Colorado: (Preliminary) avg. unsubsidized 2023 #ACA rate changes: +11.3%; Colorado Option plans going live

Moments ago via the Colorado Division of Insurance:

Reinsurance continues to save Coloradans money on health care, while the Colorado Option Plan is included for the first time.

DENVER - The Colorado Division of Insurance (DOI), part of the Department of Regulatory Agencies (DORA), has released preliminary information about the health insurance plans and premiums for 2023 -- for the individual market (meaning health insurance plans for people who don’t get their insurance from an employer) and the small group market (for small businesses with 2-100 employees).

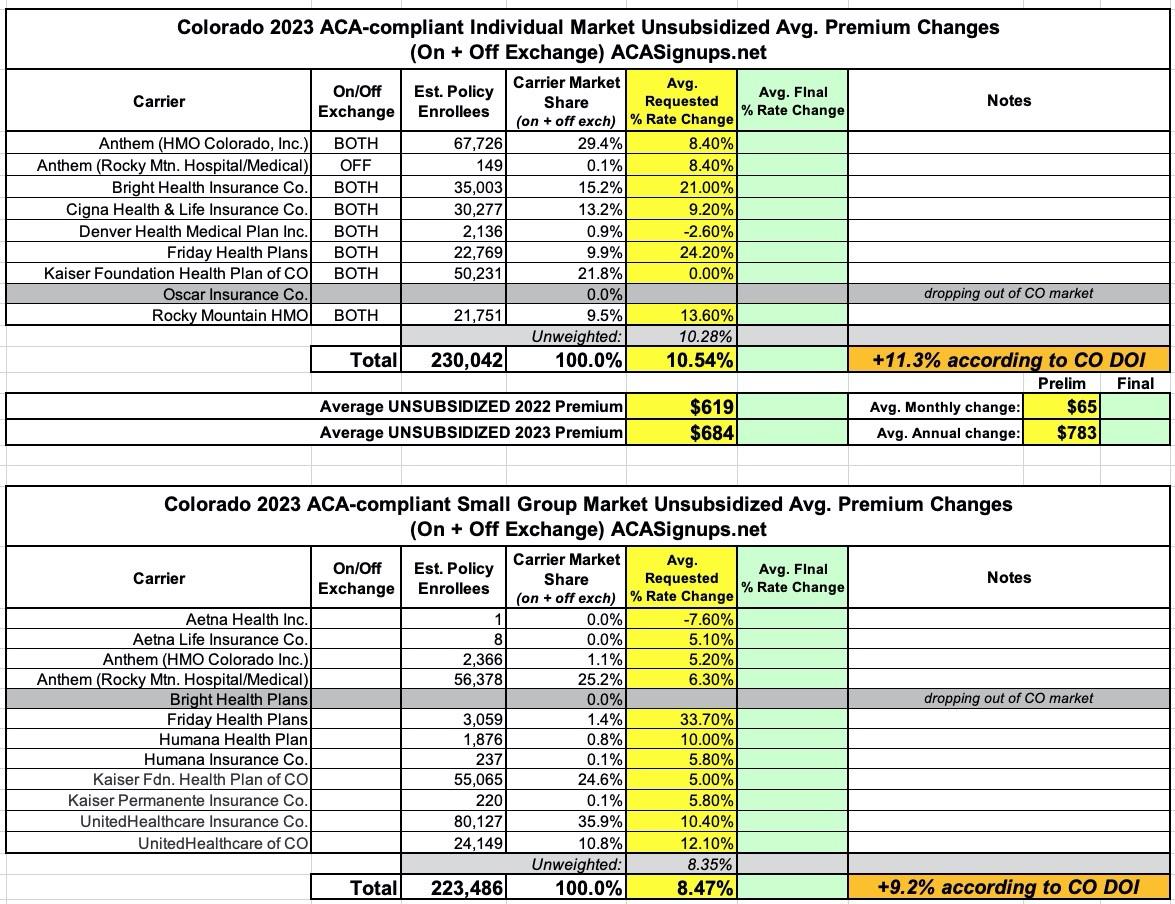

The initial review by the DOI of the insurance companies’ filings for 2023, indicate that the overall average consumer impact on premiums in the individual market will be an 11.3% increase over 2022 premiums. These are the health insurance plans available to individuals on Connect for Health Colorado, the state’s health exchange made possible by the Affordable Care Act (ACA).

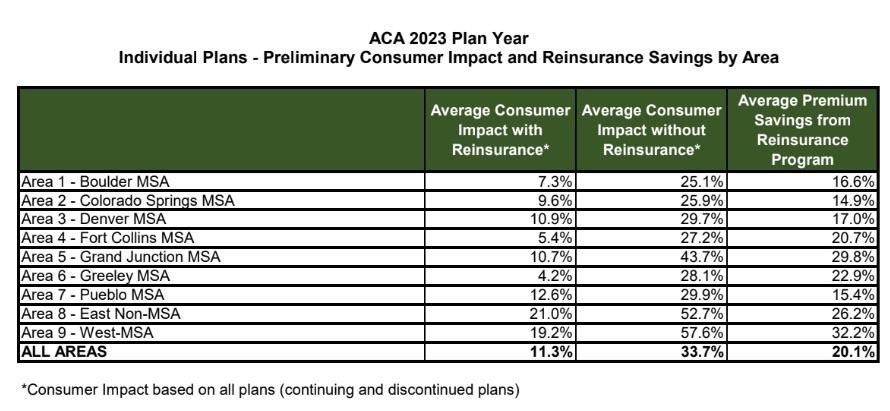

Reinsurance Program

This June, the Centers for Medicare and Medicaid Services (CMS) authorized the continuation of the Reinsurance Program through 2027 for individual health insurance plans. Initial analysis by the DOI shows that without the Reinsurance Program, consumers would be looking at an approximate 34% increase in premiums for 2023. That means without the Reinsurance Program, the increase would have been approximately 23% higher, showing that the Reinsurance Program continues to save people money on health care.“I’m really proud of all the work that the Polis-Primavera administration has been able to accomplish to ensure access to high-quality and affordable health care for all Coloradans, including the Reinsurance Program and Colorado Option,” said Dianne Primavera, Lieutenant Governor and Director of the Office of Saving People Money On Health Care. “We are setting a national precedent by offering more affordable coverage for our neighbors across the state and including primary care and mental health visits at no additional cost under the Colorado Option.”

“The Reinsurance Program continues to deliver savings for Coloradans in 2023. That makes it even more critical that the federal government authorized the extension of this valuable program through 2027 as part of the approval of the amendment to our waiver for our first-in-the-nation Colorado Option Program," said Colorado Insurance Commissioner Michael Conway. “The Colorado Option will bring strong competition to our individual and small group markets. The Colorado Option will increase the number of plans available to people throughout the state, and in nearly every county, the Colorado Option plans will have premiums that are more affordable than the average non-Colorado-Option plan.”

The Colorado Option

The Colorado Option was enacted through HB21-1232, which was signed into law by Governor Polis in June 2021. The law was sponsored by Rep. Dylan Roberts, Rep. Iman Jodeh and Senator Kerry Donovan. As part of the Colorado Option, the DOI has created a Standard Plan which will allow consumers and businesses to easily compare plans and choose the plan that is right for them. In addition to covering all essential health benefits required by the ACA, the Colorado Option will have free primary care and free mental health health visits, and has been designed to reduce racial health disparities and improve health equity.Starting in 2023, the Colorado Option will be available to all Coloradans who buy their health insurance on the individual market (i.e. not from an employer) and small employers with 2 - 100 employees. It will also include new support for Coloradans that have been left out of the financial help provided under the ACA, while expanding subsidies for some consumers enrolled through Connect for Health Colorado. Per the law, plans in the Colorado Option must lower health insurance premiums for individuals, families, and small businesses by 5% in 2023 (compared to 2021 plans), by 10% in 2024, and by 15% in 2025. Find more details about the processes and methods for the Colorado Option on the Colorado Option website.

