California: Everyone who blames the ACA for "double-digit rate hikes!" just lost another talking point...

This just in from the California Insurance Dept...

Thank you for signing up to receive email alerts when new health insurance rate filings are submitted to the California Department of Insurance.

This message is to inform you that we have posted new rate filing submissions to our health rate filing website. Please select the link below to review and/or comment on newly added rate filing submissions. The Department of Insurance does not respond to questions about rate review filings submitted through the rate website, but we do consider comments during our review process.

http://interactive.web.insurance.ca.gov/apex/f?p=102:4:0::NO:5,RIR:IRGT_...

Oh? What's up?

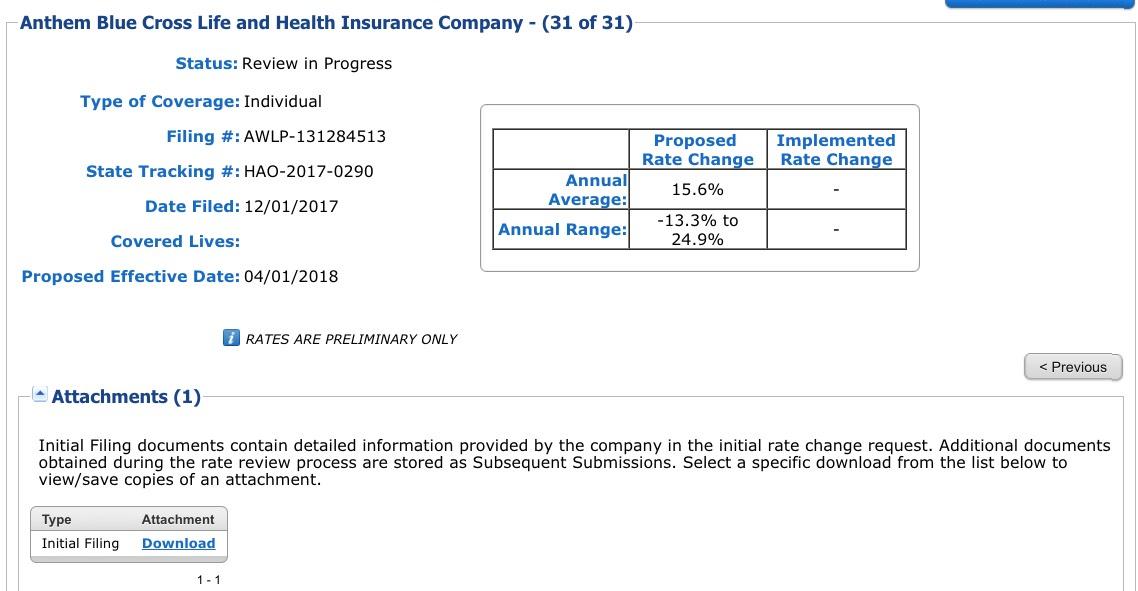

But we're already in the middle of the Open Enrollment Period! How can Anthem BCBS jack up their individual market premiums by another 15.6% in the middle of the year (the effective date is April 1st, 2018)?

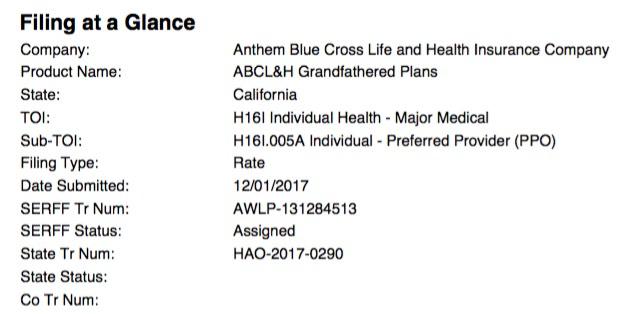

Well, let's take a closer look at the filing itself:

"Grandfathered". You see, in some states, before the Affordable Care Act, healthcare premiums could be increased quarterly...and it appears that this rule still applies for non-ACA compliant polices today as well. These are known as "grandfathered" policies: Ones which people were already enrolled in prior to March 2010 when the ACA was signed into law. (There's also some people enrolled in "transititional" polices, from between March 2010 and September 2013 which aren't subject to ACA regulations, but California didn't allow transitional policies after 12/31/13 anyway).

UPDATE: OK, I worded that poorly: No, this doesn't mean that before the ACA your premiums could go up 4 times in a single calendar year; your rates were still locked in for 12 months from the point you started coverage. It's just that before the ACA, there was no specific Open Enrollment Period, so people regularly signed up at various points throughout the year. As a result, there were 4 "starting points" at the beginning of January, April, July and October when rate increases could be put through. If you enrolled in April, May or June, your rates were locked in for 12 months at whatever they started at on April 1st, and so on. Sorry for the confusion.

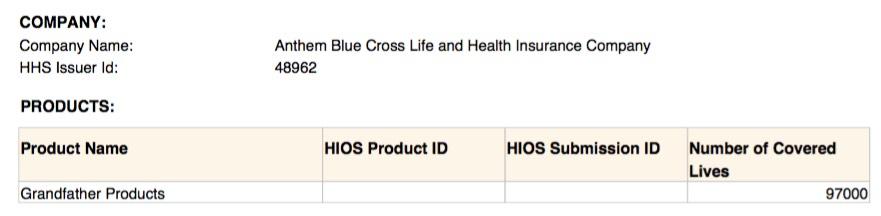

How many people are we talking about?

97,000 Californians are about to see their completely non-ACA related individual market policies shoot up by 15.6% on average starting in April.

From the rest of the filing, it looks like these grandfathered policies have been costing roughly $315/month per enrollee on average, so a 15.6% increase would bump that up to around $364/month. Obviously this is still far lower than California's $457/mo average unsubsidized premium for ACA-compliant policies in 2017 or the $530/mo unsubsidized average I estimate for 2018, but again: These are non-ACA compliant policies, which means they presumably don't include one or more of the following coverage requirements:

- One or more of the 10 required Essential Health Benefits

- A cap on maximum out of pocket expenses

- NO cap on annual or lifetime claims

- A minimum 60% AV level

- Free preventative services

...and so on. In addition, to the best of my knowledge, ACA-compliant policy premiums are locked in for the full calendar year, as opposed to being subject to quarterly increases increases mid-calendar year.

UPDATE: Thanks to Emily Gee for confirming this:

Here's CMS info on deadlines for QHP modifications and corrections. SHOP rates can be updated quarterly; individual market rates is effective for the CY: https://t.co/ODj7V5g1pG

— Emily Gee (@EmilyG_DC) December 6, 2017

Anyway, I just thought it was worth noting that double-digit premium increases didn't start with Obamacare.

UPDATE: In addition, it occurs to me that the 97,000 covered life figure for Anthem could give some insight into just how many people California still has enrolled in these types of policies.

According to the Kaiser Family Foundation, as of 2013 (just before ACA policies became mandatory), Wellpoint Inc. (which later changed their name to Anthem) held roughly 46% of California's individual market share. Assuming their share of CA's grandfathered market has remained fairly consistent since then, that suggests roughly 210,000 grandfathered enrollees in the state.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.