REMINDER: "ACA 2.0 *or* Medicare expansion" is A FALSE CHOICE.

UPDATE 4/13/21: An earlier version of this post had misinterpreted Linda Blumberg's estimate how much S.499 would cost--I thought that the $350 billion estimate was the gross projected 10-year cost without taking into account the impact of eliminating Silver Loading, but it turns out that it's the net cost after taking that into account as well. My apologies for such a bone-headed error.

Having said that, there's still the possibility of up to $196 billion in additional savings elsewhere, so it's still worth discussing the relative costs of both proposals and seeing whether both, or at least parts of both, could still be worked into the American Families Plan. I've significantly reworked the the wording of the post accordingly.

This morning, Washington Post reporter Jeff Stein posted a well-written, and presumably well-sourced story about a supposed dilemma facing the Biden White House and Congressional Democrats as they put together the second half of the upcoming, massive infrastructure bill (aka the "American Families Plan"; the first part is the "American Jobs Plan):

The White House is facing diverging pressure from two powerful allies — House Speaker Nancy Pelosi (D-Calif.) and Senate Budget Committee Chairman Bernie Sanders (I-Vt.) — over whether to use an upcoming spending package to strengthen the Affordable Care Act or expand Medicare eligibility.

Pelosi’s office is pushing the White House to make permanent a temporary expansion of Affordable Care Act subsidies that were included in the $1.9 trillion stimulus legislation last month, according to a senior Democratic aide who spoke on the condition of anonymity to describe internal conversations.

Sanders said in an interview that he is arguing for lowering the age of Medicare eligibility to 55 or 60 and expanding the program for seniors so it covers dental, vision and hearing care.

...The pressure comes as the White House works to formulate what it is calling the American Families Plan, a sequel to the infrastructure and jobs plan announced last month. The new program, which is likely to be focused on child care, higher education, anti-poverty initiatives and health care, is expected to propose cutting spending on prescription drugs by as much as $450 billion over 10 years.

I'm obviously biased towards the first of these (I've been fighting to #KillTheCliff and #UpTheSubs for years, and the ACA itself is far more within my wheelhouse than Medicare), but I very much support expanding Medicare to cover dental, vision and hearing services, especially given that the program primarily serves the elderly, after all. I'm also generally supportive of lowering the Medicare eligibility age, although I've heard from several trusted sources that doing so could, counterintuitively, increase the cost of healthcare coverage for those below the newly-lowered age threshold, which I agree sounds a bit odd.

In other words, yes, if you put a gun to my head and said it had to be one or the other, I'd lean towards beefing up the ACA, but the head-scratcher in this story is that it's probably a false choice. There's little reason why BOTH couldn't be done and fully paid for...mostly via existing bills.

According to the article, the supposed battle lines boil down to:

- Option 1: Beef up Medicare:

- Add dental coverage

- Add vision coverage

- Add hearing aid coverage

- Limit prescription drug out of pocket costs to $2,000/yr

According to a story by Amy Lotven of Inside Health Policy, as of 2019, both fo these were projected to cost a total of roughly $367 billion over 10 years ($358B for dental/ vision/ hearing + $9B for the drug MOOP). Presumably the cost would be a bit higher if you start the 10-year period in 2022...call it perhaps $400 billion? If so, that would still presumably leave a good $50 billion or so on the table for other stuff. At the very least it should leave plenty of wiggle room in case the CBO scores come out a bit higher or lower than expected for either the cost or the savings.

- Option 2: ACA 2.0:

- Permanently eliminate the 400% FPL subsidy cliff

- Permanently beef up the APTC subsidies (w/8.5% as the ceiling)

- Upgrade the benchmark plan from Silver to Gold

- Expand & beef up CSR thresholds from 250% to 400% FPL

According to another recent story by Lotven (who, by the way, is a fantastic healthcare reporter), doing all four of the above would cost around $350 billion over 10 years...and this estimate appears to be more recent, so that figure is presumably closer to what it would cost if the 10-yr period started in 2022.

On the surface, this would appear to be a pretty apples to apples comparison: You have $450 billion to work with, and two possible areas to expand healthcare coverage in, costing ~$400 billion or ~$350 billion respectively.