For 2023, the Colorado Option is succeeding in increasing the level of competition for health insurance in Colorado. It is bringing 42 new individual health plans with increased benefits into the market, and 48 new small group plans. These plans will be sold by the insurance companies in each county they sell other individual and small group plans. In almost all counties in the state, across all metal levels (bronze, silver and gold), the lowest cost individual market Colorado Option Plan in the county is cheaper than the average premium for non-Colorado-Option plans. And in the small group market, this is true for every county, for every metal level.

Initial reviews of the plans insurance companies submitted for 2023 show that ALL counties in Colorado will have access to bronze, silver and gold level individual Colorado Option plans. For current individual market enrollees, 87% will have access to either a bronze, silver or gold Colorado Option plan that is at or below the 5% premium reduction target. As that figure is based on the initial analysis, over the next few months the Division’s rate review process will dig deeper into these filings to determine exactly how many of the plans will hit that reduction target. And for 2024, the law requires the DOI to hold hearings when plans don’t meet the target.

Individual Plans

The Division is currently reviewing all the information the companies have filed to ensure that changes in premiums are justified and that the plans comply with State and federal regulations. The final, approved plans and premiums will be made available in mid-October.

- 2023 Preliminary Impact of Reinsurance Program on Individual Premiums

- 2023 Individual and Small Group Preliminary Submitted Premium Changes by Insurance Company

In the individual market, seven companies are returning to offer plans for 2023 - Anthem, Bright Health, Cigna Health, Denver Health, Friday Health, Kaiser and Rocky Mountain Health Plans. Of the 64 Colorado counties, 63 have on-exchange plans from at least two insurance companies. Jackson County is the remaining county with on-exchange plans from a single company.

Oscar Health will not offer plans in Colorado going forward (as well as Arkansas). Since entering the Colorado market in 2020, Oscar has struggled to compete with the other insurers in the individual market. In 2022, Oscar’s enrollment was only 3,800 members.

Oscar plan members will have to choose new coverage for 2023 during the fall open enrollment period that will start Nov. 1, 2022. Per Colorado insurance regulations, Oscar must provide notice to its members 180 days before its plans terminate, and the company mailed those notices in late June.

A total of seven insurance companies have proposed to offer 399 individual plans in Colorado.

- 2023 Preliminary Number of Companies and Plans

Small Group Plans

For the Small Group Market (for employers with 2-100 employees) for 2023, the overall average change in premiums anticipated will be an increase of 9.2% over 2022 premiums. This is preliminary information based on what the companies submitted to the DOI.A total of 11 insurance companies plan to offer 497 small group plans in 2023 in Colorado.

- 2023 Individual and Small Group Preliminary Submitted Premium Changes by Insurance Company

For the small group market, Bright Health has decided to not offer plans in Colorado for 2023, adding to their decision to stop offering individual plans in Illinois, New Mexico, Oklahoma, South Carolina, Utah and Virginia for the coming year (Bright will continue to offer individual plans in Colorado in 2023). Considering the DOI’s $1M fine of Bright regarding the company’s operational issues, pulling back from the small group market should provide the company with additional capacity to address those issues. Like Oscar in the individual market, Bright struggled to be competitive in the small group market since starting in 2021. This year, Bright’s enrollment in the small group market was only 951 enrollees.

View Plans / Submit Comments

The plans and requested premiums from the insurance companies, also called filings, are accessible from the Division’s “Insurance Plan Filings & Approved Plans” website. Note that these are very technical documents, so be prepared to spend some time on this process. There is a step-by-step video guide (also available as a downloadable print guide) to help you navigate to the filings that interest you, to demonstrate how to find particular information in those filings, and to show you how you can submit comments. The tables with preliminary information linked above are also available on this site.Comments must be received by Aug. 1, to be addressed and incorporated into the DOI’s review of the companies’ filings.

I get slightly lower weighted average rate increases for both the individual & small group markets:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.