It's here! House Ways & Means Committee releases (half) the #COVID19 Relief Bill!

Earlier this evening, the House Ways & Means Committee formally published the markup of nine legislative provisions which, if they all survive the process, will make up roughly half of President Biden's proposed $1.9 trillion COVID-19 relief package, aka the American Rescue Plan:

The Ways and Means’ proposals comprise half of the $1.9 trillion Democratic COVID-19 relief package

SPRINGFIELD, MA – Today, House Ways and Means Committee Chairman Richard E. Neal (D-MA) announced the Committee will consider nine legislative proposals under the budget reconciliation instructions this week as the next step in delivering COVID-19 relief to the American people. Beginning on Wednesday, February 10, 2021 at 10:00 a.m. through Friday, February 12, 2021, the Committee will markup proposals spanning from extending unemployment insurance to expanding the child tax credit to delivering another round of direct assistance to struggling Americans.

It's important to reiterate that this only covers about half of the overall package. Also, the Senate version will presumably still have to be marked up, and who knows what sort of tweaks and changes will be made along the way before final passage through both bodies? Having said that, here's the nine provisions announced today:

Additional direct assistance:

- Giving working families an additional direct payment of $1,400 per person—bringing their total relief to $2,000 per person.

This is the one which has caused the most fuss & bother (online, at least). Back in December, Democrats were pushing for the next batch of direct relief payments to be $2,000. Instead, Congress, in the last days of the Trump Administration and GOP Senate control, passed a bill including $600 per person in payments. Due to a timing confluence of that bill and the campaign for the Georgia Senate runoff elections (where Jon Ossoff & Rev. Warnock were still giving speeches & running ads pushing for "$2,000 checks") , there was some confusion about whether or not the amount "promised" was another $2,000 on top of the original $600, or $1,400 to bring the total up to $2,000.

One could honestly have interpreted it either way, but some on the left have been insisting that anything short of another $2,000 is tantamount to "betrayal" by the Dems, so (shrug)...anyway, there you have it.

Critical supports for unemployed workers:

- Extends temporary federal unemployment and benefits through August 29, 2021.

- Increases the weekly benefit from $300 to $400.

Fairness in the tax code for families and workers:

- Makes historic expansions to tax credits targeted at workers and families:

- Enhances the Earned Income Tax Credit for workers without children by nearly tripling the maximum credit and extending eligibility.

- This would be the largest expansion to EITC since 2009.

- Expands the Child Tax Credit to $3,000 per child ($3,600 for children under 6), and makes it fully refundable and advanceable.

- Helps families access high-quality child care by expanding the Child and Dependent Tax Credit (CDCTC) to allow families to claim up to half of their child care expenses.

Supporting health coverage and improving health care affordability:

- Reduces health care premiums for low- and middle-income families by increasing the Affordable Care Act’s (ACA) premium tax credits for 2021 and 2022.

- Supports the continuation of employer-based health coverage by subsidizing COBRA coverage through the end of the fiscal year.

- Creates health care subsidies for unemployed workers who are ineligible for COBRA.

This is obviously the section which is of most interest to this blog in particular. I'll list the rest of the provisions first and then return to these items.

Protecting the elderly and crushing the virus in nursing homes:

- Provides skilled nursing facilities (SNFs) the tools and on-the-ground support they need to contain COVID-19 outbreaks and gives states funding to deploy strike teams to SNFs to manage outbreaks when they do occur.

- Increases public health and social services to combat abuse, neglect, and exploitation of the elderly that has been exacerbated by the COVID-19 pandemic.

Emergency assistance for vulnerable children, families, and workers:

- Uses existing pathways to get resources to people in need quickly, including those who may not be receiving other assistance provided during the pandemic

- This aid would help ensure that pregnant women, children, and struggling families can maintain access to the essentials during the emergency, like housing, diapers, internet service, soap, and food.

Strengthened retirement security:

- Stabilizes the pensions for more than 1 million Americans, often frontline workers, who participate in multiemployer plans that are rapidly approaching insolvency.

- Without action, the multiemployer pension system could collapse entirely, leaving retirees in poverty, businesses in bankruptcy and communities in crisis.

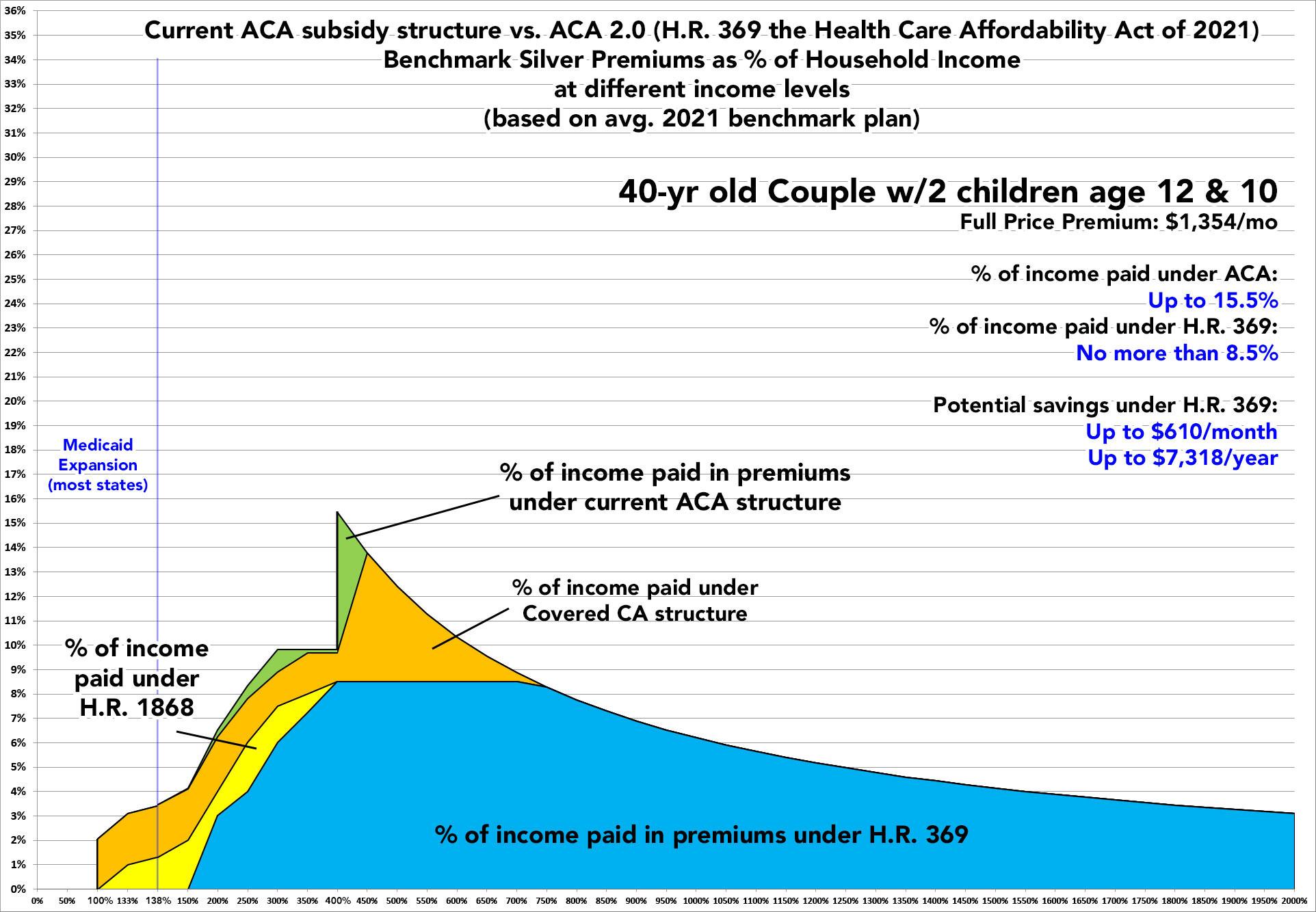

OK, let's take a closer look at the three highlighted items above. The first one is basically a 2-year version of H.R. 369, the bill to #KillTheCliff and #UpTheSubs which I've been pushing hard to be passed for upwards of three years now. More on that in a moment:

Sec. 9500. Short title This section provides a short title of the “Worker Health Coverage Protection Act”

Sec. 9501. Preserving Health Benefits for Workers

This section provides for premium assistance of 85 percent for COBRA continuation coverage for eligible individuals and families from the first of the month after enactment through September 31, 2021. The section specifies the reduction in premium payments made by individuals and plan enrollment options. This section establishes assistance eligible individuals and excludes individuals from receiving premium assistance if individuals are eligible for other group health plan coverage or Medicare. This section also provides an extension of the COBRA election period and specifies the date for commencement of coverage; provides for an expedited review process relating to denials for premium assistance; and requires notices to individuals including information about extended election periods and the expiration of premium assistance.

