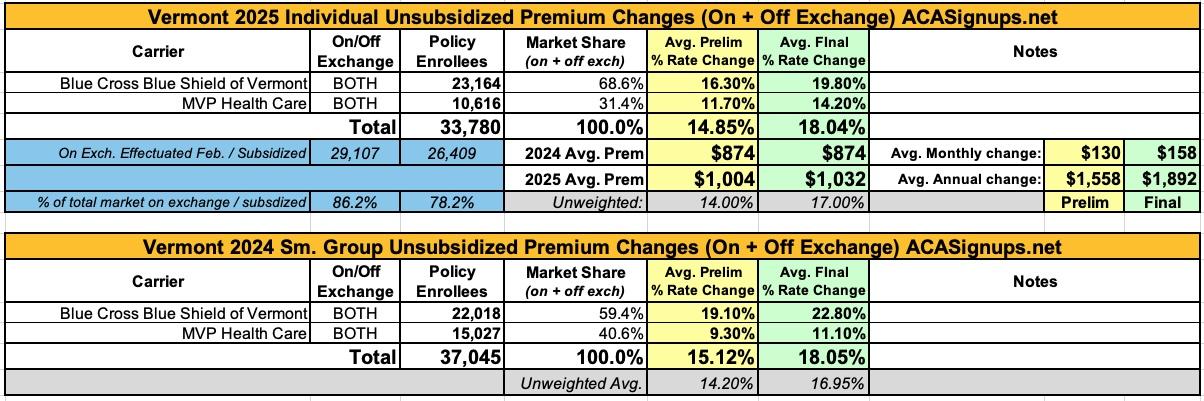

Vermont: *Final* avg. unsubsidized 2025 #ACA rate change: +18%; "limited latitude this year to require further reductions."

Originally posted 5/16/24

And here...we...go...

Every year, I spend months painstakingly tracking every insurance carrier rate filing for the following year to determine just how much average insurance policy premiums on the individual market are projected to increase or decrease.

Carriers tendency to jump in and out of the market, repeatedly revise their requests, and the confusing blizzard of actual filing forms sometimes make it next to impossible to find the specific data I need. The actual data I need to compile my estimates are actually fairly simple, however. I really only need three pieces of information for each carrier:

- How many effectuated enrollees they have in ACA-compliant individual market policies;

- The average projected premium rate change for those enrollees (assuming 100% of them renew their existing policies, of course); and

- Ideally, a breakout of the reasons behind those rate changes, since there's usually more than one.

Unfortunately, there are numerous states where due to the carriers and/or the state insurance departments heavily redacting the rate filing documentation, I've been unable to fill in the actual number of people enrolled by some or all of the insurance carriers within that state's individual market. In these cases, the average premium rate changes listed (shown in grey) are unweighted averages, not weighted.

This can make a big difference in some cases: Let's say you have 2 carriers in a state, one raising rates by 10% and the other raising them by 1%. The unweighted average increase would be 5.5%. However, what if it turns out that the first carrier has 90% of the market share while the second only has 10%? That would mean a weighted average increase 9.1%. The unweighted average is the best I can do for these states without knowing the market share breakout, however.

With that in mind...

For 2025, the first state I have preliminary rate filings available for is VERMONT. Vermont's filings are pretty easy to average because a) they don't redact any of their filing data; b) they make the forms easy to access; and c) they only have two insurance carriers operating in the individual or small group markets anyway (in fact, it's the same two carriers in both markets).

Here's what VT's preliminary 2025 filings look like:

UPDATE 9/23/24: Vermont's Green Mountain Care Board published their final, approved 2025 rate filings for both the individual and small group markets, and it's not a pretty picture for unsubsidized enrollees of either market:

GREEN MOUNTAIN CARE BOARD SETS PREMIUM ADJUSTMENTS FOR BLUE CROSS AND MVP

The Green Mountain Care Board (GMCB) directed Blue Cross and Blue Shield of Vermont (BCBSVT) and MVP Health Plan, Inc. (MVP) to adjust their proposed 2025 premiums for individuals and small businesses, affecting over 70,000 Vermonters.

Key points:

- Federal premium assistance will continue to be available in 2025 to most people who purchase a plan in the individual market. The total amount of assistance will also be much larger than in prior years. As a result, despite significant increases in the gross premiums of individual plans, for most people, the net premiums, after accounting for premium subsidies, are expected to decrease. GMCB encourages people to go to Vermont Health Connect and explore their eligibility for assistance and carefully evaluate their plan options this year.

- GMCB acknowledges that, for purchasers of small group plans, as well as individuals who are not eligible for premium assistance, the approved premium increases are painfully high. However, considering the insurers’ history of losses in these markets and serious concerns expressed by the Department of Financial Regulation about BCBSVT’s solvency, GMCB had limited latitude this year to require further reductions to the proposed premiums.

- GMCB required the insurers to make changes to the rates recommended by GMCB’s actuaries. GMCB also required the insurers to lower their assumptions about price increases at Vermont hospitals, which GMCB regulates through its hospital budget review authority.

- GMCB Board Chair, Owen Foster, stated: “These rates reflect deep fundamental failures in our healthcare system and the immediate need for systematic change. While these rates are plainly unacceptable, the alternative of an insolvent insurer unable to pay for patient care was worse. Vermont must address its underlying healthcare cost structure, demographic and housing challenges, and transform its healthcare system if we are to alleviate the healthcare affordability crisis we are facing.”

This year’s rate requests underscore the vital importance of ongoing transformation efforts included in the Act 167 Community Engagement work. These efforts aim to create a more sustainable and affordable healthcare system to better meet the needs of Vermonters while ensuring financial stability. GMCB calls on all stakeholders—hospitals, insurers, policymakers, community health care leaders, and the public—to actively engage in these transformation efforts to build a healthcare system that is both resilient and accessible.

From the actual rate filings:

Blue Cross Blue Shield of Vermont:

Individual Market

The average rate change is 16.3 percent. Changes for specific plans range from 8.5 percent to 21.5 percent for non-loaded plans and from 39.9 percent to 44.9 percent for loaded silver plans. The range of changes is due to changes to the actuarial values, plan designs, and the new guidance on silver loading, which increases the loaded silver plans by 20.8 percent and reduces the non-loaded plans by 2.1 percent.

Huh..."new guidance on Silver loading." Interesting!

Small Group Market

The average rate change is 19.1 percent. Changes for specific plans range from 14.4 percent to 22.2 percent. The range of changes is due to changes to the actuarial values and plan designs.

Reason for Rate Change(s)

The starting point of any renewal rate analysis is an assessment of actual to expected experience results. The basis for this rate filing is calendar year 2023 experience. For the individual market, the claims experience for 2023 was under the expectation embedded within the 2024 filing. This was offset by much lower than expected risk adjustment transfer and other small population changes to produce an overall change to 2023 rates due to the experience and population changes of 1.9 percent.

For the small group market, calendar year 2023 claims were higher than expected in the prior filing, due to both a higher level of claims across the whole segment and very high claimants. While not as profound as for individual, the lower expected risk adjustment transfer is also increasing rates. Combined, the experience and population changes increase the 2025 rates by 4.0 percent.

Similar to the last few years, trend is the most significant driver of the change in rates (see section 3.4.7). The 2024 approved rates included assumptions for projecting 2023 to 2024 which must be re-examined because the 2025 filing is based on updated actuarial assumptions that reflect current data. Also, an additional year of projected trend applies from 2024 to 2025. The overall anticipated increase in rates due to trend is 9.8 percent for individual and small groups.

So what's this "new guidance" about? Well lo and behold, it's Premium Alignment!

For plan year 2025, the Green Mountain Care Board requires that QHP issuers use a silver load of 41.87 percent, which is dramatically higher than in prior years. Blue Cross VT supports this effort to increase the federal Advance Premium Tax credits for Vermonters who qualify for these benefits. At the same time, this new guidance introduces complexity for members during the open enrollment season. First, On-Exchange Silver plans will have higher premiums than Gold plans. This dynamic will be confusing and members will be encouraged to carefully evaluate their options when choosing the best health plan. Blue Cross VT plans to work with other stakeholders to ensure that the messaging is consistent and that members are supported through this change.

...On February 14, 2024, the Green Mountain Care Board approved the “Revised Proposed Guidance” approach to the Silver Loaded plans. Enrollment figures were provided to Lewis and Ellis by each carrier and a statewide silver load factor was calculated to be 1.4187. The factors are shown in Exhibit 6C.

The proposed average rate increase (MVP’s revenue increase) is 11.7%, with increases ranging from 2.7% to 34.3%.

...A description of benefits is included in Exhibit 1 of the rate filing. As in 2024, MVP has filed Silver plans to be sold off exchange known as “reflective” Silver plans. These plans are equivalent to the corresponding on-exchange plan with the exception of a $5 copay or 5% coinsurance change to the ambulance benefit or a modification to the deductible/maximum out of pocket for a plan which has no cost sharing after the deductible.

Silver Load Membership Movement Claim Adjustment

In response to the prescribed silver loading guidance described below, MVP assumed a membership movement of individual members who currently have purchased a base Silver, 73% CSR, or 77% CSR plan to a corresponding Gold plan. This has been reflected in MVP’s projected “Benefit Relativity * Induced Demand Reflected In Index Rate” on Exhibit 6 but it also warrants an adjustment to experience period incurred claim cost to reflect the discrepancy between net claim expense and projected actuarial value for these members. The impact was determined by calculating the book of business experience period benefit actuarial value (including induced demand) including these members in their current plan and then comparing to the book of business actuarial value after assuming the membership movement has occurred. This was calculated as a 4% load which is shown on line 25 and incorporated into line 26 of Exhibit 3.

...Actuarial Values and Induced Utilization Factors

The AV Metal Level for each plan was determined using the Federally prescribed Actuarial Value Calculator. Adjustments for aggregate deductibles, the VT Rx OOPM, and safe harbor prescription Rx benefits were made to the calculator results for the non-standard plans. The actuarial certification of these adjustments has been included as an attachment to this filing in SERFF.

The Benefit Actuarial Value for each plan was determined using MVP’s in-house benefit relativity model. The pricing tools value the expected net paid claim cost associated with unique benefit plan designs from a starting single risk pool allowed amount. The AV is the ratio of the expected paid to allowed amount for each plan design.

The induced utilization factors used to set premium rates and compute the average in-force induced utilization factor are the HHS prescribed induced utilization factors of 1.00 for Bronze, 1.03 for Silver, 1.08 for Gold, and 1.15 for Platinum. The experience period (with adjustments for membership movement and Silver loading) actuarial value times induced demand factor (0.8313) can be found in Exhibit 6.

And once again...

Silver CSR Loading

As stated previously, the Federal government has cancelled reimbursement of incurred claims under the CSR program effective October 2017. However, members are still eligible for the reduced cost sharing plans in the program, which will have to be covered by increasing premiums. The Green Mountain Care Board’s solution to this problem was to create two sets of Silver plans: one set for non-CSR members with premiums that do not reflect the CSR defunding and 11 one set for CSR members which reflect the CSR defunding in the premium. This was done so that the second-lowest cost Silver plan on the exchange would have an increased premium, which is the plan used to determine how much low-income members will receive in premium subsidies through the federal Advance Premium Tax Credits (APTC) program. That way, premium increases for CSR defunding will be met with corresponding increases in APTC subsidies and the net policyholder premium increase will be minimized.

New guidance on silver loading was implemented by the Green Mountain Care Board in 2025. Based on this, MVP has calculated base pricing actuarial values for on-exchange Silver plans and applied the CSR load factor supplied by the Board (1.4187). The initial actuarial values and the calculated load applied to the net claim cost can be found on Exhibit 6 of the rate filing. The CSR load significantly increased the cost of Silver plans, and we compared the premium relativities (net of APTC payments) of other metal levels to Silver as proposed. Our current proposed relativities indicate that there is incentive for base Silver, 73% CSR and 77% CSR variant members to move to a different metal level. We assumed that 100% of members in these plans would shift to a corresponding Gold plan.