UPDATED: My official 2015 #OE2 QHP Enrollment Projection

OK, before I get to the number-crunchy goodness, I want to stress, yet again, that 1) I could easily be dead wrong about whatever number I spit out at the end of this entry (either above or below), and 2) unless the 2015 enrollment tally ends up a complete bust (say, below the current 7.1 million, for instance), there's a lot of different ways the ACA helps improve healthcare coverage in terms of both quantity (total number covered) and quality (comprehensiveness of coverage).

Now that I've gotten those two caveats out of the way (everyone's gonna promptly ignore them anyway), let's get to it.

Those who follow me know that I have a pretty good track record on this particular niche. However, this time I'm trying to call the shot for a full 3 month period instead of just 1 month (or less) at a time. So...no pressure, right?

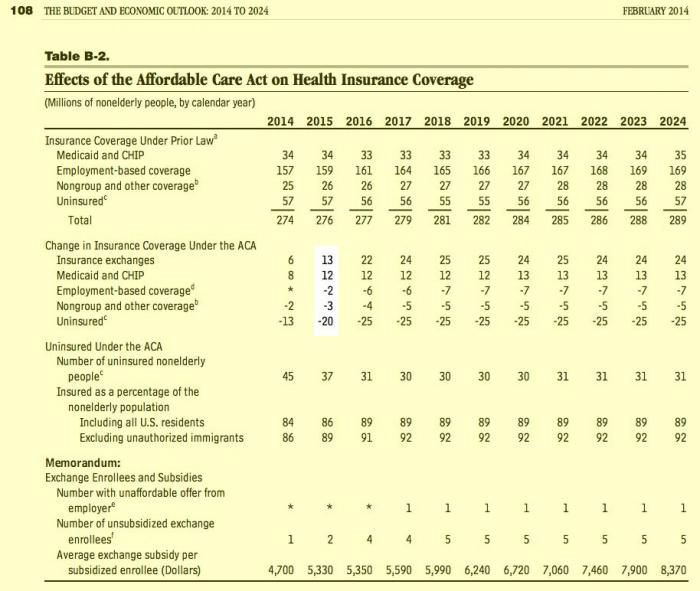

First of all, let's see what the various players have to say. First up is the Congressional Budget Office itself:

The CBO issued their #OE2 projection of 13 million exchange QHP enrollees at the same time they did the first year estimate (this is where the "7 Million Or Bust!!" figure came from in the first place which Kathleen Sebelius set in stone with her infamous "Success looks like 7 milion people..." interview). According to the CBO at the time, they figured that around 13 million folks would enroll in the second calendar year of the ACA exchanges being operational. Of course, in February of this year, they dropped that 7M projection down to 6 million based on the severe technical problems that HC.gov and some other exchanges experienced out of the gate last fall.

However, it's worth noting that they didn't change their 2015 estimate of 13 million QHPs even in that revised report (of course, it's also worth noting that they projected a net uninsured reduction of around 13 million by the end of 2014, which happens to be right in line with where things stand at the moment. The official consensus seems to be around 11 million, but that was as of a couple of months ago; with the additional expansion of Medicaid since then, a 13 million reduction by 12/31/14 could very well be doable).

It's interesting to note that even the CBO seems to assume that around 30 million people will continue to remain uninsured in the future regardless of anything else (population increases, growing exchange enrollment, etc.), but that's a whole different discussion.

Anyway, the CBO was still sticking with 13 million as their magic number for Year Two as of February of this year. Now, whether you consider that to be an 83% increase over 7.1 million paying enrollees or a 62% increase over the 8 million total enrollees depends on how you're defining "enrolled", but 13M was still their estimate last spring. I'm using 7.1 million as my base because it seems to be both the starting and finishing point for 2014.

(Thanks to manatt.com for the link tip). The projected increases from the actual insurance companies are all over the map, and it's important to remember that in some cases these may only be market share improvements taken from other companies rather than total increases. Even so, they're pretty optimistic:

U.S. insurers planning to sell 2015 Obamacare health plans expect at least 20 percent growth in customers and in some states anticipate more than doubling sign-ups.

...In Florida, Jason Alford, sales director at Health First Health Plans Inc, expects to more than double customers in Affordable Care Act compliant plans from the 4,400 it signed up this year.

...In Pennsylvania, where Medicaid is being expanded, Independence Blue Cross hopes to add about 30,000 new customers to the 165,000 it signed up for 2014 plans.

...In Texas, one small insurer predicts growth of 15,000 to 40,000 more customers from the fewer than 500 it signed up last year.

Non-profit insurer Community Health Choice Inc in Houston priced premium rates too high and was mostly shut out in 2014...the insurer foresees one million new sign-ups in Texas in addition to the more than 700,000 who enrolled in 2014.

OK, so what about the individual states? Well, so far I've seen projections from only 7 of them...but this includes the two states which, combined, made up nearly 30% of the total enrollment last spring:

Exchange officials hope to sign up another 500,000 during the second open enrollment, scheduled Nov. 15 through Feb. 15, 2015.

Technically speaking, the number of CA residents currently enrolled as of October 16 was 1.12 million, which would mean they're looking to increase the 2015 tally by about 45% to around 1.62 million.

However, the same press release they stated:

Today, a total of 1.12 million individuals have effectuated coverage and will be part of the renewal process. Covered Californiaexpects this number to increase as special enrollment continues and as recent enrollees effectuate their coverage, with about 1.3 million Californians participating in the renewal process through the end of the year.

In other words, the 500K increase CA is targeting appears to be on top of an assumed number of 1.3 million, or 1.8M total (a 38% increase). The wording is a bit confusing, so I'll split the difference and assume that CoveredCA is hoping to hit 1.7 million total during #OE2, or around 40% higher than their first year tally.

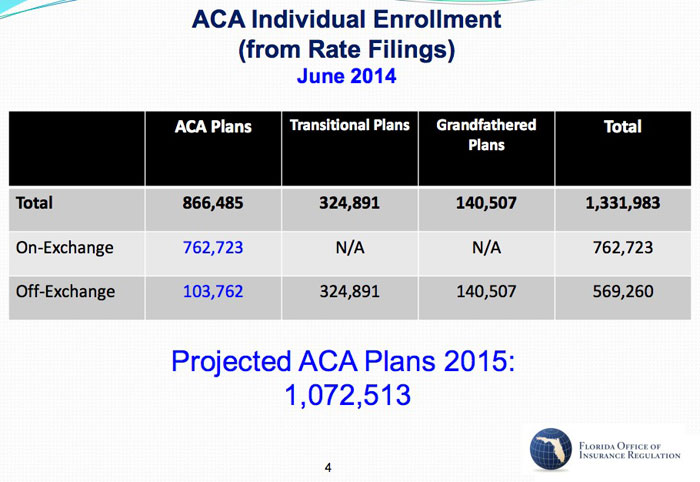

I'd take this one with a huge grain of salt. I've noted several times that FL's attrition rate for 2014, supposedly dropping from 983K to 762K in less than 6 weeks (a 22.5% reduction), never made any sense to me, even taking non-payments and immigration data discrepancies into account. Therefore, the base enrollment number of 762K is highly suspicious. With that caveat, the fact remains that the FLOIR seem to think that 2015 QHP enrollments will end up at 1,072,513 (an absurdly specific number).

During its first year, New York's exchange enrolled 960,762 people, but about 40,000 dropped off the rolls because they obtained jobs or for other reasons.

"Life goes on and changes continue to happen," Frescatore said.

More than half of New York's first-year enrollees — 525,283 — qualified for Medicaid based on their income.

The exchange expects to sign up 350,000 new enrollees for 2015. Individual policies will increase in price by 5.5 percent to 5.7 percent. The average increase in California, by comparison, is 4.2 percent.

New York's exchange enrollment ended up being roughly a 55/45 split in favor of Medicaid. I have no idea how the 40K attrition figure is split between the two, nor do I know how they're expecting that 350K new enrollee number to be broken out (according to KFF.org, NY started out with almost an equal number of residents eligible for each: up to 950K for Medicaid, up to 995K for QHP tax credits), and there's still plenty of each out there to work with, so I'll just assume the same 55/45 split. That would suggest that they're hoping to increase QHP enrollment (which was actually 370,451 last April, according to the HHS report...another 65,000 were kids in NY's unique public/private hybrid "Child Health +" program) to around 511,000 this time around.

Another 90,000 or so New Jerseyans could sign up for Obamacare coverage during open enrollment from Nov. 15 to Feb. 15, 2015, estimates Joel Cantor, director of the Rutgers Center for State Health Policy. He cautioned: “It’s hard to make firm predictions. But it seems reasonable to assume that by the end of the upcoming enrollment period we will reach 250,000 or so total enrollment — but it could be more or less.”

Cantor stresses that this is just an off-the-cuff, back-of-the-envelope shot, but it's better than nothing.

Next up is Connecticut, which (along with Kentucky) has consistently had the smoothest-running ACA exchange website, even during the bug-ridden early days of last October (in fact, Connecticut's operation ran so well that the guy in charge of it, Kevin Counihan, was tapped to take over as "CEO" of the federal exchange at Healthcare.Gov). Here's what CT's exchange has to say for 2015:

Access Health CT, the state's online marketplace, will be able to accept new enrollees from Nov. 15 through Feb. 15 for coverage for 2015. The goal for this enrollment period is to cut the number of the state's uninsured in half, to 2 percent, by enrolling about 33,000 people currently uninsured. During the inaugural enrollment period of the marketplace, created as the state's response to the federal Affordable Care Act, 256,000 people signed up for either private insurance through one of three companies, or Medicaid. About half of them previously had been uninsured. The state's uninsured rate before the marketplace opened was about 8 percent.

Connecticut's current exchange QHP enrollee total is just over 76,000. Since they've pretty much maxed out their entire Medicaid-eligible population (around 107,000 last fall according to KFF.org) already, that means that practically all 33,000 of the additional people they're targeting would have to be added to the private QHP side, for a total of around 109,000 by the end of the 2nd open enrollment period, or 43% higher.

Colorado is pretty straightforward with their target:

...Officials say it will be easier to shop this year. And their goal is to increase the number of people ensured through the exchange from 148,000 to 194,000.

Finally, Washington State:

According to consultants, the exchange needs to gain 85,000 more enrollees in “qualified health plans” — the private plans offered on Healthplanfinder — in order for the exchange to become self-sustaining, as is required by law. In the first year, the exchange enrolled 148,000 people.

Marchand said the exchange thinks it can meet that goal. Focus groups indicate many of those who have held out or who purchased insurance outside the exchange will be attracted to the offerings this year, he said.

However, there's one more rather important projection which was just announced on Monday:

A few days ago the HHS Dept. issued a lengthy press release in which they explained their reasoning/methodology. In short, they think that the CBO's eventual number of 25 million will still be reached, but that it will take 4-5 years to get there instead of 3, which is what the CBO based 13 million in 2015 on:

HHS used a bottom-up approach to project 2015 enrollments, incorporating data from our experience during the first open enrollment period and recent population surveys of insurance coverage. The bottom-up approach yielded an estimated range of 9.0 to 9.9 million for effectuated Marketplace enrollment in 2015.

HHS's main rationale for the lowered number is that they think the CBO is overestimating the number of employers who are choosing to push their employees onto the exchanges rather than provide coverage themselves. I have no idea if this is the case or not.

It's also important to note that HHS's 9 - 9.9M number is their end of year estimate for how many will remain paying/enrolled by the end of 2015; their total 2/15/15 number is about 12% higher:

While the department said 9.9 million people could have coverage on the exchanges by the end of next year, it offered different numbers — 10.3 million to 11.2 million — for how many people would pick a plan by the time open enrollment ends on Feb. 15. The dropoff comes when people don’t pay their premiums, the necessary step to trigger their benefits, or when they find other sources of coverage.

Anyway, that brings us to my own prediction.

First, let's start with how many people currently enrolled will renew their coverage (either manually switching to a different policy on the exchange, manually renewing their current policy or automatically renewing their current policy). HHS says that there were 7.1 million people still enrolled as of October 15th, but they only expect around 83% (5.9 million) of us (I'm among this group) to renew our coverage through the ACA exchanges (either keeping the same policy or switching to another one...but still using the exchange to do so).

Me? I'm a bit more optimistic. I'm gonna call it around 6.1 million of this group (86%). In addition, it's important to note that these folks will want to avoid a coverage gap, so they'll likely renew by the December 15th deadline.

Next: Of the 7.1 million people who enrolled and paid their premiums through last summer, around 57% (4 million) were previously uninsured (according to the Kaiser Family Foundation). That means that about 43% (3.1 million) were already enrolled in some existing policy. Some of these (including my wife and I) had their policies cancelled for non-compliance with ACA requirements. Others made the move because of the tax credits (or perhaps they simply liked the policies on the exchanges better than whatever they already had).

This year, I'm assuming roughly another 1.5 million people see their non-ACA compliant policies discontinued at the end of this year (remember, about 6 million policies could have been cancelled last year, but only about 1-2 million actually were; the rest were given a 1, 2 or 3 year extension waiver by HHS/President Obama in response to the "You can keep it!" backlash). I further assume that about 2/3 those folks will pick a new policy off-exchange 1/3 off-exchange, so that's about 1 million more who should enroll no later than December 15th to avoid having a coverage gap. So, between renewals and cancellations, we're up to around 7.1 million...right back where we started.

Next, how many people not currently enrolled are potential additions to the rolls? Well, also according to the Kaiser Family Foundation, last year there were potentially around 22 million people who were a) uninsured and b) eligible for ACA tax credits. If around 3.1 million of the 7.1 million were already covered, that means around 4 million weren't, leaving a potential pool of around 18 million more who could conceivably enroll this year. So the question is, how many of these folks will sign up?

Well, the HHS Dept. has this potential pool being 15 million instead of 18 million:

According to the multiple information sources listed above, there are approximately 32 million uninsured Americans – approximately one- quarter fewer than before the ACA’s coverage expansion began; 17 million of them were subtracted from this total because they are likely to be eligible for Medicaid. This means that an estimated 15 million are eligible to purchase a Qualified Health Plan (QHP) through the Marketplace.

They add the off-exchange number to this, but I've already addressed this above. So, we're now talking about somewhere between 15 - 18 million to work with.

This is the trickiest number to figure. As many have noted, the "low-hanging fruit" has already been picked, so to speak. People truly desperate for insurance due to having a pre-existing condition or serious financial difficulties have, in large part, already been swept up in Year One. The 15-18 million left are gonna be harder to get ahold of, harder to convince. Many Latinos are apparently very reluctant to enroll because they're afraid their relatives will be deported, and so on.

On the other hand, the outreach efforts are being expanded and refined, and strategies are being shifted to compensate for the different landscape.

In addition, consider the improvements to the exchange websites:

- The broken ones have either been (supposedly) fixed (Maryland, Massachusetts) or moved onto the mothership at HC.gov (Nevada, Oregon).

- The ones with serious-but-not-fatal problems have (supposedly) been at least somewhat improved (Vermont, Hawaii, Minnesota).

- The ones which were already operating pretty smoothly have had significant improvements/feature enhancements (New York, Kentucky, California, Colorado, DC, Connecticut, Rhode Island, Washington)

- And, of course, The Big One, Healthcare.Gov, has apparently been completely overhauled, cleaned up, streamlined and is a completely different animal than it was even 6 months ago, much less a year ago.

- In general, the exchanges have beefed up their customer service departments with more staff, shorter wait times, better training, multi-lingual assistance and so on.

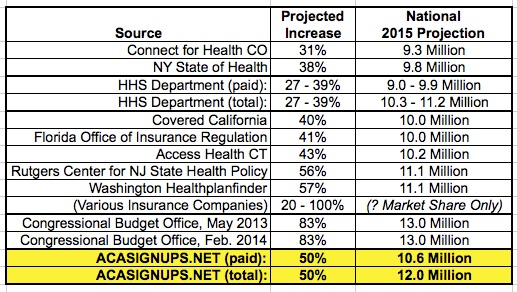

So, let's summarize, from lowest to highest:

- Colorado projects 31% increase (extrapolated nationally: 9.3 million)

- New York targeting a 38% increase (extrapolated nationally: 9.8 million)

- The HHS Dept. itself projects a 27% - 39% increase (9.0 paid out of 10.3 total - 9.9 million paid out of 11.2 million total)

- California targeting a 40% increase (extrapolated nationally: 10.0 million)

- Florida projects a 41% increase (extrapolated nationally: 10.0 million)

- Connecticut targeting a 43% increase (extrapolated nationally: 10.2 million)

- New Jersey: possible 56% increase (extrapolated nationally: 11.1 million)

- Washington projects a 57% increase (extrapolated nationally: 11.1 million)

- Insurance companies are ranging from 20% - 100% increases (again, this is for their company specifically; much of this may be simply market share swapping instead of total increases)

- The CBO projected an 83% increase (13.0 million) both in May 2013 and again in February 2014

Taking all of this into account, what do I think the final tally will be when the dust settles on #OE2 next February?

Well, I'm a realist, but I'm also an optimist.

There's tremendous uncertainty about all of this. Hell, even the announcement about the King/Halbig SCOTUS court cases could scare some people off...or, conversely, could convince more people to get off the fence and jump in before their tax credits might be taken away. The 2014 midterm results mean that Republican-run states will be even more hostile (or at best, unsupportive) of outreach/education efforts for #OE2.

At the same time, I think the CBO is pretty damned good at their job, and the fact that they didn't budge from their 13M estimate for #OE2 from May 2013 through February 2014 in spite of the technical woes last year is significant. In addition, there's a special "ace in the hole" in Massachusetts: Assuming that MA's new exchange does work properly, up to 300,000 people who got caught in "healthcare limbo" due to the states technical woes could be added this year, instantly increasing MA's tally 13-fold. I also suspect that the HHS Dept. is (wisely, in my opinion) lowballing their projection by a bit, and there's nothing wrong with that.

So, with all this in mind, I'm splitting the difference. Here's my call:

- ACASignups.net Exchange QHP Enrollee Projection for Feb. 15, 2015

(with the understanding that many policies won't be effectuated until March 1st):

12 Million total

(of which about 10.6 Million will pay at least their first premium...although some payments might not be made until the end of March)

As always, I'll be more than happy to be wrong...as long as I'm wrong on the low side, not the high side :)

Anyway, here's a handy little summary chart of the above if anyone's interested.

LATE-BREAKING UPDATE 11/14/14: Just this morning--literally moments before I posted this entry--Gallup released a survey which concludes that 55% of the remaining uninsured in the country say that they do plan on getting healthcare coverage in 2015.

In theory, if you assume 15 - 18 million who qualify for tax credits through the exchanges, that could conceivably mean 8.25 million - 9.9 million people in addition to the renewals, which would (in theory) bring the #OE2 QHP total up to as high as 16 million people, which would blow away all expectations across the board.

However, this is extremely unlikely to happen. 55% saying they "plan" to get covered doesn't mean 55% will get covered. On the other hand, the 35% who say they'll pay the penalty instead of getting covered could involve a certain amount of bluster, like Democrats or Republicans claiming they'll vote 3rd party who end up "holding their noses" and voting the party line in the end after all.

Another factor here is that the Gallup survey doesn't specify what kind of healthcare coverage that 55% plans on getting. Some will qualify for Medicaid. Some will buy a policy directly through an insurance company (off the exchange). A few may end up getting a job with ESI (employer-sponsored insurance). Not to be too morbid, but some will die (happens to the best of us, after all).

If you assume that the 55% who claim they plan on getting covered actually do, and if you further assume that, say, 2/3 of those actually do so through ACA exchange QHPs, that means around 5.5 - 6.6 million QHPs in addition to the 6.1 million current enrollees who renew and the 1 million or so who swap out cancelled policies through the exchanges. That would mean a grand total of 12.6 - 13.7 million...essentially what the CBO has been sticking to their guns on.

And if that happens, once again, I'd be very happy to be wrong!

UPDATE: 11/16/14: Just for completeness, New Mexico has issued their target as well:

Nearly 35,000 New Mexicans signed up for insurance plans offered by private insurers through the state's health insurance exchange in the first enrollment period, which ended earlier this year.

J. R. Damron, chairman of the exchange's governing board, said he hopes the state will be able to enroll between 40,000 and 45,000 individuals in the next three months.

I double-checked, and New Mexico's 4/19/14 total was actually a bit lower than 35K: 32,062. That means that 40 - 45K this year would be a 25 - 40% increase, or 33% if you split the difference.

UPDATE: 11/18/14: Minnesota has chimed in with their official projection, and it's pretty high: 100,000, or more than twice what it was during the first open enrollment period:

Currently, MNsure has about 50,000 enrollees in private health plans, and its budget projects the number will grow to just over 100,000 by the end of 2015.

A national expert on health exchanges called such an enrollment jump for MNsure in the near term a “tall order,” and MNsure chief executive Scott Leitz last week suggested the target could be revised.

UPDATE: 11/18/14: Vermont has also issued their expected number for 2015: 35,000 - 40,000 (assume 38K). On the one hand, this would only be about a 20% increase over their 2014 number. On the other hand, that's partly because the state only has about 45,000 residents even eligible for exchange QHP tax credits in the first place:

Vermont Health Connect is only anticipating 3,000 to 8,000 new customers to purchase coverage during the three-month open enrollment period that runs until Feb. 15.

The deadline is Dec. 15 for coverage that starts on Jan. 1, 2015. Vermonters who sign up by Jan. 15 will have a start date of Feb. 1, and those who sign up by the Feb. 15 close of open enrollment will have a start date of March 1.

In its first year, 32,000 people purchased commercial insurance through the exchange, or 71 percent of the estimated 45,000 eligible to do so.

UPDATE 11/21/14: Wall Street has chimed in with their take...11 million. The "higher than 9M" reference should correspond with the HHS's paid estimate, which would mean their total number would be around 12.5 million, a bit higher than mine.

A group of Wall Street analysts predicted Friday that enrollment in health law insurance plans will be higher than the 9 million projected by the Obama administration because insurers are aggressively courting new customers and more small businesses are likely to send workers to the online exchanges in 2015.

Health sector analyst Carl McDonald of Citi Investment Research said he expects about 11 million people to enroll in individual health plans, based on his firm’s survey of clients in October

I should also include a link to my #ObamaDentata note from this morning: I may very well change my projection for 2015 QHPs in the future, but so far the 393,000 dental plan enrollment issue is not enough to make me change my 12.0M total / 10.6M paid estimate.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.