Ohio: Preliminary 2021 avg. #ACA premiums: +3.2% or -0.4%??

Hmmm...on the one hand, this summary of the 2021 ACA individual market rate filings from the Ohio Insurance Dept. would appear to be pretty straightforward:

The sections below include a summary of Ohio’s individual market for 2021. The data is based on product filings the Ohio Department of Insurance is currently reviewing.

Ohio’s Health Insurance Market 2021

For 2020, the department approved 10 companies to sell on the exchange. Based on the plan information the department approved, most counties had at least three insurers. 29 counties had two insurers, and just one county had only one insurer.

For 2021, the department approved those same 10 companies to sell on the exchange. Based on those filings, all counties will have at least two insurers and all but 10 counties will have three or more insurers.

Companies Who Have Filed to Sell in 2021

- AultCare Insurance Company

- Buckeye Community Health Plan

- CareSource

- Community Insurance Company

- Medical Health Insuring Corp. of Ohio

- Molina Healthcare of Ohio, Inc.

- Oscar Buckeye State Insurance Corporation

- Oscar Insurance Corporation of Ohio

- Paramount Insurance Company

- Summa Insurance Company

Individual Market Premium Information for 2021

Premiums for 2021 are projected to stay relatively stable from 2020 - though individual companies' rates will vary from the average. Weighted average annual premiums for the individual market for 2021 is projected to be $5,670.63. In 2020 weighted average annual premiums were $5,690.26 - a decrease of .4%.

OK, so that's a 0.4% reduction on weighted average, and since the OH DOI is "currently reviewing" the filings, that means these are still preliminary, not final.

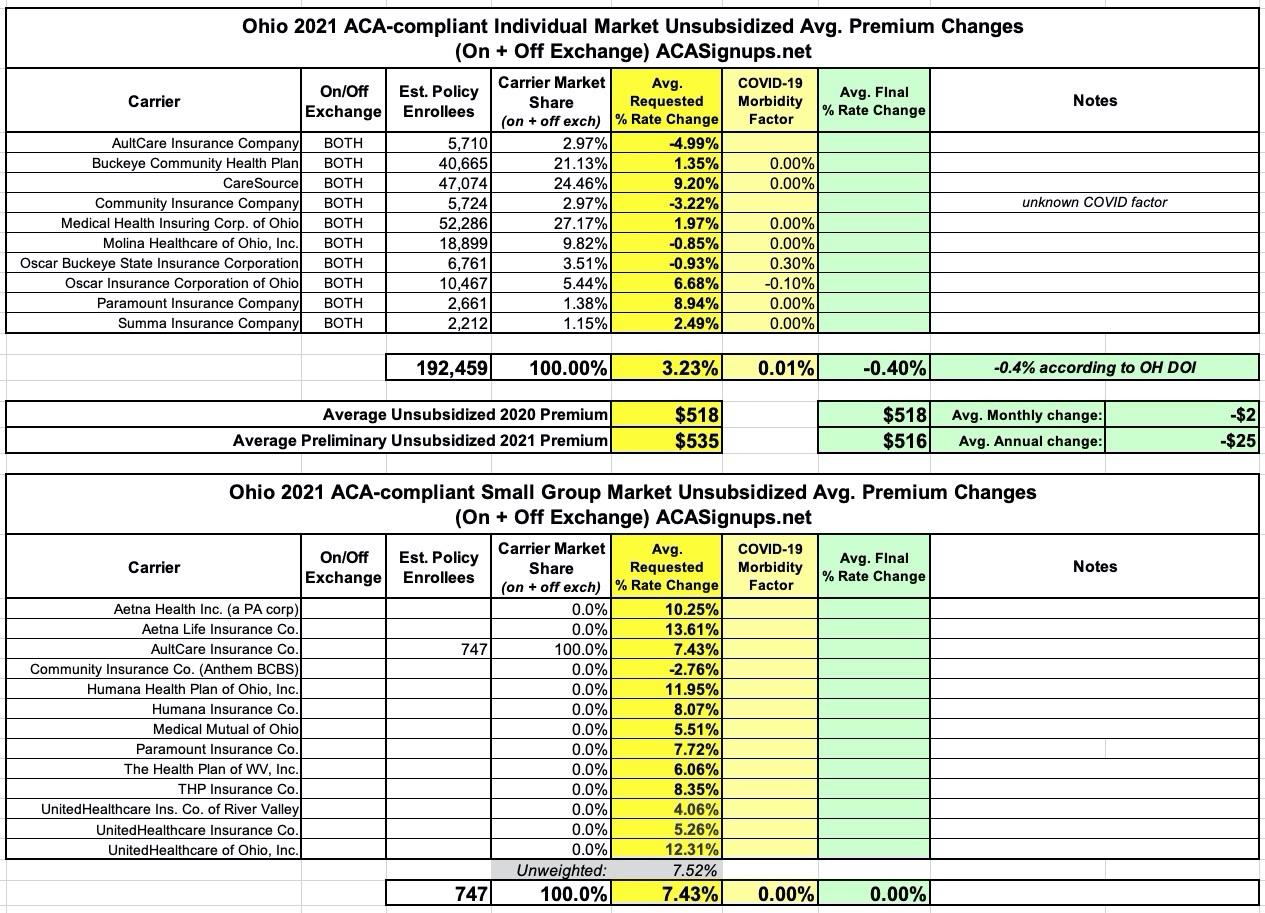

However, when I plug the actual average requested rate changes and current enrollment for each carrier into my spreadsheet, it looks different:

Instead of a 0.4% drop, this looks like a 3.2% increase on average for the individual market. Perhaps it'll be -0.4% when approved, or perhaps one of the actuarial URRT forms I looked at had an error in the enrollment number, but the weighted average comes in at +3.23% for me.

As for the small group market, I was only able to dig up the actual enrollment for one of the 13 carriers, so I have no way of running a weighted average; the unweighted average comes in at +7.5%.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.