Guest Post: Don't Be Fooled; Michiganders Just Lost More Than They Gained (by Julia Pulver, RN)

NOTE: Julia A. Pulver, RN, BSN, CCM has been an registered nurse for over 12 years who has spent her career working with the most at risk populations in Southeast Michigan, and is also a personal friend of mine.

She posted this essay on Medium in response to last Friday's shockingly sudden vote to completely overhaul Michigan's auto insurance laws by the state legislature, with the full backing of Governor Gretchen Whitmer.

I'm cross-posting the essay here with her permission in hopes of giving it greater exposure. I didn't know half the stuff on this list myself.

Know What You Have Before You Give It Away

I am a certified nurse case manager who has been working in the field of catastrophic injury for the last 5 years. Though I no longer work directly with no-fault patients, or within the no-fault system, I still keep in contact with many of my former patients. Or really, their parents, since I worked with many children who had been injured, and understandably, we formed bonds that last. Not surprisingly, many of them have been contacting me in a panic ever since the surprise and rushed vote during a special Friday session of the legislature this past week, right before the Memorial Day weekend. The changes in this bill took direct aim at these patients and threatens their very lives.

The entire legislature (with few, but noted, exceptions) decided to quickly pass this bill in a lame duck-esque manner. My patients and their families did not have the ability to consider and respond to how these changes will impact their daily lives. My colleagues did not have the ability to consider or respond to a bill that will have very real, negative impacts on their ability to provide adequate care to patients. Michiganders did not have time to consider and respond to sweeping changes to our auto no-fault system that will deeply impact every single person in our state. We were just told to celebrate this rare bipartisanship and express our gratitude that “something” had been done, even if was going to cause people direct harm. You’ll excuse me if I don’t celebrate.

My shock and horror at the course of events that lead us to today keeps getting compounded every time someone, wittingly or not, falsely equivocates “PIP Benefits” and “Medical Benefits.” As we go forward with our (late) discussions on the pros and cons of our new no-fault system, let me make one thing perfectly clear:

PIP benefits are more than just your regular medical insurance benefits. Medical coverage is only a PORTION of what is covered under your PIP benefits. PIP stands for “Personal Injury Protection” and covers a wide variety of recovery services and benefits, not just traditional medical care.

It covers vastly more than MRIs, hospital and surgery costs. It covers so much more than prescription medications, casts and doctor’s appointments. In our currently broken medical system, it was the one remaining truly patient focused system we had left, and now it’s gone.

Aside from traditional medical services, having PIP coverage without benefit caps means:

- Coverage for wage loss for three years following an accident, usually 80% of your base wages, paid in real time, while you’re out of work. (So you can pay your bills when they are actually due, not years later after litigation.) This is a life saver that keeps people from financial ruin during their recovery. Not everyone has short term or long term disability through their employers, many people do not. Three years is usually enough time to either recover and return to work, or file and be awarded Social Security Disability.

Your medical insurance does NOT cover that. Medicaid does NOT cover that.

- Coverage of guardianship costs for people with brain injuries. Guardians ensure that vulnerable people without adequate social supports aren’t taken advantage of. They handle their medical treatment consents, financial decisions, and act as their legal advocate.

Your medical insurance does NOT cover that. Medicare does NOT cover that. Medicaid does NOT cover that.

- It pays for a home health aid who can help you with your activities of daily living (bathing, dressing, wiping your butt, making sure you don’t fall and get re-injured, making sure you can get out of your house quickly if there’s an emergency so you’re not trapped) while you physically recover from a catastrophic injury in the comfort of your own home (the safest, most cost effective place to recover).

Your medical insurance does NOT cover that. Medicare does NOT cover that. Medicaid does NOT cover that.

- It pays for replacement services to offset the cost of household needs (like hiring someone to mow your lawn while you recover from a broken leg this summer.) It’s a $20/day max benefit (and includes things like childcare-good luck finding someone to watch your children for $20/day). It’s not much, but it helps offset all those little costs that pop up when you are taken away from actively participating in your own life while you recover.

Your medical insurance does NOT cover that. Medicare does NOT cover that. Medicaid does NOT cover that.

- It pays for modifications to your home and car if you are now wheelchair bound or unable to use stairs. It pays for an occupational therapist to come into your home and do an assessment of what actual modifications need to be made, and the number of care giver hours you actually require, to ensure you are safe in your home and that everyone’s care needs are appropriate.

Your medical insurance does NOT cover that. Medicare does NOT cover that. Medicaid does NOT cover that.

- It pays for a nurse case manager (independent of the insurance company and attorney’s office) to be your patient advocate, provide education about the rehab process, ensure your rehab is as effective and efficient as possible, and actually reduce costs of care by avoiding unnecessary hospitalization or redundant services.

Your medical insurance does NOT cover that. Medicare does NOT cover that. Medicaid does NOT cover that.

- It pays for long term rehab and community based care so disabled patients can achieve and maintain as much mobility and independence as possible. It pays for therapists who help disabled survivors access and remain active participants in their communities, instead of being shut away in institutions.

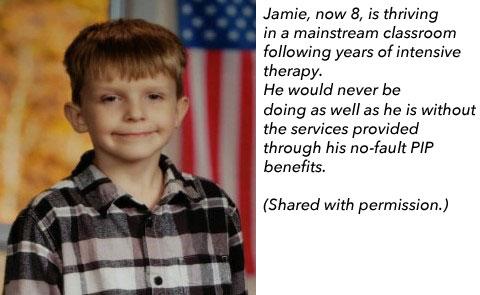

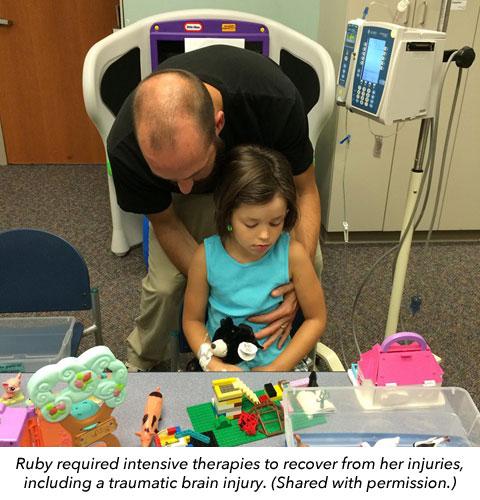

- It pays for intensive therapies for children to not only physically recover, but maintain their cognitive and physical abilities into adulthood. Outside of the no-fault system, children in need of these kinds of long term, intensive therapies are denied under their medical insurance, and are told that those therapies are the responsibility of the school systems. The schools then tell parents they don’t have the funding or staff to give kids the kind of intensive therapies they need, and will offer group based therapy for a limited amount of time. Kids who need more are forced to get intensive services through the Intermediate School Districts, and are unable to participate in mainstream classrooms. (Every teacher in the legislature should know this.)

Your medical insurance does NOT cover that. Medicare does NOT cover that. Medicaid does NOT cover that.

- It pays for therapists who will help injured people re-learn their jobs or find new jobs or skills to continue to lead meaningful lives following injuries. These therapists help return people to the workforce, which boosts our economy, instead of assuming their earning (and tax paying) days are over, and giving up on them.

Your medical insurance does NOT cover that. Medicare does NOT cover that. Medicaid does NOT cover that.

- It provides transportation for those who can’t drive following an accident to make sure they can actually get to their appointments, pick up prescriptions and stay on track with their recovery, which again, keeps them out of the ER, and saves money in the end.

Your medical insurance does NOT cover that. Medicare does NOT cover that. Medicaid does cover that, for now, let’s hope it stays that way.

That’s a lot of benefits you are being asked to sign away under the guise of being given “more choice” in your coverage options! Did you know that you were signing away your rights to all of these benefits?

This very misleading narrative: that as long as you have good medical insurance, you don’t need all those PIP benefits — is going to do long and lasting damage to our state. You have been lead astray with this talking point.

The phrase: Caveat emptor — buyer beware — is all I’ve been able to think about since this vote passed. Not only are you being asked to predict the future (which is the only way to know “which policy option works best for you” since no one PLANS to be hit by a drunk driver, distracted driver, or become a victim of road rage) we are going to allow the insurance companies to now prey on the uninformed, poor and elderly by offering them a substandard product in the form of “options.” We are giving them the bait and switch of “medical insurance” in exchange for ALL their PIP benefits, and tricking them out of all the benefits they used to have.

We now expect the people of Michigan to know the difference between all of these policies, the ones that apparently our own representatives don’t fully understand, since they are the ones telling you you’ll be fine trading away your current PIP coverage for a lesser product — because you have good health insurance.

And what do you get in exchange for signing away your rights? Possible PIP premium rate reduction for eight years. Your PIP insurance is only a fraction of your overall premium rate, and there’s no guarantee that savings won’t be balanced out in other parts of your premium. While it’s true you can’t be discriminated against for certain non-driving factors (which is arguably the only real win here for consumers) if you live in a certain “territory” you can still get a different rate. Almost like they could draw a red line around these “territories” — I’ll give you three guesses which ones will still be charged a higher rate than any others. That sounds like a pretty lousy deal for those who needed relief the most.

Your insurance company is most certainly going to come out just fine from this deal. My greatest hope is that you do, too. If someone will truly be just fine, and can afford to pay out of pocket for all these services should the unthinkable (and un-plan-able) happen, I can support their choice to opt out of PIP coverage. However, that is not the case for most Michiganders, and certainly NOT for those dependent on Medicare and/or Medicaid. Everyone deserves to fully understand what they are agreeing to before they sign away their rights. No one should be trying to mislead people about what their new policy will or will not provide them in their hour of need.

I try not to evoke outrage without having asks, so here they are:

1) Please do not let the talking point continue that your regular medical insurance is a full substitute for your current PIP benefits, because it most certainly is not.

People deserve to know exactly what they are giving away, and this notion that the two benefit plans are interchangeable is false. Do not let this debate get lost into the greater debate on healthcare, because PIP benefits provide an entirely comprehensive approach to rehabilitation — of returning to your previous status — and no medical insurance as it stands today offers the same kind of care.

2) I would also ask that you thank those legislators who had the courage to stand up and vote NO for this harmful bill.

Not just the bill, but the whole anti-democratic process of rushing these bills through, without public comment, the Friday before a holiday weekend. I know those individuals will get push back, but I hope they know that they have thousands of grateful people behind them, myself included. Doing what’s right is not always easy, and we appreciate you being willing to fight for us, no matter what.

Thank you to:

- Sen. Jeremy Moss, D, Southfield

- Sen. Mallory McMorrow, D, Royal Oak

- Sen. Winnie Brinks, D, Grand Rapids

- Sen. Jeff Irwin, D, Ann Arbor

- Rep. Sherry Gay-Dagnogo, D, Detroit

- Rep. Isaac Robinson, D, Detroit

- Rep. Kyra Bolden, D, Southfield

- Rep. Lori Stone, D, Warren

- Rep. Donna Lasinski, D, Saline Twp

- Rep. Robert Wittenberg, D, Huntington Woods

- Rep. Yousef Rabhi, D, Ann Arbor

- Rep. Kristy Pagan, D, Canton

- Rep. Julie Brixie, D, Okemos

- Rep. Jim Ellison, D, Royal Oak

- Rep. Rachel Hood, D, Grand Rapids

- Rep. Cynthia Johnson, D, Detroit

- Rep. David Lagrand, D, Grand Rapids

- Rep. Ronnie Peterson, D, Ypsilanti

- Rep. Rebekah Warren, D, Ann Arbor

3) Call Gov. Whitmer, ask her to veto this bill and share your own no-fault survivor stories. (517–335–7858-Constituent Services)

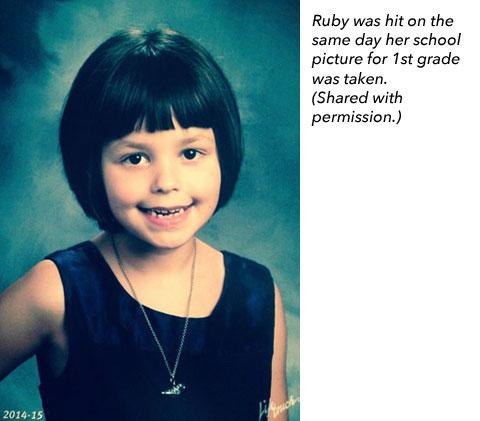

I have always supported Gov. Whitmer. I campaigned hard for her, wrote similar articles about how and why I was showing up for her. I have agreed with her on nearly everything, until now. I am urging her to please keep working on no-fault until everyone, present and future, who will depend on these services to lead dignified, productive lives — that add real, tangible value to our state — are fully protected. Please don’t sign this bill until it’s done right. Please make sure kids like Jamie, Lily and Ruby will still have good outcomes and can keep growing into healthy, strong and productive Michiganders.