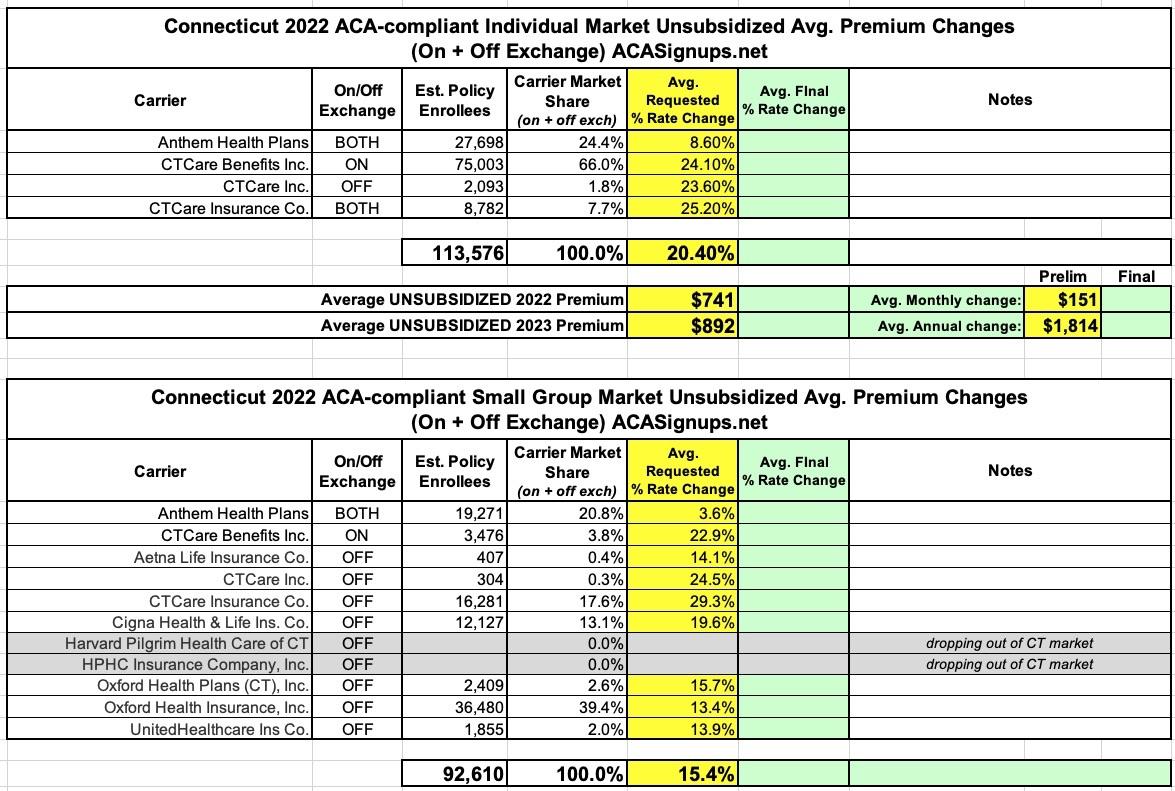

Connecticut: (Preliminary) avg. unsubsidized 2023 #ACA rate changes: +20.4%

Ouch. Via the Connecticut Insurance Dept:

The Connecticut Insurance Department has posted the initial proposed health insurance rate filings for the 2023 individual and small group markets. There are 13 filings made by 9 health insurers for plans that currently cover approximately 206,000 people.

Anthem, ConnectiCare Benefits Inc. (CBI) have filed rates for both individual and small group plans that will be marketed through Access Health CT, the state-sponsored health insurance exchange. ConnectiCare Insurance Company, Inc. has filed rates for the individual market on the exchange.

Harvard Pilgrim Health Care and HPHC have decided to leave the CT market and will no longer offer new business small group health plans. They will only renew existing plans through the end of their appropriate plan years.

The 2023 rate proposals for the individual and small group market are on average higher than last year:

The proposed average individual rate request is a 20.4 percent increase, compared to 8.6 percent in 2022 and ranges from 8.6 percent to 25.2 percent.

The proposed average small group rate request is a 14.8 percent increase, compared to 12.9 percent in 2022 and ranges from 3.6 percent to 29.3 percent.

(I have the small group market down as +15.4%...not sure what accounts for that discrepancy.)

In addition, carriers have attributed the proposed increases to:

- Trend: Trend is a factor that accounts for rising health care costs, including the cost of prescription drugs and the increased demand for medical services.

- COVID-19: An increase in morbidity and severity of projected claims due to delays in care as a result of the pandemic. In addition, there is an expectation of pent-up demand experienced throughout 2022 and a continued increase in behavioral health disease anticipated in 2022.

- Legislation: The impact of bills passed such as richer benefits for diabetic treatments (i.e. prescription drugs and medical supplies) and the elimination of copay accumulators are also included in the 2023 proposed rates.

- Discontinuance of ARPA Subsides: The potential negative impact to the individual risk pool if the ARPA subsidies are discontinued effective 1/1/2023.

The Insurance Department will conduct actuarial reviews on each filing to determine if they are justified and will either approve, reject or modify the request. The minimum 30-day public comment period on all filings begins today (July 8) and comments can be filed online through the link that accompanies every filing or can be delivered to the Connecticut Insurance Department at P.O. 816, Hartford, CT 06142-0816.

The Department expects to make final rulings on the proposals in September. Open enrollment for the 2023 coverage year begins November 1, 2022.

As for the specific reasons for the increases on the individual market:

On July 1, 2022, Anthem Health Plans, Inc. filed a rate request for an average 8.6 percent increase on individual health plans marketed on and off the state’s health insurance exchange. There are approximately 27,698 people covered in Connecticut under these Anthem plans, both on and off the exchange. The company’s price calculation does account for a 9.2 percent impact of medical cost inflation, provider contracting changes and increased demand for those medical services, a factor known as “trend.”

According to Anthem, the key factors of the price calculation are:

- Morbidity: There are anticipated changes in the market-wide morbidity of the covered population in the projection period.

- Benefit modifications, including changes made to comply with updated Actuarial Value requirements.

- Changes in taxes and fees, and some non-benefit expenses.

On July 1, 2022, ConnectiCare Benefits, Inc. (CBI) filed a request to raise rates an average of 24.1 percent for individual health plans marketed through Access Health CT, the state’s health insurance marketplace. There are approximately 75,003 people covered under these policies. CBI stated the requested increase is based on a number of factors including rising medical costs and a demand for services, an effect known as “trend.” That factor is expected to have a projected impact of 12.1 percent on the insurer’s claims costs.

In calculating the proposed 2023 rates, CBI also stated that:

- We have observed a much greater claims trend in 2022YTD after normalizing for COVID-19 treatments, testing, and vaccination compared to a normal level. This is likely due to pent-up demand as well as the increased disease burden due to COVID-19.

- The expanded subsidies under the American Rescue Plan Act put in place in 2021 are expected to go away in 2023. Less individual consumers will be qualified for Federal Advance Premium Tax Credits (APTC). We expect members to leave the individual ACA market who were previously insured, and those members are likely to be healthier than the population who will stay in the individual ACA market. As a result, we expect the average morbidity of the single risk pool to go up and therefore lead to an unfavorable impact on 2023 rates.

You get the idea. Not a pretty picture in the Nutmeg State if the American Rescue Plan's expanded subsidies aren't extended beyond 2022.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.