SIDE NOTE: I should take a moment to explain the additional twist included in the ACA 2.0 bill, via Senator Jeanne Shaheen of New Hampshire: S.499, the Improving Health Care Affordability Act.

As I've noted before, S.499 would do all four of the above but also includes a fifth provision: Formally appropriating CSR reimbursement payments...which in turn would end the practice of Silver Loading:

Once again: When Donald Trump cut off CSR payments back in late 2017, he intended to "blow up" the ACA exchange, but due to Silver Loading, he inadvertantly ended up increasing ACA subsidies...to the tune of a projected $194 billion over the next 9 years, or $21.5 billion per year. As explained in the 2017 CBO analysis:

- Had CSR reimbursement payments continued to be paid over the next decade, the CBO projected that it would have cost the federal government $118 billion between 2018 - 2026, or around $13 billion per year on average.

- Cutting off CSR reimbursement payments saves the federal government that $118 billion over 9 years. HOWEVER...

- The practice of "Silver Loading" by the carriers make up for that $118 billion is causing federal APTC subsidy costs to increase by a far more than $118 billion...in fact, the CBO projects that it's gonna increase APTC by around $309 billion for those earning between 250 - 400% FPL (that is, people who are eligible for APTC but not for CSR...)

- There's some additional revenue increases & decreases projected by the CBO as well which I don't entirely understand, but they mostly cancel each other out, so in the end, the bottom line is that the CBO projected that cutting off CSR payments is actually going to COST the federal government a net $194 billion over the next nine years. That's roughly $21.5 billion per year.

On the one hand, hooray for Silver Loading! It's the reason why there's large portions of the country where Gold plans cost less than Silver plans on the ACA exchanges (or more accurately, it's why Silver costs more than Gold). It's also the reason why there's 190 counties where many people were already eligible for a FREE Gold plan even before the American Rescue Plan (ARP) beefed up subsidies for the next 2 years.

On the other hand, Silver Loading, as clever and effective as it can be, is also a scattershot mess at the moment, as well as being inefficient and unevenly utilized. For instance, while most states have embraced Silver Loading as of 2021, there's still a few which refuse to allow it (West Virginia and Indiana, I think?) Even in states which do allow or encourage it, implementation is all over the place--some insurance carriers utilize it fully, some partially and some not at all. Finally, Silver Loading confuses the hell out of the enrollees who can't figure out why the hell a Gold plan covering 80% of their expenses costs less than a Silver plan covering 70%.

I say all this as one of those who helped coin the phrase and hashtag "#SilverLoading" in the first place. I've written about it, promoted it and encouraged it for the past 3+ years because as long as the ACA subsidy formula remained as it was, it was the most effective way of cutting down costs for individual market enrollees earning more than 200% FPL. HOWEVER, as long as we #KillTheCliff and #UpTheSubs permanently and beef up/expand CSR subsidies as well, Silver Loading is no longer necessary.

Formally appropriating CSR funding would reverse the situation, causing Silver Loading to disappear...but in doing so it would free up several hundred billion dollars over the next decade...which in turn would be used to pay for the beefed-up subsidies. Remember, that $194 billion was based on the 2018 - 2027 period. Thanks to inflation and increased ACA enrollment under the American Rescue Plan, I'd be willing to bet that the CBO would score it at more like $250 billion or so if the 10-year period started in 2022. It's even conceivable that it would be more than that if the Supreme Court ends up siding with the plaintiffs in the pending CSR class action lawsuit.

For the most part, this would be basically spending the exact same money on the exact same subsidies for most of the same people...but doing so in a more sane, rational, equitable and easier-to-understand fashion. Again, I dont think it would cover 100% of the cost, but it should cover the vast bulk of it.

