(updated) Michigan: (Preliminary) Avg. Unsubsidized 2023 #ACA Rate Change: +6.2%

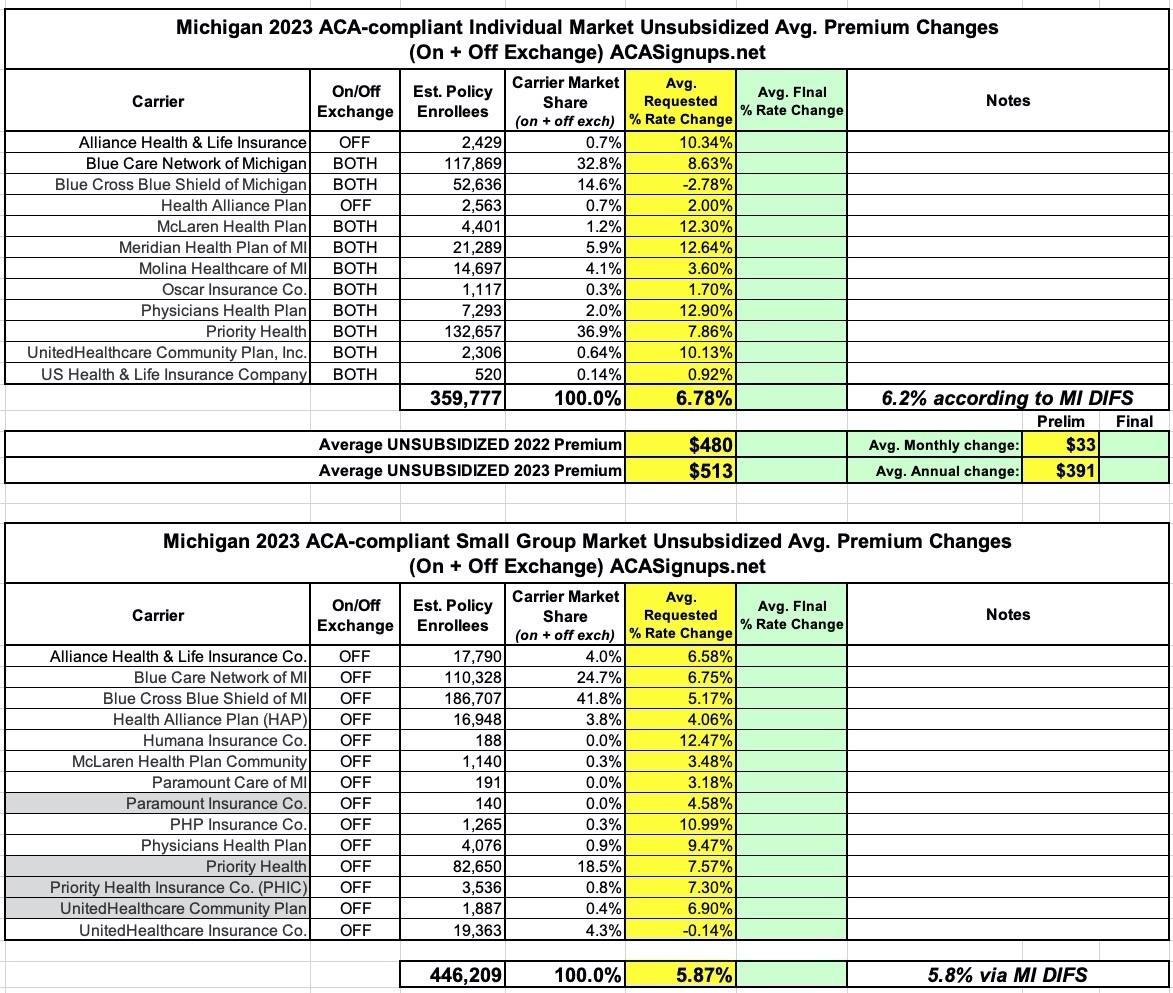

A few weeks ago I compiled the weighted average 2023 premium rate filings for Michigan's individual and small group markets. At the time, I came up with average rate hikes of 6.8% for the ACA individual market and 6.8% for the small group market.

Today, the Michigan Dept. of Financial Services posted the official preliminary 2023 filings, and while I was dead on for most of the carriers, I was off slightly for a few of them:

Michiganders to Have More Opportunities to Shop Around During Upcoming Health Insurance Open Enrollment Period

- Recent filings highlight increased consumer choice, show state in-line with national rate trends

(LANSING, MICH) During this year’s upcoming open enrollment period, Michiganders will have more than 300 health plans to choose from, giving them more flexibility in the coverage they need to protect their health and the health of their families. This information comes from proposed rate filings sent by health insurers to the Michigan Department of Insurance and Financial Services (DIFS).

“Health care continues to be at the forefront of public policy discussions, both in Michigan and nationwide, and it is critical that Michiganders have access to the affordable, high quality health insurance they need for themselves and their families," said DIFS Director Anita Fox. "Consumers who will need to buy a health plan during open enrollment this year will have all-new plan options, so it is important that they take advantage of these new choices by shopping around and choosing the plan that works best for their needs and budget."

Open enrollment for 2023 health coverage will run from November 1 through December 15, 2022. Michiganders can obtain coverage by visiting the Health Insurance Marketplace or by calling 800-318-2596 (TTY: 1-855-889-4325). During open enrollment, consumers will be able to choose from 233 health plans on the Marketplace, 59 more than last year. For the overall individual market, which includes off-Marketplace plans, 308 plans will be available, 52 more than last year.

Individual health plans are offered to Michiganders by the following companies:

- Alliance Health and Life Insurance Company (off-Marketplace)

- Blue Care Network of Michigan

- Blue Cross Blue Shield of Michigan Mutual Insurance Company

- Health Alliance Plan (off-Marketplace)

- McLaren Health Plan Community

- Meridian Health Plan of Michigan, Inc.

- Molina Healthcare of Michigan, Inc.

- Oscar Insurance Company

- Physicians Health Plan

- Priority Health

- United Healthcare Community Plan

- U.S. Health and Life Insurance Company

As the state agency that regulates the insurance industry in Michigan, DIFS is responsible for reviewing all proposed plans and rates to ensure compliance with state and federal laws. Michigan’s proposed rates for 2023 have not yet been approved by DIFS and are subject to further review and approval. The average requested rate changes filed for individual plans range from a decrease of 2.8% to an increase of 12.9%. Overall, the average proposed rates show an increase of 6.2%.

Health insurance rates nationwide, including Michigan, are being affected by several factors, such as:

- An increased demand for health care, as procedures that were postponed or cancelled during the pandemic are rescheduled.

- Inflationary and supply chain pressures that affect the cost of medical supplies and prescription drugs.

It is important to note that nearly 80% of enrolled Michiganders receive advanced premium tax credits (APTC), which reduce their monthly premium costs. In a move that will help further protect Michiganders’ pocketbooks, Governor Gretchen Whitmer has joined other state governors and signed on to a letter to Congressional leaders to make permanent the expanded APTC enacted by the American Rescue Plan. An estimated 260,000 Michiganders currently take advantage of this program, saving an average of nearly $400 per month, with many consumers eligible to get health coverage for less than $10 per month. For more information on APTC and to learn if you qualify, visit HealthCare.gov.

The 2023 Michigan Health Insurance Rate Change Request Chart is posted on the DIFS website. When reviewing the chart, it is important to note that:

- Rate changes are an average percent change across all plans offered by that insurer; some consumers will experience rate changes either greater or less than those in the chart;

- An increase or decrease does not reflect how a health insurer's premiums compare to plans offered by other insurers; and

- Individuals who receive a tax credit that covers a portion of their premiums will experience rate changes that differ due to the tax credit calculation.

DIFS is seeking public comment on these proposed rate changes. Comments should be sent electronically to DIFS-healthratecomments@michigan.gov and, if submitted before July 18, 2022, will be considered in DIFS' review. For questions or concerns about health insurance coverage in Michigan, contact DIFS at 877-999-6442, Monday through Friday from 8 a.m. to 5 p.m. or visit Michigan.gov/HealthInsurance.

Here's what the corrected spreadsheets look like. I'm still not sure how MI DIFS comes up with 6.2% instead of 6.8% for the indy market, although the small group average is almost exactly what I have when the enrollment numbers are corrected:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.