Kaiser Family Foundation survey supports my 8.5M off-exchange QHP estimate

Last year, after a bunch of different piecemeal data points and surveys came in, I estimated off-exchange (that is, directly via the insurance companies) private insurance policy enrollments were likely around 8 million or so, of whom perhaps 7 million paid at least their first premium, plus another 4-5 million or so "grandfathered" or "transitional" enrollments. Add these to the 7 million (paid) exchange-based enrollees and you had perhaps 18-19 million people on the private individual market for 2014.

This year, I actually have less hard off-exchange data to work with so far (only a handful of states), but since early February I've been operating on a rough estimate of around 80%. That is, whatever the exchange-based QHP figure is at any given time, I'm pretty sure that the off-exchange QHP tally is somewhere around 80% of that number.

As of today, the confirmed exchange-based QHP tally sits at around 11.86 million, with another likely 360K or so not yet accounted for, for a total of 12.2 million. Assuming 12% never pay up, that's around 10.7 million paid exchange QHPs, so 80% of that is around 8.5 million off-exchange QHP* enrollments.

I've further been estimating that perhaps 1-2 million of those "grandfathered/transitional" enrollees have been whittled away, bringing those groups down to around 3-4 million.

Assuming all of these check out, the current (Spring 2015) private market breakout should be something like: 10.7M exchange QHPs + 8.5M off-exchange QHPs + 3.5M grandfathered/transitional = around 22.7 million total.

*(For off-exchange enrollments, I'm counting "non-QHP but still ACA-compliant" policies as "QHPs" to keep this from getting even more complicated)

However, both the 8.5M and 3.5 million figures have been a huge unknown, as ; it's a rough estimate based on very limited data.

That's why I owe Ken Kelly a huge thank you for bringing this to my attention: The detailed methodology report of the Kaiser Family Foundation Monthly HealthTracking Poll released earlier today.

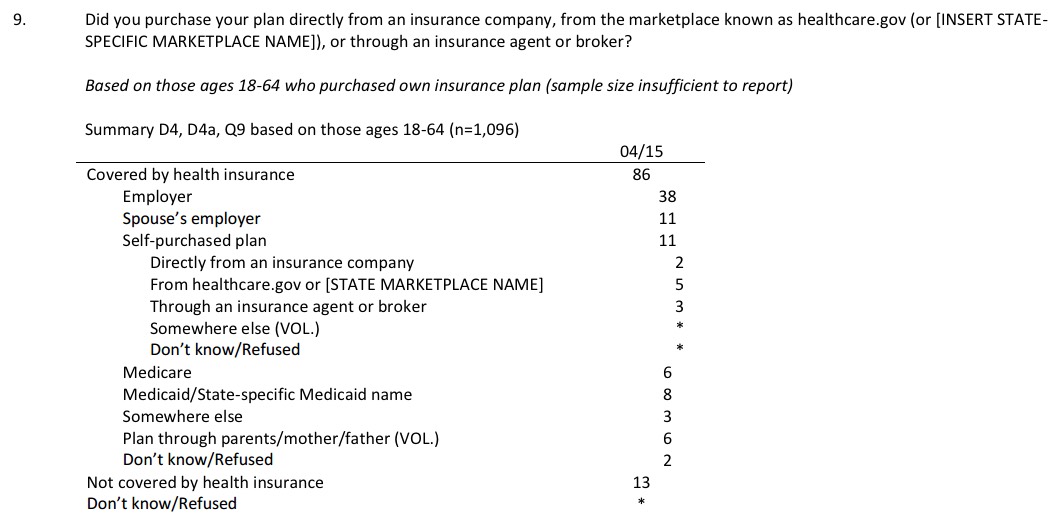

The key data is found on Page 8, Question 9:

Now, it's important to note that while the total survey pool has a fairly small margin of error, the MoE gets much larger in the more fine-grained responses, and that there's a lot of rounding off involved here. I should also note that these are self-reported responses; many people get confused about different types of insurance terminology.

With that in mind, let's see how the KFF survey matches up with my estimates:

- 11% of the total reported "self-purchased" policies, which encompasses all of the exchange-based and off-exchange individual/family market

- The total population of the U.S. is around 320.7 million people total as of April 2015

- The KFF survey doesn't include those over 64 since nearly all of them would be on Medicare, and thus wouldn't be on private policies at all (Medicare Advantage/etc are a whole other discussion).

- About 14.1% of the population is 65 or older, which brings the total down to around 275.5 million.

- The KFF survey also doesn't include children under 18 (we'll get to them later). They make up around 23.3%, or 74.7 million.

- Subtracting kids out of the equation brings the total down to around 200.8 million

- So, 11% of 200.8M = 22.1 million total.

Next, we have to add the kids into the mix.

- The final ASPE report from the HHS Dept. in March states that 7.6%, or 890,017 out of 11,688,074 QHP selections, were for children under 18

- Assuming the 88% payment rate and this is down to around 780,000.

- Add them to the above and you're up to right around 22.9 million

- However, we still have to add off-exchange enrollees under 18 in, which is tricky; Kelly asked me about this. It seems to me that since off-exchange enrollees are pretty much all over 400% of the Federal Poverty Line (otherwise they'd enroll via the exchanges for the tax credits), that suggests that they're likely to have fewer children (or at least fewer young children).

- According to the official 2014 Open Enrollment Report from eHealth Insurance, a major, nationwide private insurance exchange, only about 3% of their enrollees in 2014 were under 18. They haven't published the full results for 2015 open enrollment yet, but a partial report states that it's up a bit to 4% this year.

- Assuming that eHealth's demographics are typical of the off-exchange individual market as a whole, that suggests that the off-exchange % of children is a bit less than half the rate of exchange-based enrollees. I don't know exactly how many this is, but it sounds like perhaps 300,000 or so.

- Add those into the mix and the grand total should be around 23.2 million, give or take.

So, around 23.2 million vs. around 22.7 million. Wow, that's pretty good! Again, taking rounding/MoE into account and that's pretty darned close.

Next, what about the breakout of that 23 million or so?

- Well, again, the KFF survey says that about 5% of the adults claim exchange-based policies, or 10.04 million. Add the 780K kids and you have 10.8M, pretty close to my 10.7M

- The other 6% claim off-exchange policies, or around 12.0M total. Add 300K kids and you're up to 12.3M. 8.5M QHPs + 3.5M transitional/grandfathered = 12.0 million. Again, pretty spot on.

I'd say I have a pretty good fix on things here, no?

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.