Colorado: Effectuated QHP enrollment 146K, 25% higher than previously reported (w/one possible caveat...)

A week or so ago, I reported that Connect for Health Colorado's monthly enrollment report contained some very confusing numbers:

Last month I noted that, assuming I was reading Connect for Health Colorado's monthly dashboard report correctly, they were down to 115,890 effectuated exchange enrollees as of 3/31/16, or a whopping 23.1% lower than the official APTC report tally of 150,769 QHP selections as of the end of Open Enrollment.

...The 121,962 number at the top seems to be the one I want...except that it also includes SHOP and standalone Dental enrollments (I think).

...OK, so 121,962 includes SHOP, which has a maximum tally of 2,897, which means that the effectuated number as of 4/30/16 could be as low as 119,065...except that "Individual" could also potentially include standalone dental plans, confusing the issue further. Even worse, it says that this "Includes those who effectuated in the current plan year and later terminated a policy".

I can't tell whether that means that those who terminated their policies have been subtracted from the total (accounted for) or if they're included in the total (cumulative).

Either way, this is still confusing as hell. I've requested clarification.

UPDATE x2: OK, I've heard back from the exchange; they said that they're having some technical delay issues with the effectuation data, but believe that it will still end up being between 80-90% once it's straightened out. I'm not sure if this is compared against the official OE3 number as of the end of March, but if so, that would put them in the range that I'm expecting nationally.

Well, tonight I'm happy to report that sure enough, according to C4HCO, there were indeed some serious data lag issues which have since been straightened out. This comes straight from the CO exchange:

As you know, we have been suspicious of the number in recent weeks and working with carriers to shorten up the lag time between plan selection and reported effectuations. Our team has made significant progress in recent days, bringing the number of effectuations up to 145,930 as of this morning. That compares to the 116,466 reported in the Marketplace Dashboard provided with the material for last week’s board meeting. (All figures apply to plan year 2016 enrollment.)

Wow, that's fantastic, and here's why: Colorado's official OE3 QHP selection total, according to the ASPE report, was 150,769. The exchange itself reported 157,317, but it's the ASPE number which everyone is measuring against.

If they have 145,930 effectuated individual market QHPs (not including SHOP, standalone Dental or anything like that) as of May 17th, that means that Colorado has experienced a mere 3.2% net attrition rate since the end of open enrollment. Better yet, that's not through the end of the first quarter (3/31/16), it's through yesterday.

I should note, however, that this number is as suspiciously high as the prior number was suspiciously low. I've asked for further clarification that this number reflects the currently effectuated QHP figure, not cumulative.

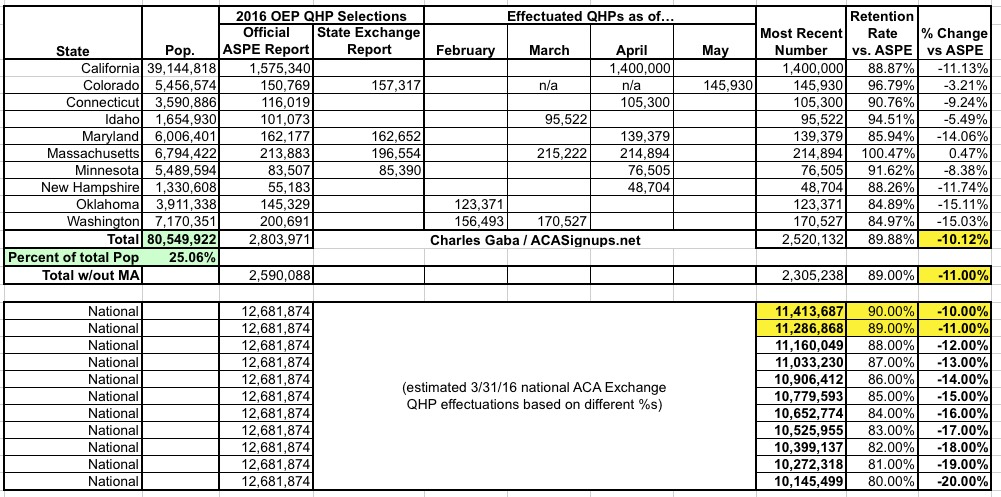

Assuming this number is CURRENTLY effectuated QHP enrollees only, it makes a significant difference in my projections for the national effectuation retention rate. Until now, I assumed it was down somewhere between 11-14% nationally; with the dramatic Colorado improvement, this drops to between 10-11%.

That means instead of estimating QHP effectuations to have dropped to 11 million, I'm not estimating them at between 11.2 - 11.4 million, centering around the 11.3 million mark...which would actually be around what I was expecting it to have hit by 3/31/16 in the first place. Of course, this could still be off significantly one way or the other; the 10 states I have recent effectuation data for only make up 25% of the national population:

UPDATE 5/18/16: Hmmmm...ok, I've heard back from the exchange; they confirm that the 146K are currently effectuated, but did clarify that the number includes "some" standalone dental policies (but no SHOP enrollments). Without knowing how many are standalone dental, I can't pin the exact number down. The monthly report lists 32,714 Dental enrollees, but most of those are bundled with full QHPs, so that's not a useful number either. Anyway, the currently-effectuated Colorado QHP-only number continues to be a mystery, but I'm gonna let it go at this point.