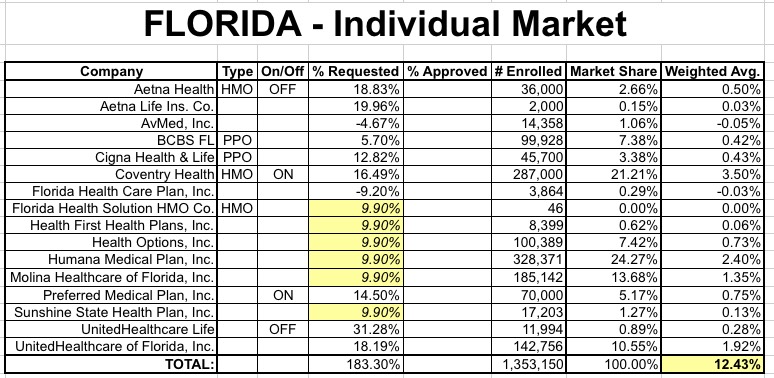

Florida: 2016 weighted avg. rate request: Best case: 12.4%; worst case: 16.8%

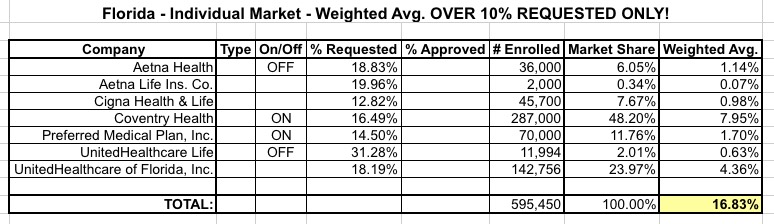

The Rate Review database at Healthcare.Gov is a very useful tool for any insurance company requesting rate increases above 10%, but it's completely useless for requests below 10%. As such, I have hard data on the requested increases for about 600,000 Florida residents:

If Florida's entire ACA-compliant individual market was only 600K people, that would be the end of the story.

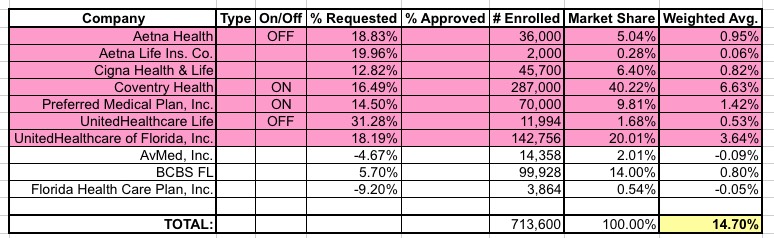

However, Florida actually has 16 different insurance companies selling individual policies...and the other 9 are all asking for lower than 10% hikes. After poking around the Florida Office of Insurance Regulation website as well as contacting the department directly, I've been able to pull together covered lives data for all 16, and requested rate change data for 3 more of them...2 of which are actually requesting rate decreases. When I add those 3 companies into the mix, the picture changes like so:

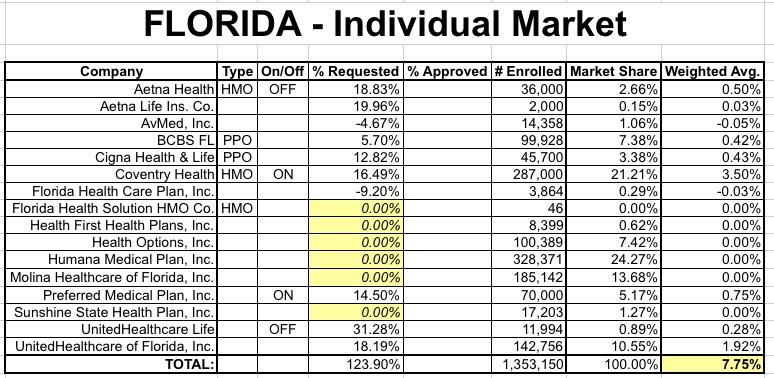

This leaves the 6 companies for which I have total lives covered but don't have the actual rate requests. I do know what the highest possible request for these companies is--9.9%--but I have no idea what it is beyond that. Some might be 5%, some might not be changing their rates at all, and others may be requesting reductions.

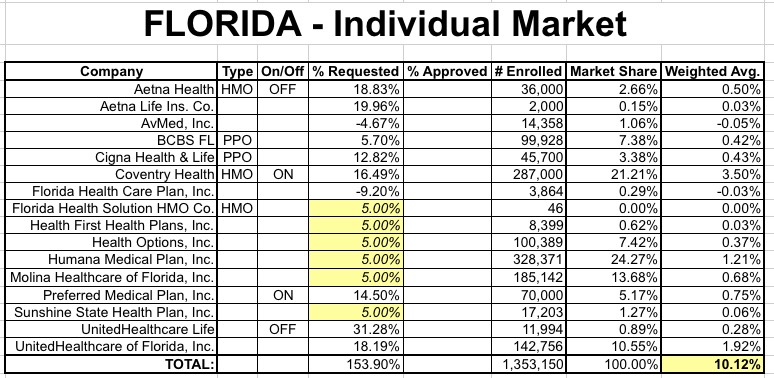

Erring on the side of caution and assuming that none of them are requesting drops, here's what the weighted average looks like under 3 different scenarios: No net change for these 6 companies; a 5% average hike and a 9.9% hike (worst-case scenario):

In other words, the best-case scenario for Florida (which seems unlikely) would be a 7.8% weighted average increase; the worst-case scenario is 12.4%.

However, this still leaves me with a problem, which is why even the worst-case scenario has to be taken with a huge grain of salt.

As of August 2014, Florida's total Individual Insurance Market was 1.56 million people, of which just over 1.0 million were ACA compliant policies (either on or off the exchange). As of the end of December, according to the Kaiser Family Foundation, the total FL individual market was down slightly to around 1.5 million even.

Also according to KFF, the total individual market nationally was about 15.6 million, of which roughly 6.7 million were on the ACA exchanges (7.1 million in May, 6.3 million by December), another 5 million or so were "grandfathered" or "transitional" policies, and the other 4 million or so were ACA-compliant off-exchange enrollees.

Unfortunately, I don't know exactly what the total Florida or national individual market is now, but all the bits & pieces I've seen so far suggest that it's likely somewhere around 18-20 million...or roughly 20% higher than 2014.

I think it's pretty safe to assume that Florida's total individual market certainly hasn't shrunk since last year, and more than likely is significantly higher...perhaps the same 20%. In other words, it's probably somewhere between 1.5 - 1.8 million people as of right now.

Even with all 16 companies included, the grand total in the tables above only adds up to 1.35 million, including both on- and off-exchange enrollees. There's somewhere between 150K - 450K people unaccounted for. So where are they?

Furthermore, according to the HHS Dept, around 1.42 million people were still enrolled in effectuated policies via the exchange alone as of 3/31/15. Even if every single ACA-compliant enrollee did so via HC.gov, we're still missing 70,000 people...and according to the FL Insurance Dept, as of last August there were about 157,000 ACA-compliant enrollees off of the exchange. I presume that many of these folks moved onto the exchange, but there's still at least 100K missing from the above equations.

As for the rest, again, last August there were about 410K people in "transitional" policies and 144K in "grandfathered" policies. That's over 550,000 people.

A good chunk of those people likely moved off of their grandfathered/transitional plans over to an ACA-compliant policy, and are thus already counted as part of the 1.35 million in the tables...but several hundred thousand should still be in non-compliant policies.

I'm assuming that this explains the discrepancy...but there's obviously still a lot of uncertainty about this, so I'm not 100% confident about it. Again, to err on the cautious side, I'm gonna ignore the two lower scenarios and assume the worst-case scenario.

Ironically, assuming that any "missing" enrollments fall into the "<10% increase" department, the more that I'm missing, the lower the overall average would be.

Anyway, assuming I have all my numbers straight here, it looks like Florida, with the 2nd largest individual policy market in the country and the largest ACA exchange enrollment in the country, is probably looking at around a 12.4% weighted average increase (or at the very worst, 16.8%).

Of course, these are still all merely requested changes, although I don't think Florida regulators under Rick Scott and the GOP-held state legislature are likely to be too harsh on the insurance companies.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.