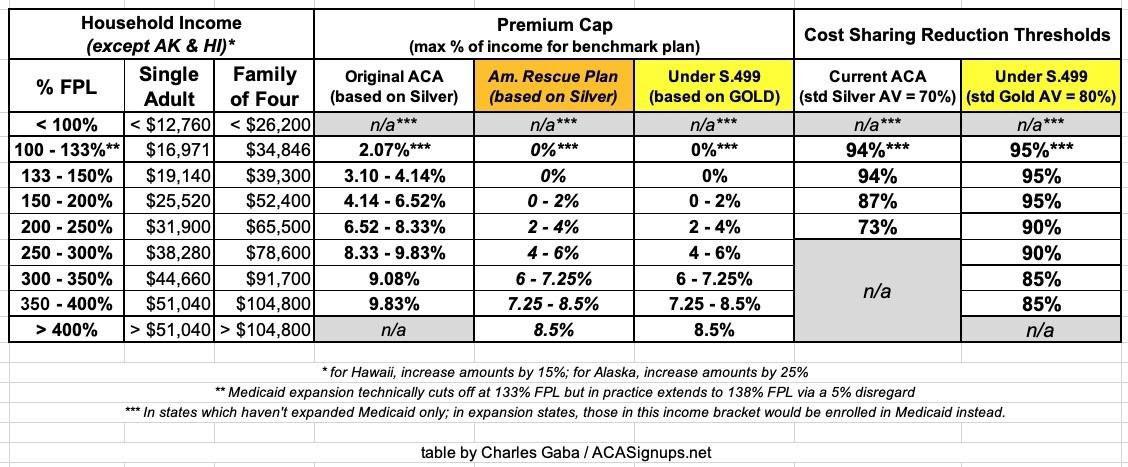

Here's a table summarizing how S.499 would change both the APTC and CSR subsidy formulas compared to the official ACA and the American Rescue Plan (which is currently only in place for 2 years):

Unfortunately, as noted at the top of the post, it turns out I misinterpreted Ms. Blumberg's analysis. I asked her for clarification (which I should have done before posting this in the first place) and it turns out:

Our estimates include the move from silver loading to explicit payment of CSRs, so that should be considered a net additional government cost.

In other words, it sounds like the gross cost would actually be more along the lines of $550 - $600 billion, minus the $200 - $250 billion in savings, for a net cost of around $350 billion over a decade.

In any event, this leaves Dems with either beefing up Medicare with the 4 bullets above would cost close to $400 billion over a decade, while S.499 as currently written would cost around $350 billion, with perhaps $450 billion to work with. This was the premise of Jeff Stein's WaPo story in the first place.

HOWEVER, according to yet another story by Amy Lotven, there may be up to $196 billion in additional savings available as well:

Sources say congressional Democrats now also plan to glean offsets by repealing the Trump administration’s Medicare Part D rebate ban rule, which CMS’ actuary has said would cost about $196 billion if implemented.

That brings the total theoretical savings back up to as much as $650 billion, which could still be just barely enough to cover all 8 bullets from both proposals.

Alternately, there's always the possibility that they can do some of each:

- Add dental & vision care and a drug MOOP to Medicare, but not hearing

- Make the APTC subsidies permanent and upgrade from Silver to Gold, but without the enhanced CSR thresholds

...and so on. There's also the posibility of incorporating the age-based subsidy bill, H.R. 6545, which would utilize the APTC subsidies in a more efficient way, which could either cover more people at the same cost or cover the same number of people at a lower cost...the latter of which is what we'd be looking at in this scenario.

Again, I'll be posting my updated HR 6545 explainer later this week; stay tuned.

UPDATE 4/13/21 (evening): There's also this update from Lotven...it's behind a paywall, but the lede seems pretty clear:

Although the Congressional Progressive Caucus did not include extending the Affordable Care Act’s enhanced tax credits in its wish list for the next legislative package, a source familiar with the discussions says progressives do support making the American Rescue Package policies permanent -- but they want savings gleaned from drug-pricing reforms to go toward expanding public health programs and not just toward bolstering the ACA. The legislative priorities floated by CPC Friday include lowering Medicare’s eligibility age and expanding the...

UPDATE 4/22/21: Oh come on now:

The next phase of President Biden’s $4 trillion push to overhaul the American economy will seek to raise taxes on millionaire investors to fund education and other spending plans, but it will not take steps to expand health coverage or reduce prescription drug prices, according to people familiar with the proposal.

Administration officials had planned to include a health care expansion of up to $700 billion, offset by efforts to reduce government spending on prescription drugs. But they have decided to instead pursue health care as a separate initiative, a move that sidesteps a fight among liberals on Capitol Hill but that risks upsetting some progressive groups that have pushed Mr. Biden to prioritize health issues.

DAMMIT, THERE'S NO NEED FOR THIS!