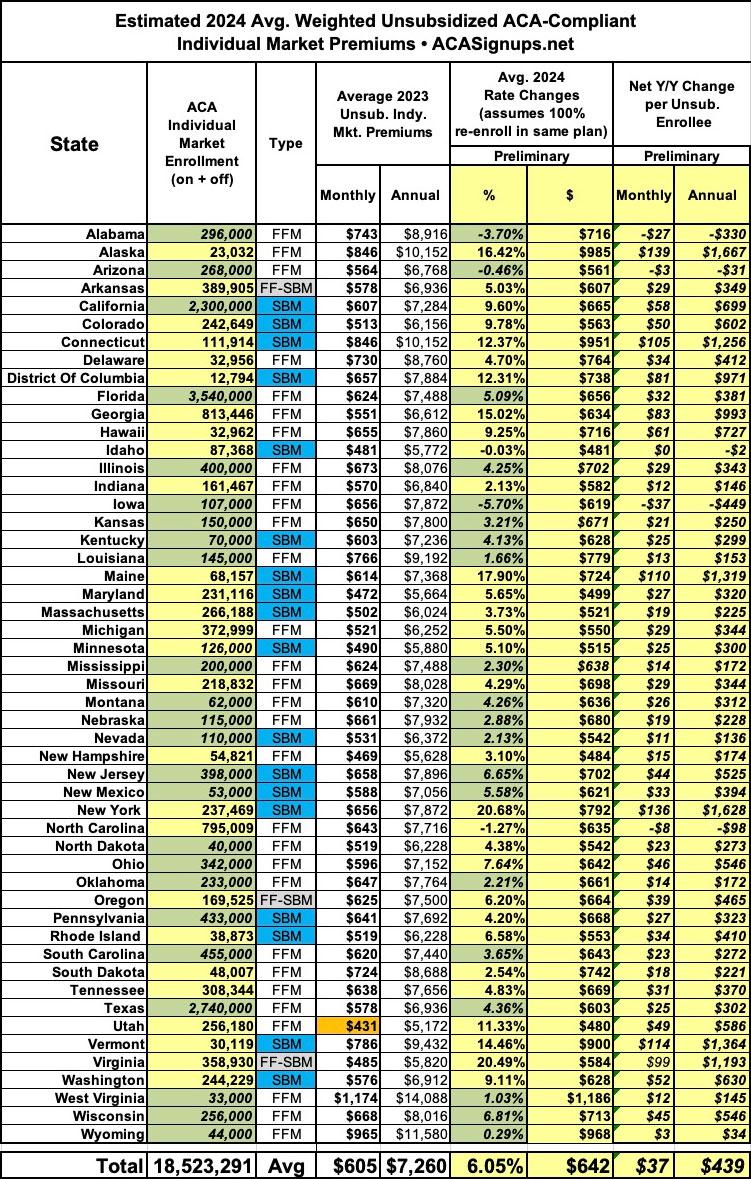

EVERY STATE: Preliminary avg. unsubsidized 2024 #ACA rate changes: +6.1% (semi-weighted)

I've finally completed my Annual Individual & Small Group Market Rate Filing project for preliminary 2024 rate filings, having analyzed & crunched the numbers for the individual and small group markets across all 50 states + DC, so it's time to step back and see where things stand nationally.

It's important to remember that these are preliminary filings only--many of the carriers will have their final 2024 rate changes reduced, although in many cases they tend to be approved as is.

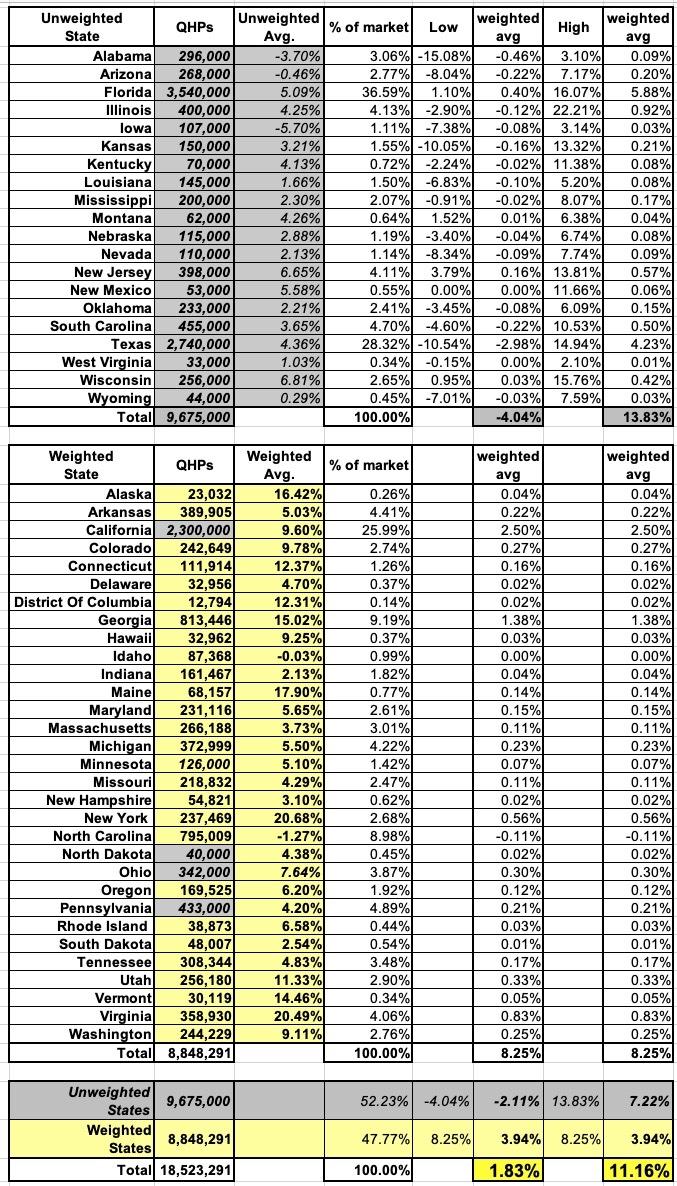

It's also important to note that I only have weighted average rate changes for 30 states (+DC). For the other 20 states, I've only been able to generate unweighted average rate changes--that is, I have to assume every carrier in that state has the same number of ACA enrollees since their rate filing forms are either unavailable or heavily redacted, making it impossible for me to know how many people are enrolled in their policies.

Furthermore, the 20 states where the average rate changes are unweighted include states with huge ACA enrollment numbers like Florida and Texas, which means they comprise over half the total individual market (roughly 52%), while the 30 states with weighted averages only make up around 48% of the total. So when I say that the national average below is "semi-weighted" I mean that quite literally: Roughly half the market has been weighted by carrier market share, while the other half is a simple unweighted average of all the carriers in those states.

It's also important to note that the states where I have to run unweighted average rate changes are also the same states where the total individual market enrollment is unknown (for the same reason). For these, I'm using estimates based on the known on-exchange enrollment and educated guesses of off-exchange enrollment.

With these caveats in mind, the average requested increases range from a 5.7% reduction in Iowa (unweighted) to as much as a 20.7% increase in New York (weighted). Again, Iowa is an example of how unweighted averages can be misleading--there are three carriers ranging from a 7.4% drop to a 3.1% increase. If it turns out that the latter holds the bulk of the Iowa market, Iowa enrollees could still be looking at increases (plus, of course, the rates vary by plan anyway).

In any event, assuming these estimates are reasonably accurate and assuming the state regulators approve all of the requested changes as is (which won't be the case many of them), premiums for unsubsidized ACA individual market plan enrollees will go up an average of around 6.1% nationally, from ~$605/month to ~$642/month, give or take. This amounts to roughly $37 more per month or $439 more per year for those not receiving federal subsidies.

Of course, only 9% of on-exchange enrollees are unsubsidized this year, although it's more like ~30% when you include the off-exchange market, which still comprises roughly 23% of total individual market enrollment.

As it happens, 6.1% is almost identical to the 6% median premium increases recently estimated across all 50 states & DC by the Kaiser Family Foundation (KFF).

UPDATE: I decided to go the extra mile and see how wide the hypothetical range is for a fully weighted national average across all 50 states+DC by assuming 100% of all enrollees in the unweighted states were enrolled with carriers having the lowest and highest average 2024 rate changes. As you can see below, if you assume that the carriers with the lowest rate changes had 100% market share in those states, it would drop the weighted national average down to a 1.8% increase overall; if you assume the carriers with the highest rate changes had 100% market share, it would increase the weighted national average up to 11.2%.

Again, the actual weighted average is somewhere in between these extremes...which I have pegged at roughly 6.1%.