This section provides a refundable payroll tax credit to reimburse employers and plans who paid the subsidized portion of the premium to COBRA assistance eligible individuals; specifies penalties associated with failure to notify employees and plans of cessation of eligibility for premium assistance; and excludes premium assistance from income.

Sec. 9502. Implementation Funding This section provides $10 million for the Department of Labor for implementation funding.

Wow. I assumed this would simply provide ongoing employer premium subsidies at the same level that the employer was already providing before the employee was laid off...but that can range all over the place depending on the employer, the number of employees and whether the employees' families are included or not. Nationally, the average appears to be around 82%, but in some cases it's as low as 60% or as high as 85% or more. It would probably be a logistical nightmare to keep track of every possible subsidy range, so this appears to lock it all in at a flat 85%, meaning laid-off employees will only have to pay 15% of their full premium amount until the end of September.

Part 7 – Premium Tax Credit

Sec. 9661 – Improving affordability by expanding premium assistance for consumer

Modifies the affordability percentages used for 36 (B) premium tax credits for 2021 and 2022 to increase credits for individuals eligible for assistance under current law and provides 36 (B) credits for taxpayers with income

belowabove 400 percent of the federal poverty line (FPL).

First of all, that's clearly a typo!! It provides credits for taxpayers above 400% FPL, not below! (I've checked the legislative text itself and thankfully it's correct there!)

More to the point, this is, indeed, a reference to the language of H.R. 369, Rep. Lauren Underwood's "Healthcare Affordability Act", otherwise known as #KillTheCliff and #UpTheSubs.

Another important thing to note is that it would be retroactive to the beginning of 2021. That means that not only would most of the ~9 million or so exchange enrollees currently receiving subsidies see them boosted dating back to January, but anyone who enrolls during the pending 3-month COVID19 Enrollment Period set to launch on February 15th would also see the boosted subsidies...including many of those earning more than 400% FPL. That's potentially huge, assuming it passes and they're able to get the word out (remember, the actual final bill may not be signed into law by President Biden until late February or so).

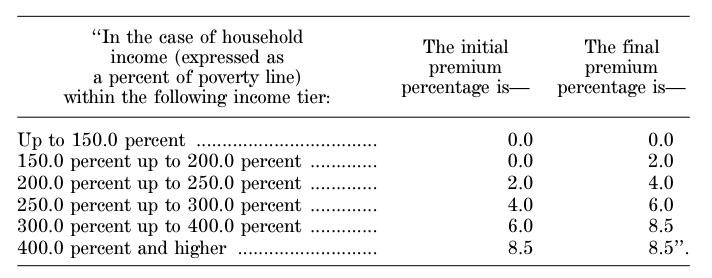

Here's the actual corresponding legislative text:

PART 7—PREMIUM TAX CREDIT

SEC. 9661. IMPROVING AFFORDABILITY BY EXPANDING PREMIUM ASSISTANCE FOR CONSUMERS.

(a) IN GENERAL.—Section 36B(b)(3)(A) of the Internal Revenue Code of 1986 is amended by adding at the end the following new clause:

‘‘(iii) TEMPORARY PERCENTAGES FOR 2021 AND 2022.— In the case of a taxable 24 year beginning in 2021 or 2022—

‘‘(I) clause (ii) shall not apply for purposes of adjusting premium percentages under this subparagraph, and

‘‘(II) the following table shall be applied in lieu of the table contained in clause (i):

(b) CONFORMING AMENDMENT.—Section 36B(c)(1) of the Internal Revenue Code of 1986 is amended by adding at the end the following new subparagraph:

‘‘(E) TEMPORARY RULE FOR 2021 AND 2022.—In the case of a taxable year beginning in 2021 or 2022, subparagraph (A) shall be applied without regard to ‘but does not exceed 400 percent’.’’.

(c) EFFECTIVE DATE.—The amendments made by this section shall apply to taxable years beginning after December 31, 2020.

