Vermont: (Preliminary) avg. unsubsidized 2023 #ACA rate change: +14.7%

And here...we...go...

Every year, I spend months painstakingly tracking every insurance carrier rate filing for the following year to determine just how much average insurance policy premiums on the individual market are projected to increase or decrease.

Carriers tendency to jump in and out of the market, repeatedly revise their requests, and the confusing blizzard of actual filing forms sometimes make it next to impossible to find the specific data I need. The actual data I need to compile my estimates are actually fairly simple, however. I really only need three pieces of information for each carrier:

- How many effectuated enrollees they have in ACA-compliant individual market policies;

- The average projected premium rate change for those enrollees (assuming 100% of them renew their existing policies, of course); and

- Ideally, a breakout of the reasons behind those rate changes, since there's usually more than one.

Unfortunately, there are numerous states where due to the carriers and/or the state insurance departments heavily redacting the rate filing documentation, I've been unable to fill in the actual number of people enrolled by some or all of the insurance carriers within that state's individual market. In these cases, the average premium rate changes listed (shown in grey) are unweighted averages, not weighted.

This can make a big difference in some cases: Let's say you have 2 carriers in a state, one raising rates by 10% and the other raising them by 1%. The unweighted average increase would be 5.5%. However, what if it turns out that the first carrier has 90% of the market share while the second only has 10%? That would mean a weighted average increase 9.1%. The unweighted average is the best I can do for these states without knowing the market share breakout, however.

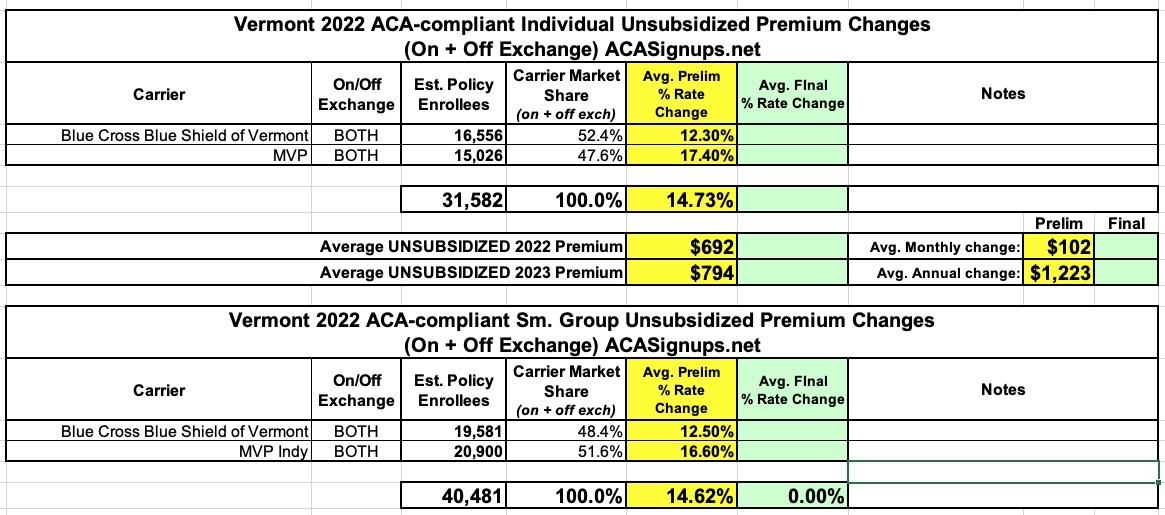

For 2023, the first state out of the gate with its preliminary rate filings is VERMONT. Vermont's filings are pretty easy to average because a) they don't redact any of their filing data; b) they make the forms easy to access; and c) they only have two insurance carriers operating in the individual or small group markets anyway (in fact, it's the same two carriers in both markets).

Here's what VT's preliminary 2023 filings look like...and it's not pretty. On average, the two carriers (Blue Cross Blue Shield and MVP) are asking for 14.7% increases in individual market premiums and nearly the same (14.6%) for small group plans:

Liora Engel-Smith of VT Digger has a good story on the news:

Private health insurers have asked state regulators to approve double-digit premium hikes in 2023 — increases that could mean Vermonters with private insurance could pay hundreds of dollars more for health coverage next year.

In its annual filing to the Green Mountain Care Board, BlueCross BlueShield of Vermont asked regulators to approve a 12.5% increase in 2023. MVP Health Care asked for 16.6%.

Insurers said the increases would cover what is expected to be a costly year for hospital spending.

The exact increase for each customer would depend on the plan the enrollee chooses. For example, a BlueCross analysis projects its Silver Plan enrollees could pay $700 more in premiums next year.

Hospital executives have said previously the pandemic forced them to raise salaries and hire costly temporary staff.

...If the Green Mountain Care Board allows insurers to raise their rates in 2023, Vermont Health Connect enrollees who don’t get federal subsidies would take a hit. So would Vermonters who get health insurance coverage through small employers.

It's worth noting that if the American Rescue Plan's enhanced ACA subsidies aren't extended beyond the end of 2022, the population referred to above (households no longer eligible for ACA subsidies due to earning slightly more than 4x the Federal Poverty Line) were already looking at net premium increases of as much as $1,800/month for a family of four) even without these rate hikes.

From the actual rate filings:

Reasons for rate changes in the individual and small group markets.

Some changes increased rates for 2022, while cost containment efforts decreased rates. Key factors include:

- Medical care and retail pharmacy costs continue to rise. Hospital costs and prescription drugs are the two greatest pressures on the cost of health care in Vermont. This alone resulted in a 13.8 percent increase in our members’ premiums.

- Impact of required benefit changes. We changed the cost sharing aspect of our plans as required. Because of the relationship between cost sharing and premiums, those changes decreased rates by -0.7 percent.

- Blue Cross efforts resulted in decreased rates. Our work to verify that services are billed correctly and fairly and to reduce costs of prescription drugs for our members decreased our rate request by -1.3 percent.

Why We Are Changing Our Premiums

MVP must obtain approval from the Green Mountain Care Board for the health insurance premium rates charged. MVP files annual premium rates for the Exchange which are guaranteed for 12 months. This rate filing seeks approval of MVP's 2023 Individual Exchange rates for effective dates of coverage between January 1, 2023 and December 31, 2023. The premium rates filed reflect MVP's current estimate of the cost to provide health insurance for that coverage period. The filed premium rates may be higher or lower than the previously filed premium rates, however, premium rates generally increase over time. Changes in the filed premium rates (relative to previously approved rates) are driven by many factors, including:

- Increases in base period experience. Premium rates are increasing by 16.1% because our estimate of 2022 claims are higher than expected compared to the previous year.

- Increases in cost and utilization of services. The cost and utilization of medical and pharmacy services generally increase over time. Premium rates are increasing by 7.1% because of this estimated trend in 2023.

- Impact of the Federal Risk Adjustment Program. The federal risk adjustment program seeks to “level the playing field” among insurers. MVP has enrolled a population of higher-risk members, so it will receive money from the program, decreasing premium rates by approximately 4.8%.

- Impact of the COVID-19 pandemic. MVP is assuming that cost and utilization of services related to COVID-19 will decrease in 2023. This decreases the premium rate by 0.7%.

- Changes in the cost of doing business. As the cost of doing business rises over time, MVP must collect a portion of the premium revenue to protect consumers by ensuring its solvency. MVP aligned its administrative costs with the expected cost of the individual market. These changes are worth approximately 0.1% of a premium decrease.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.