Maryland: PRELIMINARY 2020 ACA Exchange Premium Rate Changes: 2.9% reduction

Every year for 4 years running, I've spent the entire spring/summer/early fall painstakingly tracking every insurance carrier rate filing for the following year to determine just how much average insurance policy premiums on the individual market are projected to increase or decrease.

The actual work is difficult due to the ever-changing landscape as carriers jump in and out of the market, their tendency repeatedly revise their requests, and the confusing blizzard of actual filing forms which sometimes make it next to impossible to find the specific data I need.

The actual data I need to compile my estimates are actually fairly simple, however. I really only need three pieces of information for each carrier:

- How many effectuated enrollees they have enrolled in ACA-compliant individual market policies;

- What their average projected premium rate increase (or decrease) is for those enrollees (assuming 100% of them renew their existing policies, of course); and

- Ideally, a breakout of the reasons behind those rate changes, since there's usually more than one.

- In 2015, I projected that the overall average rate increases for 2016 would be roughly 12-13% nationally...which was confirmed by mid-December, when the Robert Wood Johnson Foundation released a report which, when you weighted the averages by metal level market share, came in at around 11.6% across the entire ACA exchange market.

- In 2016, I concluded that the average unsubsidized rate hikes for 2017 would likely be about twice as high: Around 25% nationwide. When the official ASPE report came out sometime later, they concluded that the average Silver benchmark policy was going up around 22%...except that they only included 44 states, only included the on-exchange market, and again, only included the benchmark Silver plan, whereas I included all metal levels wherever possible (Bronze, Silver, Gold and Platinum).

- In 2017, I concluded that average rate hikes for 2018 would likely be higher still: Around 29% nationally...and I further concluded that around 60% of this (~17% or so) was due specifically to several deliberate actions designed to sabotage the ACA markets. The first part of this (~29%) was confirmed first by the Urban Institute and then, officially, by the Centers for Medicare & Medicaid themselves: Not only was I within 1 percentage point of the actual average nationally, on a state-level basis I was within 5 percentage points in 24 states and within 10 points in a dozen more.

- In 2018, I concluded that average rate changes for 2019 would likely be far lower...a mere 2.8% nationally. HOWEVER, I also concluded that premiums would have dropped by around 5.4% on average if not for two other types of deliberate ACA sabotage: Repeal of the Individual Mandate Penalty and expansion of so-called "Short-Term" and "Association" health plans. Sure enough, healthcare policy think tank Avalere Health came to almost the exact same estimates on the actual rate changes, while Brookings Institute healthcare analyst Matthew Fiedler concluded that unsubsidized ACA individual market premiums would indeed have dropped by around 4.3% nationally on average in the absence of mandate repeal and expansion of #ShortAssPlans.

In other words, I've had a pretty good track record of accurately projecting average premium increases for the upcoming year for four years in a row.

Well, it's now May 2019, and after Virginia being the first state out of the gate with their preliminary rate filings for the following year, I'm surprised to see Maryland has beaten them to the punch for 2020:

Health insurance carriers are seeking a range of changes to the premium rates they will charge consumers for plans sold in Maryland’s “Individual Non-Medigap” (INM) and “Small Group (50 or fewer contracts)” (SG) markets in 2020. The rates submitted by the carriers for the INM market include the estimated impacts from the state-based reinsurance program (SBRP) enacted in 2019 via a 1332 State Innovation Waiver (approved by the Centers for Medicare & Medicaid or “CMS”).

The Maryland Insurance Administration (“MIA”) has posted rate filing documents at www.healthrates.mdinsurance.state.md.us. On that website, consumers can review filings and submit comments, as well as find answers to frequently asked questions about the rate review process. A detailed set of exhibits are attached that outline all proposed rates submitted by carriers, to include stand-alone dental coverage.

“We are pleased with the rates that have been requested. It is obvious that the federal waiver and reinsurance plan crafted by Governor Hogan and the legislature have provided the positive results as intended,” said Insurance Commissioner Al Redmer, Jr. ”It’s important to remember that these rates are what companies have requested, and not necessarily what will be approved. There will be a thorough review of all the filings. As in years past, we may require changes.”

In Maryland, for health benefit plans, only those rates approved by the Insurance Commissioner may be charged to policyholders. Before approval, all filings undergo a comprehensive analysis of the carriers’ analyses and assumptions. Public comments are considered as part of the review process. By law, the Commissioner must disapprove or modify any proposed premium rates that appear to be inadequate or excessive in relationship to the benefits offered, or are unfairly discriminatory. The MIA expects to issue decisions about rates for 2020 INM and SG products no later than mid-September. A public meeting will be held on July 16, 2019 from 2 p.m. – 4 p.m. at the Maryland Insurance Administration to seek comments on the proposed rate filings; a notice will be forthcoming.

SUMMARY OF PROPOSED RATES FOR 2020

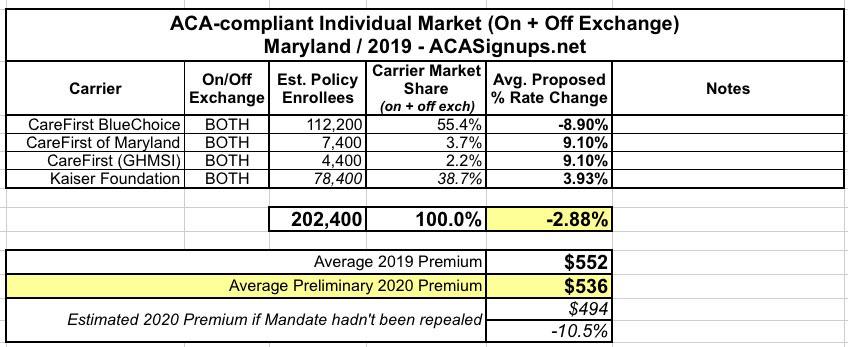

For the INM market, carriers filed an average annual rate decrease of 2.9% affecting 202,400 members. Despite the average rate decrease, preliminary estimates indicate that subsidies could still increase. Carriers proposed the following average rate changes in the (INM) market:

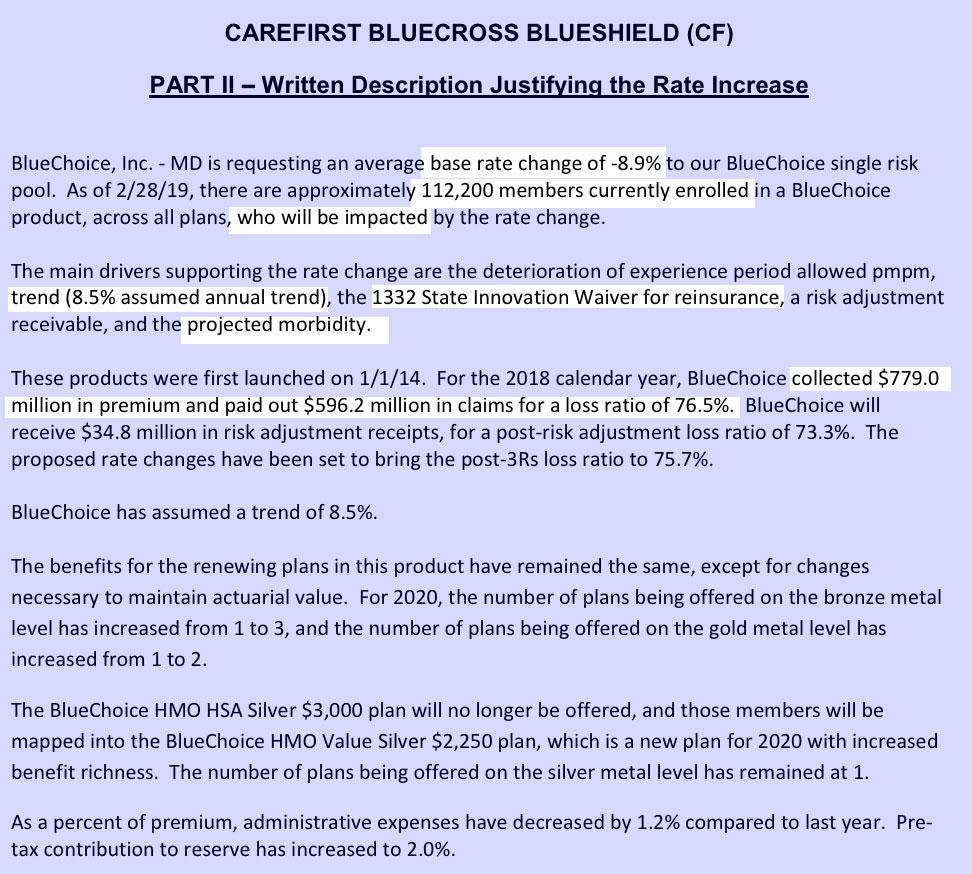

- CareFirst BlueChoice Inc. HMO – a -8.9% decrease;

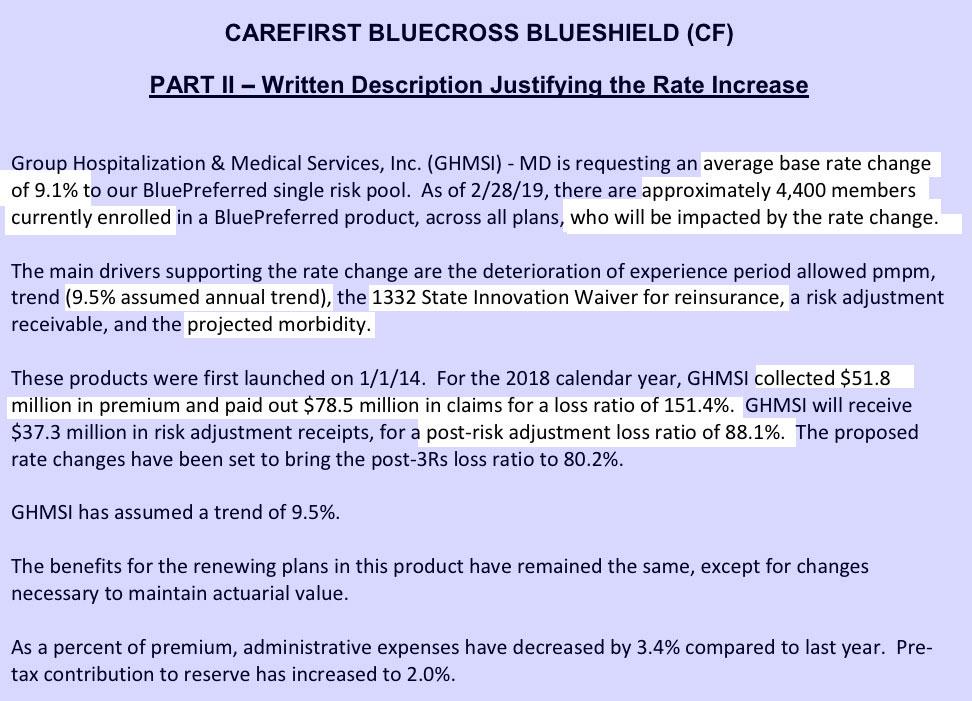

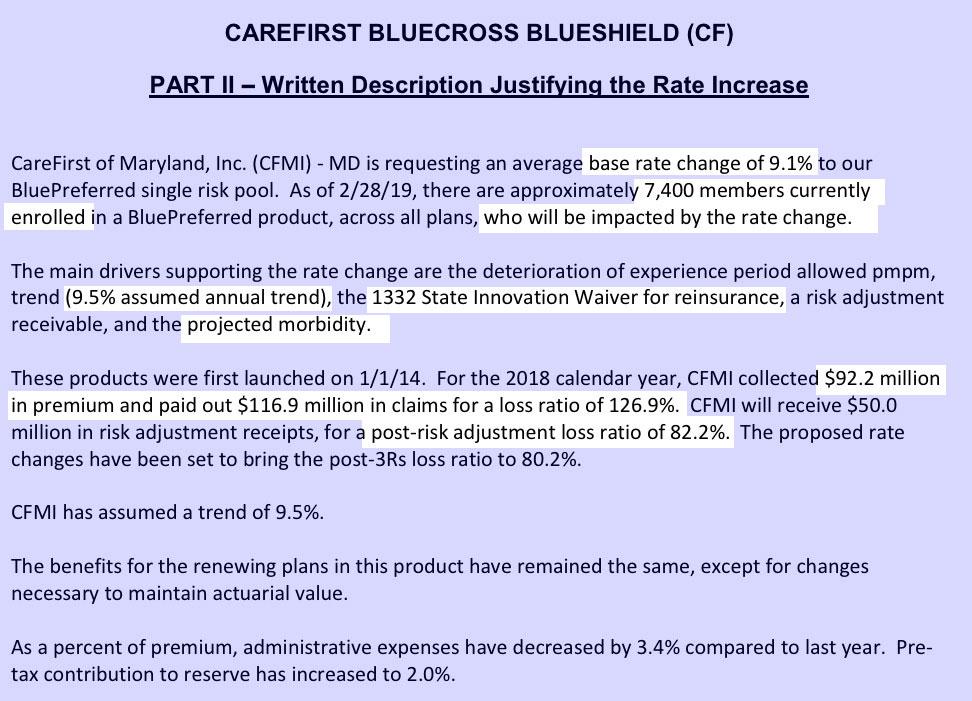

- CareFirst of Maryland Inc. and Group Hospitalization and Medical Services Inc. (GHMSI) (both CareFirst companies) PPO – a +9.1% increase;

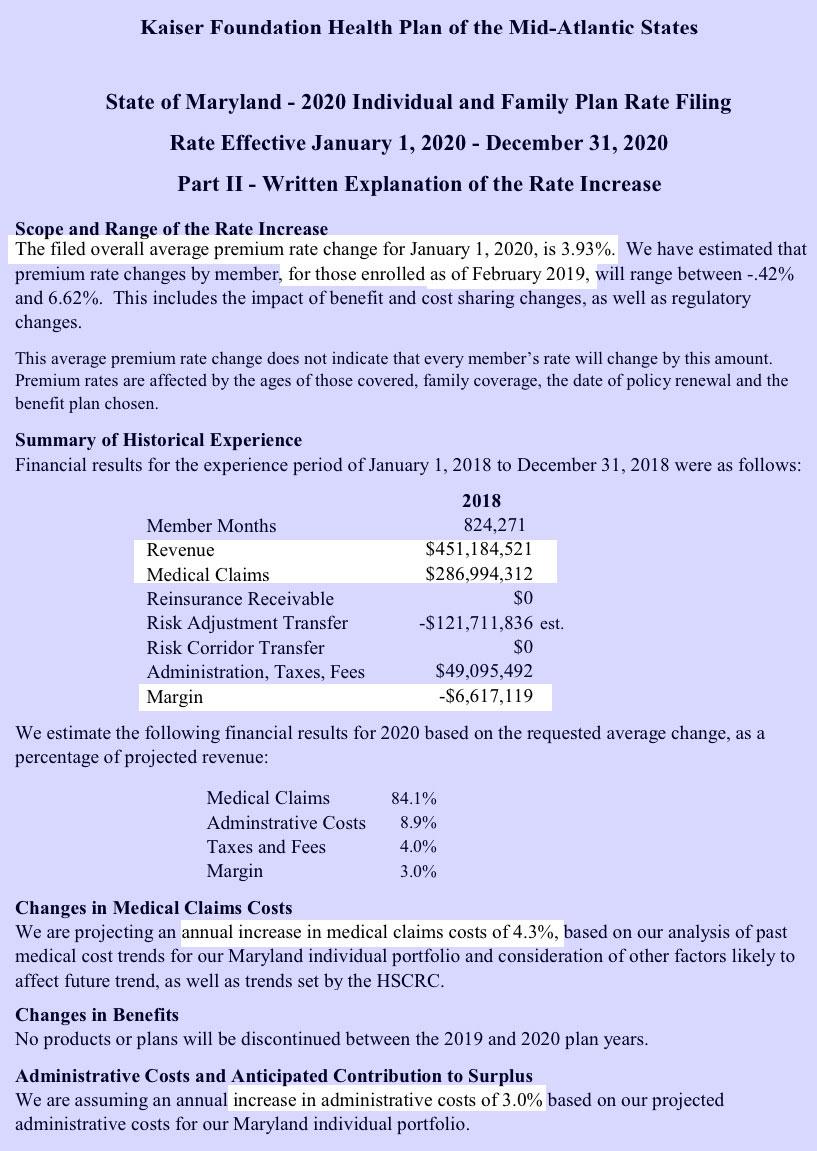

- Kaiser Foundation Health Plan of the Mid-Atlantic States HMO – a +3.9% increase.

It's important to keep in mind that while a 2.9% average premium reduction is a good thing, it would be even lower if the individual mandate hadn't been repealed. For Maryland, I estimate that reinstating the Individual Mandate Penalty would result in premiums 10.6% lower (around $42/month per unsubsidized enrollee).

In any event, assuming the preliminary rate changes are approved as is, I'd expect 2020 ACA exchange policies to average around $536/month.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.