#ACA 2.0 to be included in the next big "Human Infrastructure" bill...and #HR3 could pay for a big chunk of it

via Amy Lotven and John Wilkerson of Inside Health Policy:

Pelosi: Drug Pricing May Pay For Health Care Pieces Of Infrastructure Bill

House Speaker Nancy Pelosi (D-CA) said everything is on the table for the next legislative package that is expected to focus on infrastructure improvements and include health care provisions like a permanent increase to the Affordable Care Act tax credits — and she said the package likely will be paid for by tackling prescription drug prices.

...Pelosi said including House Democrats’ drug pricing bill, H.R.3, would pay for $500 billion of the cost of the infrastructure bill, part of which could be used to boost ACA tax credits and make ACA coverage more affordable. The savings also could also be used for other health-related efforts, she said. For example, House Energy & Commerce Chair Frank Pallone (D-NJ) has been working with Rep. Jim Clyburn (D-SC) to expand community health centers and to improve broadband services, which would support telehealth.

...Expanding access to Medicare and adding a public option to the ACA are also in the mix, according to Pelosi. She noted that House Democrats included a public option in their version of the ACA in 2009, and she said she supports the policy but it’s unclear if it could make it into the next package.

Yet she added: “Everything is on the table.”

As I've noted before, my strong suspicion is that a full, robust Public Option (that is, one which is available to anyone and which pays healthcare providers significantly less than private insurance typically does) is extremely unlikely to make it through the sausage-making process. My guess is if it happens at all, it'll be something along the lines of "Medicare Advantage for All"...publicly funded but privately administered.

Alternately, it's possible that lowering the age of Medicare eligibility from 65 to 60 will make the cut...but even that's questionable. Via Stephanie Armour & Kristina Peterson of the Wall St. Journal:

Democrats are still negotiating over which healthcare policy elements could be in the second of two spending programs the administration plans to unveil soon, according to congressional aides and industry groups.

The package is likely to contain measures to reduce drug prices and expand health coverage, lawmakers said. Proposals to expand Medicare eligibility from age 65 to 60 and to enable the federal government to negotiate drug prices in the health program for seniors—both of which President Biden supported on the campaign trail—are also likely to be included.

...The healthcare proposals would face opposition from many Republicans and hospital groups, who say they could reduce the labor force because more people may retire early.

...“It would be extremely harmful to the healthcare system,” said Tom Nickels, executive vice president for government relations at the American Hospital Association, a trade group representing nearly 5,000 hospitals and providers.

...That leaves Democrats little room for disagreement within their own ranks. House Democrats can currently lose no more than three votes on legislation opposed by all Republicans, and legislation can pass the evenly divided Senate in the reconciliation process only if it has the support of every one of the Senate’s 50 Democrats.

What is almost certain to make the cut, however, is Sen. Jeanne Shaheen's S.499 (or something extremely close to it). As a refresher:

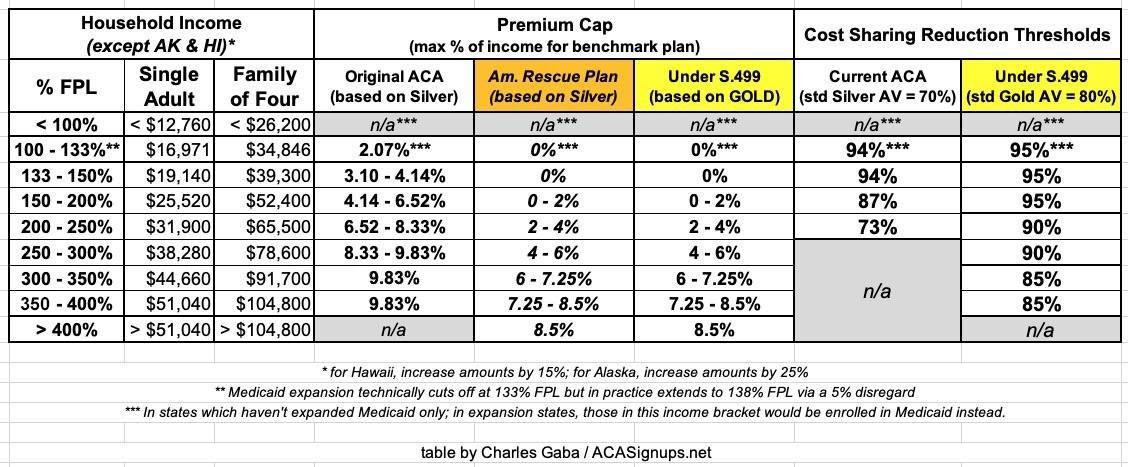

Senate Democrats led by New Hampshire Sen. Jeanne Shaheen are pushing legislation that would enhance the value of and eligibly for the Affordable Care Act’s cost-sharing reductions (CSRs) and permanently fund the program, thus eliminating the need for the “silver-loading” workaround that insurers crafted after the Trump administration ended direct payments to reimburse their costs for the subsidies in 2017.

The Improving Health Care Affordability Act, introduced March 1, also would also make permanent the ACA premium tax credit enhancements in the soon-to-be-enacted COVID-19 relief bill.

And the Senate Democrats’ bill would lift the actuarial value of the ACA subsides from 70% to 80% by linking the premium tax credits to the gold-level instead of silver-level plans.

...It also would expand CSRs to everyone earning up to 400% of poverty. For enrollees earning up to 200% FPL, the CSRs would hike the actuarial value of their plan from 87% up to 95%. Enrollees earning 200%-300% of FPL would have plans with a 90% AV and those earning from 300%-400% of FPL would get their plan value boosted to 85% AV.

Here, again, is a table summarizing how the current ACA subsidy structure works for both premiums and cost sharing (deductibles, co-pays & coinsurance); how the American Rescue Plan has temporarily beefed up the premium subsidies; and how both would look under S.499's permanently expanded subsidy structure for both premiums & cost sharing reductions:

The irony here is that, as my colleague Andrew Sprung noted the other day:

Any inkling whether enrollment at 60 is envisioned to be on the same terms as current enrollment at 65? Or a more expensive buy-in?

If the latter, expanded ACA subsidies would be a better deal for many, narrow networks aside.— xpostfactoid (@xpostfactoid) March 30, 2021

Yes, it's true: While it would be more expensive from the federal government's POV, in some ways an ACA plan with the permanently-expanded & enhanced subsidies could actually be a better value for 60 - 64 yr. old enrollees than Medicare would be, depending on how it's structured.

As for HR 3 (the House's Elijah Cummings Lower Drug Costs Now Act) helping pay for the bill, another irony here is that, as I explained the other day, it's likely that simply eliminating Silver Loading from the ACA exchanges could in and of itself potentially pay for the expanded subsidies...or at least a large chunk of doing so:

If you read my simple Silver Loading explainer above, you might have noticed something: CSR subsidies only apply to people enrolled in CSR plans (which are all Silver)...but the APTC subsidies, which are greatly enhanced by Silver Loading, apply to people enrolled in every plan. This means that, ironically, Trump's attempt to "save" ~$10 billion per year in CSR payments actually resulted in APTC payments increasing substantially MORE than that. How much more?

...The insurers further say that allowing the government to ignore obligations can create greater problems. The government itself admitted that the decision to end CSRs will cost taxpayers $194 billion more over 10 years, Common Ground says, referring to a Congressional Budget Office score on silver-loading that the Department of Justice mentioned in a February brief in the MCHO/CHC case at the Federal Circuit.

That's an average of $19.4 billion per year from 2017 - 2026...but once Silver Loading was fully accepted as the "new normal", the CBO projected that it would be more like $25 - $26 billion per year. In other words, if you assume the 10-year period from 2022 - 2031, you're talking about the federal government spending more like $250 billion more due to Donald Trump cutting off CSR payments.

IF, however, this latest CSR challenge to the Supreme Court were to actually be successful, that would mean the federal government could ALSO have to pay out the CSR reimbursements as well! That's another $14 billion or so per year on average, according to the CBO report (though this also assumes those payments would be owed for every year ad infinitum as opposed to 2018 only). At the very least, it would tack another $8 billion or so (from 2018) onto the tab.

...In other words, it's just barely within the range of a conceivable development that making the American Rescue Plan subsidy expansion permanent and upgrading the benchmark plan from Silver to Gold and upgrading the CSR ceiling from 250% FPL to 400% FPL and upgrading the CSR values from 94/87/73 to 95/90/85 could all be done while somehow managing to "save" the U.S. federal government $40 billion vs. what it would otherwise have to spend.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.