2026 Final Gross Rate Changes - Tennessee: +37.5% avg; ~555,000 enrollees are in for a hell of a shock this fall (updated)

Originally posted 6/06/25

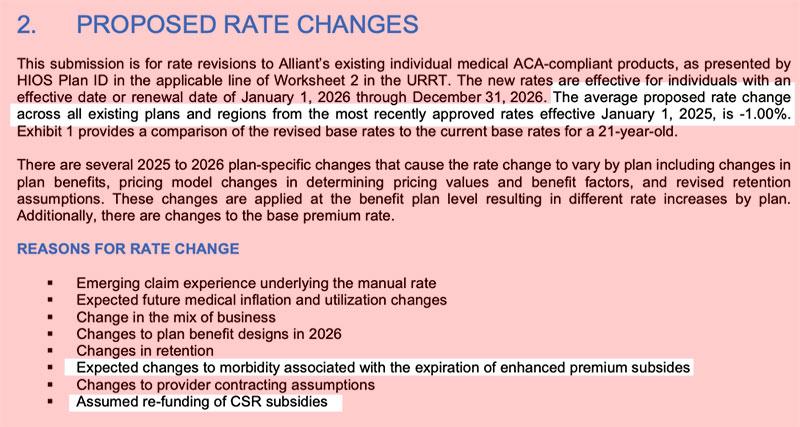

Tennessee ACA exchange carriers were instructed to provide two sets of rate filings for 2026: One which assumes CSR reimbursement payments won't be reinstated, one which assumes they are reinstated. In addition, both sets of filings assume that IRA subsidies won't be extended; all but one carrier clarified how much extending the IRA subsidies would impact 2026 premium changes.

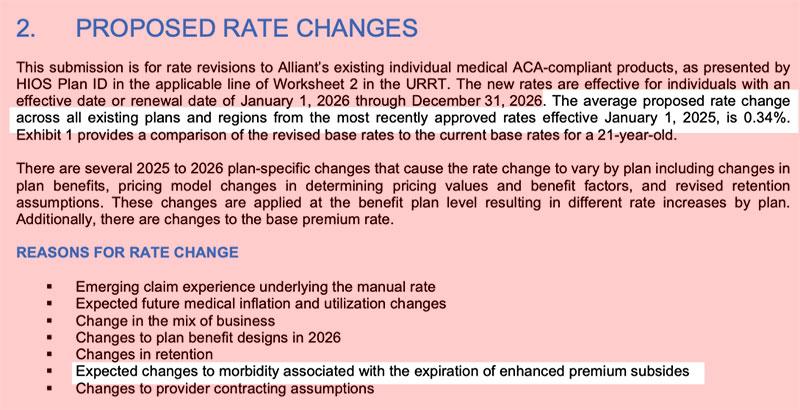

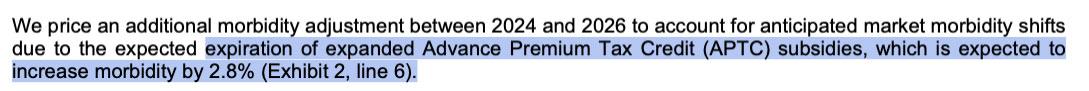

Alliant Health Plans: Alliant is requesting a nominal 0.3% increase next year if CSR payments aren't reinstated and a 1.0% drop if they are. In both cases, premiums would be 2.8% lower if IRA subsidies were to be extended by Congress:

Blue Cross Blue Shield of TN (assuming CSR reimbursements aren't reinstated...):

The rate change proposed in this filing is an average increase of 31.3%, not including the impact of aging.

Each individual will also see additional rate changes due to aging. Rate changes vary by plan for the following reasons:

- Variation in the expected loss ratio of plans by metallic level.

- Variation in the expected paid to allowed ratio by plan design.

...Other Adjustments:

Claims in the experience period were adjusted to account for the difference in the impact of one-time events between the experience period and the projection period.

An 8.5% adjustment is included in the Other Factor to account for the expected migration of members out of the individual market from 2024 to 2026, with projected BCBST membership decreasing from 112,000 members to 88,000. In developing this proposal, we considered the following assumptions regarding the projected change to market membership and morbidity.

- Experience from 2024 to 2025

- Expiration of enhanced premium tax credits

- Proposals under the Marketplace Integrity and Affordability proposed rule

Assuming CSR reimbursements are reinstated...

The rate change proposed in this filing is an average increase of 19.0%, not including the impact of aging.

Centene (without CSR reimbursements):

Impact of eAPTC Expiration

To account for eAPTC expiration prior to the 2026 benefit year, we have assumed rates will increase due to anticipated reductions in enrollment, both at the issuer and single risk pool level. As eAPTCs expire and enrollees subsequently face increased out-of-pocket premiums, we assume healthier individuals who tend to be more price sensitive will leave the market, worsening the average morbidity of the individual risk pool.

...The rate projections for 2026 have been updated from the previous year’s projections to reflect the most recent assumptions and information available.

The following provides a narrative description of the significant factors driving the proposed rate increase for 2026.

- Single Risk Pool Experience and Morbidity (9.0% of premium impact versus 2025 filed rates)

The individual single risk pool experience underlying the rate projections has been updated. The current model reflects the projected utilization trend applied to adjusted experience (from 2024 to 2026), including anticipated changes in the average morbidity of the single risk pool. There is a full description of utilization trend and other projection factors applied to experience in Section 6, ’Trend Factors’.

Risk adjustment transfer experience for 2026 includes consideration of changes to the statewide average premium, the Risk Adjustment program, and Celtic Insurance Company enrollee population morbidity relative to the Tennessee single risk pool.

- Unit Cost trend ( 2.2% of premium impact versus 2025 filed rates)

Unit costs and provider reimbursement agreements have been updated to reflect changes in the rating year.

- Utilization trend ( 0.4% of premium impact versus 2025 filed rates)

The projected utilization trends are consistent with observed historical trends based on internal analysis of our marketplace experience, supplemented by the Milliman Health Cost Guidelines. There is a description of the Health Cost Guidelines in Section 8, "Manual Rate Adjustments".

- Changes in Administrative Expenses and Profit ( 4.0% of premium impact versus 2025 filed rates)

Changes in general administrative expenses incorporated into 2026 rates are resulting in a rate change due to differences from prior year expense assumptions. See Section 12, "Plan Adjusted Index Rate", for details on projected non-benefit expenses.

The proposed rate increase of 16.2% reflected in this memorandum assumes that:

- 1. eAPTCs expire at the end of 2025, and

- 2. CMS’ Marketplace Integrity and Affordability rule, as published in the Federal Register on March 19, 2025, is finalized as proposed.

Under an alternate scenario where eAPTCs are funded for plan year 2026 and CMS’ proposed rule is implemented without modifications, the shift in statewide average morbidity is expected to increase the Index Rate by 5.8% between the base and projection periods. Key provisions included in the proposed rule related to open enrollment, special enrollment periods and annual eligibility redeterminations (e.g. requiring $5 premium obligation for auto re-enrollees) are still expected to drive a meaningful decline in enrollment, particularly among healthier enrollees and adversely affect the average morbidity of the single risk pool.

The overall average rate change under this alternate scenario is 15.6%, compared to 16.2% in the baseline scenario reflected in this memorandum. The difference in average rate changes also reflects other varying assumptions between scenarios, such as CSR loading, administrative expenses, and other demographic factors.

Cigna (assuming CSR payments):

The proposed weighted average annual rate change by product, without the impact of aging, is provided below. It was calculated using enrollment data as of 2/28/2025: 13.93%

The following factors are the main drivers of the proposed rate change:

- Expiration of APTC Subsidies: This rate filing assumes that APTC subsidies will expire on 12/31/2025. The conclusion of the enhanced subsidies is expected to convey significant morbidity impacts by driving substantial decreases in enrollment from year to year. Subsidy expiration will reduce the affordability of plans, which incentivizes members who expect to be healthy to forgo enrollment. Enrollment decreases tend to increase the average healthcare cost of the remaining market enrollees. The predicted morbidity impacts associated with this change account for a sizeable portion of the premium rate increases.

- Medical inflation and unit cost changes of medical services year over year: The underlying claim costs are expected to increase from 2024 to 2026, which is reflective of anticipated changes in the prices of medical services, the frequency with which consumers utilize services, as well as any changes in network contracts or provider payment mechanisms. The recent increase in Consumer Price Index (CPI) inflation is adding additional inflationary pressure for network contracts and provider payment mechanisms.

- The non-grandfathered individual market has continued to evolve since the inception of the Patient Protection and Affordable Care Act (PPACA), such as the introduction of the guaranteed issue requirement, the elimination of the individual mandate tax penalty, modified community rating, subsidies, the risk adjustment program, the external competitive landscape, anticipated changes to regulations regarding Short Term Medical and Association Health Plans, and many other provisions. After consideration for expected risk adjustment transfers, the single risk pool experience for Cigna Health & Life Insurance Company in Tennessee was more adverse than assumed in the current rates. As a result, Cigna Health & Life Insurance Company’s best estimate of the average market-wide morbidity of the covered population has increased compared to 2025.

