GAME BACK ON: 9 million total exchange QHPs possible by mid-August?

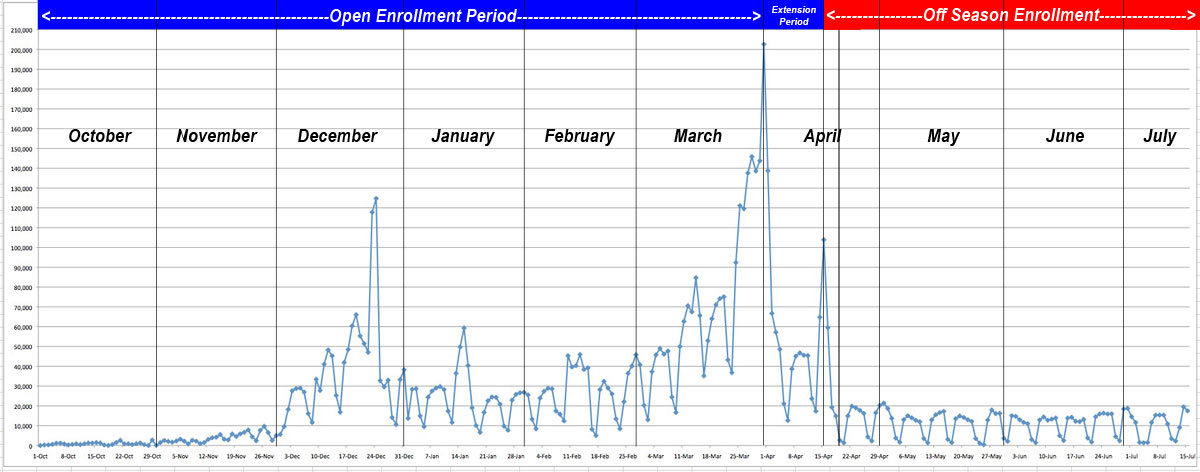

OK, I've had a chance to download the actual Excel file with the raw data and a handy graph already set up; I've cleaned up and color-coded the graph, and it's fascinating to look at, both during open enrollment as well as since it ended The things which stand out the most:

- The obvious dead zone in October and most of November, finally coming to live around Thanksgiving time

- The gradual rise in December, culminating in a large spike on Christmas Eve (the "official" deadline for January 1st coverage, although that varied in some states)

- The massive spike in late March, culminating in a nearly off-the-chart peak on the "official" open enrollment deadline of March 31st, which saw over 200,000 transactions by itself

- The smaller, but still impressive spike on April 15th (the "true" final deadline for the extension period, although a few states were still open even beyond that, notably Oregon and Nevada)

- And finally, the almost perfectly steady enrollment pattern during the off-season to date, from April 20th until now (the current data is cut off as of July 15th). Week in and week out, the pattern is the same: 1-2 thousand per day on weekends, 10-20 thousand per day during the week, then repeat.

(click image to launch higher-resolution version)

As for my "panic attack" a week and a half ago when I thought that off-season enrollments had cratered after July 1st due to the expiration of the COBRA extension period ended in every state except California, it now looks like this was a false alarm. I saw a massive drop-off in 3 states (Minnesota, Oregon and Hawaii) in the first week or so of July and assumed that the 7/01 COBRA cut-off was to blame; it now looks as though that was just a temporary lull due to the extended Fourth of July weekend. Not only did all three states start to bounce back again in my latest updates, but the HC.gov data shows the federal enrollments also jumping right back up again the very next week.

The only other factors I can imagine making a major dent in this pattern between now and November (when the next Open Enrollment period begins) are Labor Day weekend, possibly Election Day...and, just maybe, yesterday's Halbig decision, which may spook some people in the 36 "Federal" states into delaying enrollment, at least until they have a better idea of whether there will be any disruption to the subsidies while the process continues to play out (which is doubtful).

All of this being the case, while I'm still going to keep a close eye on any more sudden "dips", it looks like my original estimate of around 9,000 additional QHP enrollments per day (nationally) should hold steady straight through mid-November after all...which would add up to roughly 1.9 million additional enrollments on top of the 8.02 million as of 4/19, for a grand total of around 9.9 million people...and possibly even crossing the 10 million mark. Assuming a 90% payment rate, that may result in up to 9 million PAID exchange QHPs on the books for 2014.

I should also note that if I'm correct about my "9,000/day" estimate holding steady, the total number of exchange QHPs (whether paid or not) should cross over the 9 million mark sometime around August 10th, give or take. It'll be interesting to see if the Obama administation makes an announcement upon reaching that milestone...

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.