those with 50 or fewer employees).

These average final rates are slightly lower than those initially requested by health insurers – which were 26 percent for individuals and 19 percent for small employers – and are consistent with increasing rates across the nation. A recent analysis by the Kaiser Family Foundation found that, nationally, rates are increasing by an average of 20 percent.

Note: It's actually more like 23%...

The Bureau is limited in what it can do to control proposed rate increases. Under State law, the Bureau examines each insurer’s experience and projected costs and is charged with determining whether rates are excessive, inadequate, or unfairly discriminatory. In this context, “excessive” is measured by the amount of premium needed to cover the expected cost. Federal law requires insurers to spend at least 80 cents of every premium dollar on health care services to ensure that health insurer profits do not drive premium increases.

“These higher rates are being driven by the increasing cost of medical services, the growing cost of prescription drugs, and the instability of Federal policies – especially the potential expiration of enhanced premium tax credits at the end of this year,” said Bob Carey, Superintendent of the Maine Bureau of Insurance. “While the premium tax credits will continue in 2026, they will be greatly reduced unless Congress and the President act soon.”

...The individual market covers roughly 71,000 Maine residents who purchase health plans on their own, primarily through CoverME.Gov, the state’s online marketplace. At year-end 2024, the small group market covered over 45,000 people who obtain health insurance through a small employer. The vast majority of Maine people obtain health insurance coverage through their employer through the large group market. Rates in the large group market are not subject to review and approval by the BOI.

Health insurance premiums vary by health insurer and by health plan. The Bureau urges consumers to shop for a policy that best meets their needs.

The 45,000 figure for small group enrollees is fascinating since I have the Maine small group market down as being nearly twice that...I'm assuming this is also the reason for the discrepancy in avg. rate increases as well. Huh.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.