UPDATE: The House #COVID19 #TakeResponsibilityAct is missing one more important ACA subsidy provision: Age-based Adjustments!

For several years now, I've been urging Congress to upgrade the Affordable Care Act via a series of major improvements. Most notable among these is the need to #KillTheCliff...that is, to eliminate the so-called "Subsidy Cliff" which kicks in for ACA individual market enrollees who earn more than 400% of the Federal Poverty Line (roughly $50,000 for a single adult or $103,000 for a family of four).

As I've explained many tmes, the ACA's subsidy structure works pretty well for those earning between 100 - 200% FPL, and is at least acceptable for those earning 200 - 400% FPL (in fact, thanks to #SilverLoading, it works quite well for most of that population as well). The real problem kicks in above 400% FPL (and to a lesser extent below 138% FPL for those living in the 14 states which still haven't expanded Medicaid). In addition, the subsidy formula still doesn't make policies truly affordable for many of those receiving them.

In short, both the upper- & lower-bound Subsidy Cliffs need to be eliminated, and the underlying formula needs to be strengthened as well.

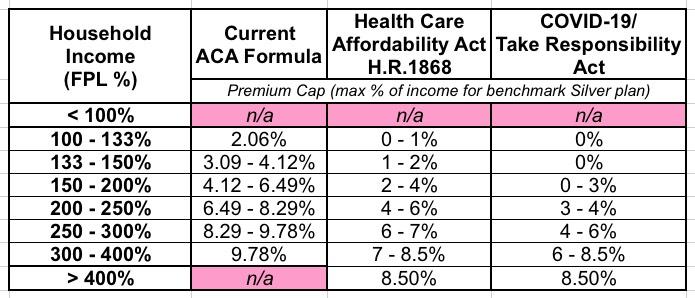

All of these issues are resolved by several different bills which have been introduced by Democrats in both the House (H.R. 1868, H.R. 1884) and the Senate (S.1213). They were also addressed by Hillary Clinton as part of her 2016 campaign healthcare plan and by Joe Biden in his current plan, along with the healthcare proposals put forth by many of the other 2020 Democratic candidates who have since dropped out, including Michael Bloomberg, Tom Steyer, Pete Buttigieg, Amy Klobuchar and others...all of which have relied on the exact same formula: Instead of capping benchmark premiums between 2 - 10% of income between 100 - 400% FPL, the new formula calls on premiums to be capped between 0 - 8.5%...and then to stay at 8.5% above the 400% FPL threshold.

Last night, the House Democrats introduced a new bill in response to the ongoing COVID-19 pandemic: The Take Responsibility for Workers and Families Act. Among the many, many healthcare funding provisions (of course), it includes a modified version of the "0 - 8.5% / Kill the Cliff" subsidy table. The version included in the Take Responsibility Act is more generous still; it caps benchmark plan premiums at nothing for anyone earning up to 150% FPL. After that it still scales up to max out at 8.5% for anyone earning 400% FPL or more.

Here's the three tables side by side for comparison; the 2nd one is the formula adopted by pretty much every Democrat not seeking Medicare for All until now (and even some who are):

Either the second or third formula would certainly be a massive improvement over the current one; those having to pay full price now would have their premiums capped at no more than 8.5% of their household income (as opposed to the 25% or more which they have to pay today), while most of those already receiving some financial help would see it increase significantly.

However, even this still presents a problem when it comes to risk pools and adverse selection. David Anderson addressed the issue this morning:

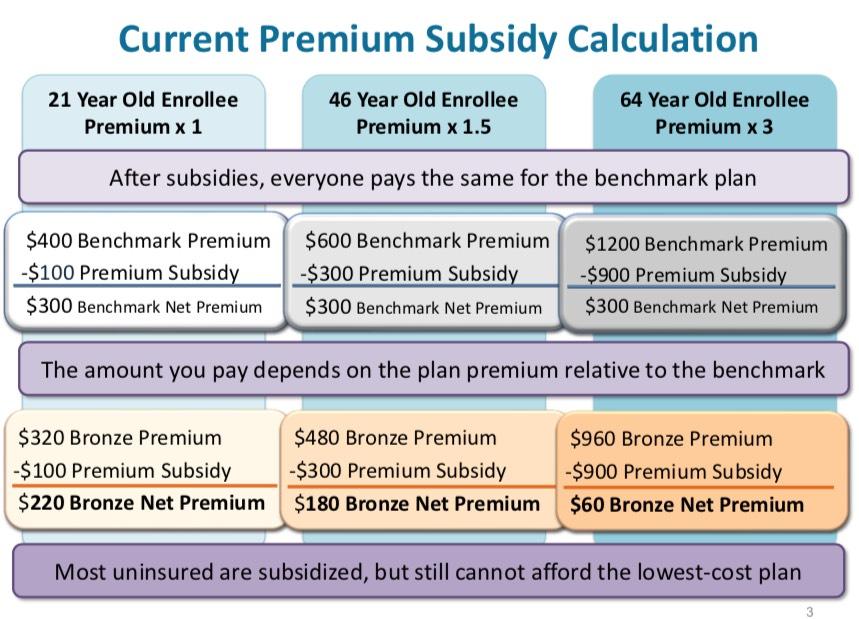

However the fundamental challenge of the age ratchet and premium spread game is still in place. These policies will make insurance more attractive to the older population that is not particularly selected against versus the younger population that has adverse selection regarding who is covered now. This will not be the case for individuals earning under 150% FPL as a perfectly healthy 21 year old will be paying the same as a deathly ill 64 year old — $0 but above 150% FPL, a lot of the benefit will be going to people who have already shown that they are more than willing to buy insurance at current prices.

Changing the subsidy formula so that the young can buy the least expensive plan relative to benchmark for the same premium as the old would produce bigger enrollment gains. The key is to make the most risk tolerant groups see relatively cheaper prices than they are seeing now. This will have a secondary effect of bringing into the marketplaces a large, fairly healthy cohort that will, in normal years, bring down average premiums because the pool will be, on average, significantly healthier.

To illustrate Dave's point, one only need look at one of the many examples I've been touting about the benefits of H.R. 1868 itself. Let's look at Rep. Lauren Underwood's (D-IL) district, since she's the one who introduced H.R. 1868 in the first place.

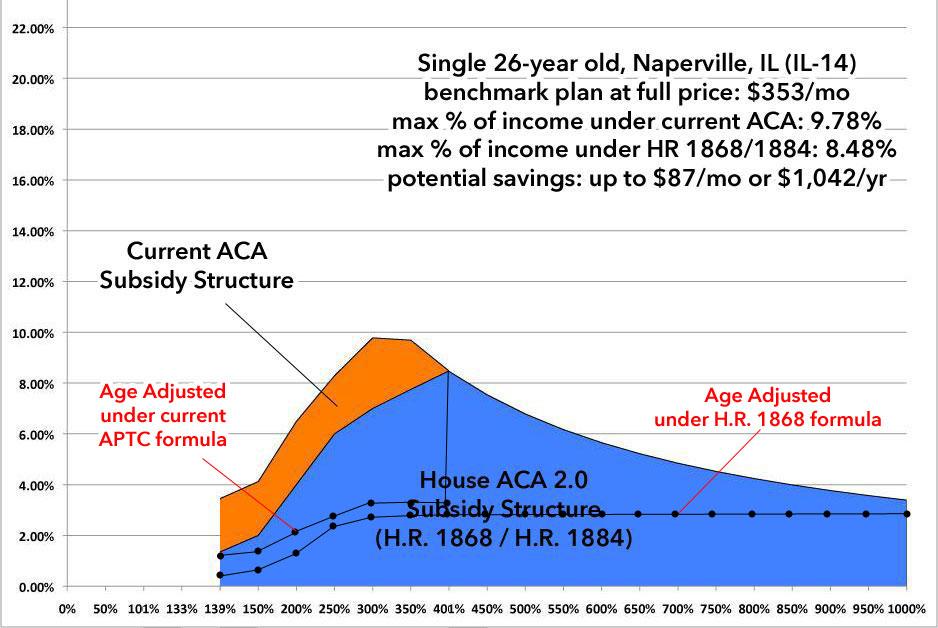

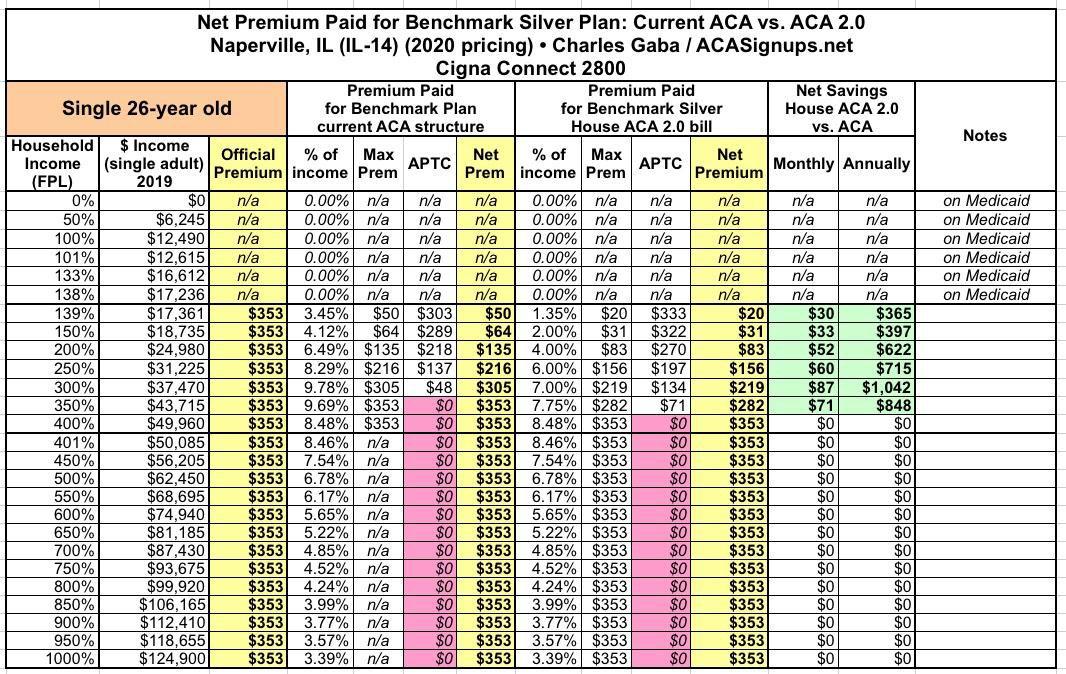

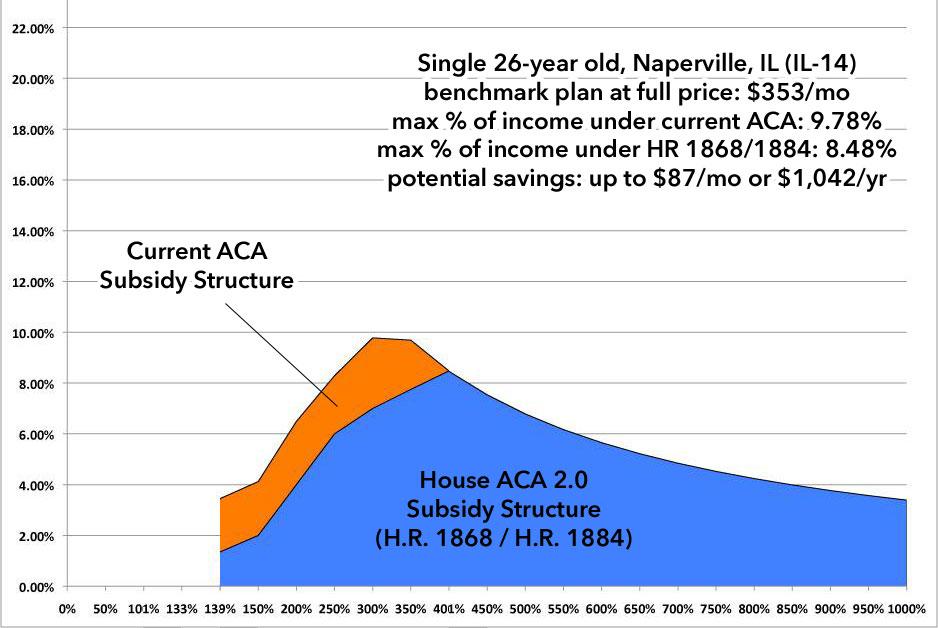

First, let's look at a single 26-year old adult; presumably a Young Invincible type just moving off of their parents' plan:

This enrollee saves up to $1,000 or so per year by H.R.1868...but only if they happen to earn right around 300% FPL. below that they save a few hudred bucks; above that they never even hit the Subsidy Cliff as it is. Here's what it looks like visually:

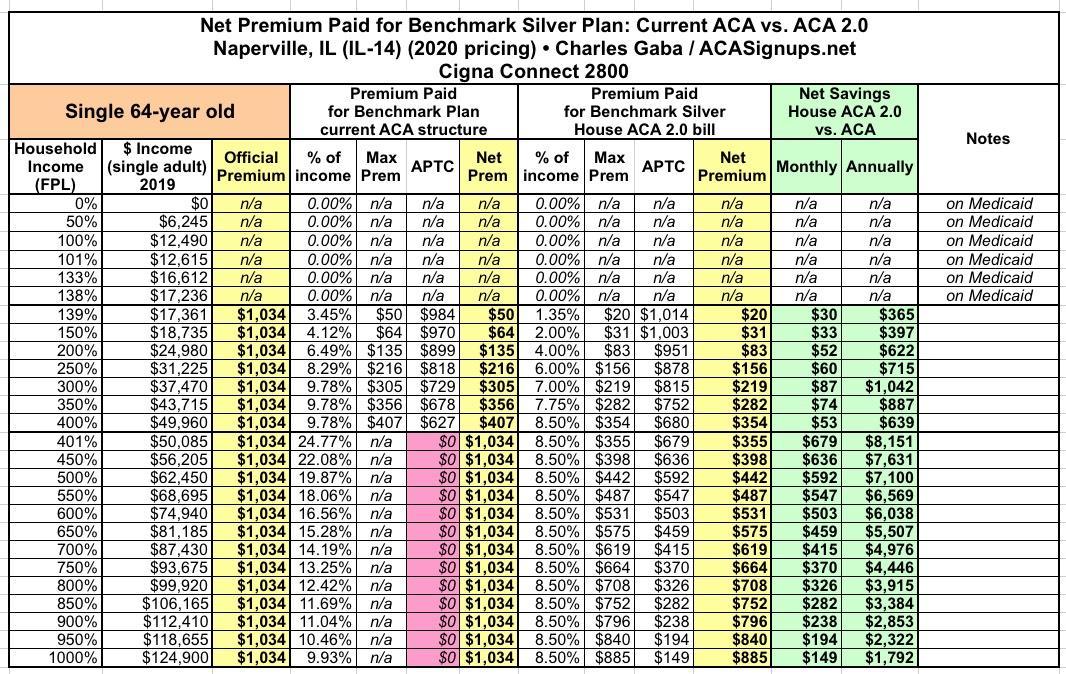

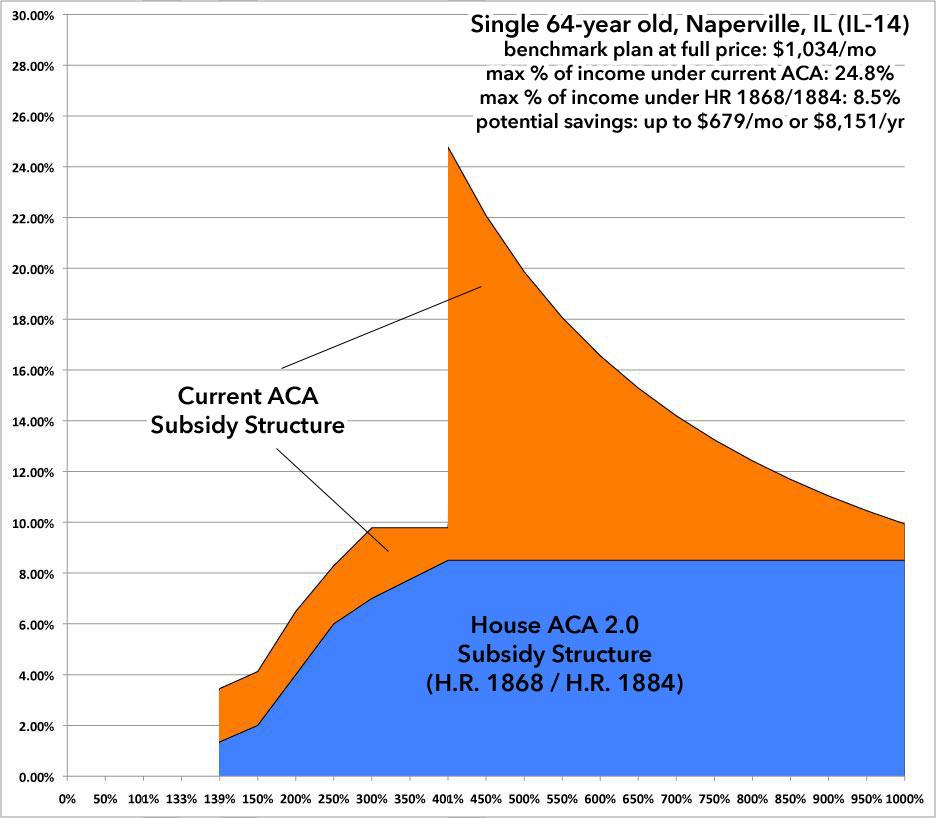

Now, let's take a single 64-year old living in Naperville, IL:

HOLY CRAP. THIS is why it's called the Subsidy Cliff...and it's really more of a chasm. Because of the ACA's 3:1 Premium Age Band, a 64-year old pays 3x as much as a 21-year old (or in this case, 2.93x as much as a 26-year old)...or, conversely, a 21-year old pays 1/3 as much as a 64-year old.

This means that any subsidy formula which is purely income-based instead of age-based is going to disproportionately help older enrollees a lot more relative to what the official, unsubsidized premiums are than it will younger enrollees.

Now, you may ask why this is a problem--after all, the younger enrollee is only paying about 1/3 as much as the older enrollee at full price and they'd still be paying less than the 64-year old under the enhanced formula...but that's not how people work. Remember, the 26-year old is likely to earn less than the 64-year old...but more importantly, there's a reason they're called "Young Invincibles". Think of all that footage of college kids partying it up in Ft. Lauderdale last week in the middle of a deadly global pandemic...because they were certain that they wouldn't be impacted; only the "Olds" would be.

It doesn't matter how wrong they are; the bottom line is that younger folks tend to assume that they're not going to need health insurance (and again, they are a much lower risk of most medical issues than older folks...that's why the age band runs 3:1 in the first place, and it's why from a strict actuarial POV, it's more like 5:1 or 6:1).

