#ACA 2.0: Let's Get Ready to Rumble: #HR369 vs #HR6545 (or better yet...both!)

So, the American Rescue Plan includes two important provisions whch I've been fighting for for years: #KillTheCliff and #UpTheSubs. The only downside is that, for now at least, these ACA enhancements are only included for two years (including 2021...the beefed-up & expanded subsidies are retroactive to January 1st of this year).

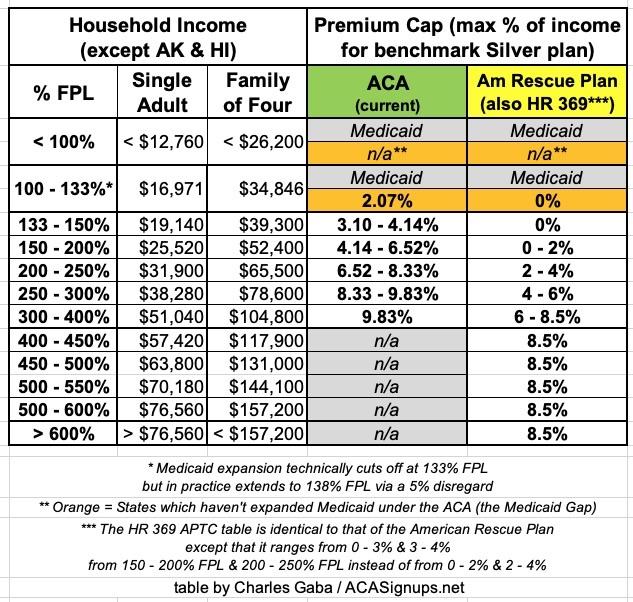

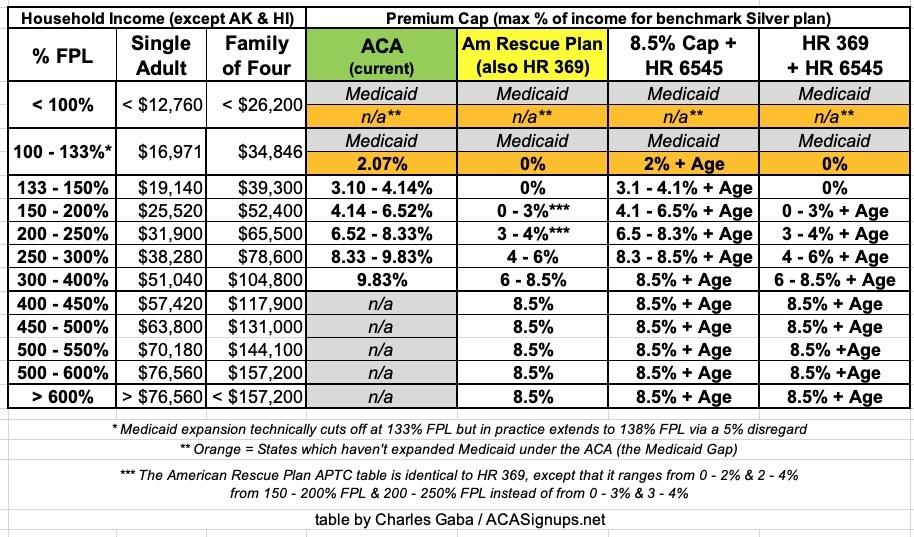

As a reminder (this is like the 20th time I've posted a table like this), here's the official ACA subsidy formula compared to the improved formula under the American Rescue Plan (ARP):

Note: The Federal Poverty Level (FPL) is 15% higher per household in Hawaii and 25% higher in Alaska.

In Medicaid expansion states, Americans below 138% FPL are automatically redirected towards Medicaid instead, and are therefore not eligible for ACA subsidies (Advanced Premium Tax Credits, or APTC) anyway. In states which haven't expanded Medicaid, anyone below 100% FPL is SOL* (for now), but those earning more than 100% FPL are eligible for APTC.

*For 2021 only, those receiving unemployment benefits in any state have their income considered to be 133% FPL, which gives some non-expansion state residents a way of getting decent coverage at an affordable price.

Above either the 100% or 138% FPL level, people are eligible for APTC up to 400% FPL along a sliding scale...but under the official ACA subsidy formula, over that level, they're immediately cut off and have to pay full price if they want an ACA exchange plan no matter how much it costs.

The American Rescue Plan (ARP) removes that upper-end 400% FPL eligibility cap (it #KillsTheCliff) as well as making the sliding scale formula from 100 - 400% FPL more generous (it #UpsTheSubs). Rep. Lauren Underwood's H.R. 369 bill, the Health Care Affordability Act of 2021, would do exactly the same thing, but permanently. The sliding scale formula is nearly identical in both bills, except oddly the ARP is slightly more generous yet between 150 - 250% FPL.

As a refresher, the way the scale works is as follows:

- Look at the full-price cost of the Benchmark Silver Plan, aka the Second Lowest-Cost Silver plan available on the exchange (SLCSP).

- Take the applicable percentage of your household income (say, 200% FPL).

- Compare the percentage (6.52% under the official formula; 2.0% under the ARP) against the cost of the SLCSP.

- Whatever the difference is, that's how much in APTC subsidies you're eligible for.

For example, let's say you're a single adult, no kids, who earns just over $25,000/year (200% FPL). Let's say the full price of the SLCSP is $500/month. $500 x 12 = $6,000/year, or a whopping 24% of your annual income, ouch.

Under the official ACA formula, your benchmark Silver premiums are limited to no more than 6.5% of your income, or $135/month. Take the difference between the two ($500 - $135) and voila, you're eligible for $365/month in APTC to help pay your premiums. In addition, you don't have to buy the benchmark Silver plan with the subsidies; you can use it to buy any Bronze, Silver, Gold or Platinum plan available on the exchange if you prefer (although under 200% FPL you're usually better off with Silver anyway).

Under the ARP, it's the same process, but your premiums would be limited to 2% of your income, or just $42/month. That would give you $458/mo in ATPC ($5,500/year) to use for any exchange plan available.

If you earn $51,000 (just under 400% FPL), under the official formula, you'd be limited to 9.8% of income, or $416/month, so you'd only receive $84/mo in APTC...and due to the Subsidy Cliff, if you earn $52,000 (just over 400% FPL), under the official formula, you'd have to pay full price. That's not such a big deal at $500/month, but if you're older or have a large family, this could amount to several thousand dollars per month, potentially costing up to 25% of your annual income or more.

I've posted numerous graphs showing how much different households would save at different income levels under ARP / HR 369 around the country. The most extreme example I could find involves a 64-year old couple living in a county with the most expensive benchmark plan in the country going from paying an insane 72% of their annual income down to just 8.5%, saving them as much as $44,000/year. Again, that's an extreme outlier, but cutting premiums down from ~25% or so of income down to 8.5% would be fairly common.

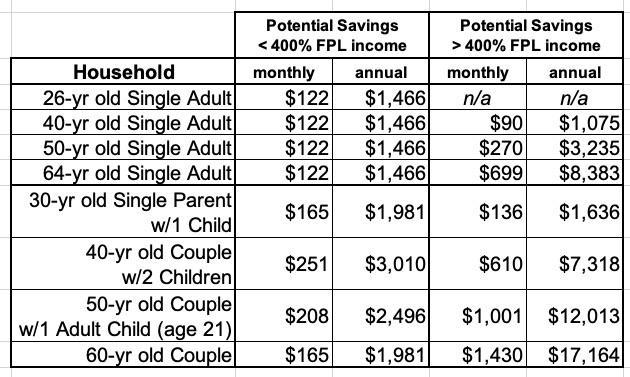

Here's a summary table listing the most that eight representative households could save based on the average 2021 benchmark Silver plan prices around the country. The savings below the 400% threshold may seem "low" compared to those over 400%, but that's because the <400% enrollees are already receiving much larger subsidies to begin with:

Now, having worked for years to get a #KillTheCliff / #UpTheSubs bill passed for the ACA, believe me, I'd be thrilled if the ARP subsidy structure was made permanent. It would increase ACA enrollment by several million people while saving nearly every individual market insurance enrollee thousands of dollars in premiums per year.

HOWEVER...there's another ACA subsidy enhancement bill on the table as well which might be an even better alternative to the #UpTheSubs portion of HR 369. In fact, the ideal scenario would involve passing both HR 369 and this bill on top of it.

The bill I'm referring to has a nearly identical name: The Health Insurance Marketplace Affordability Act. It was H.R. 6545 last year; I don't know what the bill number will be this session, so I'll just call it HR 6545 for now.

I actually wrote an extensive explainer of HR 6545 last summer, but with the ARP having just passed, this is a good time to revisit it. As I said last June:

...While [HR 369] would certainly provide dramatic premium relief for millions of middle-class Americans, the vast bulk of that relief only goes towards older unsubsidized Americans.

...In short, any subsidy formula which is purely income-based instead of age-based is going to disproportionately help older enrollees a lot more relative to what the official, unsubsidized premiums are than it will younger enrollees.

Now, you may ask why this is a problem--after all, the younger enrollee is only paying about 1/3 as much as the older enrollee at full price and they'd still be paying less than the 64-year old under the enhanced formula...but that's not how people work. Remember, the 26-year old is likely to earn less than the 64-year old...but more importantly, there's a reason they're called "Young Invincibles"...and it's not because they are invincible; they just tend to think they are.

HR 369 does make subsidies even more generous yet than the prior version (HR 1868) did, reducing benchmark Silver premiums down to $0 for anyone earning less than 150% FPL and bumping up the subsidies from 150 - 400% FPL...but it doesn't completely resolve the issue.

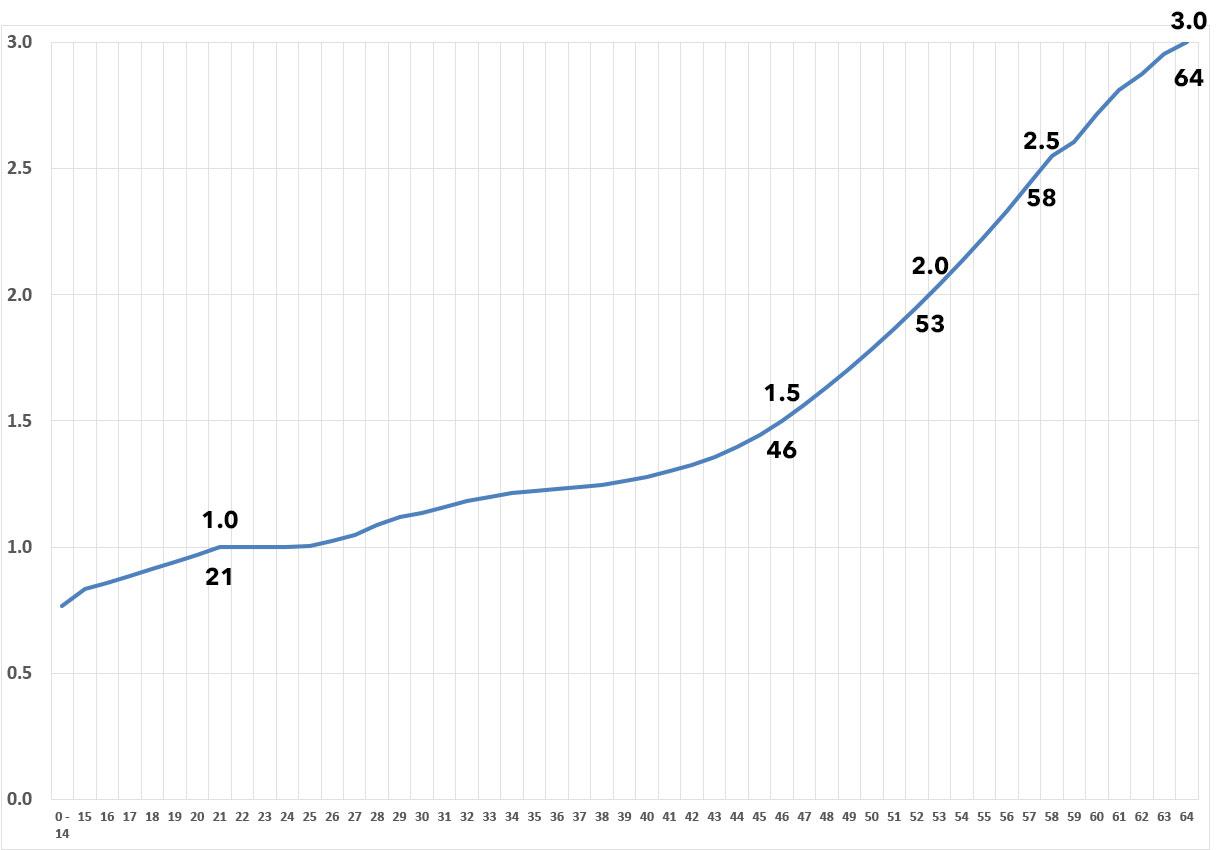

The essence of the problem remains the fact that there's a 3:1 pricing ratio limit between 64-yr olds and 21-yr olds even though the actuarial cost difference between the the two tends to be more like 5 or 6 to 1. Making this even more confusing is the fact that even that 3:1 age band isn't a straight line; that is, it doesn't hit 1.5x at 32 years old, 2.0x at 42, 2.5x at 53 and 3.0x at 64. The actual band looks more like this:

Notice how the line doesn't really start to curve upwards until around age 45-50, but climbs sharply from there? "Young Invincibles" are generally defined as those age 18 - 34, but enrollees age 35 - 49 are also disproportionately overcharged relative to those over 50:

The solution to this is to add another formula tweak to the premium subsidy formula...one which is age-based instead of income-based.

Enter H.R. 6545. Like HR 369, the language of the bill is remarkably simple. Here's what it boils down to:

“(I) IN GENERAL.—The applicable percentage otherwise determined under clause (i) shall be multiplied by the age adjustment value determined under subclause (II).

“(II) AGE ADJUSTMENT VALUE.—The age adjustment value for any taxpayer is the average of the age rate adjustments for all individuals which have coverage described in paragraph (2)(A) with respect to the taxpayer, divided by the maximum age rate adjustment allowed under section 2701(a)(1)(A)(iii) of the Public Health Service Act.

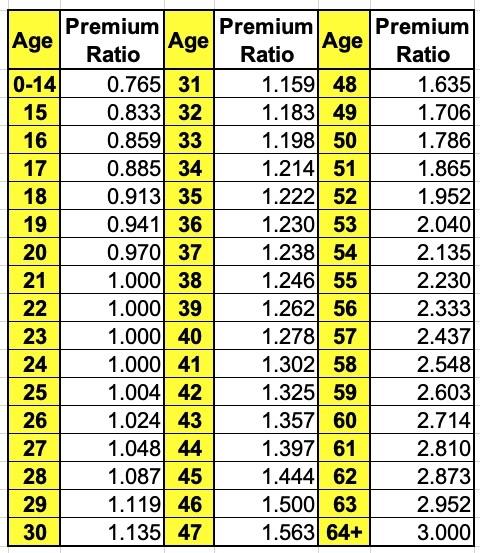

Put more simply, you take the average age rate adjustments of everyone enrolling in the policy and divide it by 3.

- Let's say you're a 40-yr old single adult with no kids. Your age rate adjustment is 1.278.

- Divide that by 3 and you get 0.426.

- Multiply that by the APTC premium cap percentage and that's yoiur age-adjusted premium cap.

UNDER THE CURRENT APTC TABLE, if you earned 200% FPL, you'd go from paying 6.5% of your income to 2.78%.

If you were 50 years old, your age rate adjustment would be 1.786, for an age-adjusted cap of 0.595. At 200% FPL, you'd pay 3.88%, and so on.

