MAGA Murder Bill: CBO: "8.2M will lose ACA coverage!" Wakely: "Hold our beer."

A few weeks ago, the Congressional Budget Office (CBO) issued their official projection of just how much damage the combined effect of the House GOP's budget reconciliation bill (officially the "One Big Beautiful Bill Act") would cause to healthcare coverage in the U.S.: Over 16 million Americans would lose coverage, over half of whom (~8.2 million) are currently enrolled in ACA exchange plans.

If this happens, it would mean the ACA exchange market would drop by more than 1/3 from the ~24.2 million currently enrolled (myself & my own family included).

However, I've repeatedly stated that even this is likely a low estimate--the remaining ~16 million exchange enrollees would still be hit with MASSIVE (and in some cases eye-poppingly huge) premium hikes which would force them to drop to far worse plans (meaning much higher deductibles & co-pays; worse provider networks and so on).

There's also the ripple effect of insurance carriers either shrinking their footprint or dropping out of the exchange market altogether, as Aetna/CVS recently announced.

Today, Wakely Consulting Group--one of the largest & most respected healthcare actuarial firms in the country--appears to agree with me, and then some:

New Wakely white paper explores potential impacts of House Reconciliation Bill on ACA Individual Market Coverage

Future market will look fundamentally different as enrollment declines

A new white paper released today by Wakely Consulting Group, an HMA Company, (Wakely) examines the potential enrollment and premium impacts of the House budget reconciliation bill, H.R. 1, and the expiring subsidies for the ACA Individual Market.

“Future of the Individual Market: Impact of the House Reconciliation Bill and Other Changes on the ACA Individual Market” analyzes the effects of both the House budget reconciliation bill and the expiration of enhanced premium tax credits (ePTCs). It determines the individual market will look fundamentally different when the full effects of all proposed changes occur. Specifically, the combination of ePTC expiring and full enactment of H.R. 1 could reduce individual market enrollment by 47% to 57% or between 11.2 and 13.6 million individual market enrollees.

“This range includes both direct impacts on subsidized individuals due to net premium increases after premium tax credits and loss of unsubsidized enrollment between 3.9% and 6.1% following significant gross premium increases,” the paper states. “Non-Medicaid expansion states would see especially large enrollment losses with reductions in enrollment ranging between 53% and 64%.”

“This report shows that the totality of the proposed Congressional changes and the expiration of ePTC could lead to a much smaller and less stable individual market,” said Michelle Anderson, FSA, MAAA, one of the paper’s authors. “Enrollment could shrink to the lowest it’s been since the culmination of the ACA Marketplaces in 2014. Remaining enrollees are likely to be sicker and to have higher healthcare needs than those who will drop coverage, which in turn will weaken the risk pool and drive up premiums.”

Other key findings from the Wakely paper include:

- Estimated combined effects could increase gross market average premiums between 7% and 11.5% because of market attrition and residual risk pool morbidity increases, not accounting for incremental claims cost trend impacts.

- H.R. 1 alone could reduce enrollment by 22% to 27%, or 5.2 to 6.4 million enrollees, when layered on top of the expiration of ePTCs.

- Enrollment and premium impacts varied greatly by state; the range of enrollment reductions in some states exceeded the national average range of 47% to 57%, and premium changes also varied more widely than the average increase of 7% to 11.5%.

The white paper analysis of the sunsetting ePTCs and the House budget reconciliation bill effects includes the provisions outlined in the proposed program integrity and affordability rule on the ACA-compliant individual market. Authors used various methodologies, as well as unique data provided by State-Based Marketplaces (SBM) to develop a range of impacts on enrollment and premiums within the individual market. The data represents roughly 50% of the SBM enrollment population. While the full effect of many of the provisions may not be fully realized until 2028 or later, for simplicity, Wakely estimated a range of steady state effects of all changes as if they occurred in 2026.

- The combination of ending passive enrollment and pre-enrollment verification is estimated to reduce enrollment between 1.5 million and 3.3 million. The wide range of enrollment losses is driven by uncertainty about the impact of pre-enrollment verification which will be highly dependent on how it will be defined and enforced by CMS and operationalized by State Based Marketplaces and Healthcare.gov.

- The pre-enrollment verification program alone is estimated to result in coverage losses of 720,000 to 2.2 million people.

The white paper itself also includes some critical additional warnings, which I noted above:

If all provisions modeled go into effect, individual market enrollment could drop by 47 to 57 percent in 2026 (assuming full impact is seen in the first year), resulting in only 10.1 to 12.5 million enrollees remaining in the individual market.

Further, the enrollees who do remain could see their premiums rise solely because of shifts in single risk pool morbidity between 7.0 percent to 11.5 percent on average, based on gross premium costs before PTC. Those with PTC could experience significantly higher net premium cost increases.

It is important to note that these estimates do not account for other factors, such as rising healthcare costs or issuer market exits, which, in combination, could make the increases significantly higher. Note these premium changes account for morbidity and fixed cost per member per month (PMPM) increases from a smaller enrollment base; they do not account for metal level re-sloping, mix changes (e.g., age and region), trends, or reductions due to CSR funding and will vary based on a member’s plan selection.

The expiration of ePTCs and CSR funding could result in substantial premium increases for lower-income members. For example, in states with significant silver-loading—where gold plan premiums are lower than silver plans’—many low-income individuals now pay little or nothing for gold level coverage.

Without these subsidies, monthly premiums could rise dramatically. For example, a state with this dynamic could increase net premiums for households with incomes less than 150 percent of FPL by $100 per month (from previously being free) or those with earnings of greater than 150 percent of FPL by more than $200 per month, if they want to maintain the same level of coverage. These increases would likely be unaffordable for many households, potentially forcing them to downgrade to less generous plans or to leave the Marketplace altogether.

Unfortunately, the white paper doesn't break out their estimates by state, but they do break it out between the 40 states (+DC) which expanded Medicaid under the ACA and the 10 which haven't done so:

- Expansion states: Between 41 - 49.8% of exchange enrollees would lose coverage; gross premiums would increase between 6.5 - 10.5%

- Non-Expansion states: Between 53 - 64.3% of exchange enrollees would lose coverage; gross premiums would increase between 7.5 - 13%.

Oh yeah, there's also this:

The modeling did not include Massachusetts and the District of Columbia due to their merged market status. Additionally, no analysis was conducted on enrollment in basic health plans (BHP). Inclusion of these states/programs would increase the total enrollment losses.

For what it's worth:

- Both MA & DC are Medicaid expansion states, so if you assume the ~45% midpoint for them, that would be an additional ~182,000 losing coverage.

- A study by the New York Health Dept. estimates that around 224,000 of their ~1.64 million BHP enrollees would lose coverage, or roughly 14% of the total. If you assume a similar percentage in MN & OR, that'd be around 251,000 across all 3 states.

This would bring the grand total up to somewhere between 11.6 - 14.0 million losing coverage out of the ~26 million exchange QHP + BHP enrollees nationally.

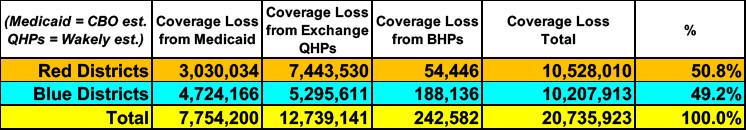

UPDATE: Last week I broke out the CBO's projection of ~16 million losing coverage total (between Medicaid, ACA exchange enrollees & BHP enrollees combined) between red & blue House districts to get a sense of political impact. My conclusion was that it would hit blue districts slightly higher, but woul actually be pretty much a wash: Roughly 8.0 - 8.1 million in each category.

Assuming the Wakely projection (for ACA exchange enrollees alone) proves to be more accurate, however, here's what the red/blue breakout would look like:

In this scenario, the balance shifts over to the red districts (~10.5 million vs. ~10.2 million in blue districts) due to both a) there being more exchange enrollees in red states overall and b) Wakely projecting higher exchange losses as a percent of total enrollees in NON-expansion states than expansion states.

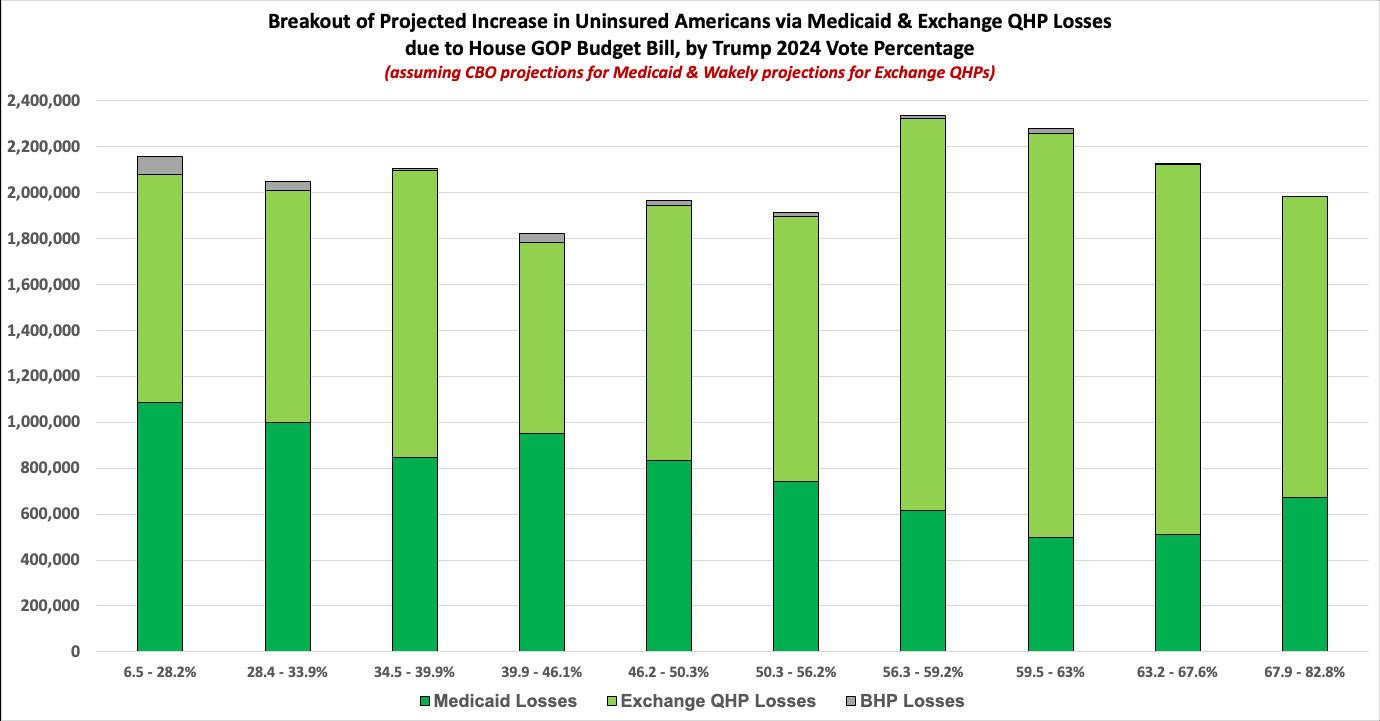

Broken out into partisan-lean brackets it looks very much the same: Huge numbers everywhere but a slight lean towards the redder districts (ie, broken out by Trump's 2024 vote percent):