The point is that people don't think of how expensive things are relative to how much it costs other people...they think about it relative to how much they earn, how much they're worth and how much they currently pay for it. The 26-year old in the example above isn't likely to see it as "saving $1,000/year by only paying $219/month instead of $305/month"...they're gonna see it as "still wasting $2,600/year for something totally useless".

As a result, passing H.R. 1868 would increase enrollment in ACA exchange plans substantially...but the bulk of that increase will be among older enrollees who would see savings in the thousands of dollars as opposed to younger enrollees who would only be likely to save a few hundred bucks in most cases (and nothing at all over around 400-500% FPL, since they never hit the Cliff in the first place).

The net result of this would be that a lot of older uninsured Americans would sign up (which is still a very good thing!)...but not so much uninsured younger Americans, who are necessary to help spread the risk across a wider, healthier population to bring unsubsidized premiums down (or at least prevent them from spiking out of control).

The solution to this is to add another formula tweak to the premium subsidy formula...one which is age-based instead of income-based.

Last November, U.S. Senator Tammy Baldwin and U.S. Rep. Don McEachin introduced a bill which set out to resolve this problem as well; it's called the Advancing Youth Enrollment Act, and it would further shave off up to 2.5 percentage points from the premium cap for enrollees up to 34 years old:

The AYE Act would reduce the maximum percent of income that young people would have to pay toward premiums by 2.5 percentage points up to age 30, followed by a .5 percentage point less reduction each year for ages 31- 34.

Using the 26-year old example above, under the current ACA formula, the enrollee would go from paying between 3.5 - 9.8% of their income on premiums to paying between 1.0 - 7.3%. If combined with the H.R. 1868 or "Take Responsibility Act" formula, they'd go from 1.4 - 8.5% down to 0 - 6.0%. If they were 31 - 34 years old, they'd still see an additional savings, reduced by half-point increments each year.

