2026 FINAL Gross Rate Changes - Vermont: +6.7%, WAY down from 17.4% requested...but BCBS is on verge of insolvency??

via Vermont's Green Mountain Care Board:

May 13, 2025

Green Mountain Care Board Receives 2026 QHP Rate Requests Amid Rising Health Care Costs

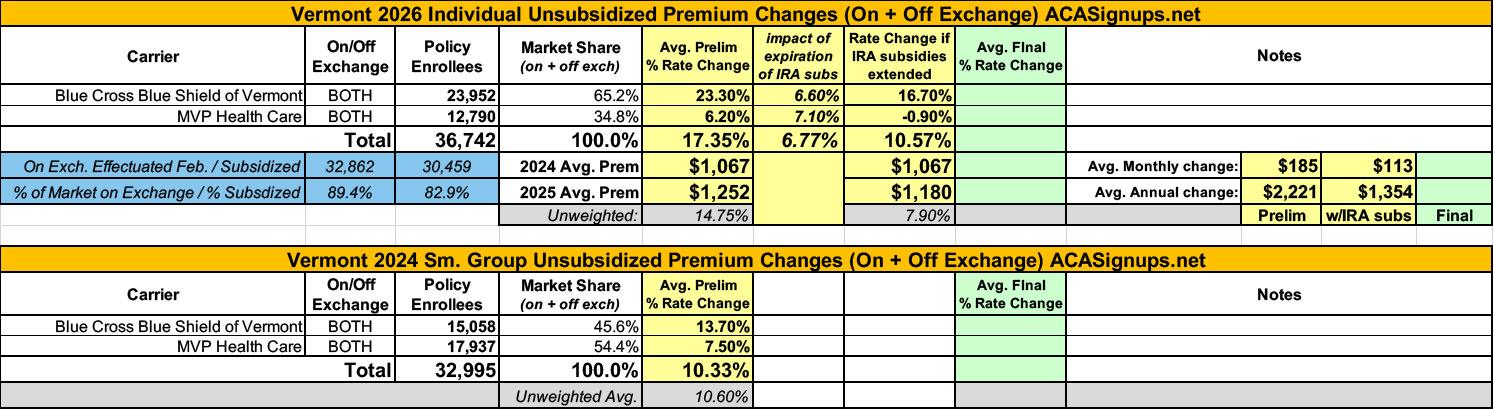

Montpelier, VT – On May 12, 2025, the Green Mountain Care Board (GMCB) received the 2026 individual and small group health insurance premium rate filings from BlueCross and BlueShield of Vermont and MVP Health Plan. The filings will be posted on GMCB’s rate review website. The average rate increases being requested are shown below:

- Blue Cross Blue Shield of VT

- Individual Market: 23.3%

- Small Group Market: 13.7%

- MVP Health Plan

- Individual Market: 6.2%

- Small Group Market: 7.5%

The filings mark the beginning of a multi-month public review process led by the GMCB, during which GMCB hears from its actuaries, the carriers, the Health Care Advocate, the Department of Financial Regulation, and the public. Final decisions are expected to be issued in August.

The proposed rates may change during this review period, including due to potential changes at the federal level. For example, the proposed rates for the individual market reflect increases due to the anticipated loss of federal enhanced premium tax credits. Absent Congressional action, these enhanced tax credits will expire on December 31, 2025, and may result in higher net premium increases for individuals.

GMCB has scheduled public rate review hearings for:

- BlueCross and BlueShield on Monday, July 21 at 8:00 a.m.

- MVP on Wednesday, July 23 at 8:00 a.m.

GMCB is accepting public comments on these filings on an ongoing basis through July 28, 2025. Additionally, a Public Comment Forum will be held on Thursday, July 24 at 4:00 p.m. to provide Vermonters with an opportunity to share their perspectives directly with the GMCB.

Additional information about these meetings, including how to attend or participate, will be posted to the GMCB website. Meeting materials and filing documents will also be posted as they become available.

According to BCBS VT's Actuarial Memo, of the whopping 23.3% average rate hike they're asking for, 6.6 points of it (28% of the total hike) is due specifically to the anticipated expiration of the enhanced IRA premium subsidies:

At the time of this filing, the enhanced Advanced Premium Tax Credits (APTC) currently available to individuals are set to expire at the end of 2025. Due to the lower APTC expected in 2026, we project that some individuals will leave the QHP market. We estimated that this will increase the overall morbidity of the individual market and this resulted in an additional increase of 6.6 percent for the individual market only.

...as of this date, Congress has not extended them. The expiration of these federal benefits increases premium costs for individuals and families and is expected to result in more people deciding to forego insurance coverage. This will shrink the population with coverage and worsen the risk pool requiring higher premiums for the remaining members.

BCBS VT doesn't just say they anticipate a drop in enrollment; they lay out the exact number of enrollees they expect to drop coverage for every policy offered on the exchange, which is pretty impressive. Overall, they expect individual market enrollment to drop from 23,952 to 20,935 (12.6% of enrollees), while they don't expect any significant change in small group market enrollment (15,058).

It's also worth noting that Vermont, which used to have a merged individual & small group market, recently enacted legislation to permanently unmerge the two, joining nearly every other state (I think Massachusetts is the only state which has a merged indy/sm group market now).

BCBS VT also addresses the potential for Silver Loading to be terminated by Congressional Republicans:

For plan year 2026, the Green Mountain Care Board requires that QHP issuers use a silver load of 41.94%. Blue Cross VT continues to support this effort to increase the federal Advance Premium Tax Credits for Vermonters who qualify for these benefits. At the same time, this guidance introduces complexity for members during the open enrollment season.

First, on-exchange Silver Plans will, similarly to 2025, have higher premiums than Gold plans. Blue Cross VT plans to continue to work with other stakeholders to ensure that the messaging is consistent and that members are supported through open enrollment.

On May 2, 2025, CMS released a bulletin to provide technical direction in light of potential Congressional action related to the cost-share reduction (CSR) program. If Congress appropriates federal funds to fund the CSR program, Blue Cross VT will work with other Vermont stakeholders to understand the impacts to the Vermont QHP individual market.

According to MVP Health Plan's actuarial memo, they had 9,312 policyholders and 12,790 effectuated enrollees as of February. Regarding the IRA subsidies, they state:

The IRA-enhanced Advanced Premium Tax Credit (APTC) subsidies are currently set to expire at the end of 2025. A disproportionate share of healthy members are expected to leave the market, resulting in increased morbidity.

...MVP assumed the lapse of 25% of contracts that receive APTC subsidies and have one HCC. The overall disenrollment would be 17% of MVP's total individual market membership (which is in line with the estimates from the CBO and the carrier survey). Removing the claims and membership for these members from our population (which simulates these members leaving the market in total) results in a morbidity impact of 7.1%.

If the current law is amended to extend APTC enhancements through 2026, MVP reserves the right to modify the submitted rates. We have provided additional rate filing exhibits in SERFF that reflect our alternate rates if the subsidies are extended as currently in place. The impact is the removal of the 7.1% morbidity assumption in the indext rate development. MVP recognizes that the amount of the federal premium tax credits could change in which case, the estimated rate impact may differ from the two scenarios provided.

Here's what it looks like when you put it all together: The weighted average preliminary rate hikes are 17.4% for the individual market and 10.3% for the small group market.

On the individual market, the weighted average impact of IRA subsidies being allowed to expire is 6.8%, which means that if approved as is, avg. 2026 ACA premiums in Vermont will be 6.8% higher than they otherwise would be, costing unsubsidized enrollees an extra $72/month or $864/year.

Remember, that's on top of the dramatic rate hikes for subsidized enrollees caused by the subsidy expriation itself.

Click graphic for high-res version:

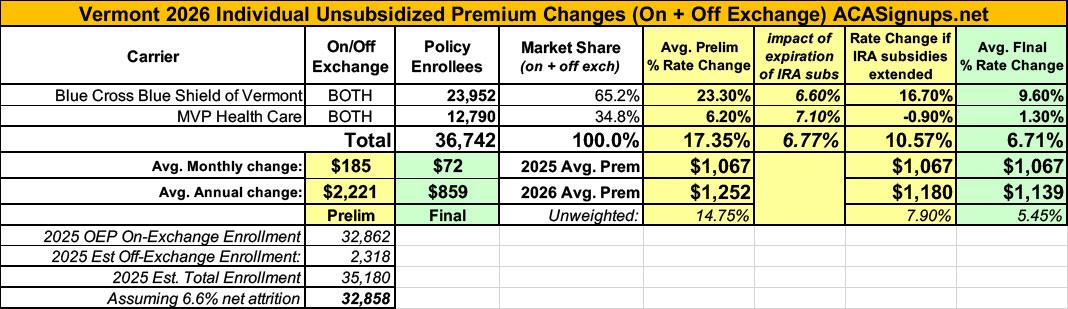

UPDATE 8/29/25: Wow. The Green Mountain Care Board has issued their decisions on the individual & small group market filings...and have cut them all way down. Via VT Digger:

Vermont’s top health care regulator ordered health insurers selling plans on the state’s Affordable Care Act marketplace to keep their premium price increases for next year much lower than the companies proposed in May.

On Friday, the Green Mountain Care Board released its final decision on the percentage increase that it would allow. The order impacts so-called Qualified Health Plans sold on Vermont Health Connect to both individuals and small groups. The regulatory board reviews proposed price increases for these plans annually.

This year, Blue Cross Blue Shield of Vermont, which is one of only two insurers that sells plans on Vermont Health Connect, initially requested a 23.5% increase in rates for the individual insurance market and a 13.5% increase for its small group market plans. The care board ultimately approved a 9.6% and 4.4% increase, respectively.

MVP Health Plan Inc., the other insurer selling plans on Vermont’s marketplace, initially requested a 6.2% increase for its individual market plans and an increase of 7.5% for its small group plans. Again, the care board approved rate increases that are far lower than those requested: 1.3% for individual plans and 2.5% for the small group plans.

The decision comes as Vermonters face higher insurance premiums than do residents of any other state and as Blue Cross Blue Shield of Vermont risks insolvency.

Hoo boy...that last line...

In any event, here's what the individual market numbers look like in the end: The weighted average drops from 17.4% to just 6.7%...by far the largest reduction I've seen so far this year.

The actual decisions (see PDFs below). The one for BCBS will definitely raise an eyebrow or two:

Blue Cross and Blue Shield of Vermont (BCBSVT or the Company), one of two carriers offering individual and small group health insurance coverage in Vermont, seeks to increase its premiums in 2026 by an average of 23.5% for its individual plans and an average of 13.5% for its small group plans. Based on our review of the record, we modify BCBSVT’s proposed rates and then approve the filings. As modified, we expect BCBSVT’s premiums to increase, on average, 9.6% for individual plans and 4.4% for small group plans. In orders issued today in connection with this decision, we also require the Company to implement reforms aimed at protecting its solvency and reducing its need for high premium increases.

During the Board’s review of these filings, BCBSVT witnesses provided candid, thoughtful testimony that struck at the core of some of Vermont’s health system challenges. The Board appreciates BCBSVT’s diligence in responding to requests for information in these proceedings, as well as its efforts more generally to provide the Board, the Legislature, and the public with information needed to address many of the difficult dynamics in our healthcare markets. While this order is critical of some aspects of the Company’s role in those dynamics, we recognize BCBSVT’s professional and respectful approach in connection with our review and decisions, as well as the Company’s collaborative efforts to try to improve healthcare for Vermonters.

BCBSVT’s requests highlight the tension inherent in the rate review standard, which requires the Board to consider competing factors, including consumer affordability, access, and fairness, as well as actuarial soundness and insurer solvency. The affordability and access challenges presented by these filings are obvious: Vermont already has some of the highest individual and small group rates in the country; BCBSVT, which has higher rates than its competitor, seeks enormous increases after years of double-digit growth; and on top of the increases the Company implements next year, changes in federal law will make individual rates more expensive for most people. At the same time, BCBSVT’s solvency remains challenged, and its insolvency would not promote affordability, access, or quality.

The Board’s orders seek to strike a balance between the competing rate review factors. The orders also reflect that BCBSVT’s solvency challenges are amplified by losses in other markets, and 1by its relations with hospitals. BCBSVT has lost enormous reserves in recent years—more than it lost on its individual and small group plans—from other business lines, including its products for self-funded groups, Medicare Advantage and Part D products, Medicare Supplement offerings, and in connection with large litigation settlements. BCBSVT’s filings seek to disproportionately and inequitably build back reserves from Vermonters on its individual and small group plans.

BCBSVT has also been ineffective in negotiating contracts with Vermont hospitals that reflect (1) BCBSVT’s financial situation, (2) BCBSVT’s members’ ability to pay increased healthcare costs, and (3) the exceedingly high prices certain hospitals charge BCBSVT. The Company has failed to push back on hospital requests to increase rates for certain services above the commercial rate caps in the Board’s budget orders and has failed to reject hospital assertions that budget orders provide a revenue guarantee. While BCBSVT explains that it is unable to effectively negotiate given market dynamics, recent history suggests the status quo does not work, and that simply increasing rates will be inadequate, perpetuate market dysfunction, and result in more large premium increases in the future.

The Board has appointed a liaison to oversee certain aspects of the University of Vermont Medical Center’s (UVMMC) and the University of Vermont Health Network’s (UVMHN) operations. The Department of Financial Regulation (DFR) recently issued an order prohibiting BCBSVT from contracting with certain hospitals without first demonstrating that the agreements “support a material reduction in commercial insurance premiums while protecting the insurer’s solvency.” DFR’s order also allows for the appointment of a liaison. These steps, taken together, and in conjunction with the Board’s supplemental orders, will promote BCBSVT’s solvency, ensure fair and equitable contracting, support appropriate claims management, and reduce the need for large premium increases.

Lastly, the Board is concerned with the substantial pay increases that BCBSVT executives have received during a period of financial deterioration and while Vermonters have struggled under punishing premium increases. In 2022, 2023, and 2024, BCBSVT requested large, double-digit rate increases in these markets, ranging from 11.4% to 22.9%, and the Company’s reserves plummeted, dropping $24.4 million in 2022, $23.8 million in 2023, and $29.3 million in 2024. Yet from 2021 to 2024, BCBSVT increased the salaries1 of its CEO and VP/Treasurer by approximately 38% and 40%, respectively. It also paid its executives approximately $280,000 in retention incentives, $910,600 in affiliation/project incentives, and $1,852,275 in variable compensation ($3.04M in total).

We are encouraged that BCBSVT is considering adding goals to its variable compensation plan in 2026 related to, for example, quality and value-based contracts. However, the large payments made in 2022 – 2024 were not adequately justified, are inconsistent with BCBSVT’s performance, and do not reflect efficient and economical management of a small, non-profit insurer in BCBSVT’s situation. Variable compensation for 2025 also conflicts with Vermont’s principles of healthcare reform as a key component of an award is directly tied to Vermonters paying more in healthcare premiums. Specifically, variable pay for 2025 is tied to underwriting gains, which, in turn, depend significantly on BCBSVT increasing its rates in these markets to fund the large CTR it requested.

MVP Health Plan, Inc. (MVP), one of two carriers offering individual and small group health insurance coverage in Vermont, submitted filings to increase its premiums in 2026 by an average of 6.2% for its individual plans and an average of 7.5% for its small group plans. Based on our review of the record, including the testimony and evidence presented at a hearing on July 21, 2025, we modify the proposed rates and then approve the filings. As modified, we expect premiums to increase, on average, approximately 1.3% for MVP’s individual plans and approximately 2.5% for MVP’s small group plans. In orders issued today in connection with this decision, we also require MVP to implement reforms aimed at reducing future premium increases and improving quality care.

MVP’s requests highlight the tension inherent in the rate review standard, which requires the Board to consider competing factors, including consumer affordability, access, and fairness, as well as actuarial soundness and insurer solvency. The affordability and access challenges presented by these filings are substantial; Vermont already has some of the highest individual and small group rates in the country. MVP may have lower rates than its competitor, but its increases since 2021 have exceeded Vermont wage growth. Moreover, changes in federal law will make individual rates more expensive for most people.

The Department of Financial Regulation (DFR) recently issued an order prohibiting MVP and Blue Cross and Blue Shield of Vermont, the other carrier in these markets, from contracting with certain hospitals without first demonstrating that the agreements “support a material reduction in commercial insurance premiums while protecting insurer’s solvency.” The provision, in conjunction with the Board’s supplemental orders, will ensure fair and equitable contracting, support appropriate claims management, and reduce the need for large premium increases.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.