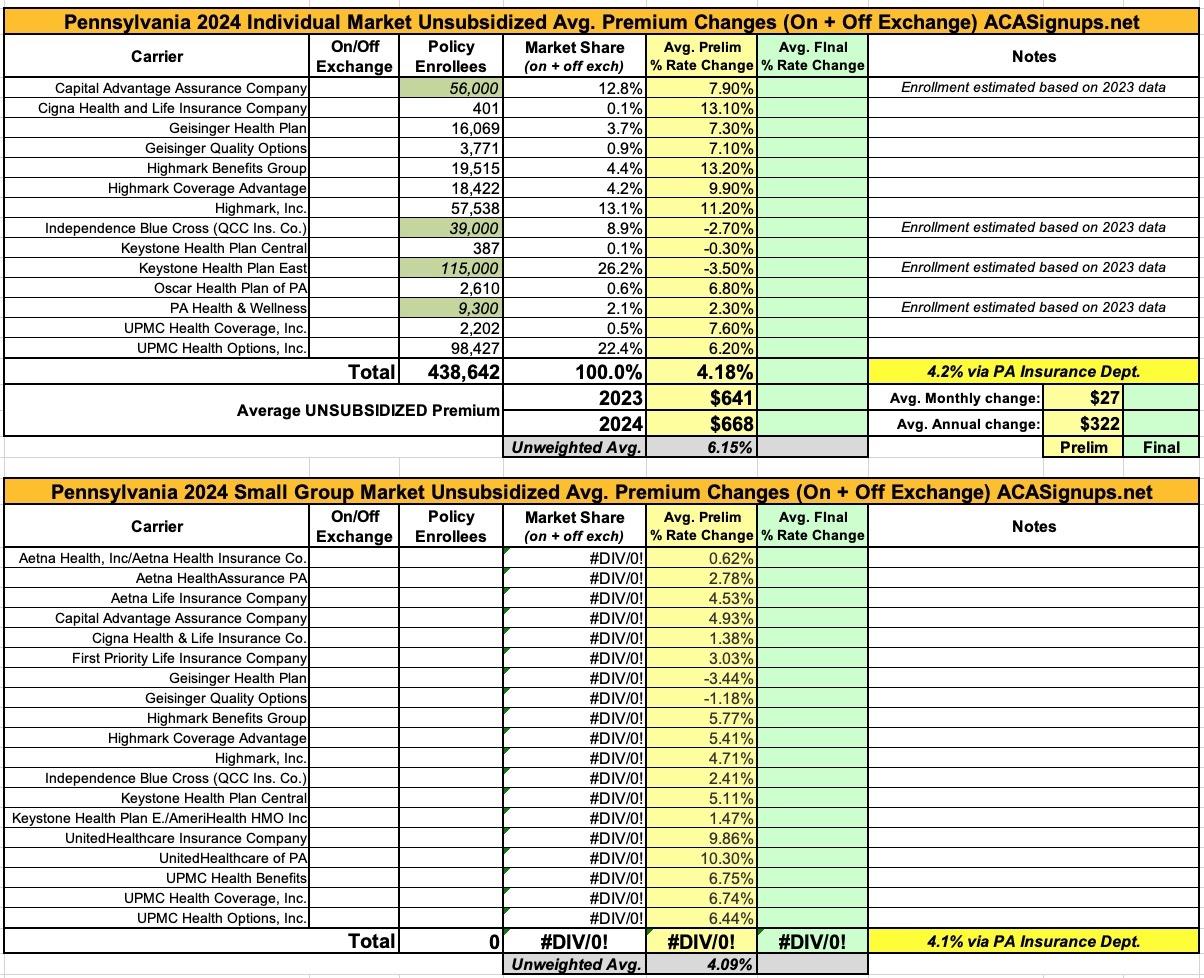

Pennsylvania: Preliminary avg. unsubsidized 2024 #ACA rate changes: +4.2%

via the Pennsylvania Insurance Dept:

Shapiro Administration Announces Public Comment Period On Proposed 2024 Health Insurance Rate Increases

Harrisburg, PA – Pennsylvania Insurance Commissioner Michael Humphreys today welcomed public comment on the requested rate changes insurance companies currently operating in Pennsylvania's individual and small group market filed for 2024. The comment period on the proposed rate increases will close on September 8.

"The Shapiro Administration is committed to raising awareness about the importance of health insurance and providing increased access to affordable, comprehensive health coverage," said Humphreys. "We strongly encourage individual market consumers to shop for coverage on Pennie® where they may qualify for financial assistance that, as we consistently hear from Pennsylvanians, makes coverage more affordable than they thought might be possible."

"This year's requested rates are tracking below the rate of medical inflation and represent a smaller increase than policy holders saw coming into 2023," added Humphreys. "Health care costs are rising across the country, but in Pennsylvania, our health insurance market is stabilizing, and our health insurance remain accessible and competitive."

Insurance companies offering individual and small group health insurance plans are required to file proposed rates with the Pennsylvania Insurance Department for review and approval before plans can be sold to consumers. The Department reviews rates to ensure that the plans are priced appropriately and are not unfairly discriminatory.

