Maryland's reinsurance approved; 2019 rates ~30% lower than what they'd be otherwise...but enrollees will STILL pay $450 more than they need to due to #ACASabotage

CMS Administrator Seema Verma is difficult to get a read on. On the one hand, she glories in trashing the ACA every chance she gets while happily endorsing nearly every effort to undermine or sabotage it, including repeal of the individual mandate, slashing the marketing and outreach budgets and so forth. Last year she was even busted trying to (effectively) blackmail the insurance carriers at large by offering to push through CSR reimbursement payment in return for them supporting the GOP's Obamacare repeal bill.

At the same time, she--like Trump's first HHS Secretary, Tom Price--also seems to have a soft spot for one particular type of ACA improvement program: Reinsurance.

Between the two of them, they've signed off on ACA market reinsurance waivers for Alaska, Minnesota, Oregon, Wisconsin, New Jersey and now...Maryland:

U.S. approves waiver to allow Maryland to lower Obamacare premium costs

Top Maryland officials plan to announce Wednesday that the Trump administration has approved a federal waiver that would stave off expected increases in health insurance costs for more than 200,000 state residents.

...Del. Joseline Pena-Melnyk and Sen. Thomas M. “Mac” Middleton, who sponsored the bills to fill the gap left by Congress’ elimination of a key source of funds for Obamacare, said they have been told the announcement about the waiver had been approved.

...The Republican governor worked with the Democratic leaders to cushion the blow to ratepayers in the individual health insurance market of the elimination of the federal individual mandate that had required taxpayers to insure themselves or pay a penalty.

...Middleton, a Charles County Democrat, said the elimination of the mandate contributed to a roughly 50 percent increase in individual premiums last year and threatened to force another 40 percent increase this year — a rise that might have forced CareFirst BlueCross BlueShield out of the individual insurance market.

I actually suspect that Middleton is confusing last year's cut-off of CSR reimbursement payments by Donald Trump (one type of ACA sabotage) with this year's elimination of the individual mandate penalty, but both factors contributed to significant rate hikes.

...“You’re talking about over $800 million to create a reinsurance program to help people in Maryland,” she said. She said about 218,000 would benefit, but she warned a longer-term solution will be needed in four to five years.

Unlike New Jersey's reinsurance program, which will receive the state's portion of the funding from reinstating the individual mandate penalty itself, Maryland's share of funding for their program will come from, ironically...a fee on the insurance carriers themselves:

...Pena-Melnyk said about $380 million will come through an assessment on insurance carriers approved by the legislature with the agreement of the companies. She said the rest will come from federal matching funds.

I looked up the waiver application itself, and it appears to be one of the most generous reinsurance proposals I've seen so far:

House Bill 1795 was signed into law on April 5, 2018, establishing the Maryland reinsurance program, which will be operated by the MHBE. Total program costs for 2019 are expected to be approximately $462 million. House Bill 1782, signed into law on April 10, 2018, creates a 2.75 percent assessment on certain health insurance plans and state regulated Medicaid managed care organizations to help fund the reinsurance program; the assessment fee is estimated to collect $365 million in 2019. Through this waiver application, Maryland is seeking federal pass-through funding through net APTC savings to fund the remainder of the program costs.

The reinsurance program will operate as a traditional, claims-based reinsurance program that will reimburse qualifying health insurers for a percentage of an enrollee’s claims between an attachment point and cap. Maryland is proposing a cap of $250,000 and a coinsurance rate of 80 percent for the 2019 plan year. The attachment point will be determined after further analyses and in consultation with stakeholders. The MHBE will establish the payment parameters each year. It is estimated that the reinsurance program will reduce average premiums by approximately 30 percent in 2019 from what they would be absent the waiver. Operationally, the MHBE can administer the program with existing resources if the federal government is able to accommodate certain modifications to the existing EDGE server infrastructure, thereby leveraging existing resources and reducing downstream administrative burden. If such federal flexibility is not available, the MHBE can administer the program with additional resources ii costing $434,000 in fiscal year 2019. These potential approaches are detailed in Section VI. Additional Information under Administrative Burden.

Waiver of Section 1312(c)(1) will not affect the comprehensiveness of coverage in Maryland’s insurance markets. The reinsurance program will reduce premiums by approximately 30 percent in 2019 from what they would be absent the waiver, making insurance more affordable. In turn, enrollment in the non-group market is expected to increase by 5.8 percent in 2019. The decreased premiums will decrease federal spending on APTCs. The actuarial analysis estimates that federal savings will be $304 million, $319 million, and $157 million in 2019, 2020, and 2021, respectively.

OK, so what does this mean in terms of actual unsubsidized individual market premiums for Maryland enrollees?

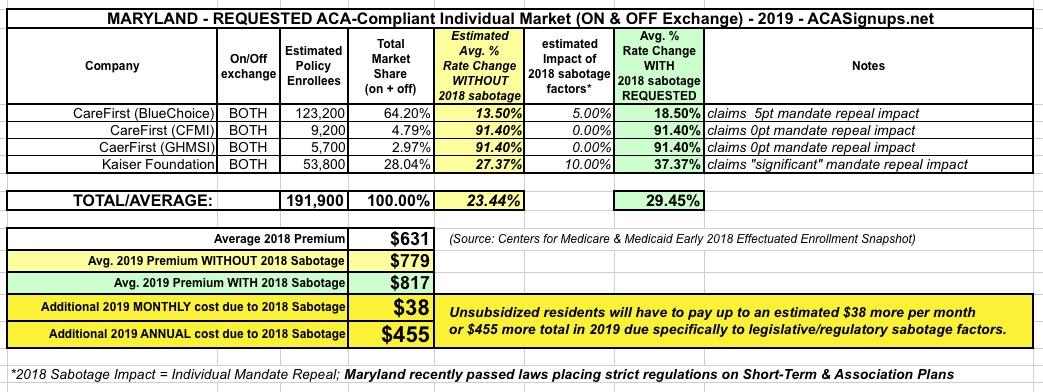

Well, without the reinsurance proposal in effect, 2019 enrollees were looking at premium increases of around 29.5% statewide...increasing from around $631/month on average to roughly $817/month for unsubsidized enrollees.

Assuming the state's calculations/projections are accurate, this should effectively wipe out all of that, leaving 2019 rates pretty much flat year over year.

HOWEVER...it's important to keep in mind that a large chunk of Maryland's rate increase is still due to the ACA mandate being repealed (along with the CSR cut-off from last year, of course). Mandate repeal specifically seems to be causing 2019 rates to be around 6 percentage points higher than they would be otherwise:

In other words, instead of a 29.5% hike with sabotage (23.4% without), Maryland residents will likely be looking at roughly flat rates with sabotage (vs. a 6-7% rate reduction if the mandate hadn't been repealed).

No matter how you slice it, that's still roughly $450 per enrollee more than they'd have to pay if the mandate hadn't been repealed.

Even so, this is still a very good thing overall.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.