Breaking: Trump's pollster confirms GOP is screwed if they let IRA tax credits expire

Presented with some comment (but mostly with a link to my state-by-state analysis of how much ACA exchange premiums are likely to skyrocket less than 6 months from now if the IRA subsidies expire):

via Politico, which has acquired the results of a poll conducted by Fabrizio/Ward, which is Donald Trump's own polling firm:

Our survey of voters in the most competitive Congressional Districts shows Republicans have an opportunity to overcome a current generic ballot deficit and take the lead by extending the healthcare premium tax credits for those who purchase health insurance for themselves. Without Congressional action, the tax credit expires this year.

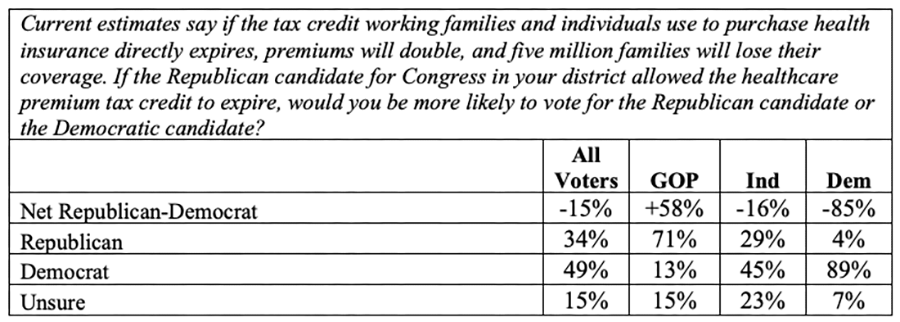

While the 2024 outcome for these districts was even, the generic Republican is down 3-points among all registered voters. Among those most motivated to vote, an early indication of vote likelihood in the midterms, the Republican is down 7-points. If the Republican candidate lets the premium tax credit expire, the Republican trails the Democrat by 15-points. There is broad bipartisan support for the tax credit and their extension.

Unlike recent changes to Medicaid which do not go into effect until after the midterm elections, voters on the individual insurance marketplace, who voted for Trump by 4-points, will begin getting notices of significant premium hikes this fall.

I should note that the claim that "changes to Medicaid don't go into effect until after the midterms" is overstated; many of the Medicaid provisions of the MAGA Murder Bill (OBBBA) have actually already started or will do so well before next November.

It is true, however, that insurance carriers will start sending out premium hike letters to enrollees this October ahead of the 2026 ACA Open Enrollment Period which begins on November 1st.

As for "using the individual market as a landing spot" for the Medicaid expansion population, this may poll well but I'd be stunned if it ever happened, as it would cost hundreds of billions of dollars MORE than Medicaid expansion for the same population does; I'll explain more on that below.

Generic Ballot

The 28 Congressional Districts surveyed include fifteen where the Republican won in 2024 by a margin of 5% or less and thirteen won by both the Democrat and President Trump. In aggregate, the Congressional vote was tied and President Trump won these districts by 4 points. It will be these districts that decide control of the House after the midterm election.

Currently, among all registered voters the generic Republican is trailing the generic Democrat by three points. Among the 65% of voters who rate themselves 10-out-of-10 motivated to vote, an early indication of who could turn out next year, the Republican trails by 7-points.

...Overwhelming Bi-Partisan Support for Premium Tax Credits & Their Extension

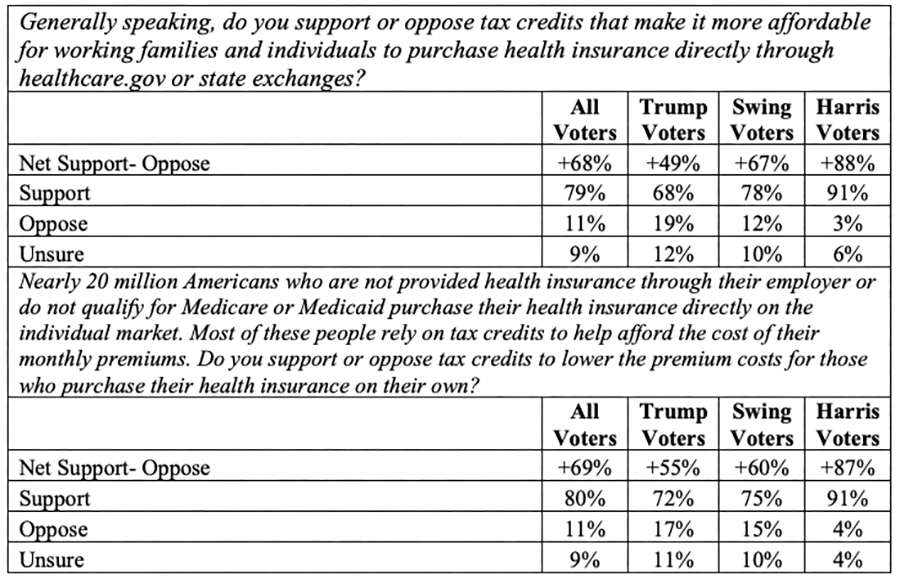

Nearly eight-in-ten voters support tax credits that make it more affordable for working families and individuals to purchase health insurance directly through healthcare.gov or state exchanges. Support comes from more than two-thirds of Trump voters and three-quarters of Swing voters, those voters that tell us they typically don’t vote a straight party ticket.

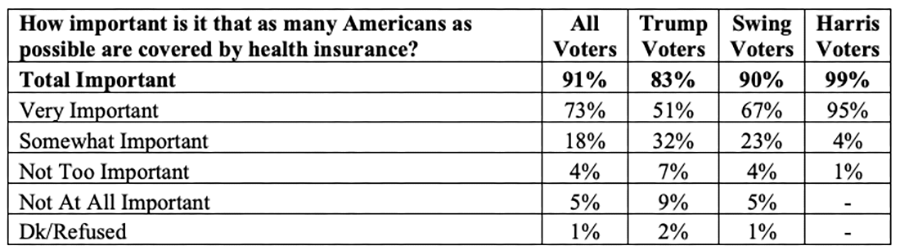

Support for the tax credit is higher (86%) among the 28% of voters who are either on the individual insurance market or have been in the past, but it is also very high (77%) among those with no personal connection to the marketplace. This can be explained in part by the overwhelming number of voters across the political spectrum that told us that it is important that as many Americans as possible are covered by health insurance. Voters don’t want to see people losing their health insurance.

Broad Support for Extending Premium Tax Credit

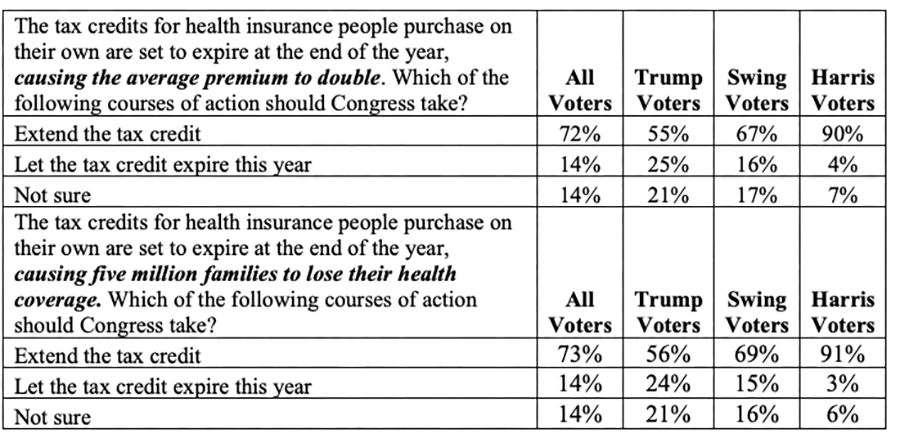

By broad bi-partisan margins, voters want to see the tax credits extended rather than expire at the end of the year, whether in the context of premiums doubling or 5 million families losing their health insurance. This includes solid majorities of Trump voters and Swing voters.

Even though most voters do not get their insurance from healthcare.gov, they understand the impact of doubled health care premiums. Asked if they could afford their health insurance premiums doubling, fewer than one in five said they could afford without it significantly disrupting their household finances, and nearly a third said they could not afford to pay the doubled premium.

...Political Penalty to be Paid by Republicans if Tax Credit is Not Extended

Republicans can expect a loss of support in these most competitive districts if the premium tax credit is not extended. Among all registered voters, a 3-point deficit becomes a 15-point deficit for the generic Republican they allowed the healthcare premium tax credit to expire. Among Independents, the GOP candidate moves from down 2-points on the initial generic ballot to down 16-points.

For what it's worth, there are 43 House Republicans who won by less than 15 points last fall.

OK, now we get to the "good news" for Republicans in the poll: A hypothetical, radical change in the way the ACA works:

GOP Benefit for Shifting Low Income Working-Age Adults from Medicaid to Individual Market Using Tax Credit

In addition to extending the tax credit, Republicans have an opportunity to pull ahead of the Democrats in these districts leveraging the premium tax credit as a landing spot for working-aged Medicaid enrollees.

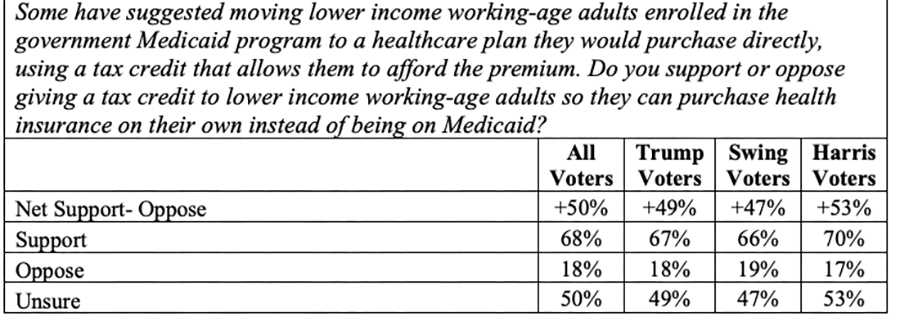

By a 50-point margin which varies little among Trump and Harris voters, voters support moving lower income working-age adults enrolled in Medicaid to a healthcare plan they would purchase directly, using a tax credit that allows them to afford the premium.

The Republican benefits politically by supporting this move. While the Republican candidate trials on the initial generic ballot, by supporting the Medicaid to individual market shift, the Republican leads the Democrat by 6-points. Among the 10-out-of-10 most motivated to vote, the Republican started 7-points behind the Democrat, and by supporting this policy, leads the Democrat by 4-points. Among Independents, the Republican candidate started out trailing by 2- points, and when supporting this policy, leads by 12-points.

Let's talk about this a bit. There are two possible scenarios this is talking about.

The first would be making two radical changes to the ACA as a whole:

- 1. Eliminating Medicaid expansion entirely, and

- 2. Extending ACA exchange subsidies to those earning less than 100% of the Federal Poverty Level (FPL)

Doing this would extend coverage to several million more Americans currently caught in the "Medicaid Gap" in 9 of the 10 non-expansion states, which would certainly be a good thing...however, doing so would also cost the federal government an absolute fortune more than Medicaid expansion does today, for several reasons:

- First, private ACA exchange plans cost around 27% more per enrollee than similarly comprehensive Medicaid plans

- Second, unlike Medicaid expansion where the federal government pays 90% of the cost, the feds cover 100% of the cost of ACA exchange tax credits

- Third, doing this would dramatically expand the subsidized ACA exchange rolls by several million people in the non-expansion states.

The second, and more likely scenario would be for Congressional Republicans to instead extend ACA tax credits only to those who get kicked off of Medicaid expansion for failing to meet the draconian paperwork requirements. As I noted recently, the OBBBA bill as passed & signed into law cruelly and specifically makes this population INELIGIBLE for ACA tax credits.

I could see Republicans "fixing" one of the very problems they created in the first place by passing another bill to make those kicked off the Medicaid program eligible for ACA tax credits after all; this would still cost a lot, but not nearly as much as a blanket expansion of subsidy eligibility, while providing them with the positive PR coverage the poll above describes.

However, doing this would still present a problem: Simply allowing those kicked off of Medicaid to receive ACA exchange subsidies would only do so for those earning 100 - 138% FPL. Those under the 100% FPL threshold would still be cast into the Medicaid Gap population, eligible for neither Medicaid nor ACA subsidies, unless such a bill included a special "under 100% FPL" exception.

Complicating things further: Even if they did include a special clause like this, it would mean that you'd have several million Americans below the poverty line who would be eligible for ACA subsidies because they failed to meet the work reporting requirements in the same states that millions of other Americans below the poverty line wouldn't be eligible for the same subsidies, which would be pretty tricky to defend.

I suppose this is conceivable, but I wouldn't bet on it.

Methodology:

Fabrizio Ward conducted a survey July 7-10, 2025 of 1,000 registered voters in the 28 most competitive House districts across the country – the 15 districts won by the current Republican member by a margin of 5% or less in 2024 and the 13 districts won by a Democrat but also won by President Trump. Interviews were conducted evenly across the 28 districts. Quotas were set by age, gender, partisan registration, education, and race/ethnicity. Data was weighted by district, age, gender, recalled 2024 vote, education, and race/ethnicity. Margin of sampling error for n1,000 is ±3.1% at the 95% confidence level. The interviews were conducted via cell phones (35%), landlines (25%), and SMS-to-Web (40%) to voters sampled from the voter file.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.