I think this is a great idea as well, of course, but even it still has some logistical problems. Especially in multi-enrollee households? What if there's a 20-year old, a 25-year old and a 50-year old on the same policy...the subsidy is supposed to be calculated based on the household income, so is the percent of income supposed to drop for all three of them or just the younger enrollees? There's all sorts of calculation headaches this would raise depending on differnet household makeups.

Some of my fellow healthcare wonks have have done some additional thinking on this and came up with an even better way of handling the "Young Invincible" subsidy issue:

Age Adjustment is a way to align net premium with risk. This is the most efficient and effective way to get the largest number of uninsured to enroll.

This Age Adjustment proposal would achieve this goal by enhancing subsidies based on the age of enrollees. Even the oldest enrollees benefit from the premium reduction of a larger, younger risk pool.

It is “upside only” so the proposal does not lower premium subsidies for anyone.

Right now, when premium goes up, net premium goes down for the most affordable plans. See example on the next slide. For subsidized enrollees, health insurance gets cheaper when you get older, which explains why affordable coverage is out-of-reach for most uninsured consumers despite subsidy eligibility.

Any additional subsidy enhancements will bring in more uninsured at lower costs if they are combined with Age Adjustment.

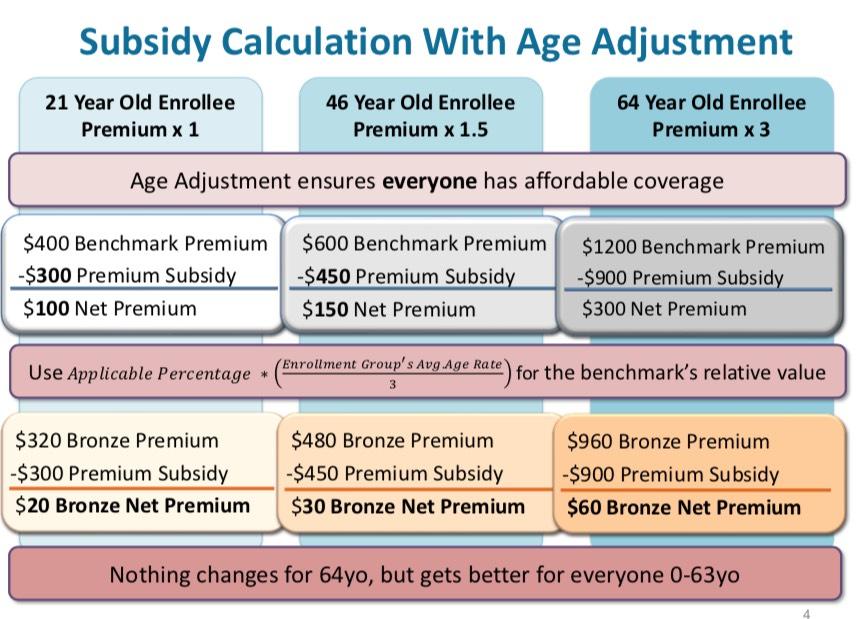

As far as I can tell, this formula would basically take everyone in the household and average together their age band ratings to achieve a single number. That number is divided by 3 (he uses this because of the 3:1 age band) and multiplies that by the original percentage to get the revised premium percentage cap.

For example, let's look at the single 64-year old above earning exactly 300% FPL ($37,470/year). They're at the upper end of the age band, so for them it would be 9.78% x (3 / 3) = 9.78%. Nothing changes; they receive whatever their current subsidies are (or what they'd be under H.R. 1868 or the "Take Responsibility Act"). Under the current ACA formula, they'd still pay $305/month.

How about the single 26-year old? In their case, they have an age rating of 1.024 on the standard 3:1 Age Band, so their calculation would be: 9.78% x (1.024 / 3) = 9.78% x 0.341 = 3.34%. They'd go from paying $305/month to just $104/month under the current ACA formula. Here's what this would look like. I've overlaid two scenarios: The first includes only the age adjustment formula on top of the existing APTC table; the second shows what the age-adjusted formula would look like on top of the H.R. 1868 #KillTheCliff table:

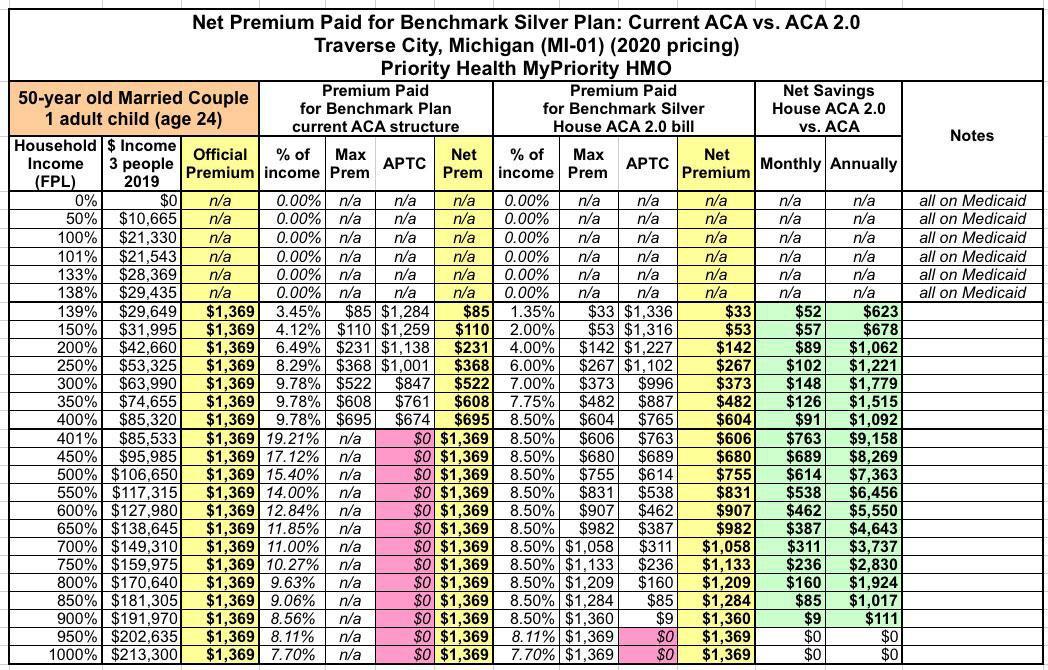

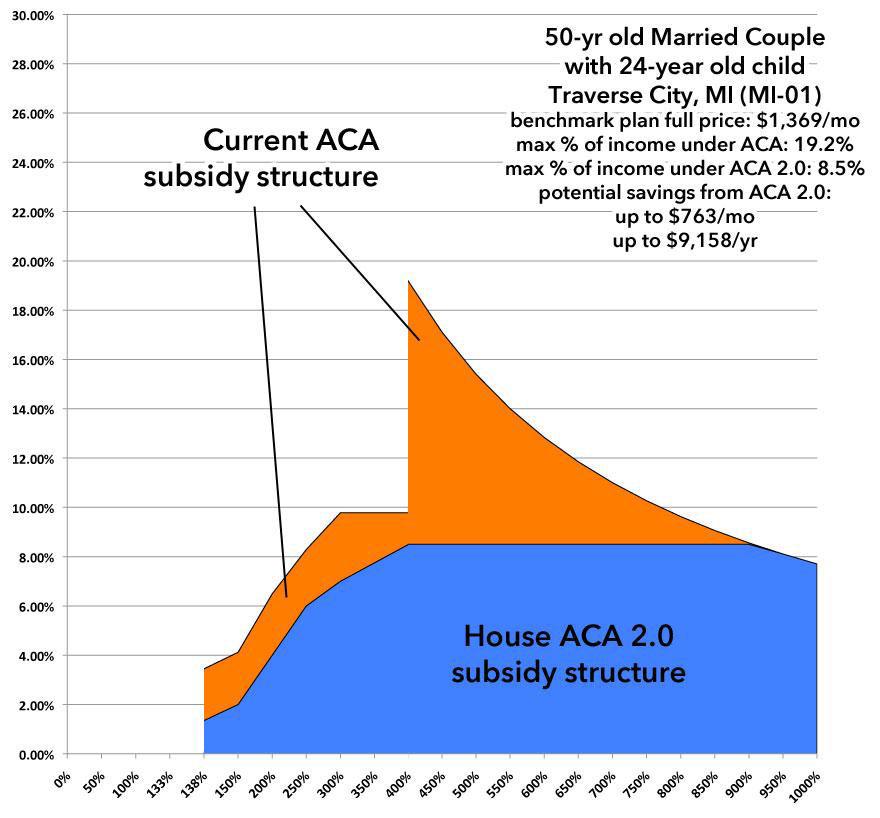

As I said above, the main problem with Baldwin's formula is that it works fine for a single-person household but causes all sorts of headaches when there's more than one person on the policy. Let's take a look at one more example. In this case, let's say it's a 50-year old couple with a single 24-year old child still on their plan living in Traverse City, Michigan. Here's what it looks like for them today, along with the H.R. 1868 formula:

In this case, 300% FPL income is around $64,000 per year. At full price, they'd pay $1,369/month or $16,428/year. Under the current ACA subsidy structure, at exactly 300% FPL they're paying $522/month or $6,260/year, receiving over $10,000/year in federal subsidies.

Under Baldwin's bill, 2.5 percentage points would be shaved off of the 24-year old's premium cap...but how is that supposed to be calculated? You can't knock 2.5 points off the entire household since the other two are 50 years old.

Under this formula it would be done like so:

- The 24-year old's Age Rating is still 1.000

- The 50-year olds Age Ratings are 1.786 each

So, you'd average the three together to get 1.524. Divide that by 3 and you get 0.508. Multiply that by 9.78% and you get 4.97% of income. This would reduce the family's premiums from $522/mo down to $265/month, saving them an additional $3,084/year.

The exact formula could be played around with a bit, of course, but the point is that it's a far more elegant way of blending age-based with income based subsidies without running into all sorts of logistical headaches and sudden jumps/drops in net premium expenses.

You could obviously play around with the exact formula a bit. The point is that this is a much more elegant way of blending together income based subsidies with age-based subsidies without causing all sorts of logistical headaches and sudden jumps in net premiums being owed.

UPDATE 6/15/20: I'm happy to report that H.R. 6545, the Health Insurance Marketplace Affordability Act of 2020, has been officially introduced by Rep. Stephanie Murphy! The actual legislative language is deceptively simple:

A BILL To amend the Internal Revenue Code of 1986 to provide an age rating adjustment to the applicable percentage used to determine the credit for coverage under qualified health plans.

Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled,

SECTION 1. SHORT TITLE.

This Act may be cited as the “Health Insurance Marketplace Affordability Act of 2020”.

SEC. 2. AGE RATING ADJUSTMENT TO APPLICABLE PERCENTAGE USED TO DETERMINE THE CREDIT FOR COVERAGE UNDER QUALIFIED HEALTH PLANS.

(a) In General.—Section 36B(b)(3)(A) of the Internal Revenue Code of 1986 is amended by adding at the end the following new clause:

“(iii) AGE RATING ADJUSTMENT.—For purposes of this subparagraph—

“(I) IN GENERAL.—The applicable percentage otherwise determined under clause (i) shall be multiplied by the age adjustment value determined under subclause (II).

“(II) AGE ADJUSTMENT VALUE.—The age adjustment value for any taxpayer is the average of the age rate adjustments for all individuals which have coverage described in paragraph (2)(A) with respect to the taxpayer, divided by the maximum age rate adjustment allowed under section 2701(a)(1)(A)(iii) of the Public Health Service Act.

“(III) AGE RATE ADJUSTMENT.—The age rate adjustment for any individual shall be determined using a single national age rating curve which shall be specified in guidance by the Secretary of Health and Human Services and shall reflect market patterns in the individual market in accordance with section 2701(a)(1)(A)(iii) of the Public Health Service Act.”.

(b) Effective Date.—The amendment made by this section shall apply to taxable years beginning after the date on which the single national age rating curve referred to in section 36B(b)(3)(A)(iii)(III) of the Internal Revenue Code of 1986 (as added by this section) is specified by the Secretary of Health and Human Services.

If you read the text above carefully, it's very simple. All it does is to take the average of the age rate adjustments for everyone in the household, divide that by three, and multiply that by the existing APTC income percentage cap to get the age-adjusted percentage cap. Boom.

The reference to "a single national age rating curve" is an important caveat, however--this is necessary because two states (New York and Vermont) don't have an age rate adjustment at all (that is, everyone pays exactly the same amount regardless of age), while one state (Massachusetts) has a 2:1 range instead of the 3:1 range used by the other 47 states. By specifying a single national age rating curve, this avoids NY, VT or MA being penalized for their age bands.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.