Maryland: Approved avg. 2021 #ACA premiums: 11.9% decrease for indy market, 2.4% increase for sm. group

Back in June, Maryland's Insurance Dept. posted the preliminary 2021 rate requests for the individual and small group markets. At the time, carriers were seeking an average 4.8% premium reduction on the individual market and a 5.1% average increase for the small group market.

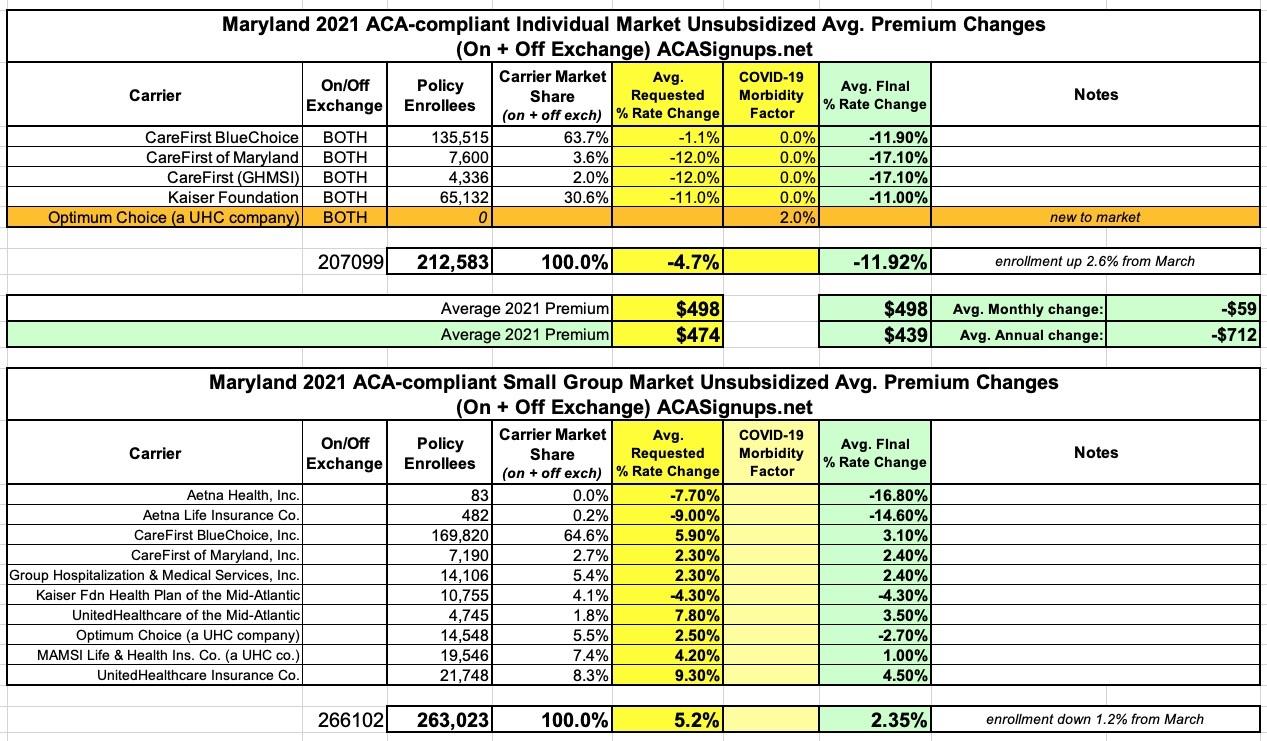

Recently, state regulators posted the approved rate changes for each, and the final 2021 rates have been reduced from the original requests:

Governor Hogan Announces Third Consecutive Year of Lower Individual Health Insurance Premiums

- Maryland Insurance Administration Secures 11.9% Average Decrease for Individual Market in 2021

- Innovative State Reinsurance Program Has Helped Drive Premiums Down By More Than 30% Over Three Years

ANNAPOLIS, MD - Governor Larry Hogan today announced that Maryland Insurance Commissioner Kathleen A. Birrane has approved an average 11.9% premium rate decrease for individual health insurance plans with an effective date of January 1, 2021. This means that for the third consecutive year, all individual insurance rates in Maryland under the Affordable Care Act (ACA) will see significant decreases.

Individual Health Insurance Premiums In Maryland

- 2019: -13.2%

- 2020: -10.3%

- 2021: -11.9%

The lower rates reflect the impact of the State Reinsurance Program, which has helped to stabilize the individual health insurance market after years of major premium increases. The three-year cumulative impact is a rate decrease of 31.4% versus 2018 premiums.

“While Washington continues to bicker back and forth about health care, we have delivered three consecutive years of lower premiums in Maryland,” said Governor Hogan. “Our innovative program to make health care more affordable continues to bring more stability and peace of mind to Marylanders, and serves as a model for the rest of the nation.”

In 2018, facing predicted health insurance rate increases of up to 50%, Governor Hogan worked in bipartisan fashion with legislative leaders to develop landmark legislation establishing a state reinsurance program. The legislation directed the Maryland Health Benefit Exchange, which operates the Maryland Health Connection insurance marketplace, to submit a State Innovation Waiver under Section 1332 of the Affordable Care Act (ACA) to the U.S. Secretaries of Health, Human Services, and Treasury to establish the program. The waiver was approved by the Centers for Medicare and Medicaid Services on August 22, 2018.

The legislation combined with this waiver set up a reinsurance pool to provide funding for catastrophic claims for policyholders in the individual market.

“I am very pleased to be able to continue the downward trajectory in premium rates for the individual market,” Commissioner Birrane said. “Maryland’s innovative and bipartisan approach to stabilizing what had been a spiraling market has been incredibly successful, has benefited Marylanders, and become a blueprint for other states. Under Governor Hogan’s leadership, Maryland has been the thought leader and trend setter in bringing rate relief to this market.”

To assist the administration in making its rate decision, MIA actuaries reviewed the data, methodologies, and assumptions companies used to develop their proposed premium rates. The MIA also considered public comments, along with other relevant factors, in determining whether to approve, modify, or deny requested rates....

...For the individual market, the three-year premium decrease is 37.6% for more than half of the market (64%) in the highest-enrollment HMO plan. Dental premiums for the Individual market affecting nearly 60,000 members were filed requesting an average 0.2% increase. Approved dental premium were for a 3.7% decrease. Compared to the premiums originally filed on 5/1/20, the approvals represent annual premium reductions for the Individual, Small Group, and dental markets of $91 million, $46 million, and $1 million respectively, for a total of $138 million. Three attached exhibits provide detail and context to the outcome of 2021 ACA premiums. Exhibit one. Exhibit two. Exhibit three.

As in the previous two years under the 1332 waiver, lower unsubsidized rates will result in lower “Advance Premium Tax Credit” (APTC) subsidies, and the post-APTC premium for some subsidized members could see significant increases depending on age/income/plan. This is particularly true in Charles, Frederick, Kent, Talbot, Washington, and Wicomico counties, where the second lowest cost silver plan upon which the APTC is benchmarked will shift from a CareFirst BluePreferred PPO plan to a UnitedHealthcare, Optimum Choice, HMO plan.

Ultimately, none of the ACA rate filings included a factor for a net expected change in costs in 2021 due to COVID-19.

Lastly, as of September 14, the extended COVID-19 “special open enrollment” (SEP) for 2020, which will run through December 15th has enrolled 23,533 members into the “Individual Non-Medigap,” ACA market and 47,929 into Medicaid for a total of 71,462. (Included in the 71,462 figure are 4,020 from the newly introduced “Maryland Easy Enrollment Health Insurance Program” where interest in health insurance coverage can be indicated on a tax form.)

For more information about the Maryland Insurance Administration's rate review process please refer to the FAQ guide on the Health Insurance Rates and Review Process page.

One other important sidenote: While effectuated enrollment in ACA individual market plans usually drops over the course of the year, it's actually increased substantially due to the COVID-19 pandemic (which has put millions out of work) and the COVID Special Enrollment Periods (which allow people who lose their employer coverage to switch over to an ACA individual market plan instead). In the case of Maryland, between 2/29 and 6/30, the small group market shrank by 1.2% (3,079 enrollees) while the individual market grew by 5,484 people: