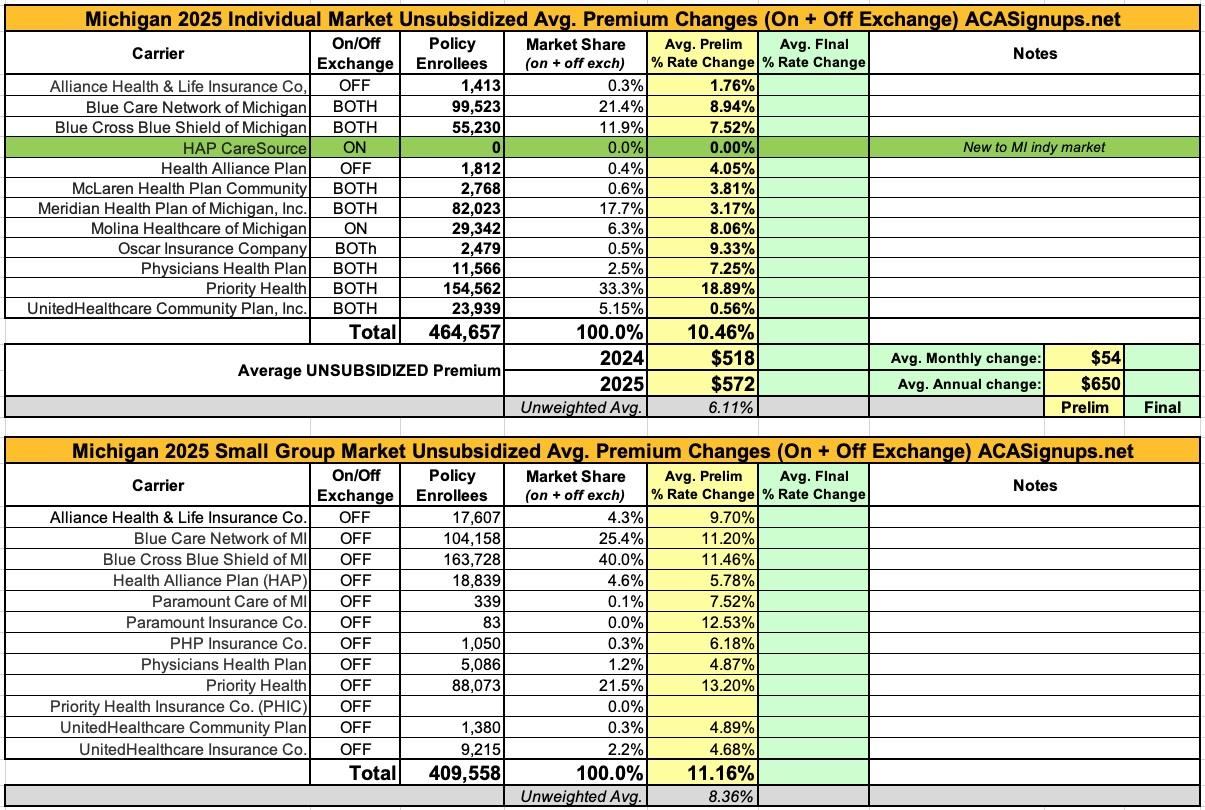

Michigan: Preliminary Avg. Unsubsidized 2025 #ACA Rate Change: +10.5%

The Michigan Dept. of Financial Services hasn't issued any press release yet, but nearly all 2025 preliminary rate filings for the MI individual and small group markets are available via the SERFF database.

The most noteworthy item in Michigan's individual market is that there's a new entry: HAP CareSource. I'm assuming this is some sort of joint insurer effort by CareSource and Health Alliance Plan (which has only offered off-exchange ACA plans for several years now) but am not certain about that.

In terms of actual rate hikes, most of them are in the mid single digits, but Priority Health, which holds exactly 1/3 of the market share (equal to Blue Cross when you combine their PPO & HMO divisions), is seeking an eye-opening 18.9% average rate increase.

With Priority Health included in the mix, rate increases being requested by Michigan indy market carriers average 10.5% for 2025.

Small group plans are asking for similar rate increases next year, averaging 11.2% (note: I'm missing the data for one of Priority Health's divisions here, although PHIC only had 3,400 enrollees in last year's filing so unless they saw dramatic growth this shouldn't be more than a rounding error statewide).

It's also worth noting that while Michigan has unfortunately not instituted formal Premium Alignment pricing, the indy market carriers are apparently utilizing Silver Loading. From the filings:

Blue Cross Blue Shield of Michigan (as well as Blue Care Network):

Significant drivers of the rate change include:

- Medical inflation and increased utilization as described in Section 5 of this memorandum

- Restates and true up of experience

- Risk Adjustment

- Plan Benefit Changes

Additional detail around the assumptions utilized in the rate development process is included in the following sections of this memorandum.

...Cost Share Reduction (CSR) Subsidy Funding

As required by DIFS in Bulletin 2024-14-INS and consistent with the 2024 filing, BCBSM has assumed no CSR payments will be made by the federal government for 2025. Therefore, rates for silver plans offered both on and off marketplace are 10.7% higher than if the federal government funded CSR subsidies.

Exhibit 2.2 includes current and projected distribution of silver plan members and the expected unfunded CSR subsidy at each variant level (70/73/87/94) that produce the CSR load. Additional expected costs were calculated consistently with the historical CSR payments made by the federal government. The additional expected costs for the four variants were weighted on projected member distribution for an overall load of 10.7%.

Health Alliance Plan of MI:

We develop premium rates for these Individual plans using HAP’s January 1, 2023 – December 31, 2023 Individual experience, in conjunction with internal research proprietary to HAP and other industry studies and surveys. We consider several items in developing the premium rates, including but not necessarily limited to:

- Impact of COVID-19 on utilization in 2024 and subsequent years

- Projected morbidity level of the population anticipated to purchase the products

- Proposed benefit plan designs

- Anticipated medical trend, both utilization and cost of services

- Applicable taxes and fees, including those newly applicable since 2014 under ACA

- Anticipated risk adjustment payments (receipts)

McLaren:

CSR Load

We have included an adjustment to the filed plans to reflect the impact of cost share reduction subsidies (CSRs) no longer being funded by the federal government. To reflect the additional cost of the CSRs on all plans to McLaren, we have increased the pricing AVs. Wakely applied a pricing AV reflecting the weighted average blend of projected membership and CSR Variant pricing for each Silver plan. The development of CSR load by plan can be seen in Appendix G.

Molina Healthcare:

Reason for Rate Change(s):

The following factors contribute toward the overall change in the proposed rates.

- Claims: Projected claims for 2025 are expected to contribute toward a -3.4% decrease in rates due to updated base period experience claims, trend, changes in product, acuity, and demographic mix on the base period experience.

- Risk Transfer: Risk transfer is expected to contribute toward a 3.4% increase in rates due to differences in actual versus expected risk transfer amounts for the 2023 benefit year and expected changes in 2025 population mix.

- Administrative Expenses: Administrative expenses are expected to contribute toward a 1.3% increase in rates due to higher plan expenses and expected broker commissions, offset by lower corporate and QA expenses.

- Taxes and Fees: Taxes, fees, and retention are expected to contribute toward a -0.7% decrease in rates.

- Margin: Margins are expected to contribute toward a 0.0% increase in rates at our company standard 3.0% after-tax profit margin.

- Membership Mix: The membership mix from the base period to the projection period compared to the membership mix for comparable time periods from the prior year rate filing is expected to contribute toward a 7.5% increase in rates. Rate changes vary by metal tier due to changes in Actuarial Value, Induced Demand Factors, and Geographic factors.

- Expiration of the Public Health Emergency: We observed no material net impact to claims with the expiration of the Public Health Emergency.

...Molina relied on a commercially available AV pricing tool to evaluate the Pricing AV of each of the plan designs. This tool complies with the ACA rating rules by using a consistent population to model the Pricing AVs for each plan. This rate methodology assumes the Cost Sharing Reduction subsidies are not funded. The Pricing AVs for the Silver 100, Silver 150 and Silver 200 plans represent the amounts without the Cost Sharing Reduction (CSR) subsidies. The CSR load is purely the difference between the Pricing AVs.

Physicians Health Plan:

We include a 29.6% load to the AV for all silver exchange plans to account for the defunding of cost sharing reduction (CSR) subsidies. The 29.6% load is applied to silver exchange plans and is calculated by increasing the silver plans' paid claim liability to the plan based on the additional financial burden of reudcing member cost sharing. The liability is based on PHP's unique projected 2025 distribution of CSR enrollment, mix of business and actuarial judgement. Table 11.1 demonstrates the calculation of the 29.6% load to silver exchange plans. PHP's rate development is based on allowed claims with a standard AV applied (without the impact of CSR subsidies); therefore, the CSR load is required to account for the additional CSR plan liability.

Priority Health:

PROPOSED RATE INCREASE(S)

The proposed rate changes and projected membership and premium amounts are shown by plan on Worksheet 2 of the URRT in the applicable line item.

The reasons for the rate change include:

- Updated experience upon which the rates are based.

- Updated medical and prescription Rx cost and utilization trends.

- Updated benefit relative values, which may cause variation in rate changes by plan.

- Prospective benefit adjustments to existing products; the benefit relative values have been updated, which may cause variation in rate changes by plan.

- Re‐evaluation of the anticipated morbidity adjustment to the rating base.

- Anticipated changes in the payments to the Federal Risk Adjustment program.

- Updated factors for administrative expenses and margin. With this filing, the margin varies by plan.

- Updated taxes and fees.

- No impact is assumed for the expiration of the Public Health Emergency.

...CSR SUBSIDY

This filing assumes that the Cost Share Reduction subsidy will not be funded in 2025. Therefore, the Silver plans that are offered both on and off exchange have an additional rating factor, as shown in our rate manual, to adjust the premium rates for the loss of the subsidies.

To develop the factor, we made assumptions on the population migration due to high silver premiums both on and off exchange to determine the base membership left in silver plans that would receive the load for the additional cost. We then took the expected subsidy amount that would be lost in 2025 and spread it over the expected premium for the base membership left in silver plans.

Meridian:

The rate projections for 2025 have been updated from the previous year’s projections to reflect the most recent assumptions and information available.

The following provides a narrative description of the significant factors driving the proposed rate increase for 2025.

- Single Risk Pool Experience and Morbidity (0.80% of premium impact versus 2024 filed rates)

- The individual single risk pool experience underlying the rate projections has been updated. The current model reflects the projected utilization trend applied to adjusted experience (from 2023 to 2025), including anticipated changes in the average morbidity of the single risk pool. There is a full description of utilization trend and other projection factors applied to experience in Section 6, "Trend Factors".

- Risk adjustment transfer experience for 2025 includes consideration of changes to the statewide average premium, the Risk Adjustment program, and Meridian Health Plan of Michigan enrollee population morbidity relative to the Michigan single risk pool.

- Unit Cost trend ( 3.10% of premium impact versus 2024 filed rates) Unit costs and provider reimbursement agreements have been updated to reflect changes in the rating year.

- Utilization trend ( 1.20% of premium impact versus 2024 filed rates) The projected utilization trends are consistent with observed historical trends based on internal analysis of our marketplace experience, supplemented by the Milliman Health Cost Guidelines. There is a description of the Health Cost Guidelines in Section 8, "Manual Rate Adjustments".

- Updated expectations regarding the impacts of COVID-19 in the rating period (0.0% premium impact versus 2024 filed rates) 2025 rates reflect no expected changes caused by impacts of COVID-19 pandemic in the rating period.

- Changes in Administrative Expenses and Profit ( -1.90% of premium impact versus 2024 filed rates)

- Changes in general administrative expenses incorporated into 2025 rates are resulting in a rate change due to differences from prior year expense assumptions. See Section 12, "Plan Adjusted Index Rate", for details on projected non-benefit expenses.

Note that the requested rate change may not be the same across all plans within a product due to changes to the member cost sharing amounts by plan. Additionally, the defunding of CSR subsidies Trade Secret 6 Trade Secret 5/21/2024 has contributed to the rate levels being higher than if the subsidies were to be funded.