Silver Loading coming full circle? Republicans may be about to damage the ACA in the most ironic way...

Over at Evensun Health, Wesley Sanders has written about two new bulletins from the Centers for Medicare & Medicaid Services (CMS) which, if followed to their conclusion, would cause massive changes to how ACA individual market policies are priced and marketed...along with dramatic changes to net premiums, deductibles, co-pays & other out of pocket expenses for exchange enrollees.

Warning: This one is not only absurdly wonky, it requires me to fire up the Wayback Machine and dig deep into the ACA's 15-year history. I actually wrote about this prospect back in January, but I haven't read or seen anything else about it since then...until today.

Here's the very short, very simplified version:

- The ACA includes two types of financial subsidies: Advance Premium Tax Credits (APTC), which reduce monthly premiums; and Cost Sharing Reductions (CSR), which cut down on deductibles, co-pays & other out-of-pocket (OOP) expenses for low-income enrollees.

- In 2014, then-Speaker of the House John Boehner filed a lawsuit on behalf of Congressional Republicans against the Obama Administration, in part because they claimed that CSR payments were unconstitutional because they weren't explicitly appropriated by Congress in the text of the Affordable Care Act.

- A long legal process ensued, the end of which resulted in a federal judge ruling in the GOP's favor and ordering that CSR payments stop being made...but also staying that same order pending appeal of her decision by the Justice Department (then still run by the Obama Administration).

- After Donald Trump took office the first time around in 2017, he started publicly threatening to "cutting off" CSR payments...and eventually did just that by having the Justice Dept. drop the appeal of the court decision on the CSR lawsuit.

- The way the CSR program worked until this point was unusual: Since the exact amount of OOP expenses varies widely month to month, insurance carriers would cover these costs up front and then submit their receipts to the federal government to be reimbursed.

- In other words, it wasn't the CSR assistance itself which Trump cut off; it was the reimbursement payments to the insurance carriers. (Put another way, the Trump Administration started stiffing federal contractors, which may sound familiar, but I'm getting off topic...)

Are you with me so far? OK, now we get to Chapter 2 of this ongoing saga:

- Ever since then, in order to prevent having to eat the costs of billions of dollars in CSR assistance, insurance carriers have instead simply jacked up their premiums to cover their CSR losses...and in most cases have placed the full load of CSR costs on Silver plans only, a practice known as...Silver Loading.

Here's a simple example of how Silver Loading works:

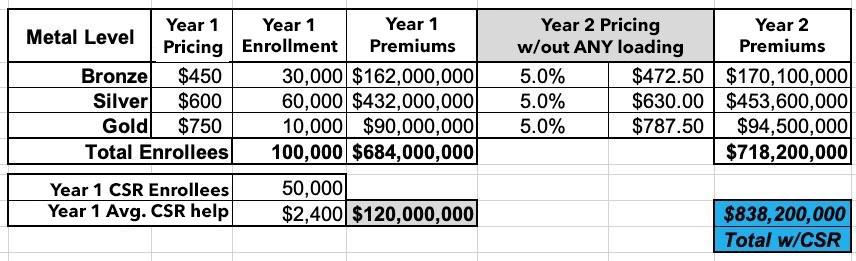

Let's say in a carrier projected that overall claim expenses in the next year would increase around 5%. To keep things simple, let's say they offered just 3 plans: One Bronze, one Silver (which happends to also be the "benchmark Silver" used to determine subsidies) and one Gold, priced at an average of $450, $600 and $750/month.

This carrier had exactly 100,000 enrollees & had to pay out $120 million in CSR assistance in Year 1. They assume that total enrollment and their CSR costs will be around the same (and the same ratios) for Year 2

Since they know they won't get reimbursed from the federal government for that $120M in CSR costs, simply raising their premiums by 5% would mean having to eat a $120 million loss. Ouch:

So, what did they start doing instead? They loaded their projected CSR losses onto the premiums.

Basically, they took the total amount ($120 million), divided that by 12 months ($10 million/month) and then divided that across their projected enrollment to figure out how much to tack onto each enrollee's monthly premium to make up the difference.

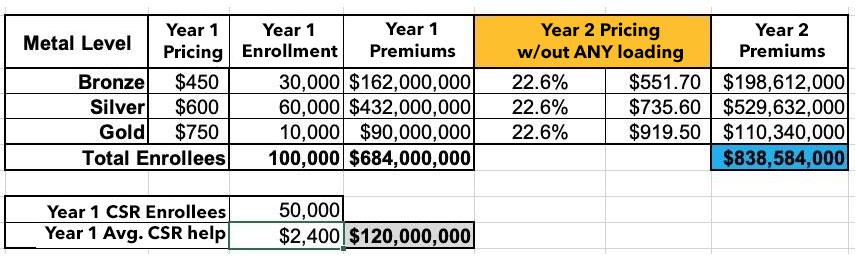

Now, if they simply divided that $10 million/month across all of their enrollees, regardless of the plan, they'd have to raise their premiums for every plan by around 22.6% to make up that difference, like so. This is called Broad Loading:

In 2018, some carriers did it this way, but most carriers in most states did something very smart instead: They Silver Loaded.

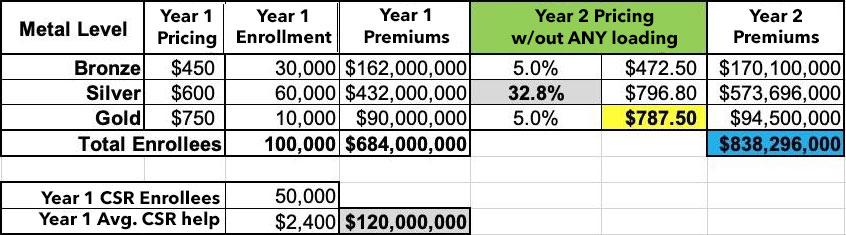

Silver loading involves concentrating the CSR costs so that they're only added to the Silver plans on the ACA market (as opposed to Bronze, Gold or Platinum). This means that instead of every plan going up by 22.6%, the Silver plans went up ~33% while the other metal tiers only went up ~5%:

The good news is that doing it this way holds Bronze and Gold plan enrollees harmless (along with Platinum enrollees, although there aren't many of those these days anyway).

The bad news is that Silver plan enrollees, who make up the bulk of all ACA enrollees, are royally screwed, right?

Well...no. Those who are unsubsidized are indeed screwed--they have to either downgrade to a Bronze plan or upgrade to a Gold plan to avoid getting hit with that 33% rate hike (in the latter case, notice that the Gold plan actually costs less at full price now even with the lower deductible...it's now a better value!)

However, the vast majority of exchange enrollees receive APTC subsidies...and the formula for those subsidies are based on the price of the 2nd lowest-cost Silver plan...but they can be applied towards any plan.

This is important for two reasons:

- First, it means that subsidized Silver plan enrollees see their subsidies increase by roughly the same rate that the premiums increased: Silver premiums go up ~33%, APTC subsidies go up ~33%. So they end up paying pretty much the same amount either way.

- Second, notice again that the Gold plan now costs LESS than the Silver plan...but the subsidies have still gone up as much as the Silver plan!

Let's say an enrollee qualified for $400/month in APTC in Year 1 (because the maximum they have to pay for the benchmark Silver is $200/month). In Year 2, their APTC would increase from $400/mo to $597/month...but they can use that $597/mo for any plan.

The Silver still costs them $200/mo, but suddenly the Gold plan, which would have cost $350/mo in Year 1, only costs $190/mo in Year 2! (Alternately, the Bronze plan, which would have cost them $50/mo in Year 1, will cost nothing in Year 2 since the APTC amount is actually more than the full-priced Bronze premium).

In a bit of tremendous irony, in attempting to sabotage the ACA, Donald Trump ended up unintentionally strengthening it. (And no, I guarantee you this was not some type of 11th Dimensional Chess move on his part; he barely understands how the ACA works much less how CSR subsidies operate).

By 2019, nearly every carrier in every state was Silver Loading, and as of today I think Mississippi is the only state which doesn't, though I could be wrong about that.

Silver Loading has resulted in millions of subsidized ACA exchange enrollees receiving more financial help than they would have otherwise, since a Bronze or Gold plan would now cost either about the same, less, or even nothing in premiums depending on where the enrollee lives.

This meant that the carriers got to be made whole on their CSR losses while millions of enrollees received more financial help and thus had lower net premiums for their policies.

And this is how things have been operating for the past seven years or so.

Still with me? OK, that brings things up to date.

Here's the thing: If cutting off CSR reimbursement payments resulted in Silver Loading becoming widespread, and Silver Loading led to higher APTC subsidies...what would be the results if the reverse were to happen?

Well, if CSR reimbursement payments were to be reinstated, that would mean that Silver Loading would end...and if Silver Loading ended, that should lead to Silver plan premiums dropping again...and if Silver plan premiums dropped, that would lead to reduced APTC subsidies.

How much would they be reduced? Well, back in 2017 when the idea of Silver Loading was first being bandied about, the Congressional Budget Office projected that doing so would increase the federal deficit by $194 billion from 2017 - 2026.

Of course, ACA exchange enrollment is twice as high as it was at the time (~24M vs. ~12M), and of course average benchmark premiums are 38% higher today than they were in 2017, so you'd expect the savings in federal subsidies to be considerably higher, right?

Instead, however, according to the House Republicans own internal "wish list" menu, they only think it would save around...$55 billion over the next decade. Huh.

I'm not sure how they came to that conclusion, but regardless, that's still a big chunk of change...and that's where we finally get to Wesley Sanders' post:

...There’s been a lot of digital spilled on the question of extending ARPA subsidies (enhanced APTCs provided under the American Rescue Plan Act (ARPA) and extended by the Inflation Reduction Act), but the memo from CMS talked about another scenario: the possibility that CSR subsidies get funded.

...The memo from CMS directs issuers in all states to include in their actuarial memorandum the amount of CSRs provided in plan year 2024 as well as the amount projected to be provided in plan year 2026. In other words, carriers have to do the work of re-adjudicating claims to determine what the member would have paid had CSRs been in place.

CMS also directs issuers in states where CMS does the rate review work to submit two rate filings. The two filing scenario is one carriers are used to, and many states have already asked carriers to submit two filings: one assuming ARPA subsidies continue, and one assuming they expire at the end of 2025. CMS’s ask for dual filings, though, is slightly different: carriers are directed to provide for one filing under current law (ARPA subsidies expire, and CSR remains unfunded), and one under a scenario where ARPA subsidies expire, but CSR subsidies are funded.

I suspect that this represents knowledge of some pending / possible congressional action, and carriers should pay attention, because if CSR is funded, several things happen:

1) Subsidies become less generous. This will further exacerbate the enrollment effects of the enhanced subsidies going away.

2) Renewals will need even more work. Members will auto-renew to their current metal level. If the pricing slopes change, that auto-renewal may not make sense, and even fewer auto-renewals will result in a $0 net premium, even at the bronze level. This will mean retention is likely to be lower and carriers and brokers will need to make intentional efforts to outreach to members who now owe a premium.

In other words, CMS is clearly laying the groundwork for CSR reimbursement payments to finally be officially appropriated some 15 years after the ACA was signed into law, 11 years after John Boeher filed his lawsuit, and 8 years after Donald Trump's DoJ dropped their appeal of the case & cut off CSR reimbursement payments.

If this happens, the truly ironic thing is that it would be done by Congressional Republicans...the same ones who filed the lawsuit to cut off CSR payments in the first place 11 years earlier.

In another surreal twist, all it would take for CSR payments to be appropriated in the first place, bringing an end to this entire saga, would be for the following 53-word bill to be passed & signed into law:

(b) FUNDING.—Section 1402 of the Patient Protection and Affordable Care Act (42 U.S.C. 18071) is amended by adding at the end the following new subsection:

‘(g) FUNDING.—Out of any funds in the Treasury not otherwise appropriated, there are appropriated to the Secretary such sums as may be necessary for payments under this section.’’.

Of course, there's also one other possibility which could theoretically happen: Congressional Republicans could use the savings from reinstating CSR reimbursement payments to help pay for extending the improved IRA subsidies instead of using it to give more tax cuts to billionaires.

Which, as it happens, is exactly what Democratic U.S. Sen. Jeanne Shaheen of New Hampshire proposed doing in her Improving Health Insurance Affordability Act of 2023 bill. (Shaheen has reintroduced this bill every year for several years now, sometimes including the CSR language, sometimes not).

Somehow I don't see Republicans being too keen on doing that given that they're desperately scrambling to slash federal healthcare spending by hundreds of billions of dollars. Then again...GOP Sen. Lisa Murkowski of Alaska supports extending the IRA subsidies, and rumor has it several other Republican Senators aren't thrilled about the optics of jacking premiums through the roof for over 20 million Americans either...so I suppose anything is possible...and it would be the ultimate irony if the ACA's subsidies were permanently upgraded and CSR payments were funded under a Republican trifecta.