Georgia: Good News: *Requested* avg. rate hike lower than I thought. Bad News: *Approved* avg. rate hike higher than requested.

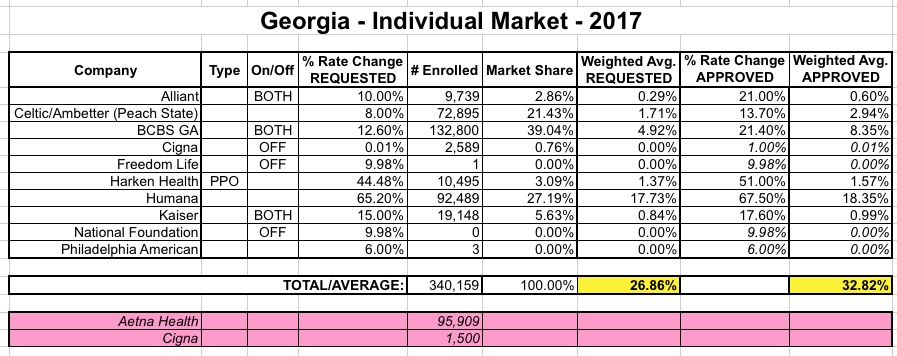

About a month ago, when I first plugged in the average requested 2017 rate hikes for Georgia's ACA-compliant independent market, I came up with an overall weighted average of around 27.7%. However, there was one major gap in the data: I had trouble finding Ambetter/Peach State's enrollment numbers or even their average rate hike request, so I reluctantly left them out of the calculation completely.

When Aetna announced that they were dropping out of the Georgia exchange-based independent market, I went back and removed them from the mix. Since Aetna's request had been 15.5% on a substantial share of the market, this meant that the rest of the statewide average shot up to 32.0%.

Today I was able to track down the missing Ambetter/Peach State data--both the average requested rate hike (around 8.0%) as well as the number of current enrollees impacted...around 73,000:

Plugging these numbers in drops the overall requested average back down to around 27%, which is a positive development.

However, today the Georgia insurance dept. also announced the approved rate hikes (h/t to Don Kramer for the link)...and the news isn't so positive:

Georgians with health coverage through the Affordable Care Act’s insurance marketplace will see their premiums jump by double-digits next year.

On Tuesday, the state insurance department approved a 21.4 percent increase for Blue Cross and Blue Shield of Georgia Obamcare plans to be sold in 2017. Alliant, Ambetter (Peach State), Harken Health, Humana and Kaiser Permanente also all received the OK to increase the cost of their marketplace plans by double digits.

Blue Cross — the only insurer that sells marketplace plans statewide and has the largest marketshare — had initially requested a 15.1 percent premium hike. But it upped its request in the wake of Aetna’s pullout from marketplaces in Georgia and 10 other states last week.

State insurance officials said that Blue Cross was the only health insurer to request a new rate after Aetna’s move.

Yup...not only did BCBS increase their request, state regulators actually approved significantly higher rate increases for several other carriers as well. Update everything and here's what the requested/approved picture looks like today:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.