What about a family of 4? Let's say you have a 40-year old couple with 2 kids age 12 & 10.

- The 40-yr old parents would be 1.278 apiece

- The kids would be 0.765 apiece

- The average for all four would be 1.022, for an age-adjusted cap of 0.341

- If this family earned 200% FPL, that'd be 0.341 x 6.52% = 2.22% of their income.

You get the idea. The older you are, the less of an age adjustment; 64-year olds would be dividing 3 into 3 for no adjustment at all...but again, they're already benefitting tremendously from the 3:1 age band limit and would be dramatically better off under the 8.5% cap. In other words, this would not be an "age tax" by any means; no one would be worse off.

Now, the ideal scenario would be for HR 6545 to be passed in addition to HR 369...but unlike the 2-year provision in the American Rescue Plan, a permanent ACA 2.0 upgrade of this nature would have to be paid for, and that's where bang for your buck becomes far more important.

That is, IF CONGRESS HAS TO CHOOSE between one or the other, which would be more effective at INCREASING enrollment the most while costing the federal government THE LEAST?

Remember, both scenarios assume that the subsidy cliff itself is killed no matter what...that is, the maximum cap on benchmark Silver premiums is 8.5% regardless of income.

The table below lists four scenarios:

- The current ACA subsidy table (maxes out at 9.8%; cuts off at 400% FPL)

- The AMR/HR 369 table (maxes out at 8.5%; kills the 400% FPL cliff)

- A table which maxes out at 8.5% & kills the cliff while keeping the current table below 8.5% but adds HR 6545's age-based modifier

- HR 369 plus HR 6545 (maxes out at 8.5%; kills the cliff; ups the subs and adds an age-based modifier)

Let's take a look at a couple of my household examples.

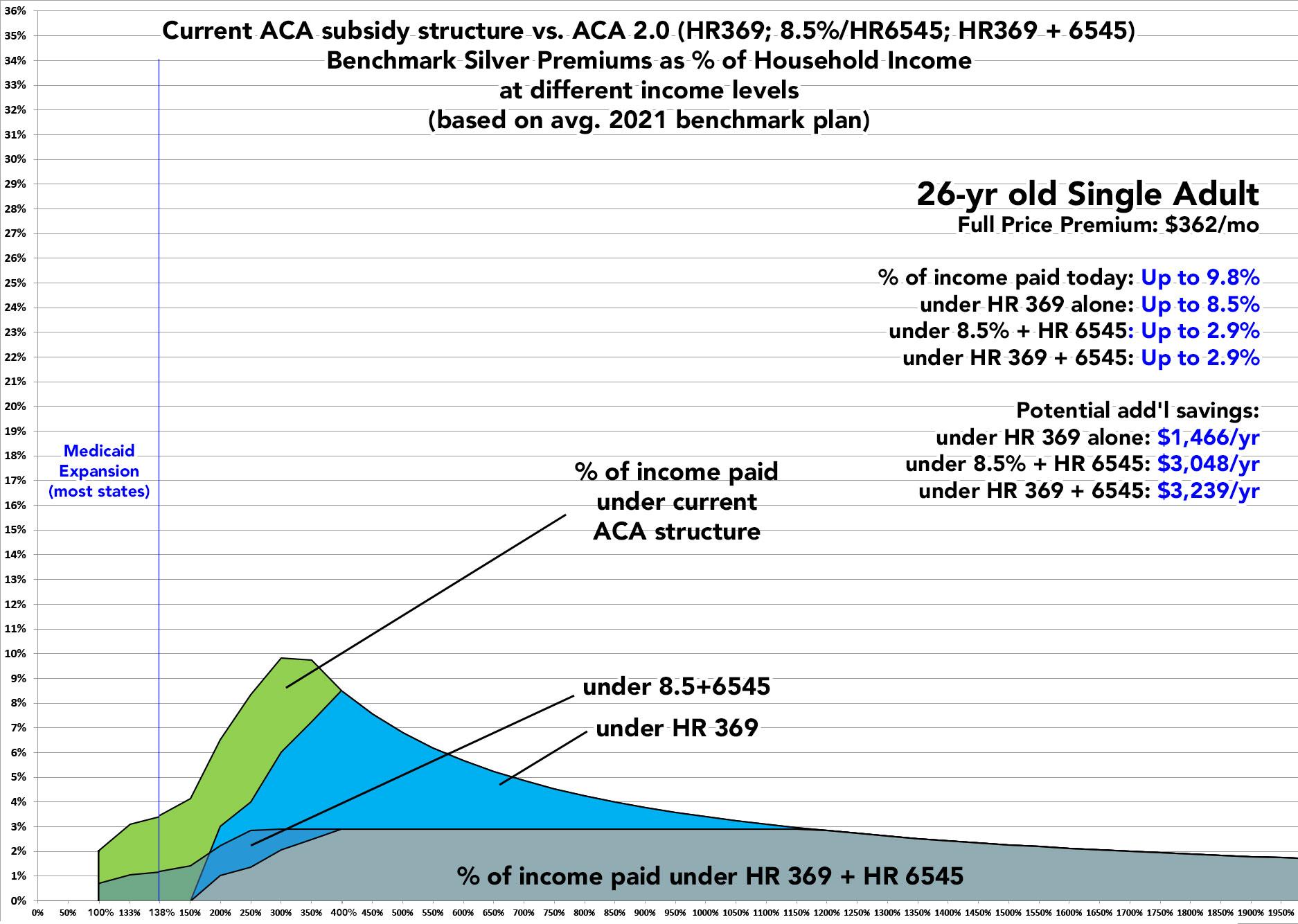

First, a single 26-year old:

A 26-year old adult without any dependents would see significant savings under all three scenarios up to around 350% FPL (roughly $45,000/year). Over that income level, HR 369 wouldn't do anything for them, while HR 6545 would...but there's not a whole lot of 26-year olds earning over $50,000/year to begin with.

Below $50,000/yr in income, given a choice between HR 369 and HR 6545, it would depend on their income bracket and whether their state has expanded Medicaid or not. In expansion states, they'd be better off under HR 369 from 138% up to around 160% FPL...but from 160% or higher, they'd be better off under HR 6545. In non-expansion states, they'd be much better off under HR 369 from 100 - 160% FPL, of course.

