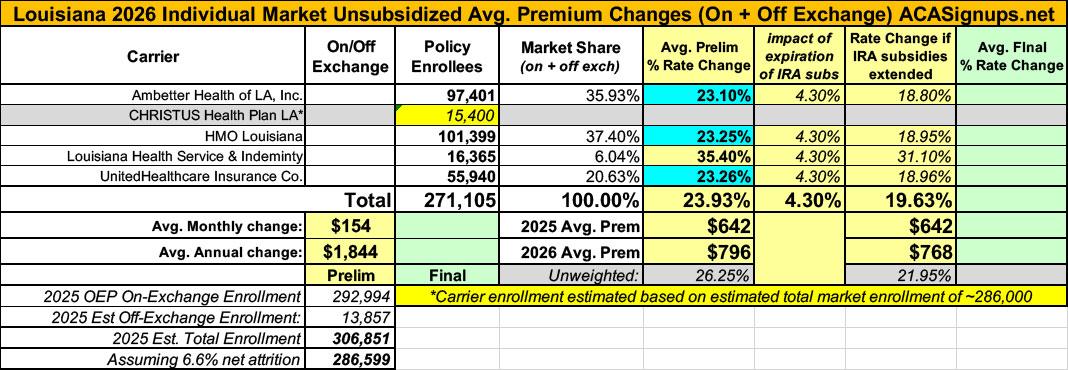

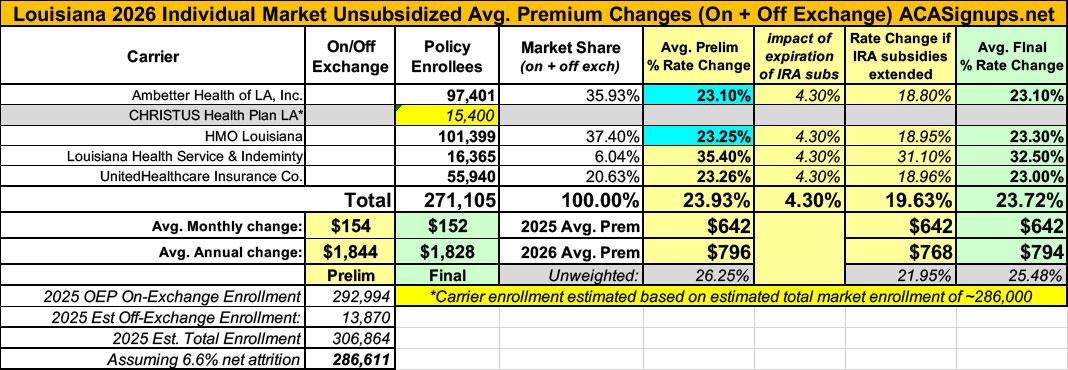

2026 FINAL Gross Rate Changes - Louisiana: +23.7% (updated - slight drop from requested)

Originally posted 8/7/25

Overall preliminary rate changes via SERFF database, state insurance dept. website and/or the federal Rate Review database.

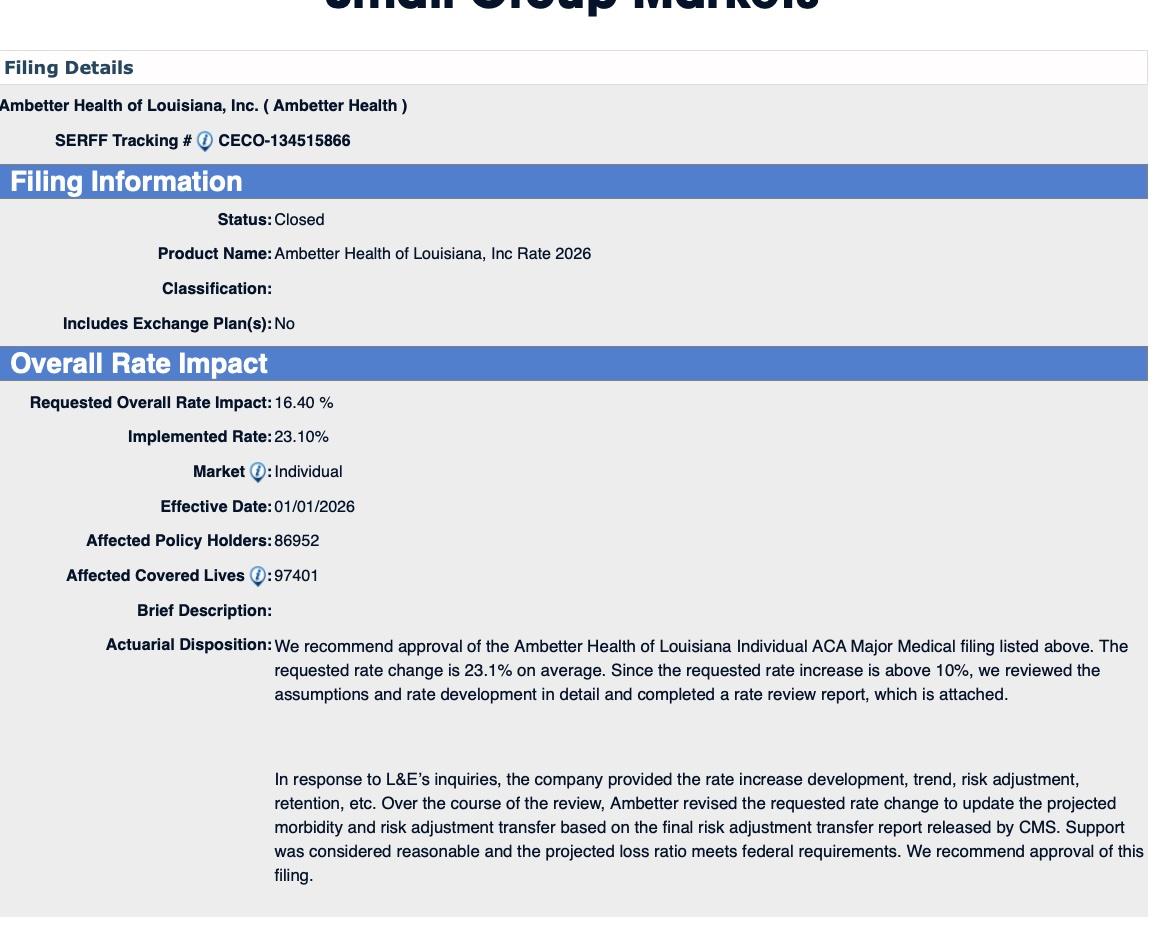

Ambetter Health of LA:

The proposed rate change of 16.4% applies to approximately 97,401 individuals. Ambetter Health of Louisiana’s projected administrative expenses for 2026 are $91.51 PMPM. Administrative expense does not include $17.45 for taxes and fees. The historical administrative expenses for 2025 were $79.64 PMPM, which excludes taxes and fees. The projected loss ratio is 81.4% which satisfies the federal minimum loss ratio requirement of 80.0%.

CHRISTUS Health Plan:

(as far as I can tell, CHRISTUS is dropping out of the Louisiana individual market...they aren't listed on the federal Rate Review database website, nor do they show up in the LA SERFF filings or on the LA Insurance Dept. website.)

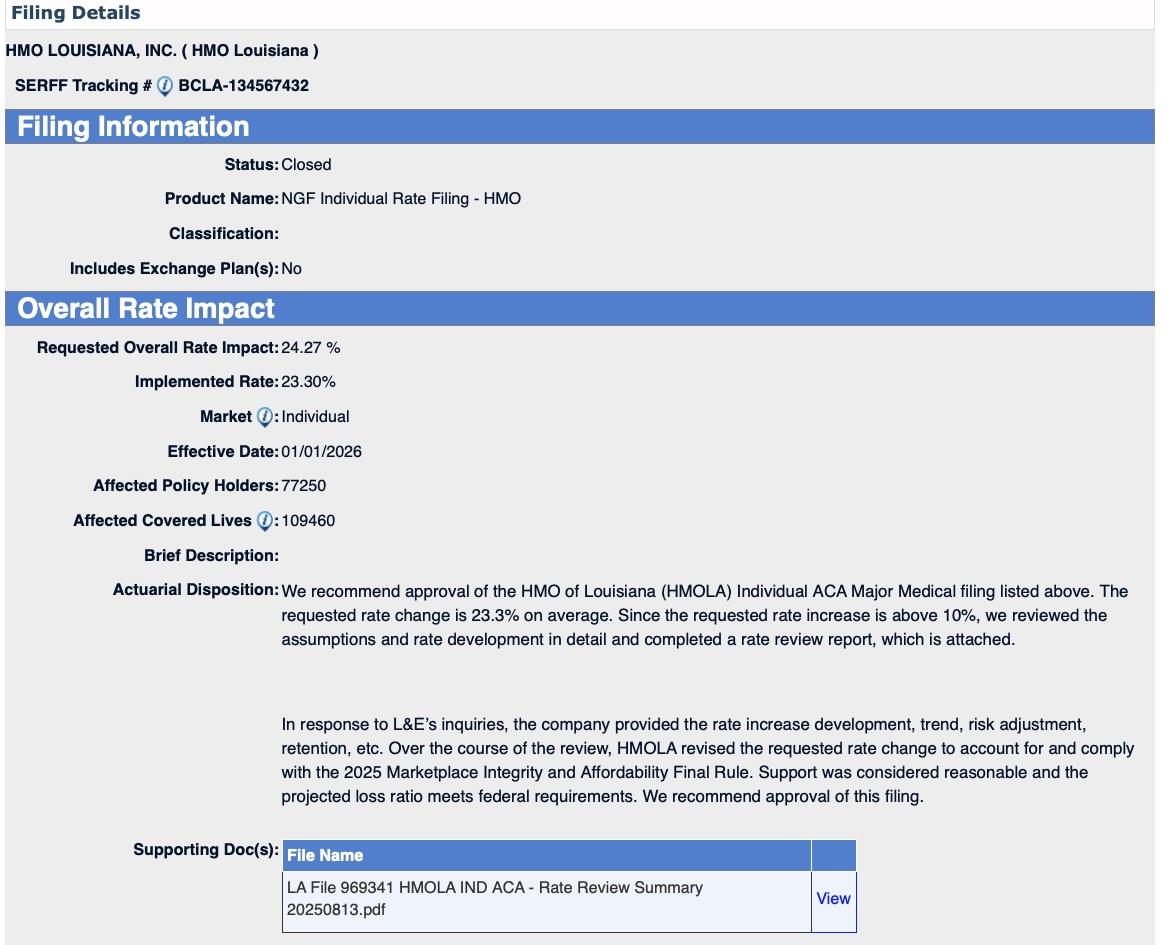

HMO Louisiana:

The rate increases scheduled for January 1, 2026 for the Blue POS Individual, Community Blue POS Individual, Blue Connect POS Individual, Signature Blue POS Individual and Precision Blue POS Individual plans are higher than the 15% threshold outlined in the Affordable Care Act (ACA). As of April 30, 2025, these plans had 101,399 members enrolled. A subscriber’s actual rate increase could vary depending on the benefit plan.

Considerations for the rate increase include:

- Expected medical trend, both utilization and cost of services

- Expected changes in the average morbidity

- Expected demographic shifts

- Expected selling, general, and administrative expenses, margin, and taxes and fees, including those that are applicable for 2026 under the ACA

- Expected payments and charges under the Risk Adjustment Program

- Continued absence of federal funding for the cost-sharing reductions, applicable to Individual Silver metal level plans

- Changes in cost-sharing levels

- Expected utilization, cost of services, and changes in delivery system characteristics for provider networks

- Movement of members to 2026 plans from 2025 plans that are being terminated in 2026

The proposed rate increases are expected to produce a projected federally prescribed 2026 single year medical loss ratio of 86.8%. This projected medical loss ratio meets the minimum requirement of 80.0% defined in the Affordable Care Act. If the actual three-year medical loss ratio were to fall below this level, HMO Louisiana would pay rebates to members as the ACA requires.

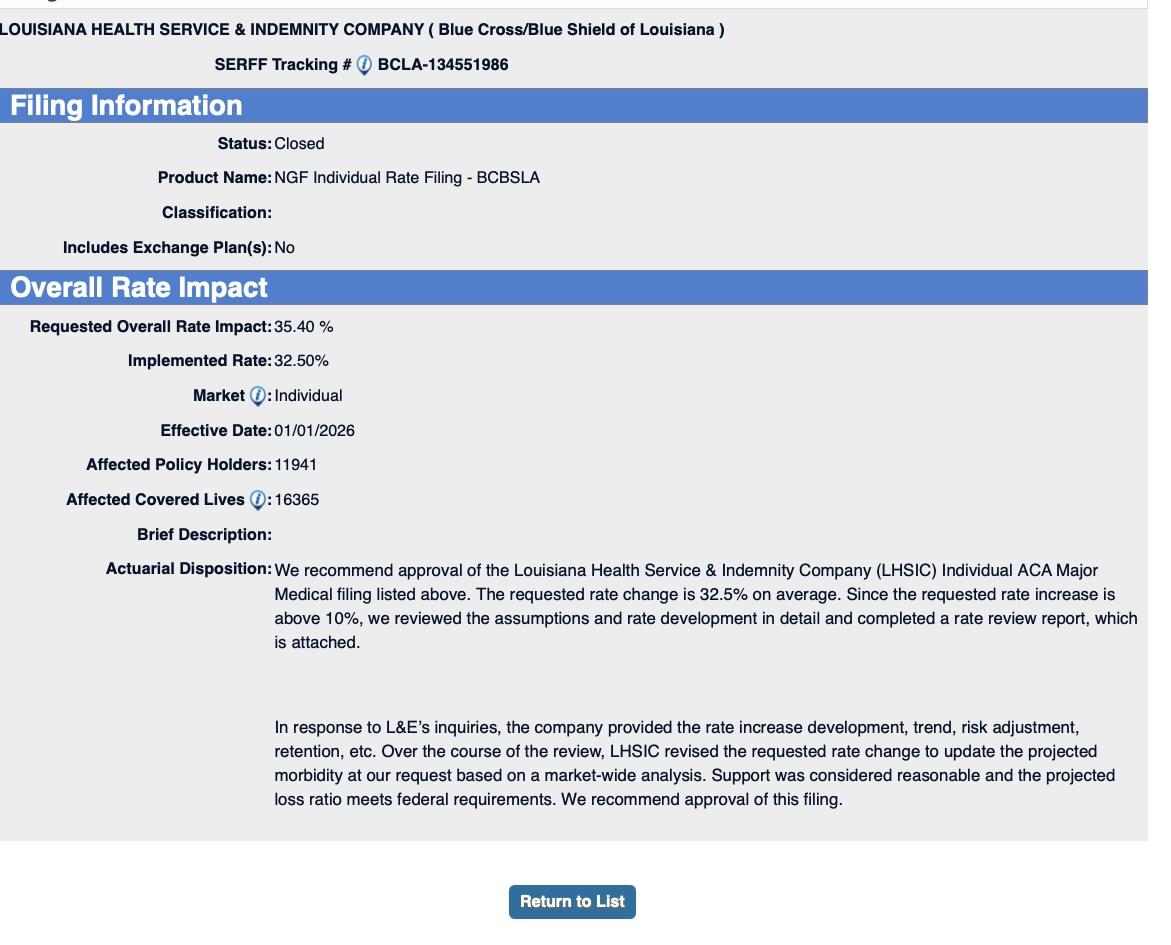

Louisiana Health Service & Indemnity:

The rate increases scheduled for January 1, 2026 for Blue Max Individual and Blue Saver Individual plans are higher than the 15% threshold outlined in the Affordable Care Act (ACA). As of April 30, 2025, these plans had 16,365 members enrolled. A subscriber’s actual rate increase could vary depending on the benefit plan.

Considerations for the rate increase include:

- Expected medical trend, both utilization and cost of services

- Expected changes in the average morbidity

- Expected demographic shifts

- Expected selling, general, and administrative expenses, margin, and taxes and fees, including those that are applicable for 2026 under the ACA

- Expected payments and charges under the Risk Adjustment Program

- Continued absence of federal funding for the cost-sharing reductions, applicable to Individual Silver metal level plans

- Changes in cost-sharing levels

The proposed rate increases are expected to produce a projected federally prescribed 2026 single year medical loss ratio of 85.9%. This projected medical loss ratio meets the minimum requirement of 80.0% defined in the Affordable Care Act. If the actual three-year medical loss ratio were to fall below this level, Blue Cross and Blue Shield of Louisiana would pay rebates to members as the ACA requires.

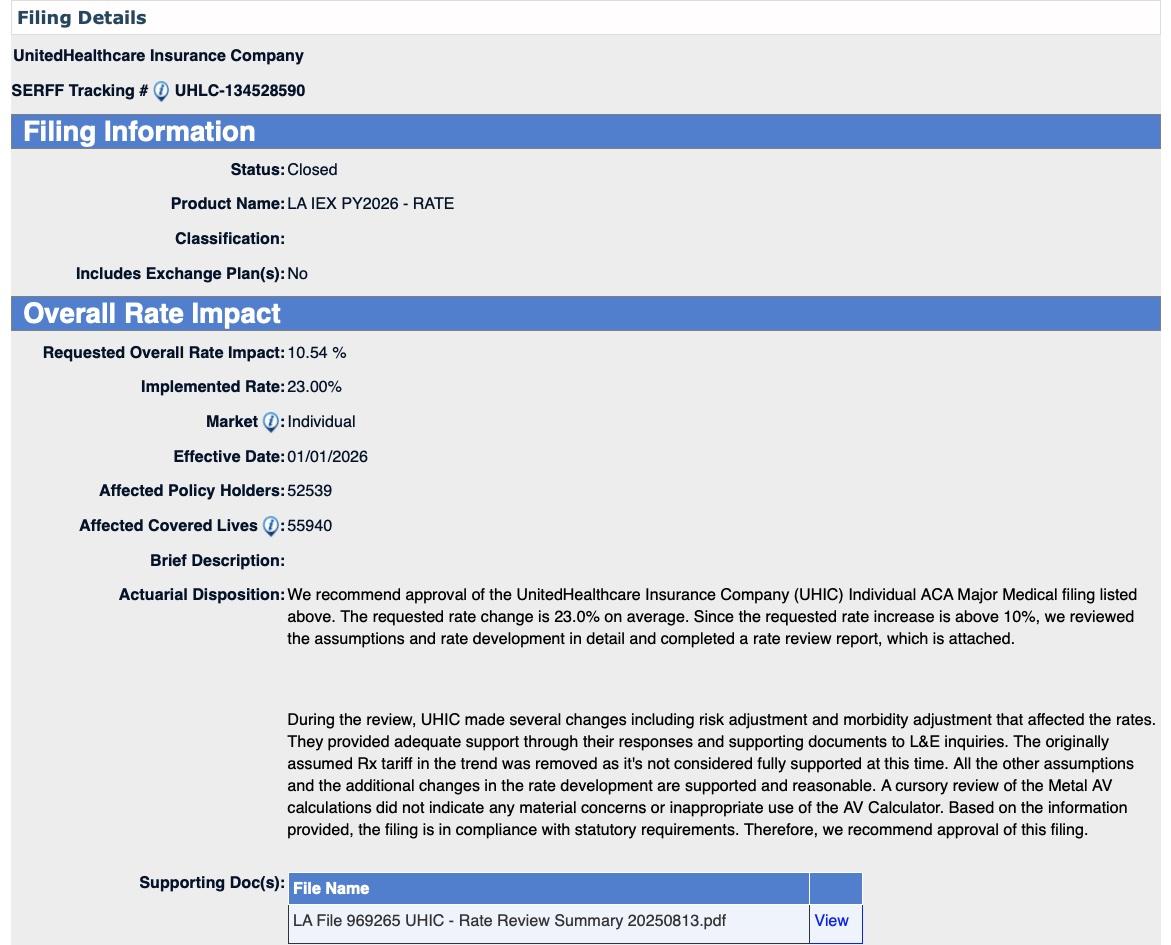

UnitedHealthcare:

UHIC is filing 2026 rates for individual products. The proposed rate change is 23.31% and will affect 55,940 individuals. The rate changes vary between 19.04% and 26.18%. Given that the rate changes are based on the same single risk pool, the rate changes vary by plan due to plan design changes.

The premium collected in plan year 2024 was $386,524,048. Incurred claims during this period were $188,754,887 and UHIC expects to pay $87,041,397 in risk adjustment. The loss ratio, or portion of premium required to pay medical claims, for plan year 2024 is 71.35%.

As noted above, CHRISTUS appears to be dropping out of the individual market. This means I can't run a fully weighted average rate change and instead have to use estimated enrollees for them.

Total 2025 Open Enrollment Period (OEP) on-exchange enrollment was 292,994; I'm assuming another ~14,000 off-exchange enrollees (based on 2024 liability risk score data from CMS), for a total of around ~307,000 individual market enrollees.

If so, that would mean CHRISTUS has roughly 35,000 enrollees, although they aren't included in the 2026 weighted average.

Overall, this gives a semi-weighted average rate hike being requested by individual market carriers in Louisiana of 21.9%.

It's important to remember that this is for unsubsidized enrollees only; for subsidized enrollees, ACTUAL net rate hikes will likely be MUCH HIGHER for most enrollees due to the expiration of the improved ACA subsidies & the Trump CMS "Affordability & Integrity" rule changes.

UPDATE 8/14/25: Ambetter and HMO Louisiana have submitted revised filings which, combined with my revising my estimate of the total LA individual market down to 286,000, results in the weighted average rate increase going up by 2 points to 23.9%.

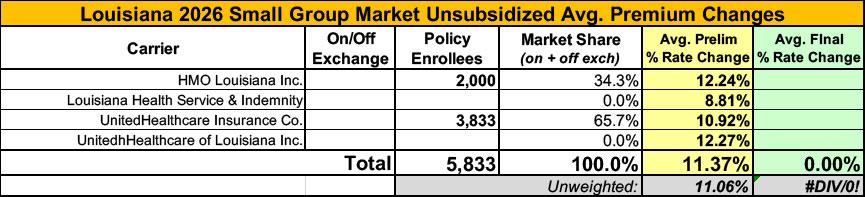

Meanwhile, I have no enrollment data at all for the small group carriers; the unweighted average 2026 rate hike there is around 11.4%

UPDATE 8/29/25: The Louisiana Insurance Dept. has published their approved 2026 rate filings for the individual market, which includes some minor tweaks to the requested rates. As a result the weighted average dropped slightly from 23.9% to 23.7%.