California: Approved avg. 2021 #ACA premiums: +0.6% individual market, +1.5% sm. group

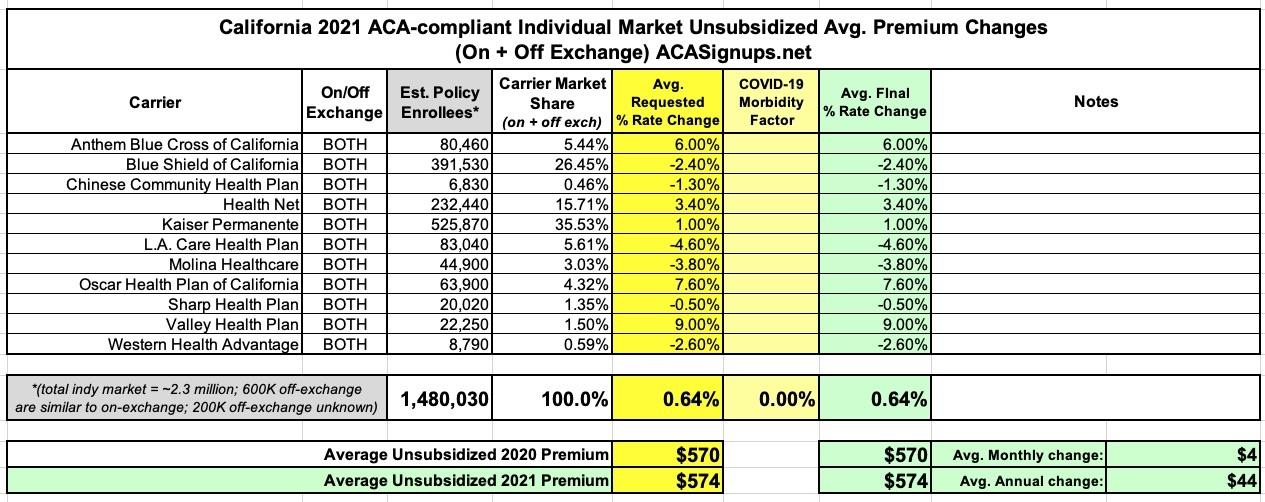

Back in early August, Covered California issued an extensive analysis of their upcoming 2021 individual market offerings, including the preliminary weighted average premium rate changes of just a 0.6% increase. Officially, this was just the average of the preliminary requests; the approved rates were presumably forthcoming at a later date.

Well, the 2021 Open Enrollment Period has technically already started in California...while new enrollees still have to wait until November 1st, current CoveredCA enrollees have apparently been able to re-enroll for 2021 since October 1st! (In previous years, CoveredCA opened up the renewal period starting on Oct. 15th)

Sure enough, the other day the state-based exchange issued a similar press release touting a mere 1.5% average rate increase for their small group plans ("Covered CA for Small Business"), which included an almost throwaway reference to the individual market as well:

Covered California for Small Business Announces a Record-Low Weighted Average Rate Change of 1.5 Percent for 2021

- The 1.5 percent weighted average rate change for Covered California for Small Business plans is the lowest since the exchange opened in 2014 — and it comes as Covered California’s individual market premiums increased by only 0.6 percent.

- Covered California’s small-business marketplace continues to grow, with more than 62,000 members to date and double-digit membership growth for six consecutive years.

- Covered California for Small Business announces plans to launch a new enrollment platform in the spring of 2021, with new tools and capabilities that will meet and, in some cases, exceed market standards.

That's literally the only reference to the individual market rate changes. Since it's identical to the 0.6% referred to in August, and since CoveredCA has already opened up renewals for current enrollees, I can only conclude that the "preliminary" rates were approved exactly as is. With that in mind, here's what the individual market changes look like for CA next year:

As for the small group market, that's what the press release is actually about. I can't seem to find a comprehensive list of carriers, rate changes and enrollment data for the small group market, so I'll just have to stick with the 1.5% overall figure for now:

SACRAMENTO, Calif. — Covered California for Small Business unveiled the health plan choices and rates for small-business employers and their employees for the upcoming 2021 plan year. The statewide weighted average rate change will be 1.5 percent, which represents the lowest annual increase in the program’s seven-year history, and is significantly lower than national projected increases for larger employers.

“Covered California for Small Business continues to meet the needs of employers and their employees across the state,” said Peter V. Lee, executive director of Covered California. “In addition to driving down premiums, we will be upgrading our platform to continue to provide small-business consumers with even more value and choice.”

This year’s rate change of 1.5 percent is lower than the recent projection of 5.0 percent that larger employers expect to see in 2021 (see Table 1: Covered California for Small Business Average Rate Change, by Year). The program’s five-year average rate change is 4.3 percent.

“The sustained growth of Covered California for Small Business is another example of how the Affordable Care Act continues to work for Californians,” Lee said. “The growth of Covered California for Small Business, coupled with only small rate changes, helps all small business employers and their employees by putting competitive pressure on plans across the state.”

Table 1: Covered California for Small Business Average Rate Change, by Year

Year: Rate Increase (Percentage)

- 2021: 1.5%

- 2020: 4.1%

- 2019: 4.6%

- 2018: 5.6%

- 2017: 5.9%

- 2016: 7.9%

- 2015: 5.2%

- Projected Large-Business Rate Change in 2021: 5.0

Covered California for Small Businesswill continue to offer five plans in 2021, including two preferred provider organization (PPO) plans from Blue Shield of California and Health Net, both offering their broadest provider networks, and two health maintenance organization (HMO) plans — which are provider- and hospital-based — from Kaiser Permanente and Blue Shield.

The 2021 portfolio of health plans also includes Sharp Health Plan in San Diego and Oscar Health Plan of California, which will be offering coverage in Los Angeles and Orange counties. In addition, Blue Shield will also provide HMO plans to residents of Fresno, Kings and Madera counties.

Covered California for Small Businesshas experienced double-digit percentage growth in membership for six consecutive years. Currently, more than 62,000 individuals have insurance through Covered California for Small Business, representing a growth of approximately 7,000 individuals, or a 12.7 percent gain in membership over this time last year.

“As we enter into open enrollment for the individual market with state subsidies again available, we want to be sure small-business owners know their options and opportunities with Covered California,” Lee said.

The steady growth makes Covered California for Small Business one of the largest small-business health options programs in the nation.

“Our weighted average rate change this year is again the lowest rate increase ever,” said Terri Convey, director of Covered California’s Outreach and Sales division. “We’ve been able to have low increases for the last five years, proving that our employee choice platform is working well for small businesses.”

Just as in Covered California’s individual market, consumers may be able to limit increases in their rates, or perhaps even save money on their premiums, by shopping and switching to the lowest-cost plan in the same metal tier.

Businesses with up to 100 full-time equivalent employees can apply for health insurance coverage for their workers through Covered California for Small Business. Federal tax credits may be available to employers with 25 or fewer employees. Visit the website for information on how to apply.

Family dental plans are optional and are provided by Delta Dental of California, Liberty Dental Plan of California, Dental Health Services and California Dental Network.

About Covered California

Covered California is the state’s health insurance marketplace, where Californians can find affordable, high-quality insurance from top insurance companies. Covered California is the only place where individuals who qualify can get financial assistance on a sliding scale to reduce premium costs. Consumers can then compare health insurance plans and choose the plan that works best for their health needs and budget. Depending on their income, some consumers may qualify for the low-cost or no-cost Medi-Cal program.

Covered California is an independent part of the state government whose job is to make the health insurance marketplace work for California’s consumers. It is overseen by a five-member board appointed by the governor and the Legislature. For more information about Covered California, please visit www.CoveredCA.com.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.