New Treasury Dept. report: 4.2M Entrepreneurs enrolled in #ACA exchange plans

via the U.S. Treasury Department:

Affordable Care Act Marketplace Coverage for the Self-Employed and Small Business Owners

Before the Affordable Care Act (ACA) was enacted in 2010, self-employed workers and small business owners had limited options to purchase affordable, high-quality health coverage. While most Americans obtained health coverage through their jobs, self-employed workers and small business owners often needed to purchase health coverage on their own, in which case quality coverage was expensive and sometimes denied.

The Affordable Care Act established Marketplaces in all states beginning in 2014. Self-employed workers and small business owners, as well as anybody else who does not have other access to affordable health coverage, can purchase it on their own and can qualify for tax credits if their premiums would otherwise be unaffordable as a share of their income.

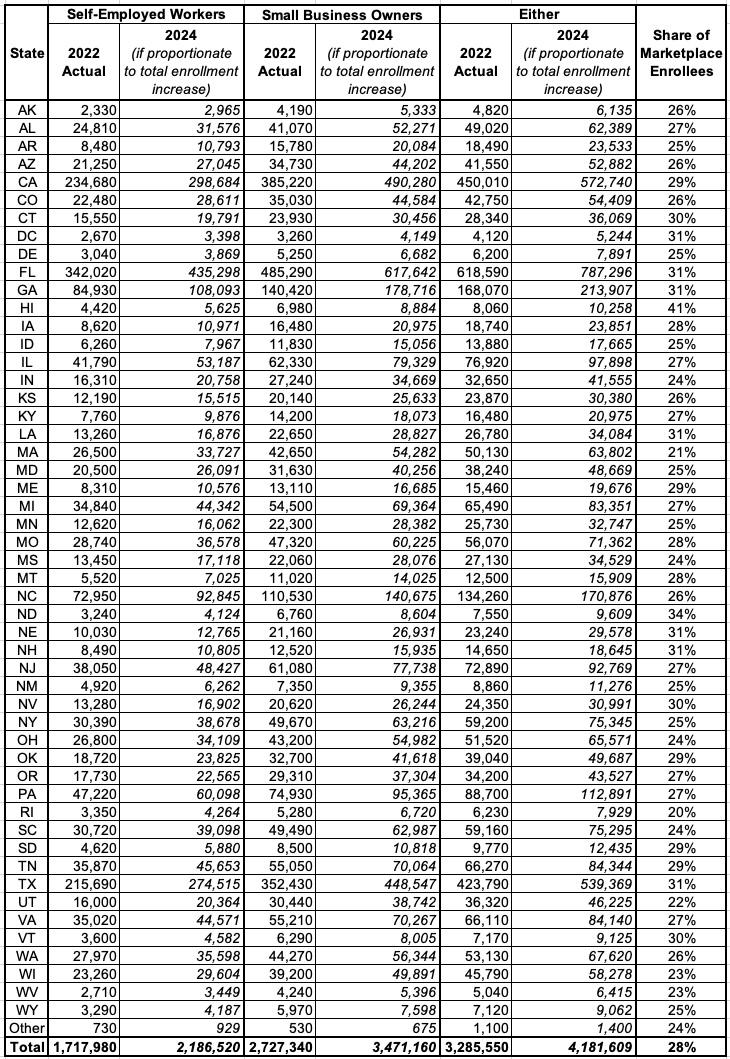

In 2022, 1.7 million self-employed workers ages 21-64 and 2.7 million small business owners ages 21-64 were covered by Marketplace coverage at some point during the year. These two groups partially overlap: a total of 3.3 million self-employed workers and small business owners were covered at some point during the year, amounting to 28 percent of all Marketplace enrollment in this age range. This represents a significant increase relative to earlier years: previous Treasury analyses found that 1.4 million self-employed workers and small business owners were covered by Marketplace coverage in 2014 and 2.6 million in 2021.

While the estimates use slightly different methods, across all three analyses self-employed workers and small business owners account for between 25 and 28 percent of Marketplace enrollment in the sample. Moreover, because overall Marketplace enrollment has grown since 2022, if self-employed workers and small business owners account for the same share of enrollment in 2024 that they did in 2022, 4.2 million self-employed workers and small business owners would have coverage.

The numbers are impressive either way, but it's important to keep this point in mind--the hard number for 2022 was 3.3 million, but since total ACA exchange enrollment has grown 27% since then, it assumes the number of self-employed & small biz owning enrollees has grown by a similar amount, which seems reasonable, though it's likely somewhat higher or lower than that.

The ACA Marketplaces are a disproportionately important source of coverage for self-employed workers and small business owners. In 2022, 18 percent of self-employed workers and small business owners ages 21-64 had ACA Marketplace coverage, compared to 6 percent of the rest of the population ages 21- 64. In every state, self-employed workers and small business owners are more likely to rely on the ACA Marketplaces for coverage than other working-age Americans. However, the rate of Marketplace coverage for this group varies across the country. In the following states, more than one fifth of small business owners and self-employed people had ACA Marketplace coverage in 2022: Florida, Georgia, Maine, North Carolina, Nebraska, New Hampshire, South Carolina, Utah, and Wyoming.

The American Rescue Plan Act of 2021 and the Inflation Reduction Act of 2022 enhanced the Premium Tax Credit (PTC) available to people purchasing coverage through the ACA Marketplaces by increasing the size of the credit for households with incomes below 400% of the poverty level and expanding eligibility to households with incomes above 400% of the poverty level for the first time. Before the American Rescue Plan was enacted, enrollees risked losing their entire PTC if they received a single dollar in income above the cutoff. Over 2.7 million, or 82%, of self-employed workers and small business owners enrolled in Marketplace coverage in 2022 claimed the Premium Tax Credit, including about 285,000 taxpayers with incomes over 400% of the poverty level.

To estimate coverage for the self-employed and small business owners, the Treasury Department analyzed tax and information returns for tax year 2022. The analysis is based on a 10% random sample of tax returns. Marketplace coverage is measured using data submitted to the IRS on Forms 1095-A for tax year 2022. A person is considered covered if they had Marketplace coverage at any point in the year. Small business owners are defined based on information contained in Form 1040 Schedules C, E and F, Forms 1065, and 1120S. We follow the definition used in OTA Technical Paper 4 with the exception that we use a $5 million income threshold. A taxpayer is defined as self-employed if they received at least 85% of their earnings from income reported on Schedule SE. PTC receipt is defined based on information contained in Form 8962. We report statistics separately for each state based on the address listed on the 1040.

I've reformatted the table included in the report to also include what each state's numbers would look like for 2024 using the Treasury Dept's assumption of roughly a 27% increase since 2022, given the overall enrollment increase.

To be honest it seems to me it should be even higher since actual total effectuated exchange enrollment actually went up 50.5% from February 2022 to February 2024, but the point is made either way: Millions of small business owners and self-employed Americans rely on ACA exchange policies: