.@NewDemCoalition wants ACA 2.0 included in the #AmFamiliesPlan, but w/one questionable ask...

As I noted last night, the healthcare provisions of the upcoming American Families Plan could be in jeopardy, due primarily to (wait for it) the liberal and progressive wings of the Democratic party squabbling over whether to pass ACA 2.0 or to beef up Medicare instead. Aside from the fact that this is likely a false choice (there seem to be several options available to pay for both, or at the very least to pay for large portions of each), this has also led to various factions of Democrats to move more assertively to ensure their priorities are included.

The New Democrat Coalition (NDC) consists of 94 mainstream House Democrats, including many of those who first took office after the 2018 midterms to help flip control of the House.

Yesterday, 52 of the 94 members of the NDC cosigned an open letter to President Biden pushing for a list of ten healthcare provisions to be included in the #AmFamiliesPlan. Most of these make perfect sense and of course I strongly support them.

There's one item, however, which is causing healthcare wonks nationwide to scratch their heads...and it happens to be the very first one on the list:

Dear President Biden,

The New Democrat Coalition (NDC) is comprised of 94 forward-looking Democrats in the U.S. House of Representatives seeking durable solutions to tackle the challenges and seize the opportunities of the twenty-first century. In the first one hundred days, the NDC has been working to advance policies in the U.S. House of Representatives to ensure people are protected from high health care costs, everyone is covered, and care is easier to access. The NDC has led the charge to put solutions over politics and stabilize and strengthen the Affordable Care Act (ACA).

...As you work to develop and advance the American Families Plan, we respectfully request that you work with us to include several NDC priorities to strengthen and expand on the ACA. These include:

- Stabilizing ACA marketplaces and reduce premiums with a national reinsurance program as proposed in the State Health Care Premium Reduction Act;

- Capping families’ health costs with permanent expansions of the premium tax credit and other enhancements in the American Rescue Plan aimed at reducing deductibles and other out-of-pocket expenses

- Simplifying enrollment for an estimated 4 million people by encouraging states to auto-enroll uninsured individuals who qualify for $0 premium health plans and for 5 million people who qualify for Medicaid or CHIP;

- Incentivizing states that have not expanded Medicaid to increase coverage to newly eligible individuals with a 100 percent federal match, building on the base rate increase for expansion states under the American Rescue Plan;

- Embracing and fostering existing value-based models which were permanently authorized under the ACA and have demonstrated the ability to simultaneously improve quality and reduce costs;

- Exploring other innovations, to increase choice and competition and close coverage gaps;

- Improving coverage and cost transparency for patient care, and streamlining the prior authorization process;

- Addressing provider shortages, especially in rural, economically distressed, and underrepresented minority communities, and embracing expanded telehealth and home care under the CARES Act and the American Rescue Plan;

- Modernizing and expanding supplemental benefits and exploring innovative payment mechanisms aimed at eliminating the financial and health burdens that barriers such as poor transportation and internet access have on underserved, elderly, and rural populations and our health care system writ large;

- Expanding health care savings and spending vehicles for workers and families.

Let's talk about reinsurance.

Back in 2018, I posted a basic explainer of how reinsurance currently works in over a dozen states via ACA Section 1332 waivers:

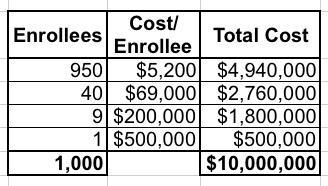

Let's say you have exactly 1,000 enrollees in a risk pool, with 950 of them only racking up average medical expenses of $5,200/year; 40 of them have expensive problems which cost $69,000/year apiece; 9 of them cost $200,000 apiece and one enrollee has really expensive problems costing $500,000/year, for a grand total of right around $10,000,000 even. Since all 1,000 are part of the same risk pool, the total healthcare cost per enrollee averages around $10,000 apiece.

Under a reinsurance program, the government agrees to pay for a percentage of the cost of the really expensive, high-risk enrollees...basically, that last 5% or so...in order to lower the premiums for everyone else. In serves a similar function to the pre-ACA "High Risk Pools", except that it's done behind the scenes, there's no individual medical underwriting needed, there's no stigma attached to the enrollees (since they aren't shunted off into a separate program), and there's no funding discrimination.

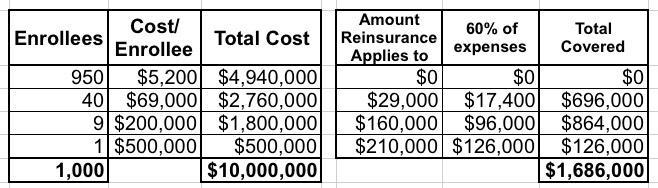

To use a real world example, the reinsurance law just passed in New Jersey will pay 60% of insurers' costs for enrollees whose medical costs exceed $40,000 in the year, up to a cap of $250,000 per enrollee.

Let's suppose we applied these parameters to my example above.

- 40 of the enrollees have total expenses of $69K apiece. Subtracting the first $40K leaves $29K. 60% of that is $17,400. Multiply by 40 enrollees and that's $696,000.

- 9 of the enrollees have total expenses of $200K apiece. Subtracting the first $40K leaves $160K. 60% of that is $96,000. Multiply by 9 and that's $864,000.

- The final enrollee has total expenses of $500K. The upper bound on the reinsurance program is $250K, so subtracting $40K leaves $210K. 60% of that is $126,000.

- Add it up and the reinsurance program would cover $1,686,000 out of the $10,000,000 grand total...or around 17% of all medical expenses for the entire pool.

This should translate into premiums being 17% lower than they would be otherwise. It doesn't necessarily mean a net 17% drop, of course, because there are other factors each year (normal inflation, medical cost trend and so on), but at the very least, it should mean the difference between a 20% increase and a 3% increase.

Of course, the actual impact will vary greatly depending on the state and how robust the percentages and thresholds are set at, but you get the idea.

It's important to note right off the bat that reinsurance does nothing to actually reduce the overall cost of healthcare coverage or claims...it simply offloads a chunk of the cost from the enrollees to the government.

Under the current state-based reinsurance waivers, the state has to come up with a portion of the reinsurance funding, with the federal government coming up with the rest. The amounts and federal/state funding ratio can vary depending on the details, but it's usually something like a 2:1 split. Using the simple example above, let's say that the federal government would provide $1 million while the state would have to come up with the other $700,000.

The state's portion can come from wherever--a new surcharge, a tax, the general fund. Under ACA Section 1332 waiver rules, the federal government's share, however, cannot increase the federal deficit...which means that it has to come from the reduced ACA subsidies caused by the reinsurance premium reduction itself.

In other words, let's say that 80% of the enrollees above are eligible for ACA subsidies, averaging $500/month apiece. That comes to around $4.8 million in APTC subsidies. By reducing premiums 17%, however, those subsidies also drop; most people now qualify for smaller subsiides and some stop qualifying at all. Let's say it drops 21% to $395/month apiece on average. Voila: That's just over $1 million.

On paper, this seems fine. Wonky, but fine.

However...it also leads to a problem: Due to who receives ACA subsidies and how they're structured, especially in combination with #SilverLoading and other quirks of health insurance premium pricing, reinsurance can actually end up hurting lower-income people more than it helps middle- or higher-income people.

Officially, subsidized enrollees shouldn't see any difference either way; if they're capped at no more than $400/month, it shouldn't matter whether the unsubsidized benchmark premium is $500 or $600, since they'll still receive enough in subsidies to keep them at $400.

In reality, that only holds true if they happen to enroll in the benchmark Silver plan. If they took advantage of #SilverLoading, the difference between a $100 or $200 subsidy can be very important if they chose any other plan besides the benchmark...primarily Bronze or Gold plans. Premiums dropping 17% could mean the subsidy dropping 21%...which ironically amounts to a net premium increase for anyone receiving the subsidy.

Reinsurance kind of, sort of makes sense as long as the subsidy cliff is in place--anyone earning slightly over 400% of the Federal Poverty Level (FPL) was paying through the nose at full price, and many states felt that something had to be done to provide some relief for them. Plus, of the various viable methods of reducing premiums, reinsurance waivers were the only one which Trump CMS Administrator Seema Verma seemed to be OK with, so that's what many states went with.

Assuming the expanded subsidies under the American Rescue Plan (ARP) are made permanent, however (one of the other key bullets in the NDC letter)...suddenly the purpose of reinsurance seems vague at best.

I'm not the only one asking about this either:

Nerdy Q, but: Is reinsurance still important if subsidies go all the way up the income scale? https://t.co/I0BTqvK2Nd

— Margot Sanger-Katz (@sangerkatz) April 22, 2021

Not really unless it is a backdoor to price caps as I have sometimes seen suggested. Basically all claims over $200,000 pay Medicare rates.

— Jon Walker (@JonWalkerDC) April 22, 2021

With increased ACA subsidies capping premiums at 8.5% of income, reinsurance would only help a very small number of high-income people.

The same could be said of a public option with respect to premiums. (A public option might have a broader network than private insurers.)

— Larry Levitt (@larry_levitt) April 22, 2021

Depends on what the goal is.

a) If the problem is net premiums are too high for the over 400% FPL-ers

HELL NOb) If problem is locally predictable high costs that are not adequately compensated by risk adjustment which lowers competition --- plausibly

— David Anderson (@bjdickmayhew) April 22, 2021

Much less, at least the way reinsurance has typically been used in the ACA markets. Maybe different if you're talking about a very high attachment point. Distributionally it'd basically all go to people making >600% of FPL.

Recent piece on this: https://t.co/XVmU0tMcmD

— Loren Adler (@LorenAdler) April 22, 2021

As Dave Anderson noted this morning:

Reinsurance as described in the HR 1425 is a caliper reinsurance program. It would have the federal government pay a percentage of claims between a floor level and a ceiling level. The program would be funded at $10 billion dollars per year and effectively it lowers premiums by about $10 billion dollars as premiums no longer have to cover all claims.

It will lower federal spending by even more than $10 billion dollars per year as the individual contribution amount is constant and all of the gain accrues back to the treasury. People who were marginally subsidy eligible under ARP enhanced subsidies without reinsurance would become marginally subsidy ineligible with reinsurance.

This is a solution in search of a problem.

...I am having a hard time figuring out what the point of reinsurance as outlined in HR 1425 actually is intended to do.

$10 billion per year is $100 billion over a decade. As Anderson notes, if included as part of the American Families Plan, the net cost of a $10 billion/year federal reinsurance program could potentially end up being less than $0...because it would also reduce the amount of APTC subsidies paid out on average by more than $10 billion/year. In other words, it's conceivable that it would be a net savings for the fedral government...which sounds great, until you realize that it would do this by reducing net subsidies for subsidized enrollees by more than it reduced gross premiums for unsubsidized enrollees.

If the goal is to make ACA subsidies less generous in order to save a few billion dollars off of the #AmFamilyPlan, there's a much simpler way of doing so: Scrap the reinsurance program and simply bump the ARP subsidy formula up by bit (ie, have benchmark premiums range from 0.5 - 9.0% instead of 0.0 - 8.5% or whatever).