In fact, the actual APTC table in the legislation is slightly more generous at lower income levels than HR 369 (it's a minor difference...people earning 150 - 200% FPL would pay between 0 - 2% of their income instead of between 0 - 3%...but that single percentage point is a big deal at that income level).

The only downside to this provision is that it's only in place for two years for now, when it should be permanent. This is disappointing, but given that this is supposed to be an "Emergency Pandemic Relief Bill" I suppose it makes sense. It's hard to call something an "emergency measure" if it's in place permanently. I'm told that the idea is to make it permanent later on in the year, so we'll see.

Anyway...this would still be a Big F*cking Deal, as President Biden once said.

Sec. 9662 – Temporary modification of limitations on reconciliation of tax credits for coverage under a qualified health plan with advance payments of such credit.

For tax year 2020, modifies the repayment obligations for taxpayers receiving excess premium tax credits under Section 36 (B) so such payments are not subject to recapture.

Normally, if you received ACA tax credits in 2020 based on your projected annual 2020 income ended up earning more than you expected, you'd have to pay back a portion (or possibly all) of your "excess" tax credits when you file your 2020 taxes. For most people impacted by the COVID-19 pandemic last year, the opposite is likely what happened...but some people probably did end up seeing an income boost compared to what they expected. This provision says that for this year specifically, you don't have to pay the "excess" credits back.

This also neatly renders moot another headache from last year involving the IRS being backlogged with tax return filing.

Sec. 9663 – Application of premium tax credit in case of individuals receiving unemployment compensation during 2021

For 2021, provides advanced premium tax credits as if the taxpayer’s income was no higher than 133 percent of the federal poverty line (FPL) for individuals receiving unemployment compensation as defined in section 85(B) of the Internal Revenue Code.

This, again, is a Big Deal for this year. Paired with the beefed-up APTC table, what it means is that if you're on unemployment this year you effectively don't have to pay anything for a benchmark Silver plan. I'm not sure if you have to be unemployed for the full year or not...the wording above sounds like even someone who's only on unemployment for one or two weeks would still be counted as having 133% FPL.

Here's the wording of that section:

SEC. 9663. APPLICATION OF PREMIUM TAX CREDIT IN CASE OF INDIVIDUALS RECEIVING UNEMPLOYMENT COMPENSATION DURING 2021.

(a) IN GENERAL.—Section 36B of the Internal Revenue Code of 1986 is amended by redesignating subsection (g) as subsection (h) and by inserting after subsection (f) the following new subsection:

‘‘(g) SPECIAL RULE FOR INDIVIDUALS WHO RECEIVE UNEMPLOYMENT COMPENSATION DURING 2021.—

‘‘(1) IN GENERAL.—For purposes of this section, in the case of a taxpayer who has received, or has been approved to receive, unemployment compensation for any week beginning during 2021, for the taxable year in which such week begins—

‘‘(A) such taxpayer shall be treated as an applicable taxpayer, and

‘‘(B) there shall not be taken into account any household income of the taxpayer in excess of 133 percent of the poverty line for a family of the size involved.

‘‘(2) UNEMPLOYMENT COMPENSATION.—For purposes of this subsection, the term ‘unemployment compensation’ has the meaning given such term in section 85(b).

‘‘(3) EVIDENCE OF UNEMPLOYMENT COMPENSATION.—For purposes of this subsection, a tax payer shall not be treated as having received (or been approved to receive) unemployment compensation for any week unless such taxpayer provides self attestation of, and such documentation as the Secretary shall prescribe which demonstrates, such receipt or approval.

‘‘(4) CLARIFICATION OF RULES REMAINING APPLICABLE.—

‘‘(A) JOINT RETURN REQUIREMENT.—

Paragraph (1)(A) shall not affect the application of subsection (c)(1)(C).

‘‘(B) HOUSEHOLD INCOME AND AFFORDABILLITY.—Paragraph (1)(B) shall not apply to any determination of household income for purposes of paragraph (2)(C)(i)(II) or 10 (4)(C)(ii) of subsection (c)’’.

(b) EFFECTIVE DATE.—The amendments made by this section shall apply to taxable years beginning after December 31, 2020.

I'm not an expert on legislative text but that sure looks to me like someone who receives even one week of unemployment this year gets treated as if they only earned 133% FPL regardless of how much they make. Huh.

In any event, assuming this goes through, this would be a HUGE deal for MILLIONS of people.

Here, again, is a typical example of how much a family of four could save on premiums: