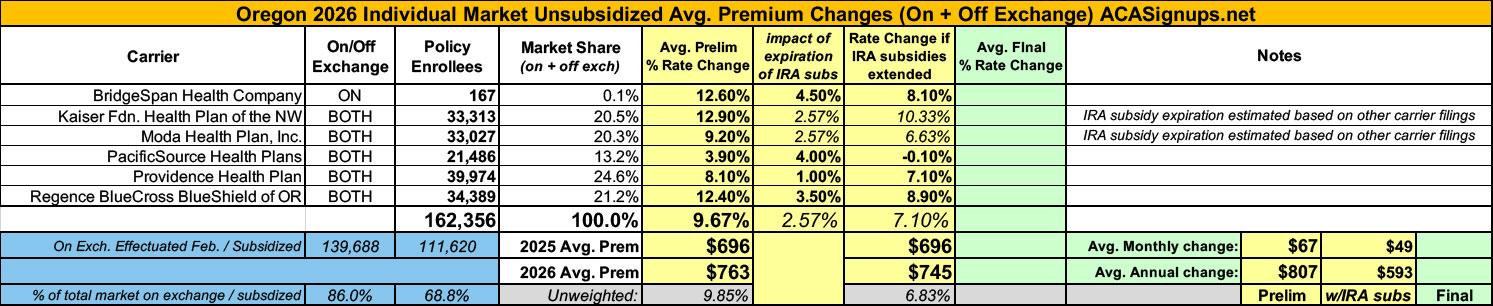

2026 Rate Changes - Oregon: +9.7% avg; 2.6% due specifically to IRA subsidy expiration (preliminary)

via the Oregon Division of Financial Regulation:

Oregonians continue to have at least five health insurance companies to choose from in every Oregon county as companies file 2026 health insurance rate requests for individual and small group markets

- In-depth rate review process just beginning, opportunities for public review and input remain through June 20

June 2, 2025

Oregon health insurers have submitted proposed 2026 rates for individual and small group plans, launching a months-long review process that includes public input and meetings.

Five insurers will again offer plans statewide (Moda, Bridgespan, PacificSource, Providence, and Regence), and Kaiser is offering insurance in 11 counties, giving six options to choose from in various areas around the state.

In the individual market, six companies submitted rate change requests ranging from an average increase of 3.9 percent (PacificSource) to 12.9 percent (Kaiser), for a weighted average increase of 9.7 percent. That average increase is slightly higher than last year’s requested weighted average increase of 9.3 percent.

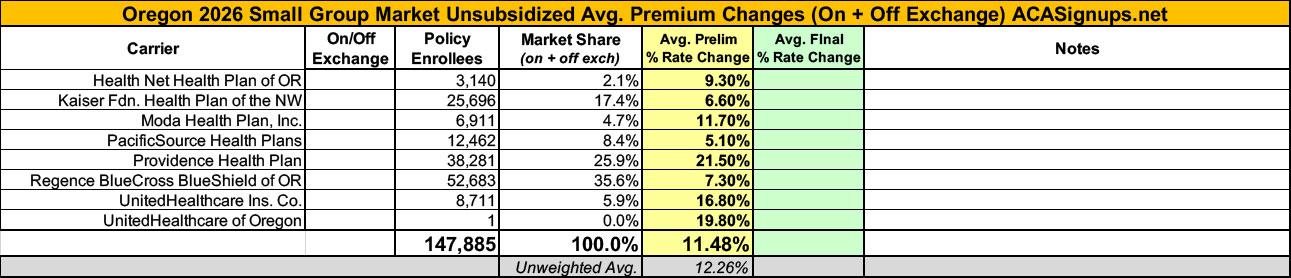

In the small group market, eight companies submitted rate change requests ranging from an average increase of 5.1 percent (PacificSource) to 21.5 percent (Providence), for a weighted average increase of 11.5 percent, which is lower than last year’s 12.3 percent requested average increase.

The Oregon Reinsurance Program continues to help stabilize the market and lower rates. Reinsurance lowered rates by at least 6 percent for the eighth straight year. In fact, this year the reinsurance program resulted in a 9.2 percent average lower premium.

The rate filings also reference uncertainty and other changes for some insurers. For example, two insurers – UnitedHealthcare Inc. and UnitedHealthcare of Oregon – include a 2.7 percent impact due to prescription drug tariffs. Also, Regence filed a separate request to consider up to an additional $25 per member per month increase as part of its rate filing based on possible Oregon legislative changes. That request, which is subject to the Oregon Division of Financial Regulation’s (DFR) approval, is not included in the attached chart of rate change requests.

DFR, which approves all rate request changes, will also inquire further with insurers throughout the process about ongoing uncertainty at the federal level, including further tariffing of prescription drugs and medical equipment, key changes in laws and subsidies, and additional cost drivers that may be felt by consumers.

See the attached chart for the full list of rate change requests.

“Oregon’s insurance market continues to grow with Kaiser adding even more counties than last year and all other counties still having five carriers offering plans,” said Oregon Insurance Commissioner and Department of Consumer and Business Services Director Andrew R. Stolfi. “The economy, uncertainty caused by federal actions, and increased spending in some areas are driving prices higher than last year. Oregonians still have a lot of options to choose from and the Oregon Reinsurance Program continues to allow Oregonians to find reasonable rates.”

Virtual public meetings about the 2026 requested health insurance rates will be held Friday, June 20, from 8:30 to 11:30 a.m. and Friday, July 18, from noon to 3 p.m. A web address to watch the public meetings will be posted at oregonhealthrates.org. At the meetings, each insurance company will provide a brief presentation about its rate increase requests, answer questions from DFR employees, and hear public comment from Oregonians. The public also can comment on the proposed rates through June 20 at oregonhealthrates.org.

“We look forward to a thorough and transparent process putting these rate requests through a rigorous public review, and we encourage the public to join the virtual public meetings and provide feedback on their health insurance plans,” Stolfi said. “This public process not only helps keep insurance companies accountable, but it gives Oregonians the opportunity be part of the process.”

The requested rates are for plans that comply with the Affordable Care Act for small businesses and individuals who buy their own coverage rather than getting it through an employer.

Over the next two months, DFR will analyze the requested rates to ensure they adequately cover Oregonians’ health care costs. DFR must review and approve rates before they are charged to policyholders.

In addition to reviewing the rate filings to determine if the rate changes are justified, DFR continues to monitor the ongoing federal policy and financing uncertainties to evaluate their effect on consumers. For example, expanded advance premium tax credits, which help subsidize premiums for some consumers and were part of COVID funding packages, expire at the end of 2025. While the expiration of these credits do not affect the rates under review, these changes would result in higher consumer costs. DFR will continue to keep consumers informed about these impacts during the rate review process.

Preliminary decisions are expected to be announced in July, and final decisions will be made in August after the public meetings and comment period ends.

Only four of the six carriers participating in Oregon's individual market included specific breakouts of the IRA subsidy expiration impact, but those four make up 60% of the total market share, so I'm using the weighted average of those four to estimate the marketwide average impact of 2.6 points:

BridgeSpan:

There is no expected rate impact because BridgeSpan’s proposed rates assume that enhanced subsidies will end. Had BridgeSpan assumed that enhanced subsidies were not ending, proposed rates would be 4% - 5% lower.

Kaiser Fdn. Health Plan of the NW:

For ARPA, there are numerous ways the discontinuation of the subsidies can and will impact the individual market in Oregon, including but not limited to: Impact on membership in on-exchange plans could lead to the overstated or understated morbidity of remaining membership

We assume that the ARPA premium subsidies will be discontinued in 2026, which decreased the projected membership and increased the morbidity factor, assuming that the healthier members would tend to leave the market when they can no longer receive the premium subsidies.

Moda Health Plan:

This rate filing does not include an explicit rate impact assuming the enhanced subsidies are eliminated. This is consistent with our approach of not including an explicit rate impact when the enhanced subsidies were introduced.

Eliminating the enhanced subsidies has the potential to reduce market enrollment, increase the uninsured rate, and lead to buy down effects and metal level changes. The magnitude and timing of these potential effects is uncertain. We have elected to not make an explicit adjustment for this in the 2026 rate filing.

PacificSource:

The expiration of enhanced subsidies is expected to cause anti-selective market shrinkage. In this filing, we apply an additional factor of 1.04 as an adjustment to market morbidity to account for this phenomenon.

Providence:

Individual: The expected impact of terminating enhanced subsidies is 1%.

Regence BlueCross BlueShield of OR:

There is no expected rate impact because Regence’s proposed rates assume that enhanced subsidies will end. Had Regence assumed that enhanced subsidies were not ending, proposed rates would be 3% - 4% lower.