2026 FINAL Gross Rate Changes - Iowa: +15.3% avg (updated)

originally posted 7/17/25

via the Iowa Insurance Division:

Iowa Code §505.19 requires the Commissioner to hold a public hearing on a proposed individual health insurance rate increase which exceeds the average annual health spending growth rate as published by the Centers for Medicare and Medicaid Services of the United State Department of Health and Human Services. For 2026 the growth rate is 5.6%.

The Iowa Insurance Commissioner will hold a public hearing regarding the relevant rate increases on August 19, 2025.

The purpose will be to hear public comments on the proposed increase in the base premium rate. Consumers wishing to make a public comment at the hearing are encouraged to attend the hearing via the live webcast.

All comments received will be considered public records and will be posted here. The Consumer Advocate will present the public comments received at the hearing.

- 2026 Golden Rule - Pre-ACA

Golden Rule has requested a new rate increase effective Jan 1, 2026 for Generations 1-22 and 25-27; June 15, 2026 for Gens. 23; and June 1, 2026 for Gen. 24. The requested increase is 24.6%.

- 2026 Wellmark Inc. - Pre-ACA

Wellmark, Inc. has requested a new rate increase effective Jan. 1, 2026 for individual pre-ACA plans. The increase is an average premium increase of 6.9%, a minimum of 3.0%, and a maximum of 10.6%.

- 2026 Wellmark Health Plan of Iowa (WHPI) - Pre-ACA

WHPI has requested a new rate increase effective Jan. 1, 2026 for individual pre-ACA plans. The increase is an average premium increase of 3.70%, a minimum of 3.0%, and a maximum of 10.6%.

- 2026 Wellmark Health Plan of Iowa (WHPI) - ACA

WHPI has requested a new rate increase effective Jan. 1, 2026 for individual ACA plans. The increase is an average premium increase of 12.6%, a minimum of 5.3%, and a maximum of 17.6%.

- 2026 UnitedHealthcare Plan of the River Valley, Inc. (UHCPRV) - ACA

UHCPRV has requested a new rate increase effective Jan. 1, 2026 for individual ACA plans. The increase is an average premium increase of 15.6%, a minimum of 13.13%, and a maximum of 18.13%.

- 2026 Oscar Insurance Company (Oscar) - ACA

Oscar has requested a new rate increase effective Jan. 1, 2026 for individual ACA plans. The increase is an average premium increase of 6.6%, a minimum of -1.5%, and a maximum of 30%.

- 2026 Iowa Total Care - ACA

Iowa Total Care has requested a new rate increase effective Jan. 1, 2026 for individual ACA plans. The increase is an average premium increase of 10.26%.

- 2026 Medica Insurance Company - ACA

Medica Insurance Company has requested a new rate increase effective Jan. 1, 2026 for individual ACA plans. The overall proposed rate increase is 26.76%, a minimum of 8.74% and 47.73% maximum.

Unfortunately, all 5 of the filings are redacted so I don't know how much of the overall rate increases are due specifically to the IRA subsidies expiring, but they make it pretty clear that this is a major factor:

Medica:

Reason for Rate Change(s)

The significant factors driving the proposed rate change primarily include:

- Anticipated medical trend, in both utilization and the cost of services

- Changes to administrative expenses and margin load

- Changes to plan designs

- Expiration of ARPA Subsidies

- Updated claim experience and Other adjustments, such as provider reimbursement changes and pharmacy rebate adjustments

Iowa Total Care:

The 2026 rates reflect increases to unit cost, changes in administrative expense, and assumptions for the federal risk adjustment program. These factors, as well as changes to the assumed morbidity of the single risk pool especially due to the impending expiration of the enhanced premium tax credits (eAPTCs) and medical trend result in a premium rate increase.

Medical trend, or the increase in health care costs over time, is composed of two components: the increase in the unit cost of services and the increase in the utilization of those services. Unit cost increases occur as care providers and their suppliers raise their prices. Utilization increases can occur as people seek more services than before. Additionally, simple services can be replaced with more complex services over time, which is known as service intensity trend. An example of service intensity trend would be the replacement of an X-ray with an MRI scan. Replacing the service with a more intense service causes the total cost of medical services to increase.

The proposed rate change of 10.26% applies to approximately 7,089 individuals. Iowa Total Care’s emerging experience in 2025 shows an overall loss ratio under 80%, but this is expected to deteriorate during the subsequent months to align with the US emerging loss ratio of near 80%. In the absence of a rate increase in 2026, we expect this ratio to far exceed 80% mainly due to both the expiration of eAPTCs and the marketplace integrity proposals from CMS. The projected loss ratio is 80.0% which satisfies the federal minimum loss ratio requirement of 80.0%.

Oscar:

A second adjustment was included to reflect changes in the anticipated market morbidity in response to the uncertainty inherent in the marketplace. Specifically, Oscar anticipated changes to the market morbidity associated with the change in Iowa’s enrollment for the projection period relative to the experience period, due to the ending of the enhanced subsidies introduced by the American Rescue Plan Act, as well as the several new procedures and requirements introduced by the 2025 Marketplace Integrity and Affordability Proposed Rule.

UnitedHealthcare:

The Exchange User Fee reflecting the expiration of enhanced premium subsidies is [Redacted: TRADE SECRET] represented as a percentage of allowed claims in the development of the MAIR. [Redacted: TRADE SECRET]

Wellmark:

American Rescue Plan Enhanced Subsidy Expiration

The enhanced subsidies afforded in the American Rescue Plan are set to expire in 2026. Wellmark anticipates this change will result in worse market risk, driving rates up.

...The overall premium weighted average proposed rate change is ….…, with rate changes ranging from ….… to …...... If ARPA enhanced subsidies are extended in their current form into 2026, the average rate change would be ….….

As an aside, Iowa still has upwards of ~21,000 residents enrolled in pre-ACA individual market policies (aka "Grandfathered" or "Grandmothered" plans), nearly all of which are via Wellmark.

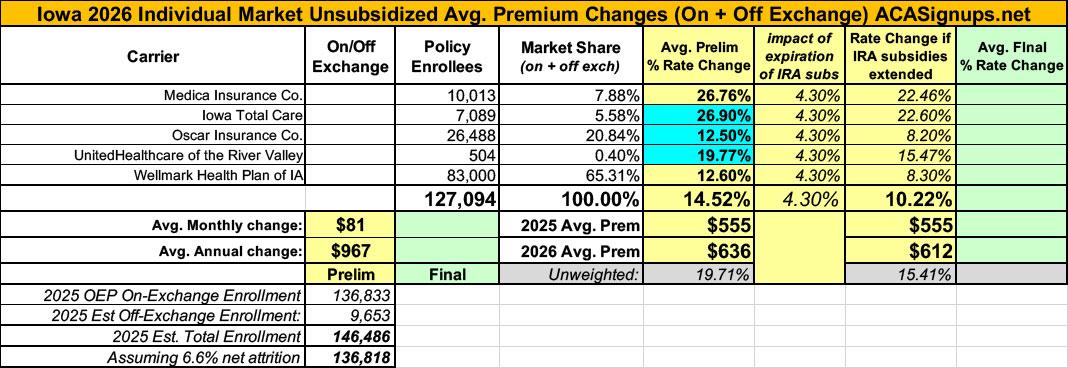

Overall, the weighted average rate increase being requested by Iowa individual market carriers is around 12.4%.

UPDATE 8/14/25: Iowa Total Care, Oscar Insurance and UnitedHealthcare of the River Valley have submitted revised filings bumping up the weighted average increase to 14.5%.

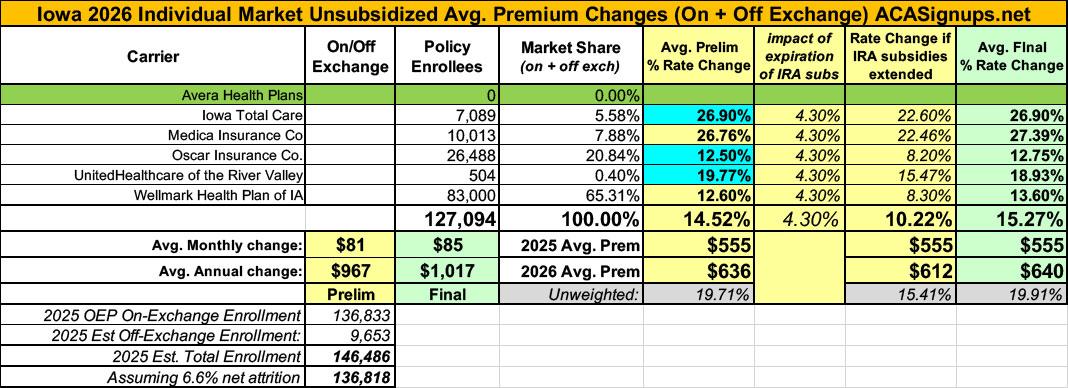

UPDATE 10/3/25: According to the latest filings uploaded to the SERFF database, the Iowa Insurance Dept. has approved final decisions for the individual market carriers. Overall, they come in at average increases of 15.3%, up slightly from the 14.5% preliminary filings.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.