Michigan: (Preliminary) Avg. Unsubsidized 2023 #ACA Rate Change: +6.8%

The Michigan Dept. of Insurance & Financial Services hasn't issued any press releases yet, so it's conceivable that these may change, but Michigan's preliminary 2023 individual & small group market health insurance policy rate filings appear to be pretty complete on the SERFF database.

Alliance Health & Life Insurance Co:

The following are the key drivers of the requested rate change.

- Base Experience – AHL’s Individual ACA experience is the basis for AHL’s 2023 premium rates. AHL’s claims experience is driving rate deficiency of 7.7%.

- Trend – AHL’s 2023 annual claims trend is approximately 4.5%.

- Prospective COVID Treatment – AHL’s projection period will contain testing, treatment, and vaccinations due to COVID-19. Our calculation of this additional cost of care translates to a -0.4% increase on claims.

- Risk Adjustment – The projected risk adjustment payable is decreasing relative to the filing approved effective January 1, 2022. This impacts the rate change by -1.5%.

- Retention Charges – The load for retention is decreasing relative to the filing approved effective January 1, 2022. This impacts the rate change by 0.1%.

...AHL’s current and projected membership (as displayed in Worksheet 2 of the URRT) is detailed in Exhibit 6. Projected membership is based on March 2022 membership and anticipated changes in take-up rates due to the competitive position of AHL and the impact of American Rescue Plan legislation on the Individual market.

Blue Care Network:

Significant drivers of the rate change include:

- Medical inflation and increased utilization as described in Section 5 of this memorandum, including the COVID PMPM noted below.

- Changes in the morbidity of the population

- Updated base period and claims deficiency resulting in a variance versus last year’s pricing expectations

- Updated projections for risk adjustment transfers as summarized in section 9 of this memorandum

- Updates to benefit designs to ensure compliance within actuarial value ranges

...COVID costs, including testing, treatment, and deferred care, are included in the projections for 2023. The Allowed PMPM impact of COVID for 2023 is $5.27. The American Rescue Plan Act of 2021 (ARPA) increased and expanded the subsidies offered on the exchange for the individual market. If the American Rescue Plan Act (ARPA) subsidies are restored, the estimated impact on rates is -0.5%. This calculation took into account lower trend / selection, as well as an adjusted mix of members within Silver variant options.

Half a point may not sound like much, but that'd be an additional savings of around $3 million for BCN enrollees alone ($30 x 103K enrollees) on top of the massive savings in net premiums thanks to the enhanced subsidies themselves.

Blue Cross Blue Shield of Michigan:

Significant drivers of the rate change include:

- Medical inflation and increased utilization as described in Section 5 of this memorandum, including the COVID PMPM noted below.

- Changes in the morbidity of the population

- Updated base period resulting in a variance versus last year’s pricing expectations

- Updated projections for risk adjustment transfers as summarized in section 9 of this memorandum

- Updates to benefit designs to ensure compliance within actuarial value ranges

...COVID costs, including testing, treatment, and deferred care, are included in the projections for 2023. The Allowed PMPM impact of COVID for 2023 is $10.15. The American Rescue Plan Act of 2021 (ARPA) increased and expanded the subsidies offered on the exchange for the individual market. If the American Rescue Plan Act (ARPA) subsidies are restored, the estimated impact on rates is -0.3%. This calculation took into account lower trend / selection, as well as an adjusted mix of members within silver variant options.

Again, that'd be an additional savings of around $1.1 million for BCBSM enrollees.

Health Alliance Plan:

These products are offered off the Individual Insurance Exchange only.

The following are the key drivers of the requested rate change.

- Base Experience – HAP’s Individual ACA experience is the basis for HAP’s 2023 premium rates. HAP’s claims experience is driving rate sufficiency of 2.6%.

- Trend – HAP’s 2023 annual claims trend is approximately 4.4%.

- Prospective COVID Treatment – HAP’s projection period will contain testing, treatment, and vaccinations due to COVID-19. Our calculation of this additional cost of care translates to a -0.3% increase on claims.

- Risk Adjustment–The projected risk adjustment payable is increasing relative to the filing approved effective January 1, 2022. This impacts the rate change by 3.7%.

- Retention Charges – The load for retention is decreasing relative to the filing approved effective January 1, 2022. This impacts the rate change by -3.2%.

...HAP’s current and projected membership (as displayed in Worksheet 2 of the URRT) is detailed in Exhibit 6. Projected membership is based on March 2022 membership and anticipated changes in take-up rates due to the competitive position of HAP and the impact of American Rescue Plan legislation on the Individual market.

HAP doesn't specify what they feel the impact of "ARP legislation" will actually be on membership, but it's especially interesting that they mention it at all given that HAP is offering off-exchange plans only. That is, their enrollees aren't eligible for ACA subsidies whether the ARP expansion continues or not.

McLaren:

Morbidity Adjustment

We do not expect a significant change due to morbidity changes and have therefore not applied a morbidity adjustment to 2021 McLaren experience. The morbidity adjustment is illustrated in Step 5 of Appendix A.

COVID-19 Adjustment

We have not applied a COVID-19 adjustment to the McLaren experience, assuming that COVID-19 related costs in 2023 will be similar to 2021.

Although we have not applied an explicit adjustment for COVID-19, we note $5.70 PMPM of allowed COVID related claims were in the 2021 base period. Rapid tests accounted for $0.54 PMPM, or 0.11% of total allowed costs. For the projection period, this would translate to $0.79 PMPM of allowed dollars.

ARP Adjustment

We have assumed ARPA will increase the average morbidity compared to our base experience. The adjustment is illustrated in Step 6 of Appendix A. ARPA created a special enrollment period which would have started impacting CY2021 claims midyear. To estimate its impact, we’ve compared average market morbidity PLRS for CY2021 versus CY2019 and attributed a portion of the increase in morbidity to ARPA.

McLaren goes on to estimate a morbidity adjustment of 1.4% due specifically to ARP...not so much because of the subsidies themselves but because of the Special Enrollment Period which coincided with it. This isn't quite accurate, however: Technically speaking, the SEP itself was independent of the ARP legislation, though obviously the two were connected. Then again, they may be referring to the more recent year-round SEP given to enrollees who earn less than 150% FPL.

Meridian:

As instructed by Meridian, the premium rates developed and supported by this Actuarial Memorandum are based on legislative and regulatory provisions in effect at the time of preparation or otherwise scheduled by law or regulation to take effect in plan- year 2023. These provisions include the December 31, 2022 expiration of the American Rescue Plan Act of 2021 (ARP) expansion of advance premium tax credit (APTC) premium subsidies. Changes to these and other provisions that impact 2023 may affect the extent to which the premium rates are sufficient and neither excessive nor deficient.

... Anticipated changes in the average morbidity of the single risk pool (-2.4% premium impact versus 2022 filed rates)

Meridian's 2023 rates reflect updated expectations regarding the risk profile of the Michigan single risk pool and its enrollee population relative to Meridian's 2022 rates. We considered the introduction and anticipated expiration of American Rescue Plan Act (ARPA) enhanced subsidies when evaluating morbidity changes using a population migration model and data from the Current Population Survey. Based on our analysis, we estimate no material rate impact associated with the introduction and expiration of these subsidies, nor a material rate impact if the subsidies were to be restored.

...Appendix 7.1 decomposes the morbidity projection factor into its components, including the following:

- An adjustment for differences in estimated direct and indirect costs associated with the COVID-19 pandemic between Meridian‘s 2021 experience and the 2023 rating period.

- ...An adjustment for potential changes in the health status profile of the statewide single risk pool from 2021 to 2023, including consideration of impacts from expiration of expanded APTCs from the American Rescue Plan Act of 2021.

Molina:

The 2023 premium rates supported by this Actuarial Memorandum include the anticipated impact of COVID-19 and reflect current law, which includes the expiration (aka sunsetting) of the American Rescue Plan (ARP) subsidies for 2023 and the return of pre-ARP federal and state subsidies.

...American Rescue Plan Impact on 2023 Rates

The 2023 premium rates supported by this Actuarial Memorandum reflect current law, which includes the expiration (aka sunsetting) of the American Rescue Plan (ARP) subsidies for 2023 and the return to the pre-ARP federal and state subsidies. No adjustment was applied to account for this change. No adjustment was applied to account for the potential that the American Rescue Plan (ARP) subsidies get extended.

Should the ARP subsidies get extended, we expect the distribution of our membership to remain similar to our current membership distribution based on currently available information. As such, we would not apply an adjustment to our rates. However, our expectation may change depending on the new legislation that would need to be passed to extend the ARP subsidies.

Oscar:

Market Morbidity

The starting claim experience was additionally adjusted to reflect changes in the anticipated market morbidity from the base period to the projection period in response to the uncertainty inherent in the marketplace and the anticipated discontinuation of the American Rescue Plan Act extended subsidies for the 2023 plan year.

American Rescue Plan (ARP) Subsidies and Public Health Emergency (PHE) Expiration

Rates were developed in line with the current law, which at the time of this rate filing, includes the expiration of the expanded ARP subsidies in PY2023 and the return to pre-ARP federal and state subsidies. Furthermore, rates assumed the expiration of the PHE on 10/15/2022 followed by redetermination of Medicaid members. Future regulatory, legislative, and economic changes may affect the extent to which the rates presented herein are neither excessive nor deficient.

...A second adjustment was included to reflect anticipated changes to the market morbidity primarily associated with changes in market membership and morbidity profile between the experience period and the projection period. Oscar relied upon the 2022 Marketplace Open Enrollment Period Public Use Files (PUF) published by CMS supporting a market membership increase between the 2021 and 2022 plan years, which was primarily driven by the expanded APTC subsidies. Oscar anticipated membership growth to decline between the 2022 and 2023 plan years attributed to the discontinuation of the expanded Advanced Premium Tax Credit (APTC) subsidies inherent in the ARP. The expiration of the subsidies has a premium impact of +1.7%. Should the subsidies be extended, it would decrease the rates by 1.7%. Lastly, in the development of the anticipated changes in the market morbidity, Oscar assumed that the Public Health Emergency will end and a certain proportion of Medicaid Redeterminations will enroll in the ACA Marketplace.

Oscar only has around 1,100 enrollees, but that'd be roughly $100 apiece in additional savings, give or take.

Physicians Health:

...As mandated by DIFS, this filing assumes the expiration of expanded subsidies under the American Rescue Plan Act (ARPA).

EXPIRATION OF ARPA SUBSIDIES

The 12.9% rate change effective 2023 assumes the enhanced subsidies under the ARPA currently in place for 2022 will not continue into 2023. We estimate the potential impact of these subsidies being restored for 2023 as approximately a 1% to 3% decrease to currently proposed premium rates, varying by metal level. In developing this estimate, we consider the underlying morbidity of the Michigan individual market population, as well as plan selection at the metal and CSR level. Specifically, emerging 2022 enrollment shows a higher proportion of CSR 73 and 87 and lower proportion of CSR 94 plans under the expanded subsidies, leading to a lower CSR load when assuming these subsidies are restored for 2023.

...We reflect an anticipated increase in the statewide morbidity due to the expiration of the ARPA, which included special enrollment periods and expanded subsidies. This adjustment is determined based on currently available data, conversations with PHP, and actuarial judgment.

Huh. That last part is kind of interesting--I would've imagined more CSR 94 enrollment under ARPA subsidies than without them, but the larger point is that extending ARPA subsidies would reduce premiums by 1 - 3% (let's call it ~2% overall). That's ~$124 per year apiece, or over $900,000 for their 7,300 enrollees.

Priority Health:

We have assumed that the American Rescue Plan Act (ARPA) subsidies expire at the end of 2022, as required by DIFS and the impact is shown in exhibit 2.1, section 1. If the subsidies continue in 2023 the impact to the filed rates would be a decrease of 1.1% or $5.55 PMPM. We looked at risk pool for members who had APTC increased compared with those with that had no change in APTC as well as estimated membership impacted by ARPA that we expect to leave the plan and/or market in 2023.

This total impact was spread over the full PH Individual business to get the 1.1% reduction if ARPA continues.

$5.55 per member per month is $66.60 apiece, or $8.8 million in additional savings beyond the ARPA subsidies themselves for Priority's ~132,000 enrollees.

(as an aside, it's noteworthy that Priority Health now has more ACA enrollees than Blue Care Network, which I think is a first?)

UnitedHealthcare:

UHCCP has evaluated historical WNRAR reports in Michigan going back to 2016 and made the key assumption that those entering the market in 2023 will look like a subset of the people who left the market since 2016. After combining this data with estimates from the Congressional Budget Office for national enrollment growth due to the American Rescue Plan Act (ARPA) to model a range of potential impacts, UHCCP selected and applied a 2.3% morbidity adjustment to reflect the impact of the end of the public health emergency order and the assumed expiration of ARPA.

UHCCP estimates that a 2.8% morbidity adjustment would be needed should ARPA be extended.

Huh. That's a pretty steep increase in UHC's projections, far higher than any other carrier...but they're new to the Michigan market this year anyway, so it sounds like they were just way off last year (remember, the ARPA subsidies were in place then as well). They also only have 2,300 enrollees.

US Health & Life:

Updated morbidity assumptions applied to manual rate experience, with an anticipated XXX% worsening morbidity assuming American Rescue Plan Act of 2021 will sunset by January 1, 2023

US Health has unfortunately redacted their data, but the point is they believe the risk pool will be worse if the ARP subsidies aren't extended.

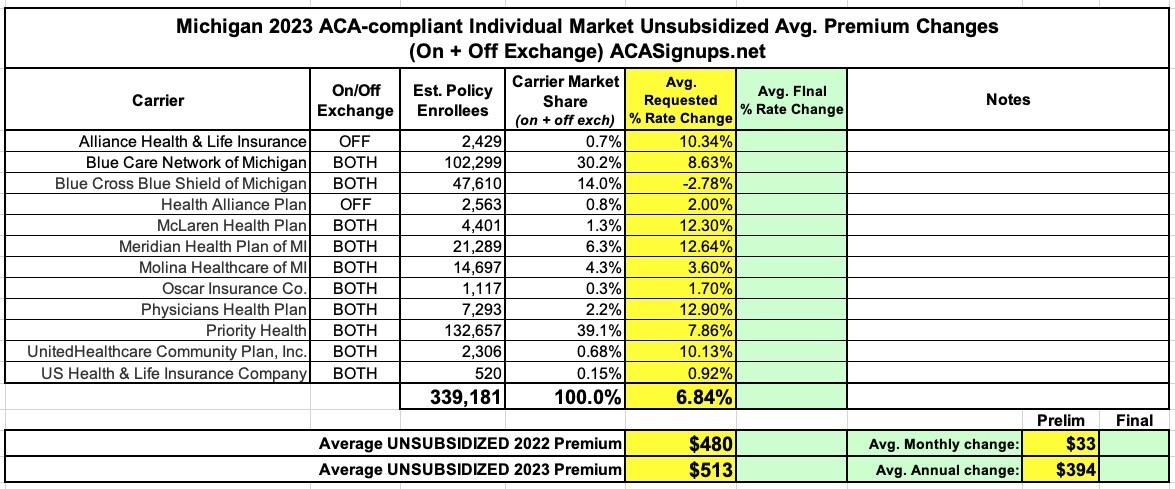

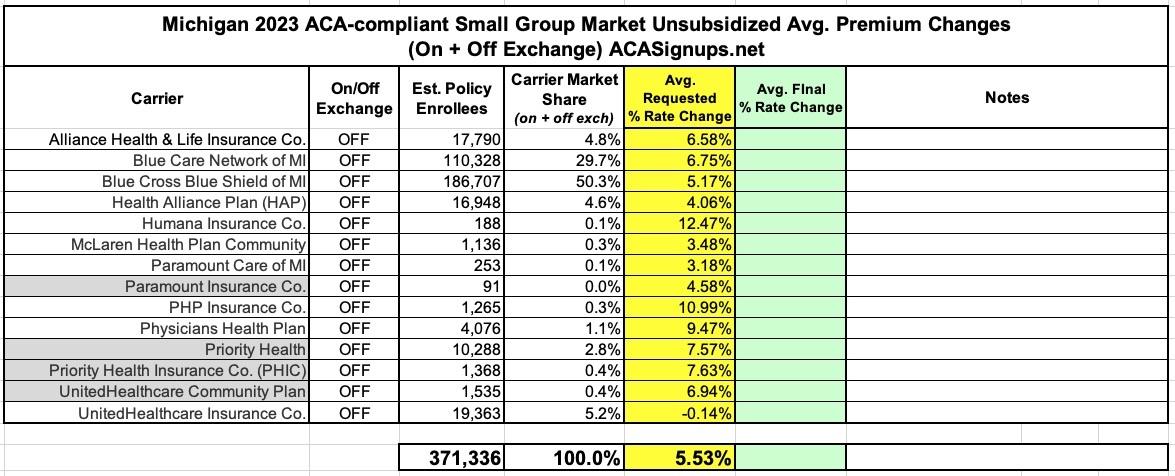

In any event, here's what it looks like overall: An average 6.8% weighted increase in unsubsidized individual market plans, and a 5.5% increase for the small group market...assuming ARP subsidies aren't extended.

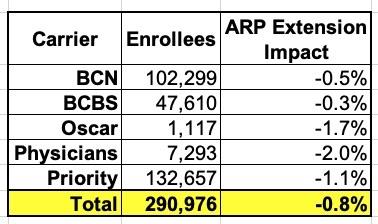

Not every carrier provided hard impact of the ARP factor on their rates, but based on the ones which have, it sounds like overall it's somewhere around 0.8%:

0.8% of $513/month = $4.10/month per enrollee on average, or around $49/year apiece. That's $16.7 million in additional savings for Michigan ACA enrollees beyond the expanded subsidies themselves if the ARP subsidies are extended, although ironically most of that savings would be to the federal government in the form of fewer subsidies actually being needed.

It's important to understand that this doesn't mean that there'd be a net savings to taxpayers--it just means that, say, $600 million in additional subsidies wouldn't actually cost $600 million, it would be more like $585 million. Not massive, but still important.

Plus, of course, the small percent of enrollees who would still be unsubsidized would see the savings directly, since their full price premiums would drop by a few bucks per month compared to what they'd otherwise have to pay.

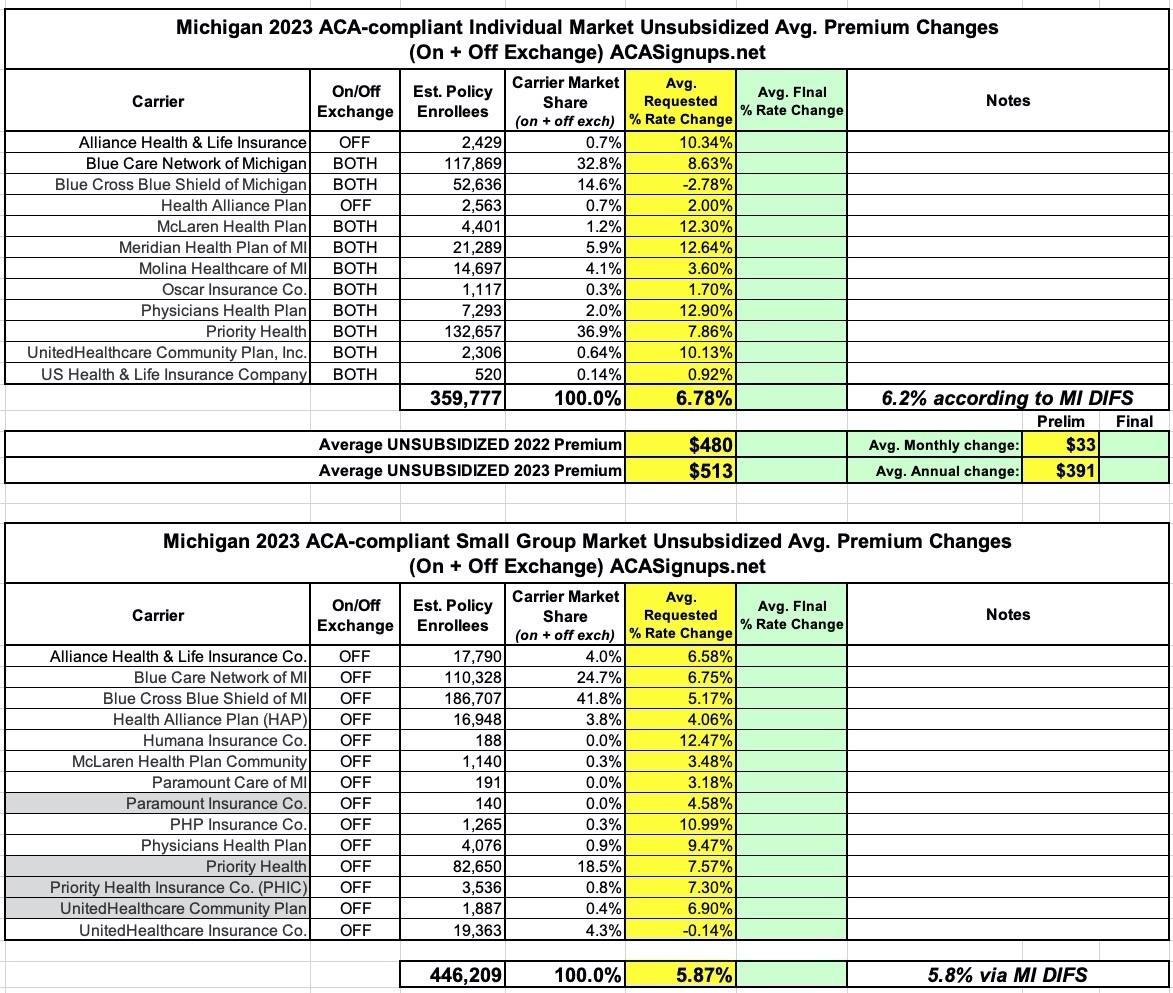

UPDATE: The Michigan Dept. of Financial Services has posted the official preliminary 2023 rate hikes, and while I have nearly all of the filings dead-on accurate, there's a couple in each market where I was off slightly:

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.