For 2024, insurers currently selling in the individual market filed plans requesting an average statewide increase of 4.2 percent. These filings include[1],[2]:

- Capital Advantage Assurance Company (Rating areas 6,7,9, Average rate request 7.9%)

- Cigna Health and Life Insurance Company (Rating area 8, Average rate request 13.1%)

- Geisinger Health Plan (Rating areas 2,3,5,6,7,9, Average rate request 7.3%)

- Geisinger Quality Options (Rating areas 2,3,5,6,7,9, Average rate request 7.1%)

- Highmark Benefits Group Inc. (Rating areas 3,8, Average rate request 13.2%)

- Highmark Coverage Advantage Inc. (Rating areas 1,4, Average rate request 9.9%)

- Highmark Inc. (Rating areas 1,2,4,5,6,7,9, Average rate request 11.2%)

- Independence Blue Cross (QCC Ins. Co.) (Rating area 8, Average rate request -2.7%)

- Keystone Health Plan Central (Rating areas 6,7,9, Average rate request -0.3%)

- Keystone Health Plan East, Inc. (Rating area 8, Average rate request -3.5%)

- Oscar Health Plan of Pennsylvania, Inc. (Rating areas 3,6,7,8, Average rate request 6.8%)

- Pennsylvania Health & Wellness, Inc. (Rating areas 3,6,7,8, Average rate request 2.3%)

- UPMC Health Coverage, Inc. (Rating areas 1,5, Average rate request 7.6%)

- UPMC Health Options, Inc. (Rating areas 1,2,3,4,5,6,7,9, Average rate request 6.2%)

Insurers that currently sell in Pennsylvania's small group market filed plans requesting average statewide increases of 4.1 percent.

In the proposed individual and small group market filings, Highmark plans to expand into five new counties: Bucks, Chester, Delaware, Montgomery, and Philadelphia counties, while Geisinger plans to expand its individual and small group offerings into Bedford County, increasing choice for consumers as three insurers will now be offering plans.

Public comment on rate requests and filings will be accepted through September 8, 2023, and can be emailed to ra-in-comment@pa.gov.

"As part of our public rate review process, we encourage consumers to submit comments to the Department on the proposed rate increases," said Humphreys. "We want to make sure that Pennsylvanians' voices are being heard while we determine if the proposed increases are actuarily justified."

Nearly 372,000 Pennsylvanians enrolled in health coverage through the Commonwealth's official marketplace, Pennie®, during the 2023 Open Enrollment period. Almost 90 percent of Pennie customers are eligible for financial savings, which for those who are taking advantage of it, is on average more than $520 a month for those customers. With these savings, over 32 percent of customers pay less than $50 a month for coverage, and over 20 percent of customers pay less than $15 a month.

Rate filings for 2024 health insurance plans were submitted to PID on May 17. Proposed rate changes vary by plan and region and are subject to change as the department conducts its review process. Final approved rates will be made public in the fall.

Unfortunately, not all of the preliminary individual market rate filings listed at the federal Rate Review website include actual enrollment data; some are redacted. However, most of them are available, and I've made what should be a fairly close estimate for the other four based on last year's final filings and the statewide weighted +4.2% average stated in the press release.

Unfortunately, the enrollment data isn't really available at all for the small group market carriers, although the weighted overall average is a nearly identical +4.1% according to the press release.

From some of the filings:

RFJ Part II – Consumer Friendly Justification Individual Exchange EPO/PPO Rate Filing

The rate change for UPMC Health Options Individual plans is 10.04% for 2024. Rate change drivers include the following:

- Increases in medical and pharmacy cost and utilization

- Changes to the state reinsurance program for the Individual health insurance market.

Scope and Range of the Rate Increase

The number of individuals affected by this rate increase is 98,427. The proposed rate increase varies by plan due to various changes made to meet AV requirements on a plan‐by‐plan basis. The range of the proposed rate change is 2.73% to 21.22%.

Financial Experience of the Product

UPMC Health Options incurred an underwriting gain in the ACA Individual market in 2022.

Changes in Medical Service Costs

Cost and utilization increases are expected to increase by approximately 4.64% for 2024.

Changes in Benefits

No changes in benefits contributed significantly to the increase.

Administrative Costs and Anticipated Margins

Changes in administrative costs contribute to the rate increase. This rate filing anticipates a surplus and risk margin for 2024.

The significant factors driving the proposed rate change include the following:

Medical and Prescription Drug Inflation and Utilization Trends

The projected premium rates reflect the most recent emerging experience which was trended for anticipated changes due to medical and prescription drug inflation and utilization.

Administrative Expenses, Taxes and Fees, and Risk Margin

Changes to the overall premium level are needed because of required changes in federal and state taxes and fees. In addition, there are anticipated changes in both administrative expenses and targeted risk margin.

Prospective Benefit Changes

Plan benefits have been revised as a result of changes in the Center for Medicare and Medicaid Services (CMS) Actuarial Value Calculator and state requirements, as well as for strategic product considerations.

Anticipated Changes in the Average Morbidity of the Covered Population

Changes to the overall premium level are needed because of anticipated changes in the underlying morbidity of the projected marketplace.

COVID-19 Pandemic

Changes to the overall premium level are needed to account for sustained lower levels of emerging COVID-19 spend, as well as for the impact of the Public Health Emergency ending.

Scope and Range:

Highmark is requesting an average ACA individual market rate increase of 10.1%, ranging from 2.0% to 18.8%. Products submitted with this filing will have effective dates from January 1, 2024 to December 31, 2024. This rate change is projected to affect 57,538 members.

Historical Financial Experience:

Highmark incurred an underwriting gain in its ACA individual market programs in 2022.

Change in Medical Service Costs:

The projected average cost of medical care for the projected population is expected to increase. The increase will emerge in utilization and average cost per service, and is spread across all types of services.

Change in Benefits and Cost Sharing:

Some cost sharing parameters were changed in order to maintain compliance with Federal AV requirements. Additionally, some out of pocket maximum parameters were changed to keep up with the rising cost of health care. These out of pocket maximum changes also aided in mitigating the rate increase.

Administrative Costs and Anticipated Operating Results:

The anticipated administrative costs and operating results are not excessive or unreasonable. In accordance with regulations, the projected medical loss ratio is over 80%.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.