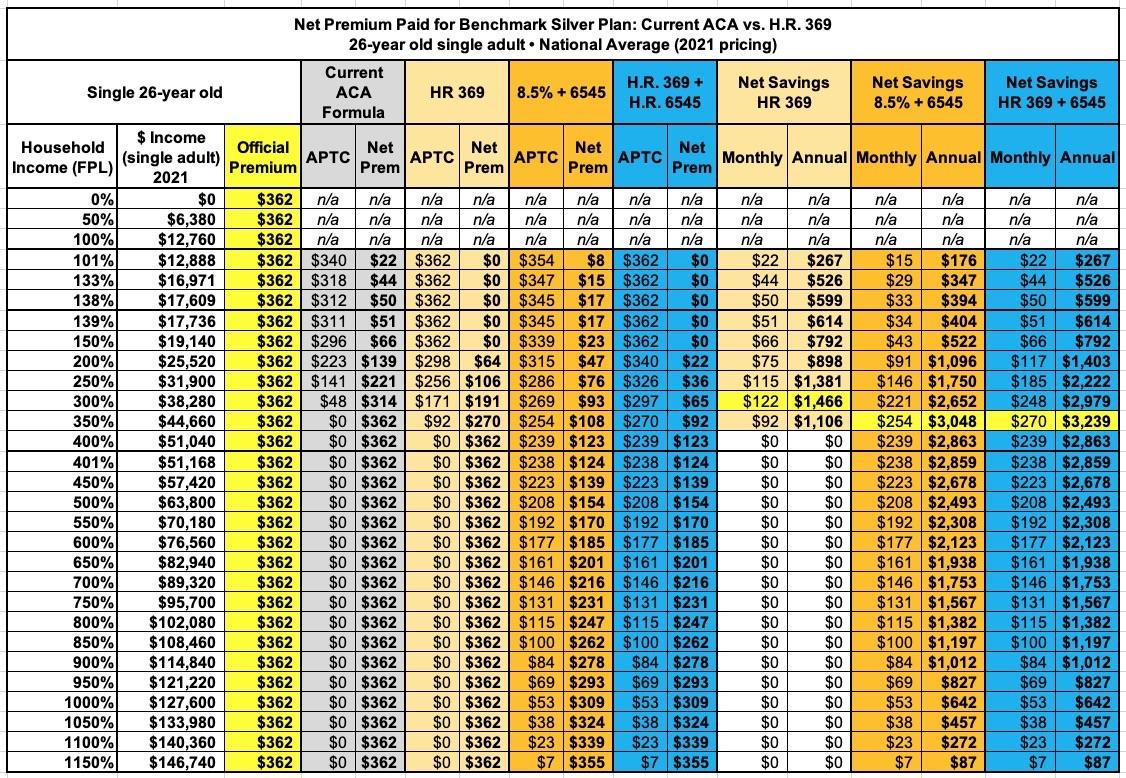

Here's a table laying out the average additional savings at different income levels for each scenario:

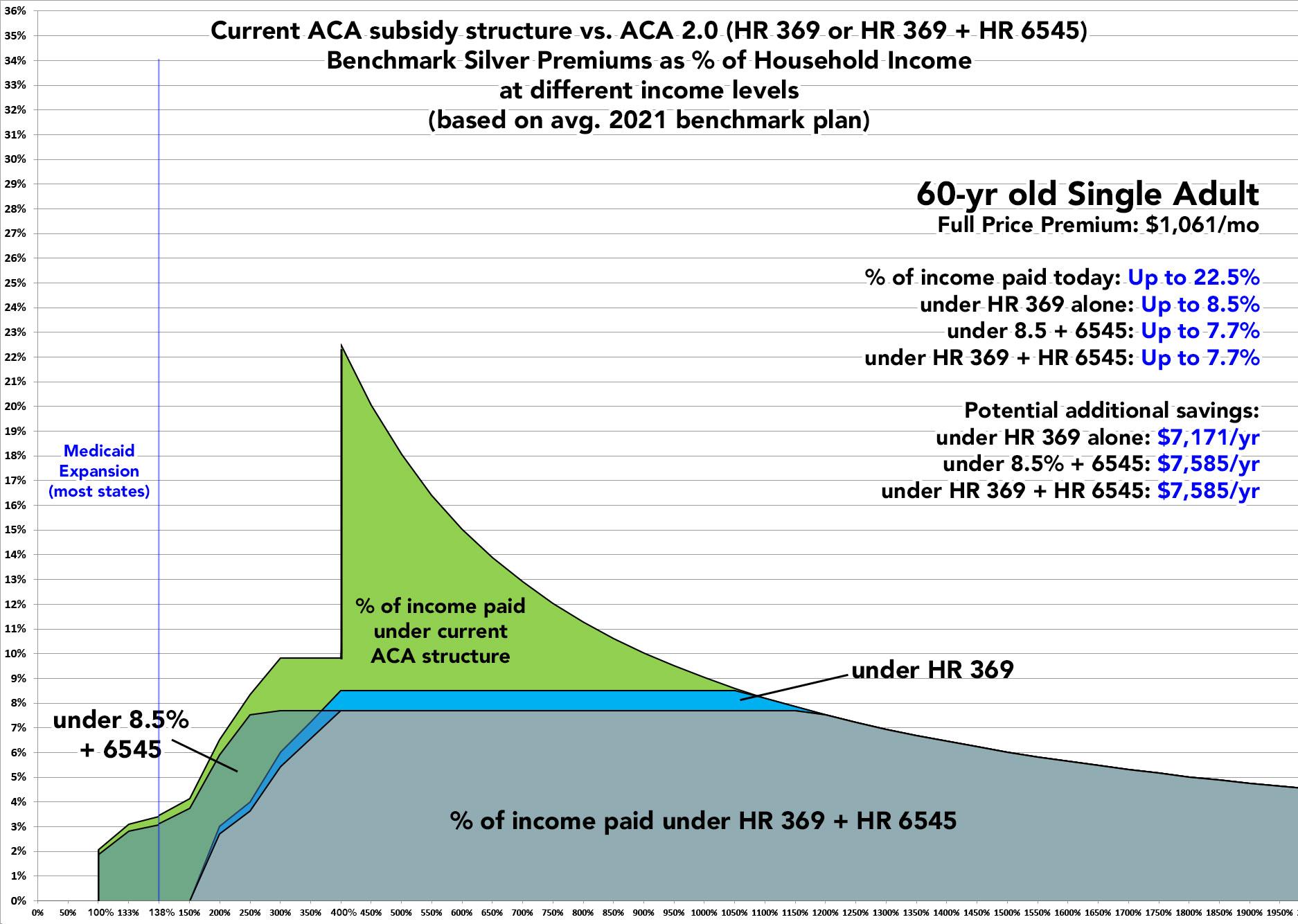

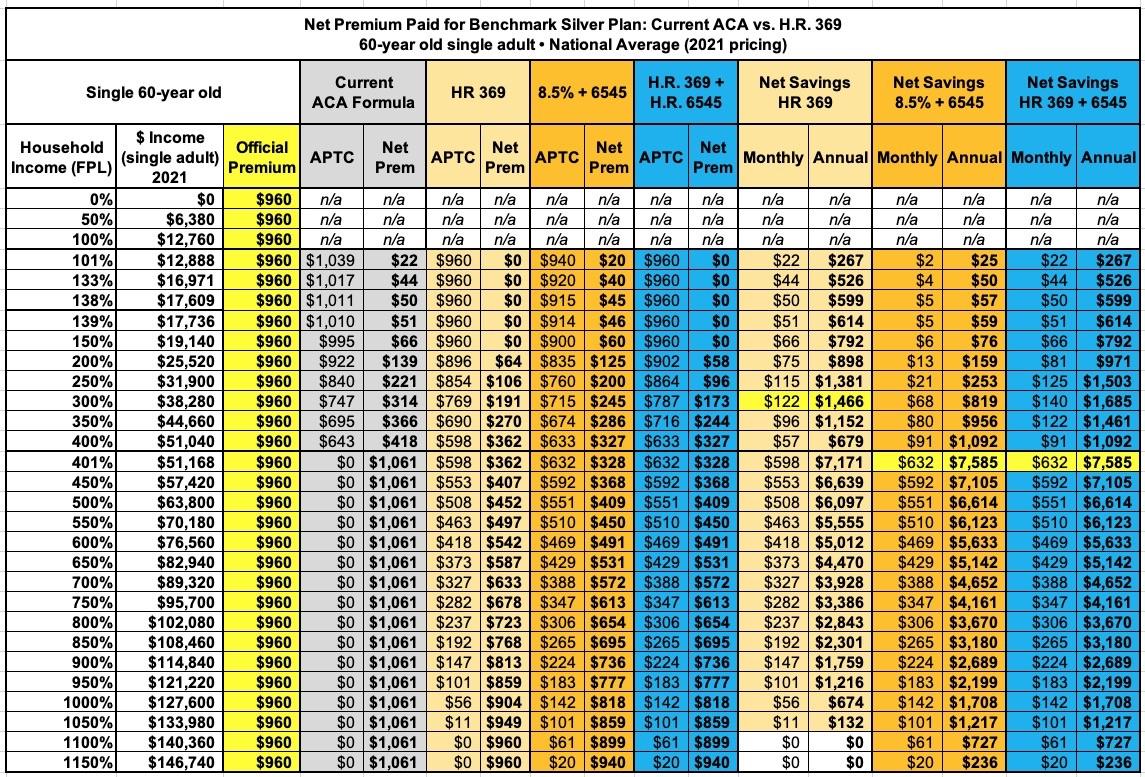

Next up, a 60-year old single adult:

At 60 years old, the situation is quite different. Here, they'd be much better off under HR 369 up to around 380% FPL...but after that they'd be a bit better off under HR 6545.

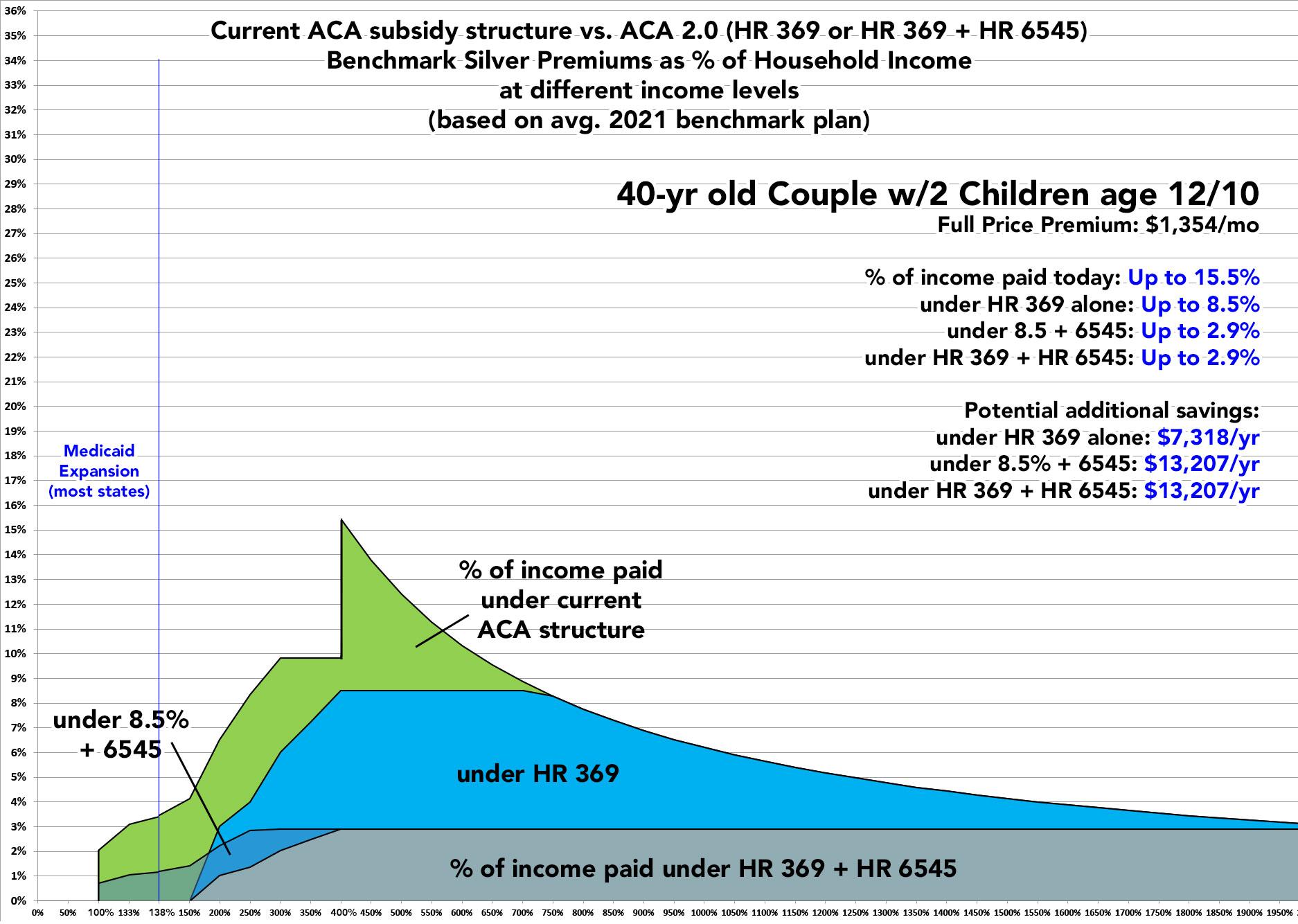

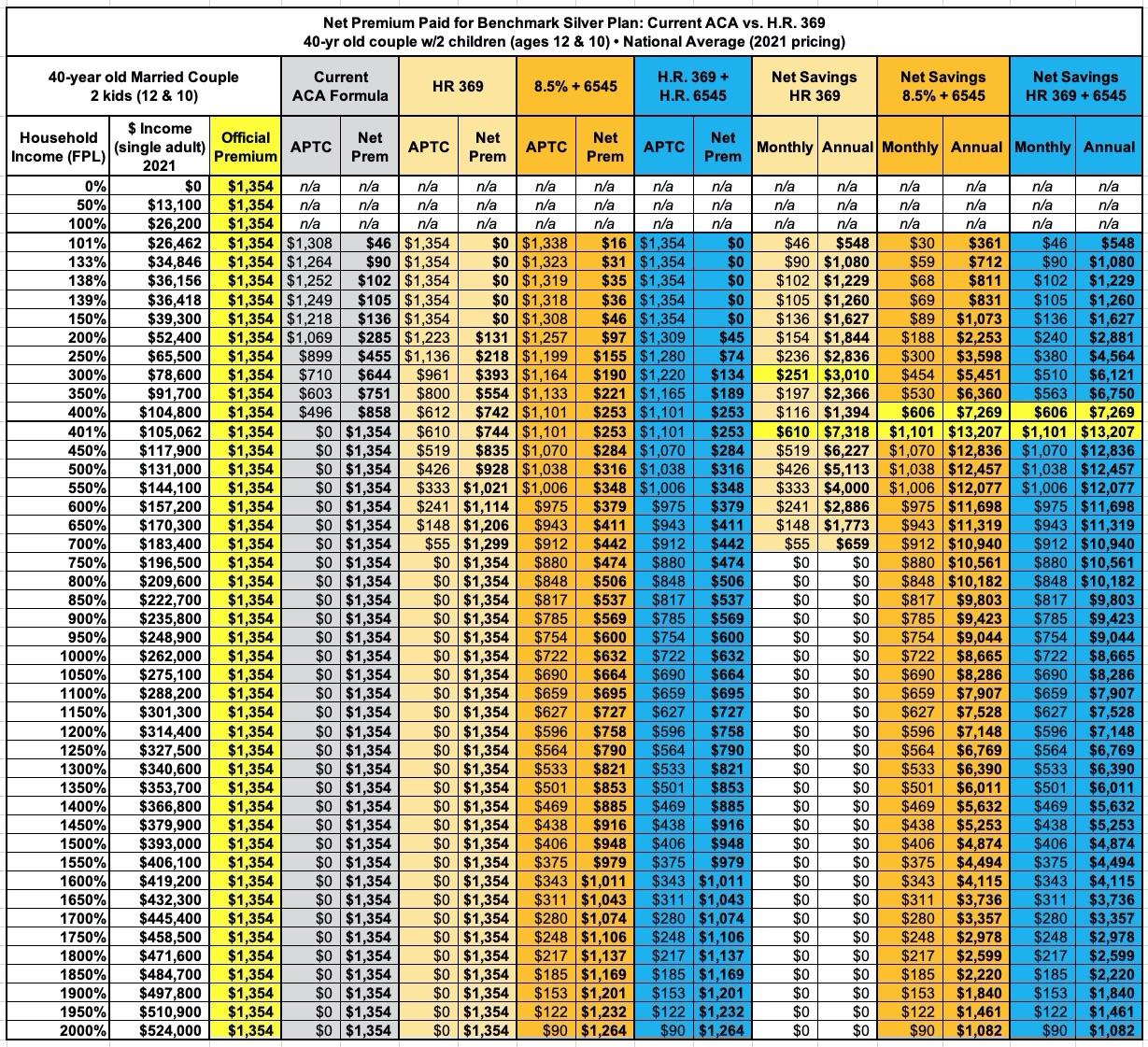

Finally, let's look at a Family of Four:

Holy Toledo! What happened here??

