2026 Final Gross Rate Changes - Michigan: +20.1%; 2 more carriers leaving market (update)

Originally posted 6/19/25

SCROLL DOWN FOR UPDATE

Blue Care Network:

BCN is filing a year-over-year average rate increase for 2026 for all individual products that were offered in 2025 of 16.3%. Significant contributors to rate change are outlined in the table below:

- Experience Restate 4.0%

- Medical and pharmaceutical price and utilization trend 5.4%

- ARPA Subsidy Expiration Impact 4.6%

- Benefit Change and CSR -2.6%

- Margin Impact 1.2%

...Incorporated in the above, BCN assumed an additional pharmacy price trend due to tariffs, as follows:

- Generic +2.5%

- Brand +10%

- Specialty 0%

- Total Impact +2.5%

...Consistent with the 2025 filing, BCN has assumed no CSR payments will be made by the federal government for 2026. Therefore, rates for Silver plans offered on exchange are 20.5% higher than if the federal government funded CSR subsidies.

Blue Cross Blue Shield of Michigan:

BCBSM is filing a year-over-year average rate increase for 2026 for all individual products that were offered in 2025 of 18.1%. Significant drivers of the rate change include:

- Medical and pharmaceutical price and utilization trend 5.8%

- ARPA Subsidy Expiration Impact 4.2%

- Benefit Change and CSR -3.1%

- Margin Impact 1.8%

- Risk Adjustment 7.6%

...Incorporated in the above, BCBSM assumed an additional pharmacy price trend due to tariffs, as follows.

- Generic 2.5%

- Brand 10%

- Specialty 0%

- Total Impact 2.5%

...Consistent with the 2025 filing, BCBSM has assumed no CSR payments will be made by the federal government for 2026. Therefore, rates for Silver plans offered on exchange are 12.8% higher than if the federal government funded CSR subsidies.

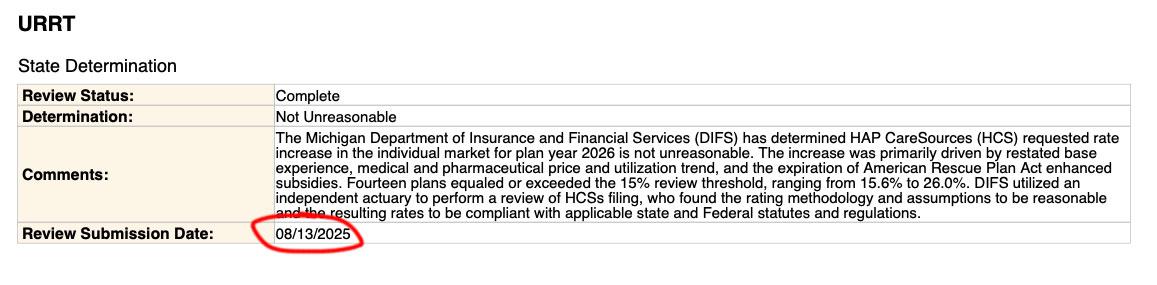

HAP Caresource:

- Company Name: HAP CareSource

- Company Rate Change: Increase

- Overall % Indicated Change: 16.900%

- Overall % Rate Impact: 16.900%

- Written Premium Change for this Program: $25,891,996

- Number of Policy Holders Affected for this Program: 10,739

- Written Premium for this Program: $152,999,712

- Maximum % Change (where req'd): 29.200%

- Minimum % Change (where req'd): 9.900%

...assuming thte enhanced premium subsidies first introduced through the American Rescue Plan Act (ARPA) and later extended by the Inflation Reduction Act (IRA) are allowed to expire at the end of 2025, we anticipate a reduction in the overall market size in 2026. This will lead to increased average statewide morbidity in 2026 relative to the manual rate experience as consumers will either lose access to subsidies (for those at or above 400% of the Federal Poverty Level) or face higher net premiums due to less generous subsidies.

We anticipate the remaining risk pool in 2026 to have higher healthcare needs, on average, as healthier consumers are more likely to lapse coverage. Given these considerations, we apply a morbidity adjustment of 2.3% on-exchange to reflect anticipated changes in statewide average morbidity in 2026 relative to the manual rate experience.

McLaren Health Plan Community:

The average annual premium for 2026 is $8,966, which is $747.20 PMPM (4.17 of URRT WK2 x 12). The average annual premium for 2025 is $7,437 (2.11 of URRT WK2 x 12). As of February 2025, there are 1,971 policy holders and 2,931 covered lives affected by this proposed rate change. The average overall rate increase is 19.20% (1.12 of URRT WK2).

...We have applied an explicit 1.017 morbidity adjustment due to expected market changes based on the expiration of the enhanced Premium Tax Credits (ePTC) made available under the American Rescue Plan Act.

Meridian (Ambetter):

Federal Policy Assumptions:

The proposed rate increase of 16.9% reflected in this memorandum assumes that:

- 1. eAPTCs expire at the end of 2025, and

- 2. CMS’ Marketplace Integrity and Affordability rule, as published in the Federal Register on March 19, 2025, is finalized as proposed.

Both policy changes are expected to materially affect projected enrollment and morbidity for plan year 2026 at the issuer and single risk pool level. Most notably, as eAPTCs expire and enrollees face increased out-of-pocket premiums, we assume healthier individuals who tend to be more price sensitive will exit the market, worsening the average morbidity of the individual risk pool. Shifts in statewide average morbidity, including both above policy changes, are expected to increase the Index Rate by 6.7% between the base and projection period.

Under an alternate scenario where eAPTCs are funded for plan year 2026 and CMS’ proposed rule is implemented without modifications, shifts in statewide average morbidity is expected to increase the Index Rate by 4.9% between the base and projection period. Key provisions included in the proposed rule related to open enrollment, special enrollment periods and annual eligibility redeterminations (e.g. requiring $5 premium obligation for auto re-enrollees) are still expected to drive a meaningful decline in enrollment, particularly among healthier enrollees and adversely affect the average morbidity of the single risk pool.

The overall average rate change under this alternate scenario is 15.9%, compared to 16.9% in the baseline scenario reflected in this memorandum. The difference in average rate changes also reflects other varying assumptions between scenarios, such as CSR loading, administrative expenses, and other demographic factors.

Molina Healthcare:

This filing assumes that the enhanced Advanced Premium Tax Credits (eAPTCs) expire on 12/31/2025 and that CSRs are not federally funded effective 1/1/2026. Rates and assumptions contained herein are no longer actuarially sound if either of these policy changes are different for plan year 2026. If the regulatory environment changes, Molina will work with the state to incorporate either or both of these changes in an actuarially sound manner.

Molina’s rate filing reflects the following rate changes by metal tier for Molina’s membership. Molina has 35,564 members in plans that are renewing and 0 members in plans that are terminating for a total of 35,564 members enrolled effective March 2025 and reported as of April 2025. Similarly, Molina has 24,937 policyholders in plans that are renewing and 0 policyholders in plans that are terminating for a total of 24,937 policyholders. The rate change calculation below is consistent with Worksheet 2, Section II of the URRT, which only includes members and policyholders on renewing plans.

...Adjustment for eAPTC expiration: 1.098

Oscar Insurance Company:

Exhibit A summarizes the proposed rate increases by plan effective January 1, 2026. Rate increases vary by plan due to a combination of factors including shifts in benefit leveraging, cost-sharing modifications, and geographic rating factors. Using in-force business as of March 2025, the proposed average rate change for renewing plans is -3.2%. This rate change is absent of rate changes due to attained age.

The significant factors driving the proposed rate change are described in the following attribution summary and are displayed quantitatively in Table 1.

- Claim Experience in 2024 -11.0%

- Medical and Prescription Drug Trend 9.2%

- Prospective Benefit Changes 1.2%

- Admin, Taxes and Fees, and Risk Margin 1.4%

- Changes in Morbidity 5.6%

- Total 6.4

...A second adjustment was included to reflect changes in the anticipated market morbidity in response to the uncertainty inherent in the marketplace. Specifically, Oscar anticipated changes to the market morbidity associated with the change in Michigan’s enrollment for the projection period relative to the experience period, due to the ending of the enhanced subsidies introduced by the American Rescue Plan Act, as well as the several new procedures and requirements introduced by the 2025 Marketplace Integrity and Affordability Proposed Rule.

These adjustments reflect the projected change in claim costs outside of the underlying demographics of the covered population and were also assumed when estimating the risk adjustment transfer for the projection period.

A combined factor of 1.053 is included in the “Morbidity Adjustment” entry on Worksheet 1, Section II of the URRT.

Physicians Health Plan has disbanded (from 2024):

LANSING — The former Physicians Health Plan insurance program that covers about 16% of Lansing area residents is no longer financially viable and will end next year, officials said.

U-M Health Plan, which changed its name after University of Michigan Health acquired Sparrow Health System, serves about 64,000 members. U-M Health announced it would end the plan in December 2025.

Priority Health:

The reasons for the rate change include:

- Updated experience upon which the rates are based.

- Updated medical and prescription Rx cost and utilization trends.

- Updated benefit relative values, which may cause variation in rate changes by plan.

- Prospective benefit adjustments to existing products; the benefit relative values have been updated, which may cause variation in rate changes by plan.

- Anticipated morbidity impact from the expiration of EPTC subsidies

- Anticipated changes in the payments to the Federal Risk Adjustment program.

- Updated factors for administrative expenses and margin. With this filing, the margin varies by plan.

- Updated taxes and fees.

- There is no separate adjustment for COVID‐19 in our build up. We expect ongoing costs to be consistent with our base period and included in the overall trend

The overall average annual increase which will be experienced by members over January 1, 2025 filed rates is a 14.42% increase.

If the Enhanced Advanced Premium Tax Credit subsidies (EPTCs) are extended to 2026 with the same structure as 2025, the following would change in our filing.

- The EPTC load noted in Exhibit 2.1 would be removed.

- If the extension is before 7/31/25, the Exchange User Fee would be 1.5% instead of 2.5%, per the NBPP.

- The assumption for proportion of membership that is on exchange would increase to 89%.

- The Admin and Fees conversion from PMPM to % of premium would need to be revised. The PMPMs would not be updated but the % of premium would be updated with the base changes.

- The combination of these changes leads to approximately a ‐3.7% impact if EPTC subsidies are extended before 7/31/25 and ‐2.8% impact if EPTC subsidies are extended after 7/31/25. These are based on the change to Exhibit 2.1 line 10b, Adjusted Premium with the updates noted above. The final URRT increase could vary slightly.

UnitedHealthcare Community Plan, Inc.:

UHC will sell Individual policies with an effective date of January 1, 2026. The 2026 aggregate rate change as shown on the Unified Rate Review Template (URRT) is 25.25%. Rate changes by plan are found in Worksheet 2, row 1.11 of the URRT. The quantitative impact for all significant factors driving the proposed rate change is shown in the table below.

Components of Rate Change / % Change

- Experience 7.1%

- Trend 6.9%

- Tariffs 0.8%

- Morbidity 14.0%

- Cost Sharing Design -5.6%

- CSR Load 0.7%

- Non-Benefit Expenses -0.3%

- Other 0.4%

- Total 25.25%

Given that the rate changes are based on the same single risk pool, the rate changes vary by plan due to plan design changes. Additional detail is provided below describing the significant adjustments driving the proposed rate change.

- Base Experience reflects the change in experience from the 2025 to 2026 rate development.

- Trend indicates the allowed level trends from 2025 to 2026.

- Tariffs to account for uncertainty regarding price changes by manufacturers due to economic policy changes and/or the onshoring of manufacturing and the impact on total medical costs, most notably on pharmaceuticals.

- Morbidity captures the expected changes in morbidity, particularly as a result of enhanced subsidy expiration and the changing regulatory environment.

- Cost Sharing Design indicates the average change in benefits and paid-to-allowed ratios, excluding changes to CSR loads.

- CSR Load reflects the changes in the average Silver load due to change in benefits and distribution of members across CSR variants.

- Non-Benefit Expense outlines the change in admin and Exchange User Fees.

- Other reflects any changes to the rates not already captured above.

The proposed rate change would be 12.5% if the enhanced subsidies are extended for plan year 2026. The difference in the proposed rate changes is primarily driven by lower expected market morbidity, and other secondary impacts such as decreased risk adjustment transfer payable, decreased Exchange user fees, etc.

It's worth noting that while most carriers state that gross premiums would drop significantly if CSR reimbursement payments are reinstated (which would actually mean higher net premiums for most enrollees), UnitedHealthcare's alternate filing states that this would be more than canceled out by a significantly higher morbidity, meaning that even after knocking 6.4 points off for CSR funding, they'd still be seeking a whopping 30% avg. rate hike (instead of 25.25%) if CSR funding is reinstated (the no-CSR funding version puts the total morbidity adjustment at 14 points):

An adjustment was applied to account for anticipated changes in market morbidity levels.

An adjustment equal to 28% was applied for the expiration of enhanced premium subsidies passed under the American Rescue Plan Act (ARP) and extended by the Inflation Reduction Act (IRA), and the funding of CSR payments by the federal government. Due to these two regulatory changes, UHC anticipates a decline in enrollment due to higher post-subsidy premiums. Healthier members are expected to leave at a disproportionately higher rate than those with significant healthcare needs, increasing market morbidity in 2026. This estimate is based on internal modeling using historical Wakely National Risk Adjustment Reporting (WNRAR) data as well as Marketplace Open Enrollment Period Public Use Files.

An additional 1% was added to this morbidity impact to reflect expected changes in market morbidity levels independent of potential regulatory changes.

The total adjustment factor is 1.290.

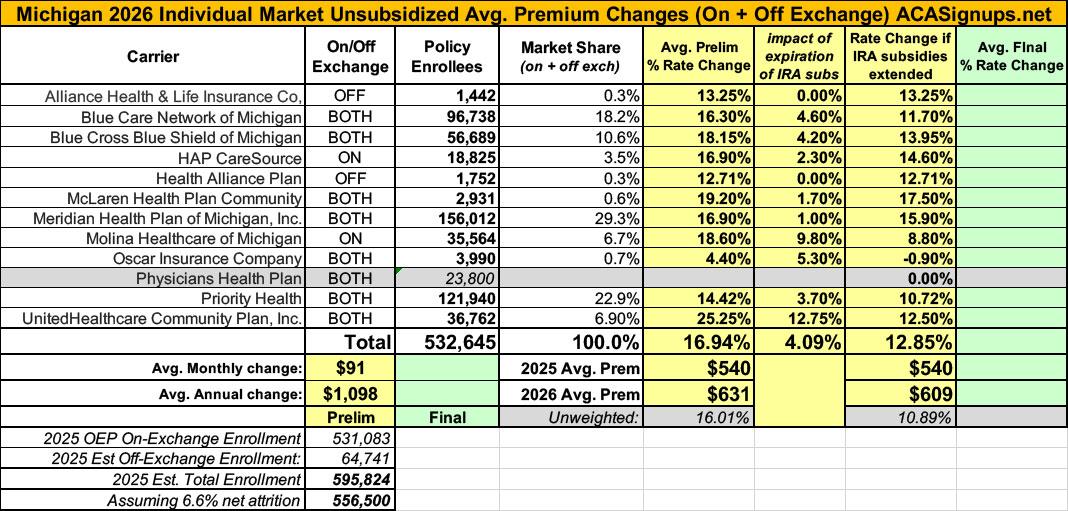

Overall, the weighted average rate hike being asked for (assuming IRA subsidies expire and CSR reimbursement payments aren't reinstated) is 17.0% across the individual market.

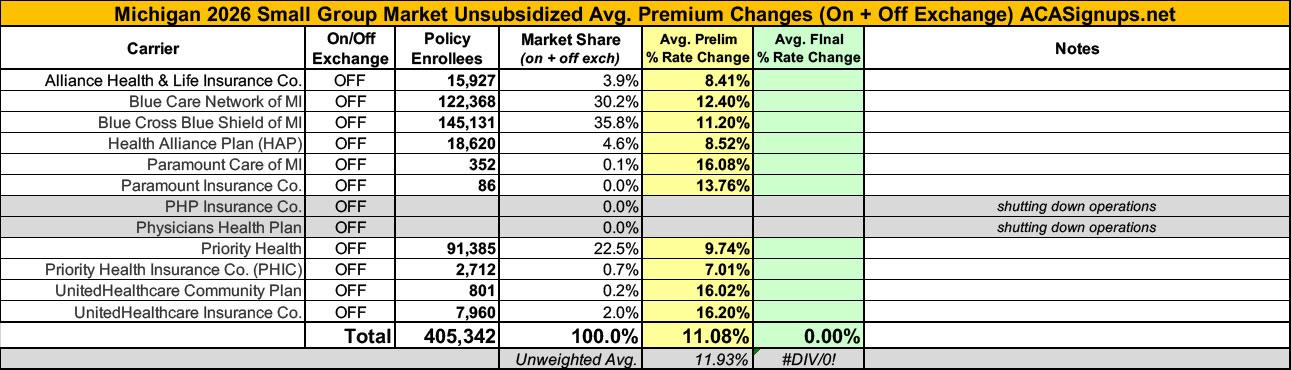

Meanwhile, small group carriers are asking for an 11.1% average rate increase:

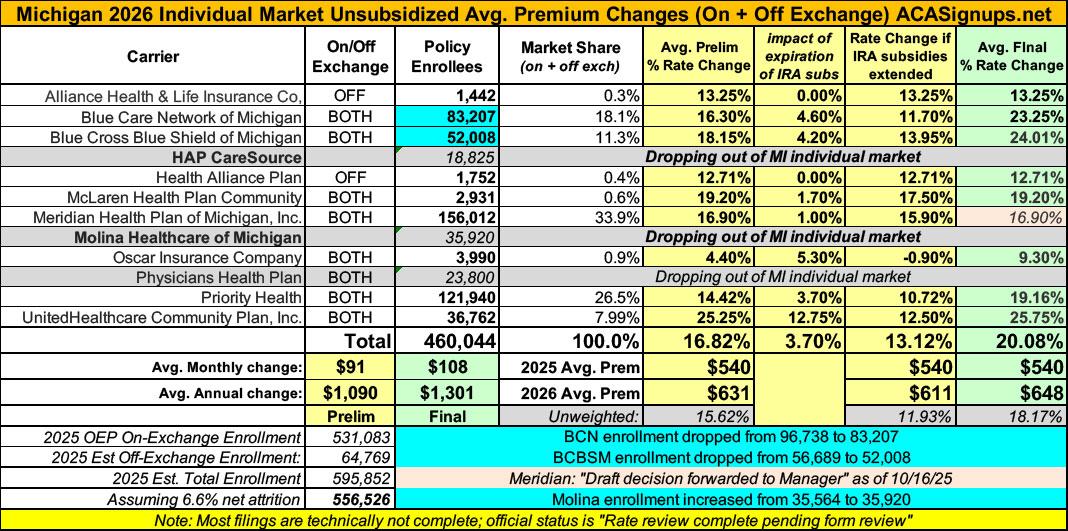

UPDATE 10/16/25: This hasn't been officially published by the Michigan Dept. of Insurance & Financial Services yet, and technically speaking the filings aren't 100% approved yet, but 10 out of 11 filings have been moved to "complete pending form review" which I think just means that a supervisor has to give the paperwork a final once-over to make sure there are no typos etc.

*Also, Meridian Health Plan (which holds an impressive 30% of the total ACA indy market in MI) is listed as "draft decision forwarded to Manager" so if any of them end up being off I'd guess it would be that one.

In any event, the SERFF Database has what appear to be the final individual market filings for Michigan. Overall, the weighted average increase appears to be 20.0%, up 3 points from the 17.0% preliminary filings.

It's also worth noting that the estimate of current enrollees has changed for three of the carriers, dropping by around 18,000 marketwide to around 515,000.

10/16/25: UPDATE TO THE UPDATE: Hoo boy. It turns out that besides Physicians Health Plan, which had already announced that they were dropping out of the Michigan market next year (in fact the entire carrier is being dissolved), two other carriers are pulling out of the MI individual market as well:

- Molina Healthcare: This article from Agility Insurance Services from September states that Molina Healthcare is pulling completely out of both the Wisconsin and Michigan markets. I haven't found confirmation within the carrier filings but I've received confirmation from another source on this.

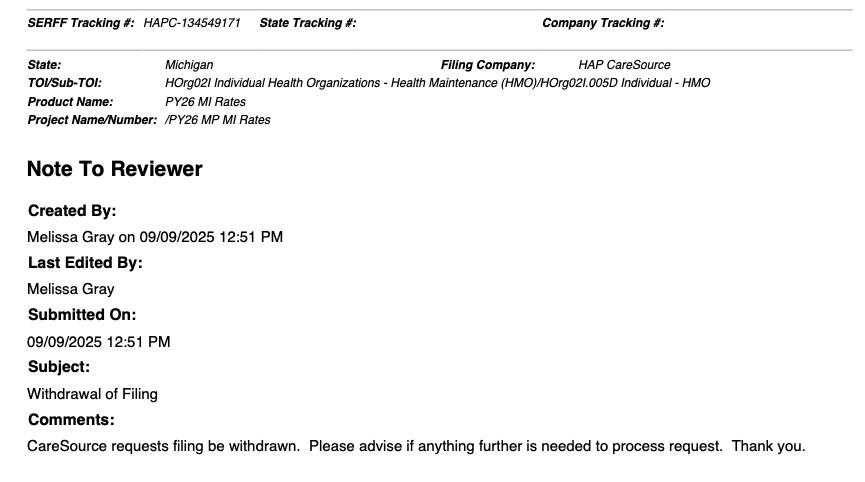

- HAP CareSource: I found this short, simple note buried deep within the HAP CareSource filings...dated on September 9th, nearly a month after the filing review had been completed and approved (see below):

The "good" news (such as it is) is that both carriers have pretty small market shares...around 18,800 for HAP CareSource and ~36,000 for Molina.

The bad news is that this is still ~55,000 Michiganders who are going to have to scramble to find other coverage, and it also means less competition in the market.

The overall impact to the weighted average rate increase is negligible, however...it's still just over 20%:

UPDATE 10/19/25: As I posted this morning, it looks like Meridian/Ambetter is pulling out of the entire Metro Detroit area as well. I don't know how many of their ~156,000 enrollees will be impacted by this (since they'll still be offering plans in about a dozen or so other counties), but since Meridian has one of the lower average rate hikes, that means the weighted increase for remaining enrollees will be a bit higher yet.