Delaware: *Approved* 2016 rate hikes reduced by 11.4%!! (but yes, you have to read that VERY carefully...)

There's an old saying: Figures lie and liars figure. Statistics and percentages are a funny thing; as politicians of every stripe know, you can often twist them to mean whatever you like, especially when you don't provide proper (or sometimes any) context whatsoever. Case in point: Yesterday's embarrassingly dishonest "chart" presented by Representative Jason Chaffetz at the Planned Parenthood witchhunt committee hearing.

For a less inflamatory example of this, consider the headline of this entry:

Delaware: *Approved* 2016 rate hikes reduced by 11.4%!!

At first glance, of course, it looks like I'm saying that after going through the regulatory approval process, the individual health insurance premium rates in Delaware are being reduced by 11.4% next year! Hooray!

Except, of course, that this isn't what I'm saying at all. It says that the hike has been reduced by 11.4%, not the actual rates. Those are still set to go up by over 20% on average:

On September 29, Delaware Insurance Commissioner Karen Weldin Stewart announced final rates for 2016, after vowing earlier in the year that the Insurance Department in Delaware would “vigorously examine” the 2016 rate proposals they received from the state’s two exchange insurers, hoping to find ways to reduce the final rates.

Highmark Blue Cross Blue Shield of Delaware initially requested an average rate increase of just over 25 percent in the individual market, although they increased their proposed rate increase to 33 percent in August. State regulators ultimately approved a 22.4 percent average rate increase for Highmark’s individual market plans, but Highmark has almost 95 percent of the individual market share in Delaware, including both on and off-exchange enrollments.

Aetna proposed raising rates by an average of 16 percent for 2016, which was approved by regulators.

Here's the actual story which includes the small group market:

The Commissioner recommended approval of a 22.4% rate increase in the individual market for Highmark Blue Cross Blue Shield of Delaware, a reduction of 3.0% from Highmark’s June request of 25.4%. Highmark had made a second request in late August for an additional 8% increase, for an overall rate hike of more than 33% which the Commissioner rejected out of hand.

Aetna Life Insurance Company’s request for a 16% increase in the individual market was also approved. In the small group market, Highmark’s request for a 12.7% increase was granted, as was Aetna’s request for a 6.1% decrease.

I actually had Aetna's small group request a bit different (a 5.4% reduction), so this is actually welcome news.

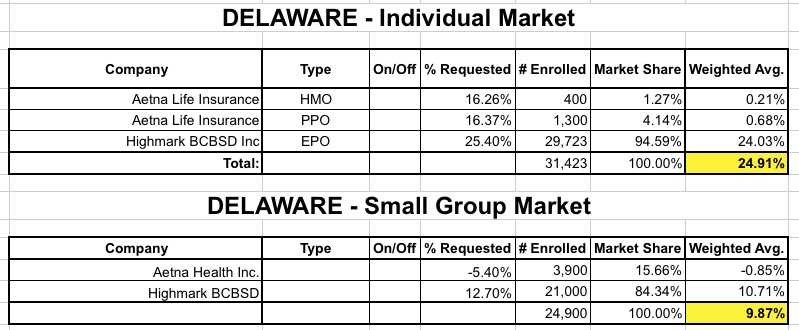

Here's what the breakout looked like with the requested increases:

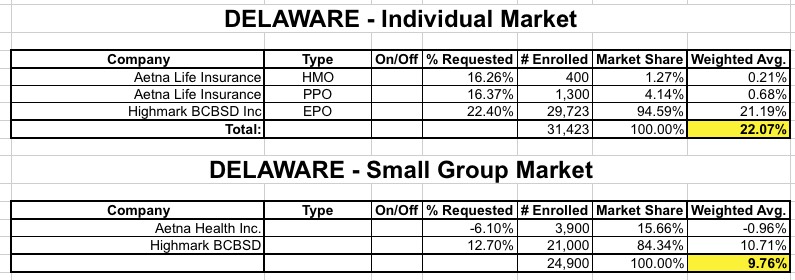

And here's what the final version looks like:

In other words, on the individual market, the average rate hike went from an ugly 24.9% increase to a slightly-less-ugly 22.1% increase...a reduction of the increase of 11.4% :)

I'm not trying to be cute here. I picked on poor Delaware for this quick lesson specifically because, with such a small market, only 2 companies participating and all of the blanks filled in both before and after the regulatory process, it's very easy to "see what I did there". Unfortunately, many politicians, pundits and outlets deliberately fart around with the numbers and how they phrase the wording for various reasons...especially in the headlines.

Sometimes they do so unintentionally. For instance, here's a quote from the DE Insurance Commissioner:

“My actuaries took a hard look at Highmark’s submitted rate request, and we were able to reduce it by 3.0%,” said Commissioner Stewart. “But Blue Cross franchisees across the country are making requests for increases of 25% or more, claiming the Affordable Care Act has unleashed pent-up demand by persons who have not seen a doctor for years. Regulators have been approving significant rate increases throughout the country.”

What she meant is that Highmark asked for a 25% hike and they approved a 22% hike. She didn't reduce the rates, she simply reduced the amount of the increase (and even then, technically speaking she didn't reduce it by "3 percent" but "3 percentage points"). I'm not attacking Stewart or the reporter here; that was an easy error to make in a light conversation, just pointing out how easy it is for readers to get confused by this stuff.

For that matter, since Highmark had actually changed their request to a 33% hike, I could just as easily have stated, accurately, that the overall rate increase was reduced from around 32.1% to 22.1%...a "31% decrease" or a "10 percentage point reduction"...even though the actual rates are still, you know, going up by more than 20%.

In the case of Delaware, there actually is a valid reason to label the increas as a "reduction" of 11.4%: That's the whole point of having regulators review and approve the rate hikes before unleashing them on the public. As I noted last week, the states which have approved their rate hikes for 2016 are, overall, clearly showing a pattern of lower hikes than those where the rate changes are still requested only. You can add Delaware to this pattern.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.