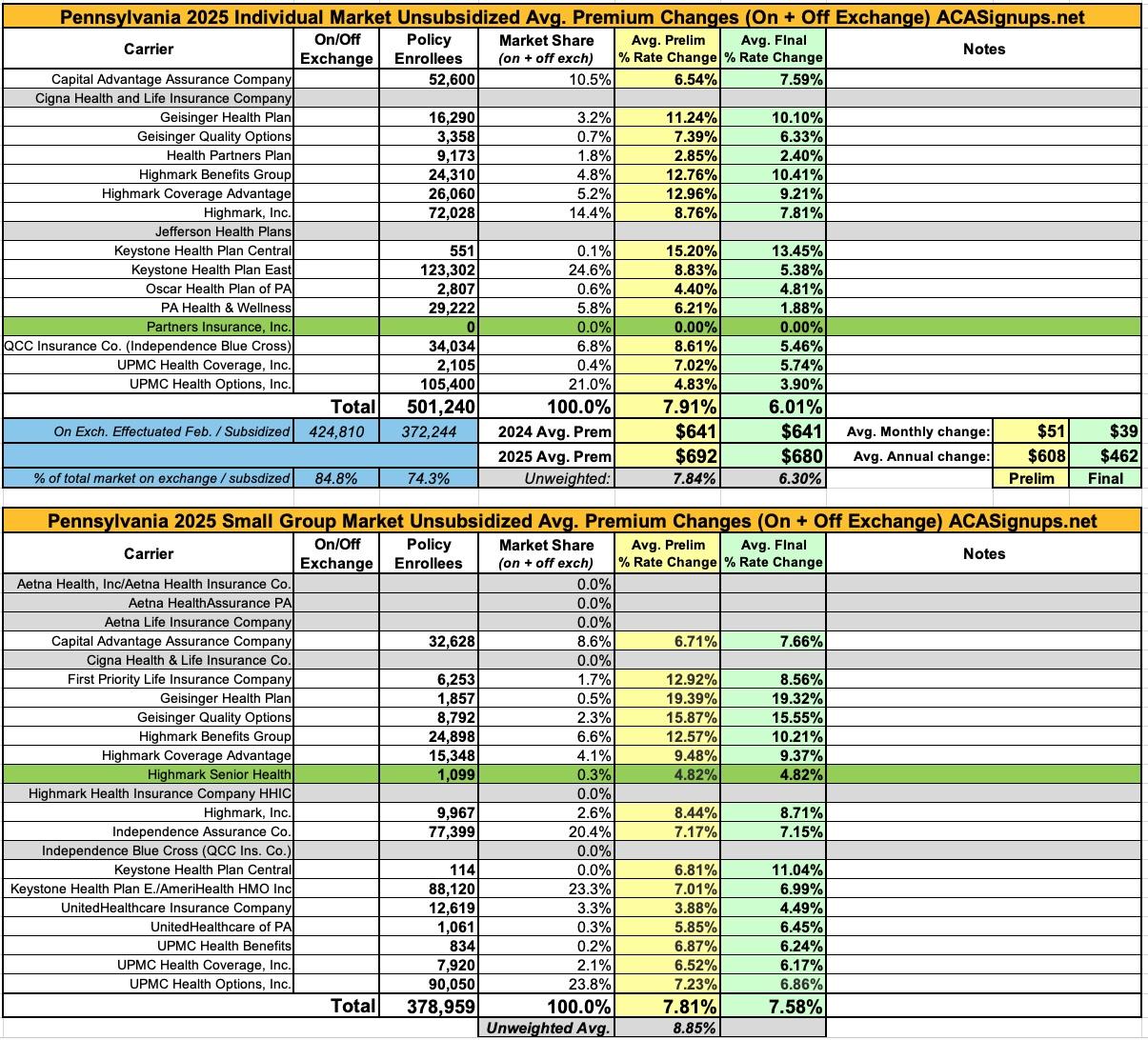

Pennsylvania: *Final* avg. unsubsidized 2025 #ACA rate changes: +6.0%; several carriers leaving/joining (updated)

Originally posted 9/12/24

via the Pennsylvania Insurance Dept:

PID is working with insurers to review proposed changes to ensure rates are adequate and fair.

Harrisburg, PA – The Pennsylvania Insurance Department (PID) today announced that 2025 rate changes requested by insurance companies currently operating in Pennsylvania's individual and small group markets are now available online. This initiative upholds the Shapiro Administration's commitment to providing consumers with the information they need when shopping for health insurance.

Rate filings for 2025 health insurance plans were submitted to PID on May 15, 2024. Ever since, PID has been working with insurers to review these insurance companies' proposed rate changes, as rates vary by plan and region and are subject to change by the Department to ensure rates are adequate and fair. Final approved rates will be made public in the fall.

“The Shapiro Administration continues to stress the importance of keeping consumers informed," said Pennsylvania Insurance Commissioner Michael Humphreys. “At PID, we see the true value in transparency at every point in the rate review process. This is why we make it a point to let Pennsylvanians know – each year – about the proposed rate increases their insurers are requesting. In doing so, we're hoping to build on the trust we've already gained from consumers, while also doubling down on our mission to keep their best interests at the forefront."

Insurance companies offering individual and small group health insurance plans are required to file proposed rates with PID for review and approval before plans can be sold to consumers, serving as an important consumer protection. The Department reviews rates to ensure that the plans are reasonably priced – not excessive or inadequate – and are not unfairly discriminatory.

One reason health insurers are required to annually file their plans is to allow for the plan-pricing to reflect the expected claims and operational costs for the upcoming year. For Plan Year 2025, general reasons for the requested rate increases, as filed by insurers, center around increases in medical unit costs. This includes rising drug costs, increased labor costs in the health care industry, and the utilization of medical services.

Most insurer proposed rate change requests show an average premium increase around 8%, which appears to be lower than the national average. The proposed rates may not reflect final reinsurance or risk adjustment amounts due to flexibilities provided to insurers to submit data needed to calculate the adjustments.

Insurers who are currently selling in the individual market that propose selling plans in 2025 have filed plans requesting an average statewide increase of 7.9%. The rates are rounded to the nearest tenth and vary by region (rating area) as indicated in the filings:

- Capital Advantage Assurance Company (Rating areas 6,7 and 9; average rate request 6.5%)

- Geisinger Health Plan (Rating areas 2,3,5,6,7 and 9; average rate request 11.2%)

- Geisinger Quality Options (Rating areas 2,3,5,6,7 and 9; average rate request 7.4%)

- Health Partners Plans “Jefferson Health Plans" (Rating areas 6 and 8; average rate request 2.9%)

- Highmark Benefits Group Inc. (Rating areas 3 and 8; average rate request 12.8%)

- Highmark Coverage Advantage Inc. (Rating areas 1 and 4; average rate request 13.0%)

- Highmark Inc. (Rating areas 1,2,4,5,6,7 and 9; average rate request 8.8%)

- Independence Blue Cross (QCC Ins. Co.) (Rating area 8; average rate request 8.6%)

- Keystone Health Plan Central (Rating areas 6,7 and 9; average rate request 15.2%)

- Keystone Health Plan East Inc. (Rating area 8; average rate request 8.8%)

- Oscar Health Plan of PA (Rating Areas 3, 6, 7 and 8; average rate request 4.4%)

- Pennsylvania Health & Wellness Inc. (Rating areas 3,6,7 and 8; average rate request 6.2%)

- UPMC Health Coverage Inc. (Rating areas 1 and 5; average rate request 7.0%)

- UPMC Health Options Inc. (Rating areas 1,2,3,4,5,6,7 and 9; average rate request 4.8%)

- Insurers in Pennsylvania's small group market have filed 2025 plans requesting an average statewide increase of 7.8 percent.

- In the proposed 2025 individual and small group market filings, the following expansions have been filed:

- Geisinger Health Plan and Geisinger Quality Options propose expanding into Franklin County (individual and small group markets)

- Health Partners Plans Inc. proposes expanding its individual ACA market offering into Delaware, Lehigh, and Northampton counties

- Pennsylvania Health & Wellness Inc. proposes expanding its individual ACA market offering into 11 counties: Blair, Cambria, Clarion, Clearfield, Centre, Elk, Fayette, Huntingdon, Jefferson, Somerset, and Westmoreland.

Hmmm...7.9% is actually higher than what I get using their own data. I have individual market policies coming in at a weighted average requested increase of 7.3%, and 7.8% for the small group market carriers.

In addition, it looks like there are several carriers leaving Pennsylvania's market (Cigna and Jefferson are leaving the individual market, while Aetna, Cigna, and QCC/Independence Blue Cross are pulling out of the small group market), while others are entering (Partners Insurance is launching in the indy market).

There's also a slightly confusing update for one of the four (!) Highmark divisions on the PA small group market: It looks liike HHIC is leaving and Highmark Senior Health is joining, but this could also just be a case of them rebranding that division?

UPDATE: It turns out "Jefferson Health Plan" just changed their name to "Health Partners Plan" so they aren't actually dropping otu of the PA market. Sheesh.

UPDATE 10/9/24: OK, the PA Insurance Dept. has posted their final/approved 2025 rate changes:

Shapiro Administration Announces 2025 Health Insurance Rates, Saving Pennsylvanians $77.2 Million Through Rate Review Process

Commonwealth will also see more marketplace competition in several counties as some insurers will be selling plans in new counties

Harrisburg, PA – The Pennsylvania Insurance Department (PID) today announced Pennsylvania's 2025 Affordable Care Act (ACA) health insurance rates, which will save Pennsylvanians approximately $77.2 million in 2025 health insurance premium costs through PID's rate review process and reinsurance program. Additionally, the Commonwealth will see an increase in marketplace competition for several counties as some insurers will be selling plans in new counties.

“Pennsylvanians care about the price of comprehensive, ACA-compliant health insurance – and they deserve affordable options," said Pennsylvania Insurance Commissioner Michael Humphreys. “This year, we heard from consumers who submitted comments on proposed rates, and we want those residents to know that we carefully considered their input while we worked with health insurers to finalize rates for 2025. We appreciate the opportunity to hear directly from Pennsylvanians and strive to ensure Commonwealth families have access to quality health insurance at an affordable price."

Most insurers currently offering individual market coverage in Pennsylvania's 67 counties will continue to provide plans in 2025 with a statewide average increase of 6 percent, which is two percentage points lower than what insurers initially filed. The Commonwealth will see a 7.6 percent average increase in the small group market.

PID encourages Pennsylvanians to explore their options and shop for coverage for 2025. Most Pennsylvanians can find the lowest costs on quality health plans through Pennie, Pennsylvania's official health insurance marketplace. Pennie is the only place where Pennsylvanians can find financial savings to reduce the cost of coverage and care. All health plans available through Pennie have important consumer protections, including coverage for pre-existing conditions and coverage of essential health benefits. Silver, gold, and platinum plans provide the richest coverage, and the higher-level metallic plans typically have lower copays, deductibles, and out of pocket maximums.

Pennie's upcoming Open Enrollment Period is the only time of year to enroll in individual and family health coverage for 2025. Open Enrollment runs from November 1 to December 15 for coverage that starts on January 1, 2025. Outside of Open Enrollment, only individuals with life changes – such as losing coverage from Medicaid and family events – can enroll.