How much impact will #COVID19 have on 2021 #ACA premiums? So far, not much (yet).

Every year, I spend months painstakingly tracking every insurance carrier rate filing for the following year to determine just how much average insurance policy premiums on the individual market are projected to increase or decrease.

Carriers jump in and out of the market, their tendency repeatedly revise their requests, and the confusing blizzard of actual filing forms which sometimes make it next to impossible to find the specific data I need. The actual data I need to compile my estimates are actually fairly simple, however. I really only need three pieces of information for each carrier:

- How many effectuated enrollees they have enrolled in ACA-compliant individual market policies;

- What their average projected premium rate increase (or decrease) is for those enrollees (assuming 100% of them renew their existing policies, of course); and

- Ideally, a breakout of the reasons behind those rate changes, since there's usually more than one.

- In 2015, I projected that the overall average rate increases for 2016 would be roughly 12-13% nationally. It turned out to be around 11.6%.

- In 2016, I projected that the overall average rate increases for 2017 would be roughly 25% nationally. It turned out to be around 22%, but that only included on-exchange Silver plan enrollees across 44 states (I included all metal levels, both on and off exchange, across all 50 states).

- In 2017, I projected that the overall average rate increases for 2018 would be around 29% nationally, and that 60% of that would be due specifically to deliberate Trump Administration actions designed to sabotage the ACA markets. It turned out to be around 28% nationally.

- In 2018, I projected that the overall average rate increases for 2019 would be around 2.8% nationally, and that premiums would have dropped around 5.4% on average if not for the ACA's individual mandate being repealed & short-term & association plans being expanded. Hhealthcare think tank Avalere Health came to almost the exact same estimates on the actual rate changes, while Brookings Institute healthcare analyst Matthew Fiedler concluded that unsubsidized ACA individual market premiums would indeed have dropped by around 4.3% nationally on average in the absence of mandate repeal and expansion of #ShortAssPlans.

- In 2019, I projected that overall average rates would drop slightly (by 0.2% nationally). It later turned the drop was slightly more than that (hard to say for sure since a dozen states are missing from the CMS report).

In other words, I've had a pretty good track record of accurately projecting average premium increases for the upcoming year for five years in a row.

For the 2021 Open Enrollment Period, I've added a new column to the spreadsheets for each state as well as the nation as a whole: The COVID-19 morbidity factor. As I noted the other day:

So far only a handful of carriers have tacked on any substantial rate changes due to expected cost increases from testing & treatment of COVID-19 next year...the general rule of thumb seems to be that the added costs are pretty much gonna be cancelled out by reduced claims from non-COVID healthcare services (delayed/cancelled treatments/procedures, etc).

With that in mind and so many other unknowns, most carriers (so far) seem to be figuring either that these factors will cancel each other out or that there's simply too much uncertainty to even hazard a guess at the impact on their bottom line. As a result, most are settng their COVID morbidity factor at nothing one way or the other. In a few cases (oddly in Michigan this includes Blue Cross Blue Shield/Blue Care Network, which is by far the largest insurance carrier in the state), they don't even mention COVID-19 at all in their actuarial memo, not even to clarify a 0% change from it. Huh.

There's three important caveats to this, however:

- First: Some carriers are adding on a substantial COVID-19 morbidity factor to their preliminary 2021 premium rate filings (so far, around 8 points is the highest I've seen)

- Second: I've only analyzed eight states as of today, making up perhaps 12% of the total individual health insurance market

- Third, and most vitally: These are all preliminary filings only. Pretty much every carrier's actuarial memo, including the ones with no COVID factor at all, explicitly state that they reserve the right to submit revised 2021 filings later this summer if they change their mind.

Given that the eight states which have posted their preliminary filings so far did so based on data from April or May at the latest...and given how rapidly the COVID pandemic data is changing from day to day...I wouldn't be at all surprised to see some significant changes to many of the filings this year.

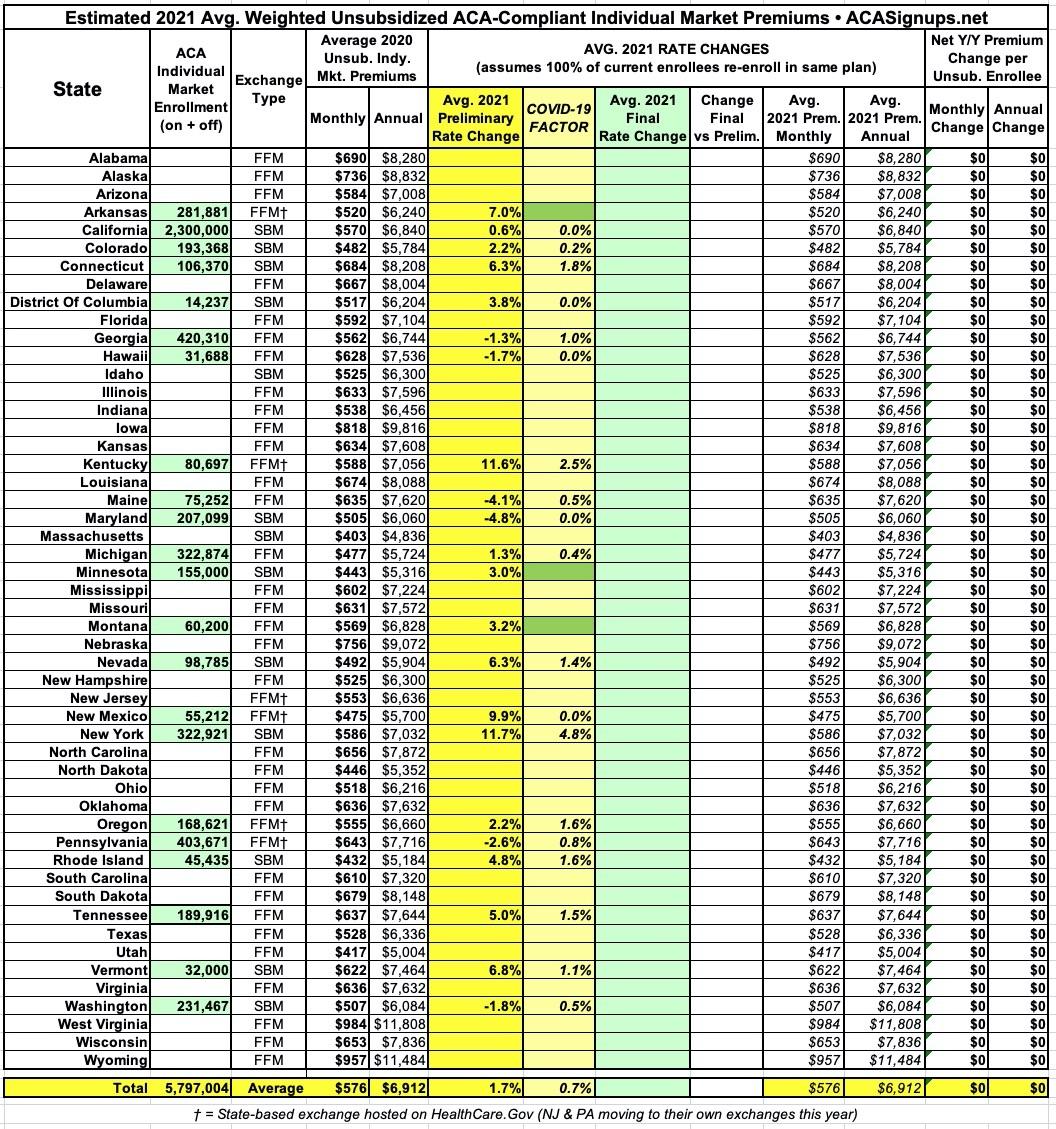

With all of this in mind, below is a table tracking the state-by-state preliminary and final rate changes for the 2021 ACA-compliant individual (and sometimes small group) markets. Scroll down for individual state entry links.

As you can see, so far, the average weighted premium increase on the ACA individual market is around 2.6%, with about 1.5% of that being due specifically to the expected impact of COVID-19 on 2021 premiums. Remember, this isn't about how the pandemic is impacting the carriers bottom line this year, it's about how much they expect it'll impact them next year...which is of course a massive question mark at the moment for even the most skilled actuary.

UPDATE 7/24: As shown above, I've added five more states since this post was originally written (Connecticut, Hawaii, Minnesota, Montana and Tennessee). However, only three of them have information about any COVID-19 impact; Minnesota and Montana's actuarial memos aren't available yet. If you only include the 12 states which have specific COVID-19 data, the average increase is 2.0% with 1.1% of that being COVID-19 specific.

UPDATE 7/31: As shown above, I've updated Tennessee and have added Rhode Island and Colorado, for a total of 16 states. I still don't have COVID impact data for MN or MO). If you only include the 14 states which have specific COVID-19 impact data included, the average increase is still nearly 3.0% but the COVID factor is more like 1.4%.

UPDATE 8/14: As shown above, I've added several more states, bringing the total up to 22, of which 19 have specific COVID-19 impact data. If you only include those 19, the average increase is down to 1.4% with the COVID-19 factor being down to 0.7 percentage points.

In the future, use this link for ongoing 2021 Rate Change updates.