Ohio: APPROVED 2020 #ACA exchange avg. rate changes: 7.7% *decrease*

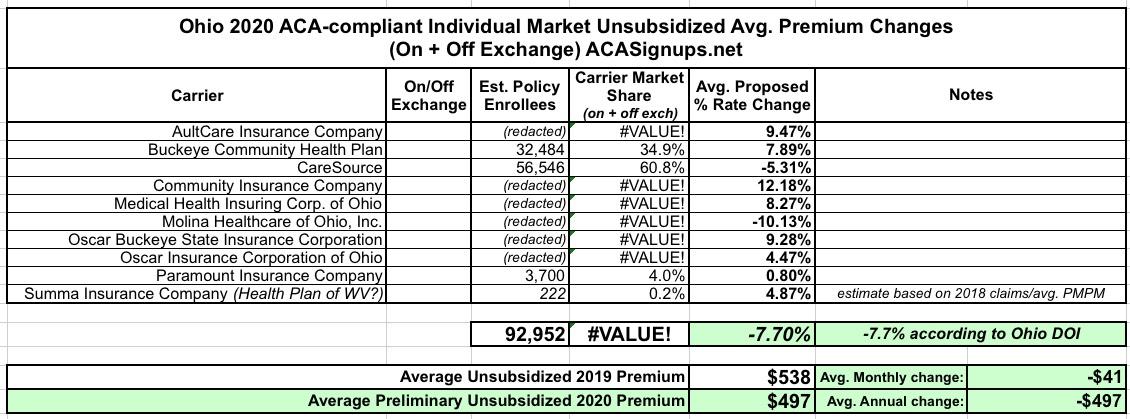

Last month I posted the average requested unsubsidized premium rate changes for the 2020 Individual Market in Ohio. At the time, the state was looking at a weighted average reduction of 7.0% from 2019 rates.

Since then, the Ohio Dept. of Insurance has reviewed and approved the rates for 2020, and while they don't provide much detail on individual carriers, overall it looks like they reduced rates slightly more (average reduction of 7.7%). The wording below is almost identical to what it was last month, except for the highlighted text:

The Affordable Care Act (ACA) requires that every state have an exchange where consumers can buy individual health insurance policies. In Ohio, the federal government runs the health insurance exchange. Ohioans who do not have health insurance through their employer, Medicare or Medicaid may be eligible to purchase coverage through the exchange. Open enrollment for coverage next year (2020) is November 1, 2019 to December 15, 2019. Below is a summary of Ohio’s individual market for 2020. The data is based on products approved by the Ohio Department of Insurance.

Ohio’s Health Insurance Market (2019–2020):

For 2019, the department approved 10 companies to sell on the exchange. Based on the plan information the Department approved, all 88 counties will have at least one insurer. Filings show 16 counties with just one insurer and 33 counties with two.

For 2020, 10 companies have been approved to sell on the exchange. Based on those filings, 29 counties will have two insurers and one county will have just one insurer. All other Ohio counties will have at least three insurers selling exchange products in 2020.

Companies approved to sell in 2020:

- AultCare Insurance Company

- Buckeye Community Health Plan

- CareSource

- Community Insurance Company

- Medical Health Insuring Corp. of Ohio

- Molina Healthcare of Ohio, Inc.

- Oscar Buckeye State Insurance Corporation

- Oscar Insurance Corporation of Ohio

- Paramount Insurance Company

- Summa Insurance Company

Individual Market Premium Information for 2020:

Following implementation of the ACA, plan options and the premiums associated with those plans underwent significant changes. Since 2013, the Department has provided information prior to open enrollment each year as plans and premiums change. In 2019, the weighted average premium for an on-exchange individual market plan was $6,161.56 and for 2020 the weighted average premium based on approved products is $5,690.26 – a decrease of 7.7 percent.

As I noted last month, I've been able to patch together most of the individual carrier data from filings posted at RateReview.HealthCare.Gov, but these are still the requested rate changes:

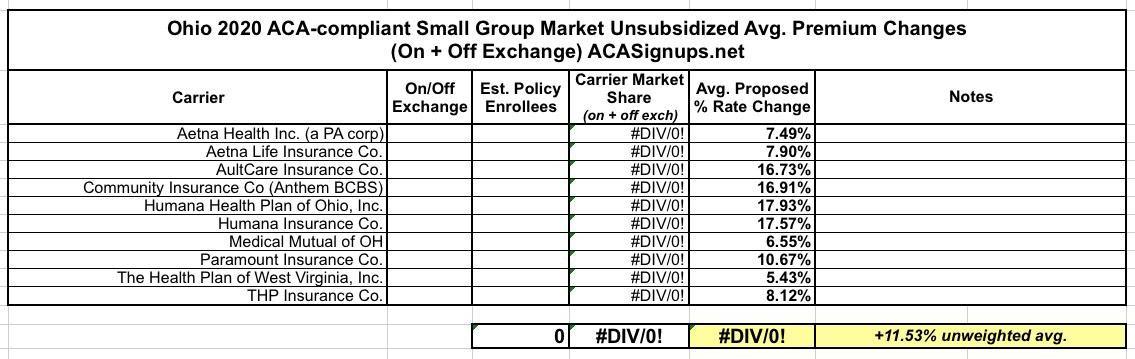

Meanwhile, here's the unweighted (requested) average of the Small Group market: