How many Grandfathered or Transitional plans are still around anyway?

To the best of my knowledge, the entire U.S. individual health insurance market should be roughly 19 million people this year. Of that, around 12 million are, of course, ACA exchange-based (I'm lopping off 700K to account for those who didn't pay their first premium, dropped out after the first month or otherwise aren't actually enrolled at the moment).

The other 7-8 million or so are off-exchange...people who enrolled directly through their insurance carrier, bypassing the ACA exchanges. Since off-exchange enrollees don't qualify for federal tax credits, the vast majority of these folks (a good 95% or more, I'd imagine) earn too much to receive them (officially over 400% of the Federal Poverty Line; realistically, some are in the 300-400% FPL range). The rest of them are presumably either undocumented immigrants, people who still don't know about the tax credits via the exchanges, or weren't able to find an exchange-based policy which they were satisfied with, even with the tax credits.

However, even then there are 4 different types of off-exchange policies:

- Qualified Health Plans (QHPs): These are the exact same types of policies that are available on the exchanges, except enrolled in directly.

- ACA-compliant Off-exchange policies: These meet the minimum requirements of the ACA, but aren't quite as comprehensive as QHPs (For simplicity, however, I tend to lump these in with QHPs anyway)

- Grandfathered Policies: These are non-ACA compliant policies which people were already enrolled in prior to March 2010, when the ACA was signed into law. Anyone enrolled in one of these can keep renewing them until the day they die if they wish (as long as they keep paying the premiums), or until the carrier chooses to (voluntarily) discontinue the policy.

- Transitional (or "Grandmothered") Policies: These are non-ACA compliant policies which people enrolled in between March 2010 and October 2013. This category was created by President Obama and the HHS Dept. in November 2013 during the ugly "If You Like Your Plan You Can Keep It!" backlash. Basically, the ACA originally would have required that these policies be terminated as of 12/31/13. However, after a bunch of people received cancellation notices from their carrier, there was a massive backlash, leading Obama to announce an extension program.

The way this program worked, it was up to individual states whether they would rip the band-aid off all at once (terminating noncompliant plans as of 12/31/13 as originally scheduled), or bumping the deadline out by one, two or even three years. Some states chose to stick with the original deadline, a few chose one or two years, and most chose to bump it out as long as possible:

HHS extended the transitional relief, allowing grandmothered plans to renew up until October 1, 2016 and remain in force as late as September 30, 2017.

Even in the states which did allow "grandmothered" plans, not every carrier chose to offer them, resulting in the deadline for these plans spreading out from as early as 12/31/13 to as late as 9/30/17.

Unless there's another extension of some sort (or the ACA really is repealed by a completely GOP-held federal government), all of the transitional plans should be phased out in another 1.5 years...while there could be a handful of Grandfathered enrollees hanging around for decades to come, in theory.

Unfortunately, very few states provide a breakout of their individual insurance market, and fewer still do so on a frequent basis. Thankfully, the one state which does so annually is a big one: Florida, which I assume is fairly representative of most states which did allow the full 3-year "grandmothered" plans. This is all I have to work with, but it's better than nothing.

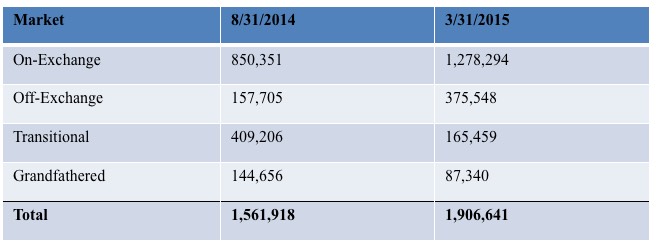

The most recent hard breakout I have is from nearly a year ago:

As you can see, Florida's Grandfathered number plummeted from 145K in August 2014 to just 87K in March 2015...a 40% drop in just 7 months. Meanwhile, their Grandmothered (Transitional) plan enrollment dropped even more dramatically, by over 60% in the same time period. And remember, this was as of 11 months ago. The thing which really surprised me here is that Transitionals dropped off much faster than Grandfathered.

How much further have each of these dropped? Well, assuming similar percentages, in Florida at least, they should be down to perhaps 50,000 Grandfathered and around 65,000 Transitional...but remember that it's been another 11 months, not 7, so let's say 40K and 50K respectively.

Florida has about 6.2% of the total U.S. population. On the other hand, none of this applies to seniors, and Florida also has a higher percentage over 65 (19.1%) than the country as a whole (14.5%), so I have to take into acocunt. I'd say this suggests perhaps 700,000 grandfathered plans nationally.

Transitional policies are even trickier to calculate since, as I noted above, they're kind of all over the calendar. 31 states are allowing the full 3-year extension, but even then, some states have a higher portion of their carriers allowing them than others. Those states represent around 2/3 of the total population, so a straight-shot extrapolation suggests perhaps 525,000 transitional plans still in force today.

(It's also worth noting that, again assuming FL is fairly representative, it suggests that the pre-ACA individual market was made up of roughly 8.0 million "transitional" plans and 2.9 million "grandfathered" plans, or 10.9 million...which is roughly the same as the Kaiser Family Foundation's estimate of 10.6 million for 2013 anyway).

Again, these are very back-of-the-envelope estimates, but if they're reasonably close, that suggests an individual market breakout of something like:

- 12.0 million exchange-based QHPs

- 6-7 million off-exchange QHPs

- 700K grandfathered

- 500K transitional

In fact, assuming the Florida drop-off rates continue at the same pace, this suggests that by next spring, these numbers could be down to something like:

- 400K grandfathered

- 200K transitional

...which would mean that by the time October 2017 finally rolls around and all 31 remaining states finally cut the cord...there will barely be anyone still enrolled in non-ACA compliant policies to complain about them being cut off anyway.

UPDATE: I should also note that according to the L.A. Times's Michael Hiltzik (who got his number from CoveredCA head Peter Lee)...

Off-exchange members account for about a third of the more than 1.8 million enrollees in the California individual market.

CoveredCA had around 1.3 million active enrollees last fall, likely down to 1.2 million by the time December rolled around, so roughly 1/3 sounds about right (600K, give or take). California doesn't have any transitional policies anymore, while their population is roughly twice that of Florida, so I'm going to assume roughly 80K of those 600K are grandfathered policies.

UPDATE: Here's a link to Louise Norris's excellent story on Grandfathered plans from just this week, which pretty much corrorborates what I have here.