- Increased Expense Margin: Reflects decreased efficiencies and scale achieved by Cigna Health & Life Insurance Company relative to 2025.

- Plan design changes and benefit modifications: Changes have been made to plans regarding the mandated restricted actuarial values for metal tiers that are resulting in an increase in expected cost share and therefore an increase to premium. All plan designs conform to actuarial value and essential health benefit requirements.

Oscar:

Using in-force business as of March 2025 , the proposed average rate increase for renewing plans is 24.8%. Rate increases vary by plan due to a combination of factors including shifts in benefit leveraging and cost-sharing modifications. This rate increase is absent of rate changes due to attained age.

Medical and Prescription Drug Inflation and Utilization Trends

The projected premium rates reflect the most recent emerging experience which was trended for anticipated changes due to medical and prescription drug inflation and utilization.

Administrative Expenses, Taxes and Fees, and Risk Margin

Changes to the overall premium level are needed because of required changes in federal and state taxes and fees. In addition, there are anticipated changes in both administrative expenses and targeted risk margin.

Prospective Benefit Changes

Plan benefits have been revised as a result of changes in the Center for Medicare and Medicaid Services (CMS) Actuarial Value Calculator and state requirements, as well as for strategic product considerations.

Anticpated Changes in the Average Morbidity of the Covered Population

Changes to the overall premium level are needed because of anticipated changes in the underlying morbidity of the projected marketplace.

...Enhanced Subsidy Continuation Alternative Rates

In the event that the American Rescue Plan Act enhanced subsidies are extended throughout the 2026 plan year, Oscar anticipates an aggregate reduction to morbidity trend and exchange fees of 2.1%, which results in a final rate change of 22.2% instead of 24.8%. This estimate is preliminary and is subject to change should there be any other regulatory developments impacting the Individual Exchanges, including but not limited to, changes to the 2025 Marketplace Integrity and Affordability Proposed Rule, changes to the enhanced subsidy structure, and the potential funding of Cost Sharing Reductions.

UnitedHealthcare:

UHIC will sell Individual policies with an effective date of January 1, 2026. The 2026 aggregate rate change as shown on the Unified Rate Review Template (URRT) is 28.37%. The rate change by product is 28.41% for UHC IND EPO and 28.03% for UHC IND EPO ADAV. Rate changes by plan are found in Worksheet 2, row 1.11 of the URRT. The quantitative impact for all significant factors driving the proposed rate change is shown in the table below. There might be small differences compared to the URRT due to rounding error.

Components of Rate Change

- Single Risk Pool Experience 4.3%

- Medical Inflation 4.5%

- Increased Utilization 3.0%

- Administrative Expenses 2.3%

- Other 11.8%

- Total 28.4%

The Other adjustment factor is 1.10 as shown on Worksheet 1 of the URRT.

EXPIRATION OF ENHANCED SUBSIDIES

An adjustment was applied to account for additional anticipated changes in morbidity due to the expiration of enhanced premium subsidies and other regulatory changes.

GEOGRAPHY

A geographic adjustment was applied to account for anticipated changes in the distribution of members by rating region including service area modifications, if applicable. The proposed rating factors by rating region were used to develop the adjustment.

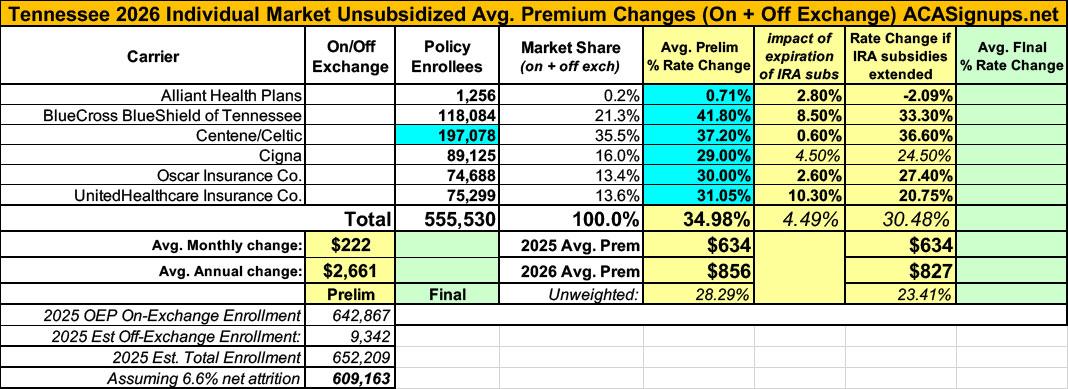

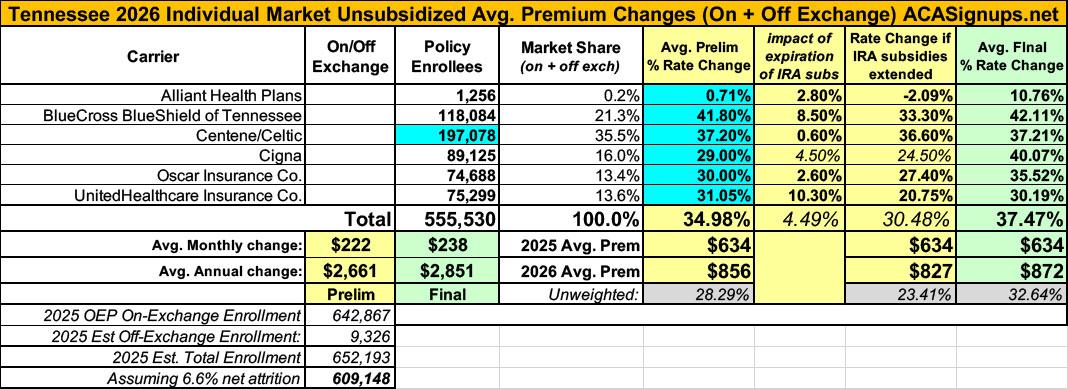

Put them all together and Tennessee looks like this: A weighted average 2026 rate increase of 24.2% (ouch), of which roughly 4.5% is due specifically to the IRA subsidies expiring.

One head scratcher: The combined total enrollment of all 6 carriers only adds up to 555,000 enrollees even though the grand total should be something like 609,000 statewide including off-exchange enrollments after adjusting for CMS's reported 6.6% net attrition thru April. I'm not sure what accounts for the "missing" 54,000; it's possible that Tennessee's attrition rate has been significantly higher than the national average.

UPDATE 8/14/25: Hoo boy. Since I originally posted this breakout, Tennessee carriers have submitted revised rate filings (see PDF attachments below) which are mostly dramatically higher than their original rate hikes (which were already pretty bad)?

- Alliant: 0.3% ⬆️ 0.7%

- BCBS TN: 31.3% ⬆️ 41.8%

- Centene/Celtic: 16.2% ⬆️ 37.2%

- Cigna: 28.8% ⬆️ 29.0%

- Oscar: 24.8% ⬆️ 30.0%

- UnitedHealthcare: 28.4% ⬆️ 31.1%

As a result, Tennessee's overall weighted average rate increase has leapt from 24.2% to 35.0%.

It's also important to remember that these are just for unsubsidized, full price premiums. The impact on net rate hikes for the vast majority of ACA exchange enrollees will be much higher than 35.0%.

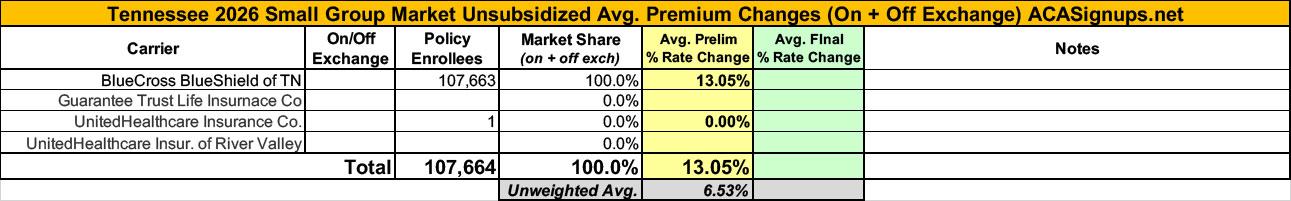

As for the small group market, I could only get hard enrollment and rate change data for one of the four carriers (BCBS); the other three are either missing entirely or only list a single enrollee; the unweighted average increase is 6.5%.

UPDATE 11/01/25: Just hours before Open Enrollment launched, the final, approved rate filings for TN's 2026 ACA individual market plans were published at the federal rate review database.

The most obvious change is to Cigna, which jumped from a 29% average hike to a whopping 40%. Alliant's premium increase also shot up from less than 1% to nearly 11%, but they only have a tiny number of enrollees so this doesn't move the needle much. Oscar also saw a bump from 30% to 35.5%.

Overall, the weighted average 2026 rate increase comes in at...37.5%.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.