Vermont: Final avg. unsubsidized 2023 #ACA rate change: +15.2%

Hmmmm...Vermont's filings are usually pretty easy to average because a) they don't redact any of their filing data; b) they make the forms easy to access; and c) they only have two insurance carriers operating in the individual or small group markets anyway (in fact, it's the same two carriers in both markets).

This year, however, there's an odd discrepancy going on between what I had originally reported as the preliminary 2023 rate filings and what's showing up as the preliminary filings under the approved rate changes.

Back in May, the preliminary individual market rate filings were +12.3% for Blue Cross Blue Shield of Vermont and +17.4% for MVP, for a weighted average increase of 14.7%, while the small group filings averaged out to +14.6%.

This was also reported by Liora Engel-Smith of VT Digger at the time:

Private health insurers have asked state regulators to approve double-digit premium hikes in 2023 — increases that could mean Vermonters with private insurance could pay hundreds of dollars more for health coverage next year.

In its annual filing to the Green Mountain Care Board, BlueCross BlueShield of Vermont asked regulators to approve a 12.5% increase in 2023. MVP Health Care asked for 16.6%.

Insurers said the increases would cover what is expected to be a costly year for hospital spending.

The exact increase for each customer would depend on the plan the enrollee chooses. For example, a BlueCross analysis projects its Silver Plan enrollees could pay $700 more in premiums next year.

Hospital executives have said previously the pandemic forced them to raise salaries and hire costly temporary staff.

...If the Green Mountain Care Board allows insurers to raise their rates in 2023, Vermont Health Connect enrollees who don’t get federal subsidies would take a hit. So would Vermonters who get health insurance coverage through small employers.

However, here's what the approved filing press release looks like from August:

GREEN MOUNTAIN CARE BOARD REDUCES HEALTH INSURANCE RATE REQUESTS FOR SMALL GROUP AND INDIVIDUAL & FAMILY PLANS FOR 2023

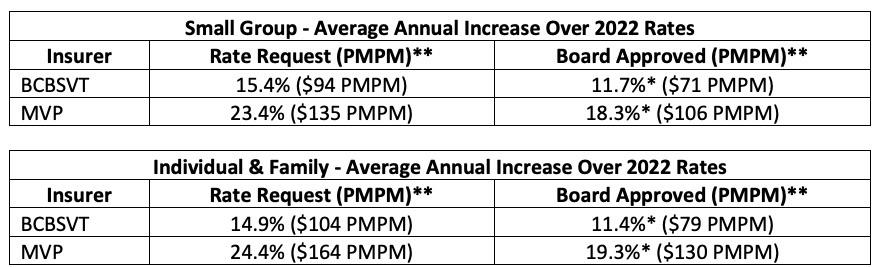

Montpelier, VT – The Green Mountain Care Board (GMCB) issued decisions today requiring Blue Cross Blue Shield of Vermont (BCBSVT) and MVP Health Plan, Inc. (MVP) to lower the premiums they wanted to charge individuals and small businesses for health insurance plans in 2023. Approximately 72,000 Vermonters were enrolled in these plans as of March 2022. The large rate increases proposed by MVP and BCBSVT this year were driven by several factors, including rising costs for specialty pharmaceuticals and higher costs paid to health care providers for delivering services, which in turn are being driven by inflationary and workforce pressures being faced by many sectors of the economy. After a thorough review, the Board, acting within its statutory authority, and balancing a number of statutory factors, reduced BCBSVT’s and MVP’s proposed rates by the amounts reflected in the following tables:

*These rate increases represent averages across different benefit plans with varying levels of cost sharing. For small group, the plan-level increases approved range from 9.1% to 15.3% for BCBSVT and 10.5% to 21.5% for MVP. For individual and family plans, the plan-level increases approved range from 8.8% to 15.3% for BCBSVT and 11.3% to 26.3% for MVP.

**Per member per month (PMPM) is the dollar amount a member pays each month for a health care plan.

Health Care Subsidies and Additional Resources

- Approximately 5,500 Vermonters could still save money in 2022 on their monthly premium by signing up through Vermont Health Connect (VHC).

- To find out if you qualify for a subsidy, use the VHC Plan Comparison Tool. • Vermonters can use the Plan Comparison Tool starting October 14, 2022, to compare plans for 2023. Open enrollment for 2023 plans begins November 1, 2022.

- As of August 4, 2022, it remains uncertain whether Congress will renew for 2023 the expanded premium tax credits initially made available through the American Rescue Plan Act (ARPA). Information is available here about ARPA and how it impacts you and your eligibility for premium assistance.

- For questions about your health insurance or health care access, please contact Vermont Legal Aid’s Office of the Health Care Advocate at 1-800-917-7787.

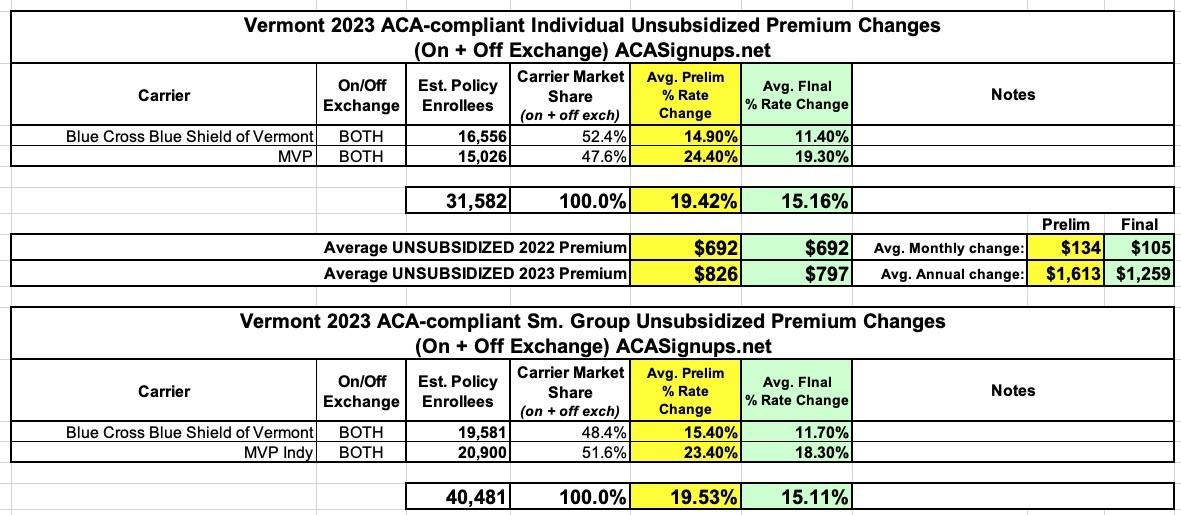

This puts the preliminary rate changes requested much higher, at 19.4% and 19.5% on average for the two markets respectively, as shown below. Of course, there's often additional revised filings submitted in between the initial and final rates, so this doesn't mean there's anything nefarious going on, but it's a bit confusing. In any event, the final, approved average increases are still pretty ugly: 15.2% and 15.1% respectively.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.