Well, there's two key things to keep in mind: First, children (with exceptions, of course) generally are pretty inexpensive medically-speaking. In fact, they come in below the 3:1 ratio range. Take another look at the official federal Age Band table:

Premiums for children under 15 are 23.5% lower than those of the baseline 21-year old, which means that technically speaking, the ACA age band is more like 3.92:1 than 3:1 if you use children as your baseline.

The second thing to note is that, again, even a 40-year old is still considered "young" from an Age Band perspective. On a straight line, you'd expect the age adjustment for a 40-year old to be around 1.900, but it's atually only 1.278.

Put these two together and you get a surprisingly low Age Adjusted Applicable Premium Percantage:

- 1.278 x 2 = 2.556

- 0.765 x 2 = 1.530

- 4.086 / 4 = 1.0215

- 1.0215 / 3 = 0.3405

In other words, this famliy's Applicable Premium Percentage ends up being just over 1/3 of what it would be be without an Age Adjustment. At the maximum level (8.5%) it drops down to just 2.89%.

This family of four's maximum benchmark Silver premiums would drop by as much as $610/month under HR 369, which would be a hell of a load off their backs...but they'd save as much as $1,100/month under the 8.5+6545 option, or over $13,000/year!

Also note that this family would do better under HR 369 than 8.5+6545 up to around the 170% FPL threshold, but over that level would do much better under 8.5+6545:

OK, if you're still with me: Which route would be better overall?

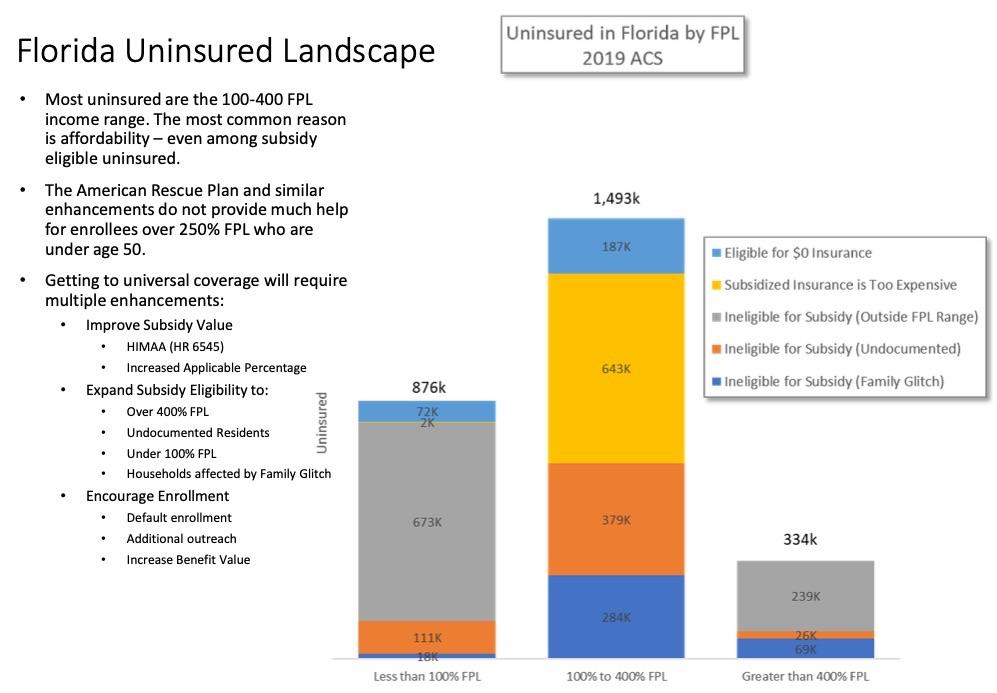

For the rest of this analysis, I'm turning things over to an analysis done by Florida Blue (Blue Cross Blue Shield of Florida). Yes, I know: They're Big Insurance®! However, not all insurance carriers are the same; Florida Blue is a Not-for Profit Mutual Insurance Holding Company. The bottom line is that enrolling as many people as possible in comprehensive healthcare coverage at a reasonable price for the enrollees happens to be in the mutual interest of them and the general public. And no, they aren't paying me a dime.

Florida Blue's analysis is, of course, limited to Florida's population; the demographics and socioeconomic variances of other states makes it difficult to know how representative this would be for the rest of the country. On the other hand, Florida has also long had by far the largest ACA exchange enrollment nationally (they actually enrolled 25% more people than California last year even though CA has nearly twice as many residents), so they're probably about as represntative as you could reasonably get.

Anyway, here's what Florida Blue's analysis has to say (I'm skipping a lot of stuff from the slide deck, which is 64 pages long total!)

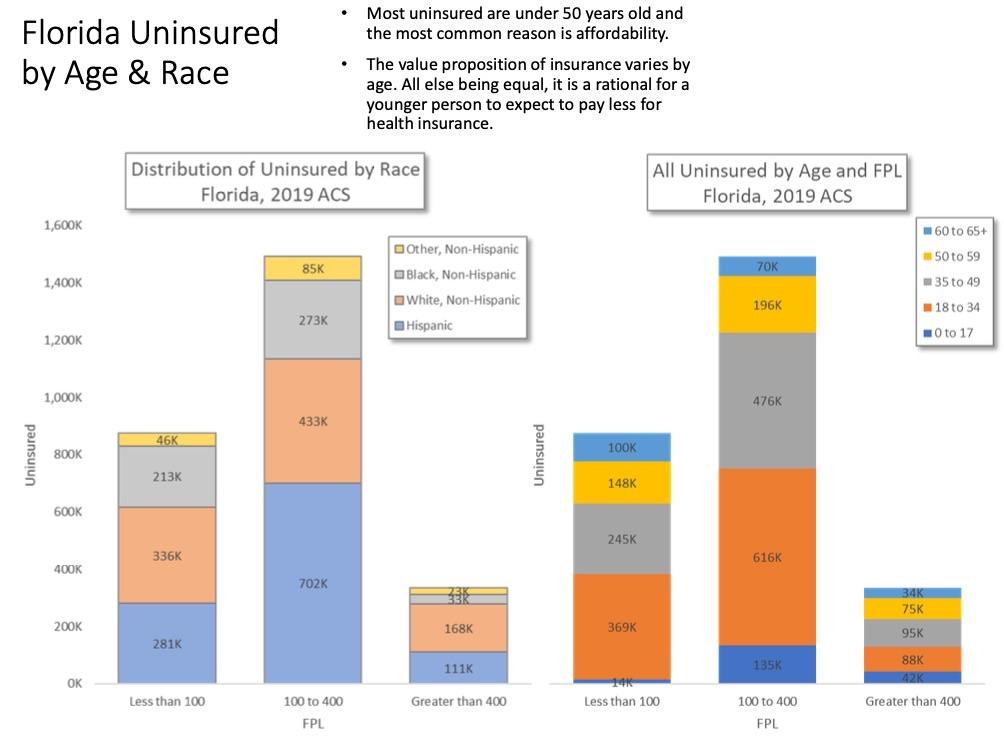

First, here's a breakout of Florida's current uninsured population by age, race, income levels and category:

The key point from this slide is that in Florida, at least, 31% of the uninsured (890,000) are already eligible for current ACA subsidies, but haven't enrolled for various reasons...primarily affordability (or, for ~7% of the uninsured (187,000), a lack of awareness that they're eligible for FREE ACA policies right now).

For these folks, killing the subsidy cliff over the 400% FPL threshold wouldn't change anything; only 239,000 Floridians earning over 400% FPL would fall into that category, which is still, you know, a buttload of people. However, that's not the debate here, since either HR 369 or 8.5+6545 would include killing the cliff anyway.

In any event, for those 890,000 Floridians, it's the #UpTheSubs part of the discussion which is most relevant, and here's where HR 369 vs. HR 6545 is most relevant.

Here's where things start to get interesting. Again, in Florida in particular, fully 47% of the population we're talking about (100 - 400% FPL) are Hispanic. Meanwhile, 82% are under 50 years old and 50% are under 35!

Takeaway: #KillTheCliff resolves the issue for those over 50 (who are also a lot more likely to earn more than 400% FPL...they make up 33% of that category)...but it's #UpTheSubs which is needed to resolve things for those under 50....which makes up a much larger population (there's 1.23 million <50 in the 100 - 400% range vs. just 109K >50 in the >400% range).

OK, so what would the actual impact on ACA exchange enrollment look like under the different scenarios?

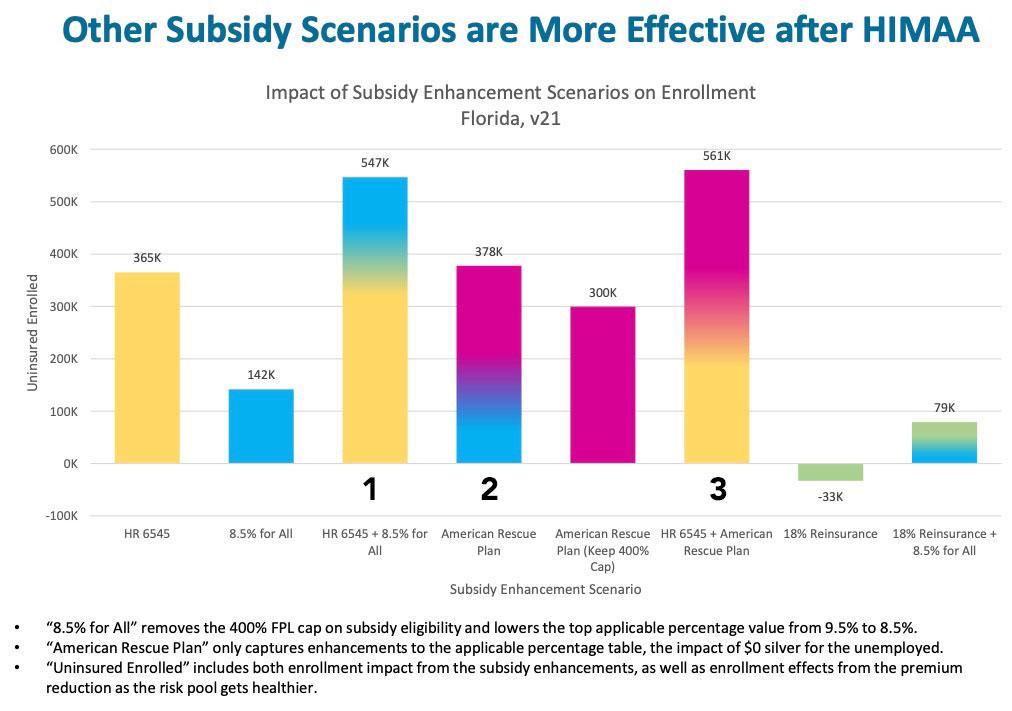

Well, FL Blue didn't just look at three scenarios; they actually broke them out into six different combinations, and even pointed out how ineffective reinsurance programs (which have been all the rage up until now across over a dozen states) tend to be:

- HR 6545 assumes the 3:1 age band-based adjustment alone...that is, it assumes we don't #KillTheCliff or #UpTheSubs, keeping the existing APTC formula exactly as is and only using the age modifier to enhance subsidies

- 8.5% for All assumes the only change made is to #KillTheCliff...no other changes.

- 8.5% + 6545 is one of the scenarios I'm looking at here.

- American Rescue Plan basically means HR 369: #KillTHeCliff, #UpTheSubs, but without the age modifier. This is the second plan I'm studying here.

- American Rescue Plan without killing the cliff is the inverse of 8.5% for all...it would keep the cliff but #UpTheSubs.

- 6545 + ARP is the best-case scenario, and is the third scenario I've laid out above.

Interestingly, in terms of sheer total enrollment increases, both 6545 and ARP/369 would result in nearly the same increases in Florida (365,000 vs. 378,000)...but 8.5+6545 would see a dramatically higher increase, to 547,000. Merging both ARP/369 with 6545 would apparently only result in a modest further effect, increasing enrollment by 561,000 people.

OK, so HR 369 would increase enrollment by a lot, 8.5+6545 would increase enrollment by a whole lot, and combining them would increase enrollment by...well, a whole lot plus a bit more. That's hardly surprising, since all three involve spending more money on subsidies to cut down costs, right?

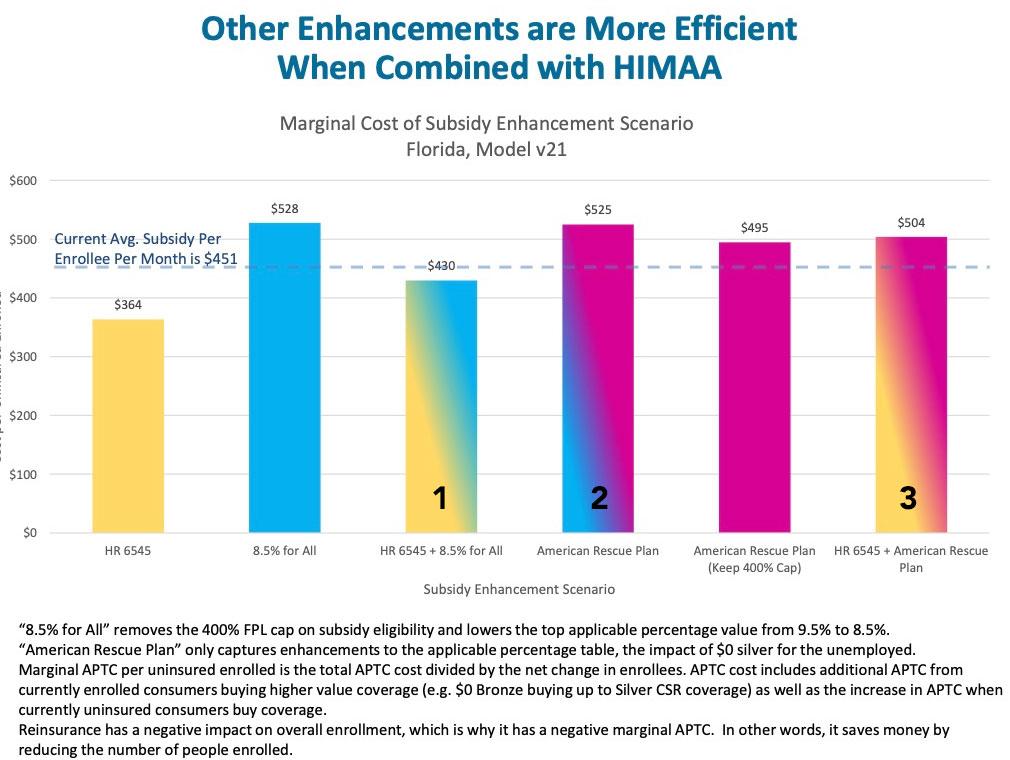

The question then becomes which of these are the most efficient in terms of federal spending relative to enrollment increases?

According to this analysis, in Florida, ARP/369 as it stands would increase the amount of subsidies spent per total exchange enrollee (including currently subsidized enrollees) by around 16%, which wouldn't be bad for a 19% increase in ACA exchange enrollment (I'm assuming 2.0 million is the baseline).

However, they also find that subsidies would drop by 4.7% per enrollee under 8.5+6545, because the 27% increase in enrollment would mostly be composed of much younger, healthier people who would have significantly lower premiums to begin with, and would thus need far smaller subsidies even with the age-based modifier!

Combining the two bills together would end up somewhere in between.

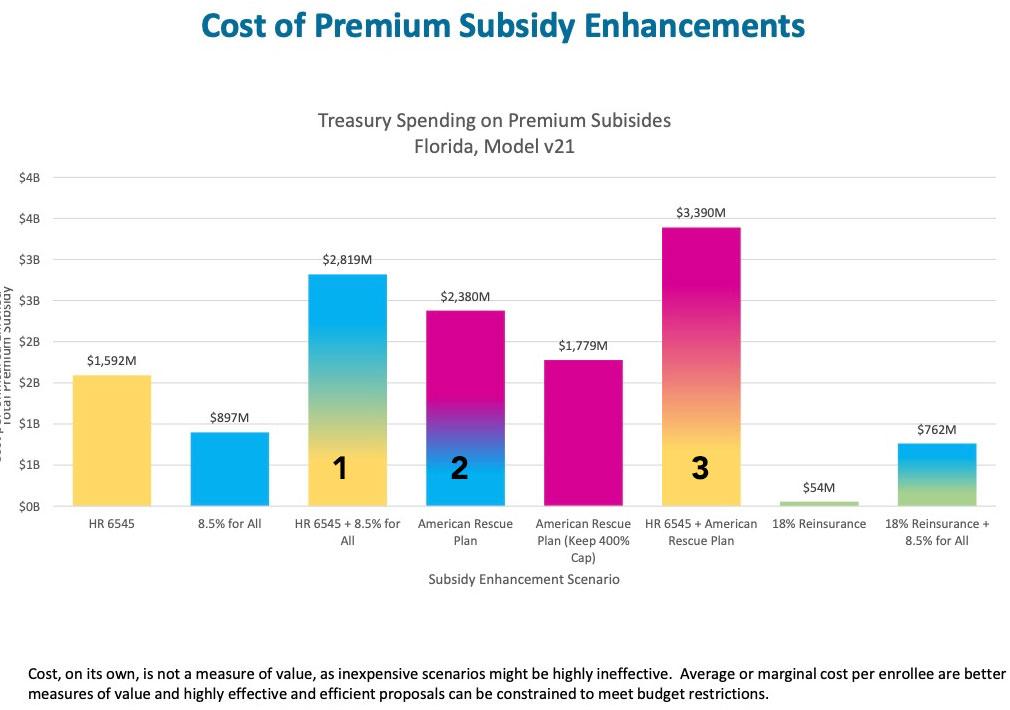

In short, Florida Blue's projection concludes that ACA subsidies in Florida would increase by:

- ARP/369: $2.4B/year to enroll 378K more people ($6,300 apiece on average)

- 8.5+6545: $2.8B/year to enroll 547K more people ($5,150 apiece on average)

- Combined: $3.4B/year to enroll 561K more people ($6,050 apiece on average)

So far, it's looking ike 8.5 + 6545 is the best option in terms of bang for your buck.

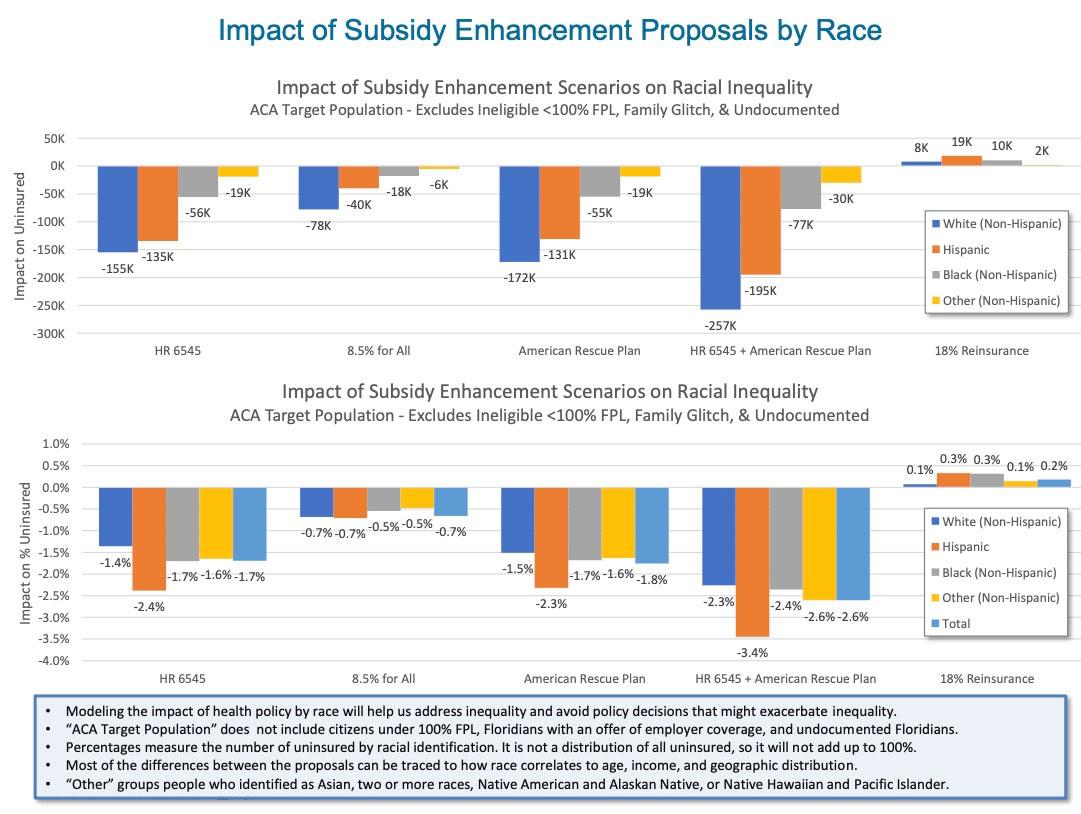

Next, let's look at the impact on racial inequality:

Huh. VERY interesting...ARP/369 and HR6545 both seem to have an almost identical impact on different racial groups...but for whatever reason this slide seems to have separated out the 8.5 from 6545 impact. Combined, 8.5+6545 would reduce the number of uninsured in each group by more than 369 alone...butnotice how the percentage drop in unemployment would be dramatically better from combining 369 and 6545.

There's a ton more in the full slide deck, but you get the picture. Overall, my takeaway would be to proceed as follows:

FIRST, the American Rescue Plan (which basically mirrors HR 369) is a damned good upgrade over the current APTC formula. It's already been passed and covers things through the end of 2022.

AFTER THAT:

Best Option for Maximum Enrollment Expansion:

- Pass HR 369 AND HR 6545 (as is)

Best Option for Maximum Fiscal Efficiency:

- Pass a modified version of HR 6545 which also sets the upper limit at 8.5%.

2nd Best Option in Either Scenario:

- Pass HR 369 by itself

3rd Best Option (Fallback position):

- Either pass HR 6545 standalone or Kill the Cliff 8.5% standalone, depending on whichever one you can get through at that time (my suspicion is that 8.5% would have an easier time if only because so many healthcare advocates, including myself, have been screaming #KillTheCliff for so long and because it would primarily help the over-50 AARP crowd, who are getting screwed today and who tend to vote at much higher levels anyway).

Again, any of these four options would still be a significant improvement over simply allowing the ARP-expanded subsidies to simply expire in two years, but given that Congressional Democrats are hoping to pass ACA 2.0 and expand Medicare comprehensiveness and close the Medicaid Gap all at the same time, anything which has the potential to shave several tens of billions of dollars off the overall cost without sacrificing affordability or comprehensiveness for the enrollees is worth considering...and HR 6545 sure as hell seems to fit the bill!

In terms of how much the various scenarios above would cost, again, it's hard to extrapolate out nationally from Florida alone, but assuming the "Cost of Premium Subsidy Enhancement" table is reflective nationally, HR6545+8.5 should run perhaps 18% less per additional enrollee than making the ARP/369 subsidies permanent by themselves would. Assuming ARP/369 cost, say, $250 billion over a decade, that'd save perhaps $45 billion off the CBO score for the same total enrollment and enrollee affordability.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.