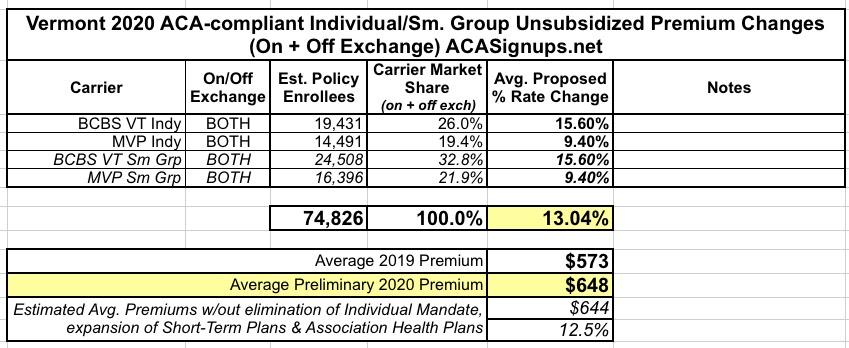

Vermont: PRELIMINARY 2020 ACA Exchange Premium Rate Changes: 13.0% increase

Last year, the two insurance carriers offering individual market policies in Vermont, BCBS and MVP, originally requested rate increases averaging 7.5% and 10.9% respectively, or a weighted average of 8.6%. These were eventually whittled down to 5.8% and 6.6% respectively, for a weighted average increase of 6.1% in 2019.

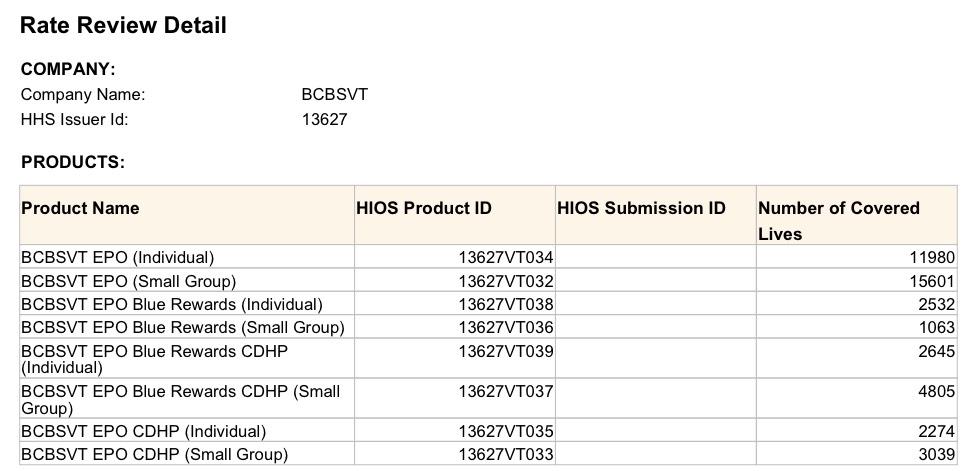

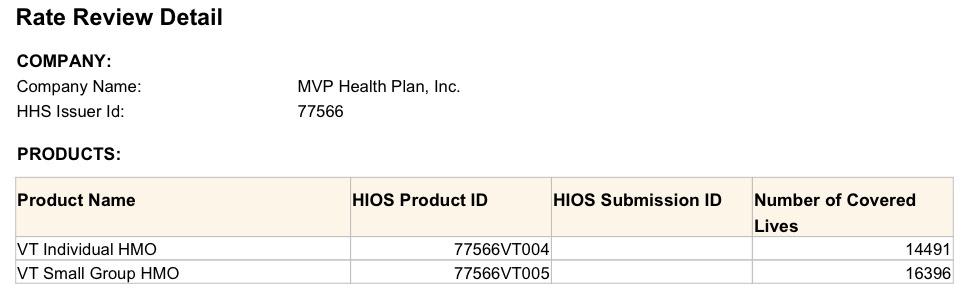

It's important to keep in mind that Vermont is one of only two states (the other is Massachusetts) which merges their Individual and Small Group risk pools into one.

In addition, Vermont made an important change for the 2019 Open Enrollment period (which most states had already done a year previously): They enabled #SilverLoading to help unsubsidized ACA enrollees save money by being able to purchase the same Silver policies off-exchange as they'd otherwise have to pay more for on-exchange. This led to a quasi-deliberate 12% on-exchange enrollment drop, but it didn't have much of an impact on overall ACA-compliant enrollment; if you compare the table below with the one from a year ago, you can see that Vermont's total ACA individual + small group markets combined is only 5% lower today than it was then.

In any event, the Vermont Green Mountain Care Board has issued a press release for preliminary rate filings for the 2020 Open Enrollment Period, and I'm afraid both BCBS and MVP are looking to spike prices quite a bit more than they did this year.

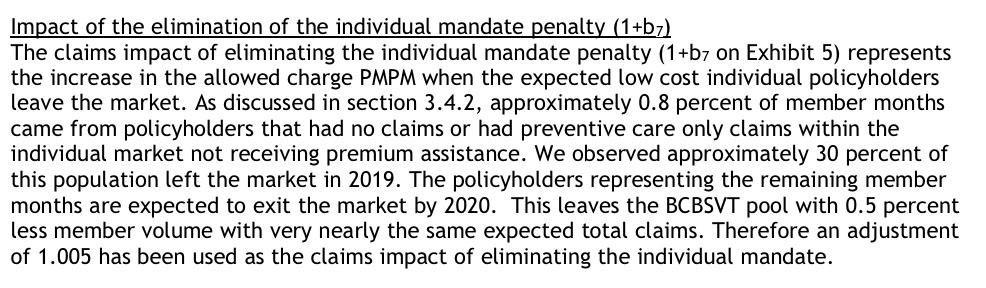

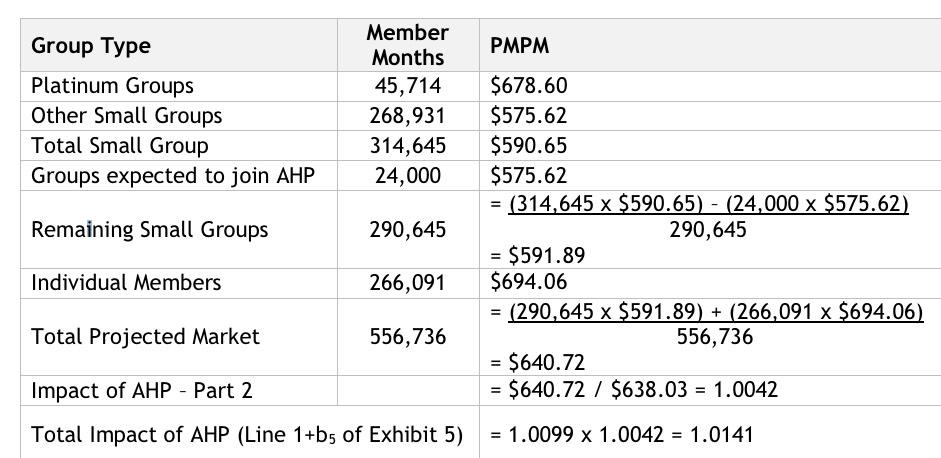

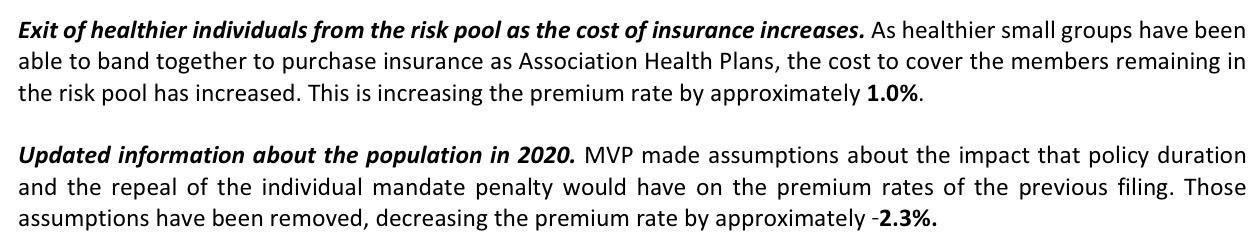

Last fall it looked like the ACASabotage Trifecta of 2018--repeal of the individual mandate, expansion of short-term plans (STLDs) and expansion of association health plans (AHPs)--was responsible for around 4.4 points of the 2019 increase. For 2020, it looks like both carriers are walking back some of that...BCBS is saying only about 0.5 points and 1.4 points of their request is mandate- or AHP-related; they don't mention short-term plans at all. MVP, meanwhile, is pegging 1.0 points of their increase on the expansion of AHPs, but says they overshot their projections for mandate repeal by 2.3 points.

Overall, it looks like 2020 premiums would only be about half a point lower in Vermont if not for mandate repeal & AHP expansion, or around $4 per month per enrollee. Note that the impact varies greatly from state to state and carrier to carrier, so this doesn't mean much for other states.

It's also worth noting that Vermont is supposedly reinstating their own individual mandate penalty...or...something:

It is the intent of the General Assembly that the individual mandate to maintain minimum essential coverage established by this act should be enforced by means of a financial penalty or other enforcement mechanism and that the enforcement mechanism or mechanisms should be enacted during the 2019 legislative session in order to provide notice of the penalty to all Vermont residents prior to the open enrollment period for coverage for the 2020 plan year.

Um...yeah. The law they ended up passing last year doesn't specify how much the financial penalty would be, nor does it even require the enforcement mechanism be a financial penalty. As a result, the insurance carriers appear to be kind of ignoring it for the time being, though they'll presumably modify their 2020 request if and when the VT legislature decides exactly how they plan on enforcing the mandate.